B.I.G. Tips – The Bespoke “Death By Amazon” Index

This content is for members onlyChart of the Day: Amazon Survivors vs Mortals

This content is for members onlyChart of the Day: Introducing The “Amazon Survivors” Index

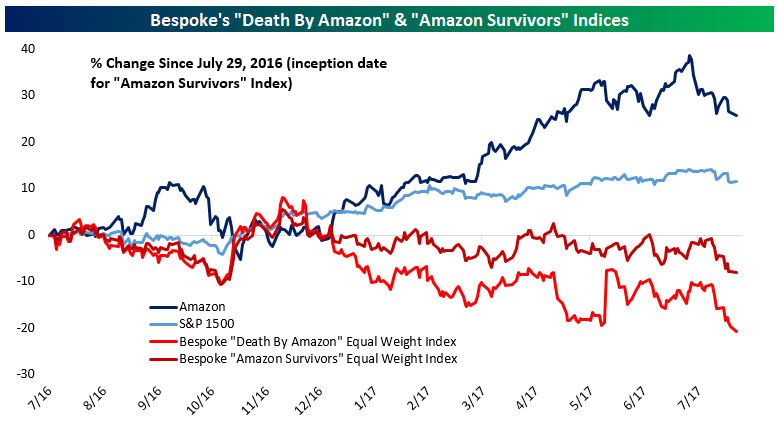

Back in February of 2014, we introduced the Bespoke “Death By Amazon” Index (DBA), a portfolio of companies culled from retailer indices that we judged as being extremely exposed to Amazon’s assault on the traditional retailing business model. The “Death By Amazon” Index has become pretty well-known over the past few years — especially over the last year since it has underperformed the rest of the stock market quite dramatically.

While the “Death By Amazon” Index is made up of retail stocks that are most threatened by Amazon.com, what about the rest of the retail sector? We wanted to know how the retailers that aren’t in the “Death By Amazon” Index are doing compared to the DBA, AMZN, and the broad market. In this regards, we’ve created the Bespoke “Amazon Survivors” Index (ASI), which is composed of companies not included in the “Death By Amazon” Index but still included in the retailing indices we use as our source list for companies. Below, we chart the performance of Amazon, the S&P 1500, and our two indices. All charts of our indices in this post are the equal weight versions.

Subscribe to one of our three membership levels to continue reading today’s Chart of the Day. We provide additional performance metrics as well a list of index members of our “Death By Amazon” and “Amazon Survivors” indices.

Sears: The 19th Century Amazon

Shares of Sears Holdings (SHLD) have been in free-fall the last three days, falling a staggering 23% during that span. This week’s decline is only a continuation of a longer-term decline where the stock has lost over half of its value in the last six months. The reason behind the most recent leg lower in the stock stems from a ratings downgrade from Fitch where there the agency said that, “although Sears has been able to fund its continued cash shortfalls through planned asset monetization, and additional financings, a meaningful business turnaround in fiscal 2017 is critical given the continued reduction of its asset base.” In other words, unless business picks up for Sears, it is going to run out of assets to fund its liabilities.

Shares of Sears Holdings (SHLD) have been in free-fall the last three days, falling a staggering 23% during that span. This week’s decline is only a continuation of a longer-term decline where the stock has lost over half of its value in the last six months. The reason behind the most recent leg lower in the stock stems from a ratings downgrade from Fitch where there the agency said that, “although Sears has been able to fund its continued cash shortfalls through planned asset monetization, and additional financings, a meaningful business turnaround in fiscal 2017 is critical given the continued reduction of its asset base.” In other words, unless business picks up for Sears, it is going to run out of assets to fund its liabilities.

The history of Sears is really a fascinating case study of how technology has upended the retail landscape. Whereas over a century ago, Sears completely altered the retail landscape with its famous catalog, today companies like Sears are being upended by technology and online sales. Back in the late 1800s, when the country was much more agrarian in nature, farmers had just one option to purchase their goods and supplies – the local general store. With zero competition, the owner of the store was a price maker and could, within reason, charge whatever he wanted for whatever he decided to sell. The customer basically had no choice as to selection or price. When the Sears catalog was first introduced, it completely upended the retail landscape by introducing uniform prices and a wider selection of merchandise (sound familiar).

With the success of the catalog business, Sears began to diversify its product offerings as well as its distribution by opening retail stores in cities and towns around the country. The company saw massive growth and success over a period that spanned decades, and in the early 1970s finished building the Sears Tower, which was at the time of its completion the world’s largest skyscraper. Sears was literally on top of the world! Nothing lasts forever, though, and looking back, the 1970s were probably the peak for Sears. Sales from the catalog started to decline as the concept became stale, and in the 1990s the company stopped publishing it. Then ten years later Sears was purchased by Kmart, another once famous retailer that was losing its relevance. While the combined company saw some success in its stock price after the merger, most of the period as a combined company has been negative for shareholders.

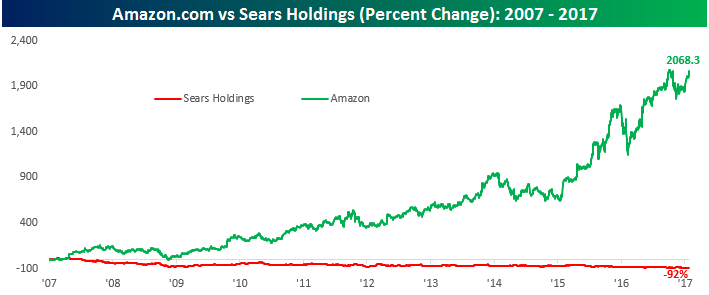

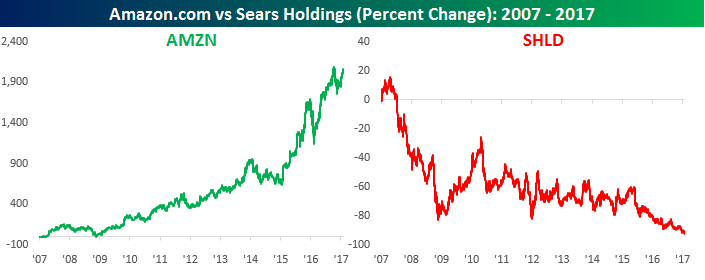

The experience of Sears really provides a perfect example of the ‘bricks to clicks’ trend we first highlighted several years ago in our Death By Amazon index. Like Sears over a century ago, starting with books, Amazon came into the traditional retail environment and completely transformed it. Numbers don’t lie, and the stock performance of Sears and Amazon.com over the last decade illustrates how traditional retail’s pain (in this case Sears) has been Amazon’s gain. Over that span, shares of AMZN are up over 2,000% while SHLD is down over 90%!

In fact, the chart above doesn’t even do justice to the disparity in the performance of the two stocks, because AMZN’s return has been so positive and SHLD’s has been so negative. Below we show the performance of both stocks on separate charts. Just to get back to where it was ten years ago, Sears would have to rally more than 1,300%. There’s probably a good chance that ten years from now Sears will no longer be around, but as ancient as the company now seems, it was once the Amazon of its day.