Bespoke Brunch Reads: 4/28/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Real Estate

Want to Make Millions and Pay No Taxes? Try Real Estate by Patrick Clark and Benjamin Stupples (Bloomberg)

Financial records from the divorce of New York City real estate developer Harry Macklowe give us a view into the world of real estate taxation, where prolific deductions have allowed the billionaire to (legally) avoid paying income taxes since the 1980s! [Link; soft paywall]

Trump’s Housing Agency Cracks Down on Zero-Down Home Loans by Prashant Gopal (Bloomberg)

FHA-backed loans that give borrowers without a down payment access to the housing market have been targeted as a risk due to their high delinquency rates. [Link; soft paywall]

Renters Are Mad. Presidential Candidates Have Noticed. by Emily Badger (NYT)

With homeownership rates only barely above multi-decade lows, renters are an increasingly large bloc of the electorate, and one that Democrats see as a natural interest group to appeal to. [Link; soft paywall]

Fake News

How 11 People Are Trying to Stop Fake News in the World’s Largest Election by Saritha Rai (Bloomberg)

In many developing countries, WhatsApp is a more critical information source than traditional social networks or the formal news media. That creates fertile ground for the spread of misinformation, especially in India during the world’s largest elections. [Link; soft paywall]

Rise of the Machines

Google Spinoff’s Drone Delivery Business First to Get FAA Approval by Alan Levin (Bloomberg)

Wing Aviation, formerly a division of Google, has received the same certification as small airlines. It plans to deliver packages to rural communities in Virginia starting this year. [Link; soft paywall]

This YouTube Channel Streams AI-Generated Death Metal 24/7 by Rob Dozier (Motherboard)

A machine learning algorithm is streaming live death metal on YouTube. While we’re not huge fans of the genre, the results are actually pretty good. [Link]

Food

The United States of Mexican Food by Gustavo Arellano (Eater)

A summary of the massive catalogue of stories on Eater about the bounty of cuisine in the United States that ultimately originates south of the border. Mexican sushi, pea guacamole, debates over authenticity, tater tots, Punjabi-Mexican cuisine, the power of tortillas, panaderías, Yakima Valley tacos, masa, and more. [Link]

Leaked documents show that McDonald’s is adding international hits to its American menu, including the Spanish Grand McExtreme Bacon Burger and the Dutch Stroopwafel McFlurry by Kate Taylor (BI)

This year McDonalds will be rolling out a number of popular menu items from around the world: a mozzarella chicken sandwich, a burger with bacon sauce, gouda, and onions, and a waffle cookie ice cream treat are all due to become available to American fast food consumers. [Link]

Local Government

Lobbyist’s crusade to change Title IX in Missouri stems from his son’s expulsion by Edward McKinley (KC Star)

A Missouri lobbyist’s son was expelled from Washington University via a process involving Title IX, so the lobbyist has natural gone on a crusade to change the rules that ban sexual discrimination in education. [Link]

Chalking tires to enforce parking rules is unconstitutional, court finds by Alex Johnson (NBC)

A woman issued 15 parking tickets over a three year span in Michigan brought suit, arguing that chalking car tires to track how long they’ve been in a spot is a search and therefore a violation of the 4th Amendment. [Link]

Boston-area judge charged with helping undocumented immigrant escape courthouse to elude ICE by Tom Winter, Adiel Kaplan, and Rich Schapiro (NBC)

After a plainclothes ICE representative identified himself to a Massachusetts district court judge before detaining a defendant in the court, the judge permitted the defendant to leave via the back of the courthouse. The judge and a court officer are facing multiple charges as a result. [Link]

Workaholics

Women Did Everything Right. Then Work Got ‘Greedy.’ by Claire Cain Miller (NYT)

A professional culture that values work hours uber alles means that women who provide child care are unable to advance in their careers, presenting a tradeoff that men do not face. To quote: “the nature of work has changed in ways that push couples who have equal career potential to take on unequal roles”. [Link; soft paywall]

Trivia

The Man Who Solved ‘Jeopardy!’ by Oliver Roeder (538)

Through April 26th, James Holzhauer has won 16 straight Jeopardy games, with winnings in excess of $1mm. In addition to strong buzzer work, Holzhauer has pursued a unique strategy that focuses on locking down Daily Doubles and takes big risks with the money he has already racked up in that round. [Link]

Fund Flows

‘Boom, Another Billion’: Muni Funds Land a Year’s Worth of Cash in Four Months by Danielle Moran (Bloomberg)

Since January, mutual funds focused on municipal bonds have hauled in more than $30bn, a massive haul larger than good years experienced in the past. [Link; soft paywall]

Savings

The NFL Draft’s Most Frugal Player by Rachel Bachman (WSJ)

Former Clemson defensive tackle and top draft pick for the Miami Dolphins is an epically frugal spender, piling up $15k in savings during his time at Clemson thanks to an eclectic desire to spend as little as possible; resources available to college football players made this possible, along with avoiding a car and using his family’s phone plan and accepting federal Pell Grants available to low-income students. [Link; paywall]

Economic Research

The Macroeconomic Effects Of Student Debt Cancellation by Scott Fullwiler, Stephanie Kelton, Catherine Ruetschlin, and Marshall Steinbaum (Levy Economics Institute)

A comprehensive analysis of what would happen if the federal government were to cancel all outstanding student loan debt, with implications for consumer spending, overall growth, employment, and inflation. [Link; 68 page PDF]

Geology

The Fantastically Strange Origin of Most Coal on Earth by Robert Krulwich (National Geographic)

Where does coal come from? 90 percent of the coal extracted today comes from trees that were never broken down by microorganisms because they hadn’t evolved yet. [Link]

Driverless Kids

Driving? The Kids Are So Over It by Adrienne Roberts (WSJ)

Fewer teens have a driver’s license, thanks to more restrictive licensing laws as well as less need for cars thanks to ride-sharing, a preference for denser cities a bit later in their life, and the cost of car ownership. [Link; paywall]

Venture Capital

How the Kleiner Perkins Empire Fell by Polina Marinova (Fortune)

How one of the most successful venture capital firms fell behind: personality clashes, internal dissent, and chasing returns. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Closer: End of Week Charts — 4/26/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

The Bespoke Report — With All-Time Highs Achieved, Time For Earnings To Deliver

The S&P 500 shrugged off disappointing mid-week global economic data and some soft Friday earnings to close the week at a new all-time high. Just about half of the S&P 500’s market cap has now reported, though smaller-cap stocks have a lot more left in the tank this earnings season. So far, results have been a bit mixed, especially when it comes to top-line revenues; with stocks back at record levels, earnings need to deliver and finish the season strong.

Below is a look at asset class total returns using key ETFs. For each ETF, we show total returns year-to-date, since the last all-time high for the S&P 500 on 9/20/18, and since the bull market began back on March 9th, 2009.

In this week’s report, we analyze earnings results, global economic data, commodity and foreign exchange price movements, market sentiment, and more to give you the inside track on what’s driving the market at all-time highs. We cover everything you need to know as an investor in this week’s Bespoke Report newsletter. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Ford (F) Market Cap Back Above Tesla (TSLA)

US auto-maker Ford (F) is up 10.76% today after reporting better than expected earnings. If the gains hold at these levels into the close, it will be Ford’s 3rd best earnings reaction day in the last 20 years and its best since its April 2009 report ten years ago.

Today’s gain for Ford (F) gives it a market cap of $41.2 billion. That’s $700 million more than Tesla’s (TSLA) market cap of $40.5 billion at the moment. Just four months ago in December 2018, Tesla’s market cap was double that of Ford’s, but how quickly things can change. Note that General Motors (GM) now has the largest market cap of the three at $56.2 billion, followed by Ford and then Tesla. Start a two-week free trial to Bespoke Premium to receive our most actionable investment ideas on a daily basis.

B.I.G. Tips – Early Earnings Season Analysis

Log-in here if you’re a member with access to our B.I.G. Tips reports.

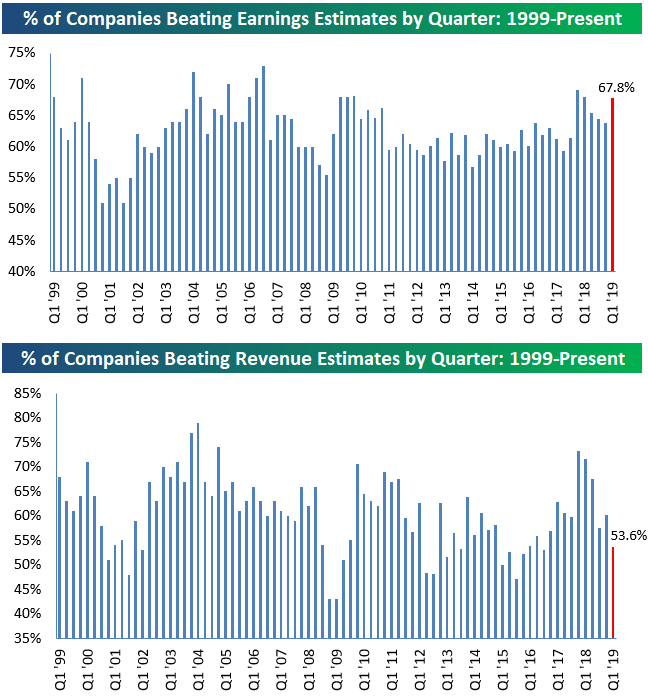

More than 500 stocks have reported their first quarter numbers so far this earnings season, which gives us a pretty large sample size to start analyzing overall trends. Through today, 67% of stocks that have reported this season have beaten bottom-line consensus EPS estimates. That’s a strong reading relative to the historical average of roughly 60% going back to 1999 (first chart below).

While the bottom line beat rate is strong, the top line has so far been lacking. As shown in the second chart below, only 53.6% of companies have managed to report stronger than expected revenues this season. This is definitely a concern now that we’re already about a quarter of the way through the reporting period. We would note, though, that last season we saw a similar trend as the top-line beat rate started very low before rebounding by the end of the reporting period and actually showing a sequential increase.

On another note, we’ve seen an interesting shift in guidance compared to the last two quarters. We’re also seeing some negative signs when it comes to how stock prices are reacting to earnings reports. To read our full earnings analysis, become a Bespoke Premium or Bespoke Institutional member and access the rest of this report. You can start a free two-week trial at THIS PAGE.

Thanks Intel!

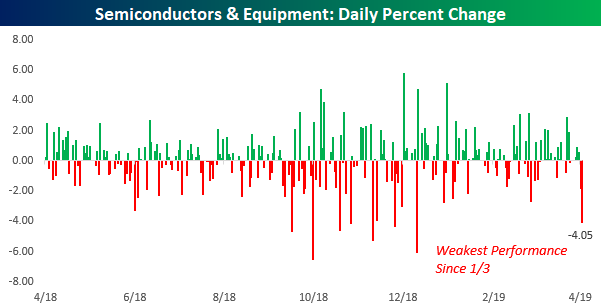

With a decline of 10% in the early going, shares of Intel (INTC) are having their worst earnings reaction day in over a decade (since January 2008). Not surprisingly, INTC’s decline has been felt across the entire semiconductor space as the S&P 500 Semiconductor and Equipment industry is down over 4%, which would be on pace for the worst day since January 3rd.

Today’s decline in the semis has also brought the industry’s price level back below its highs from last year. While not a major break of support, keep a close eye on the group. It’s still trading above the levels it was at last week before Qualcomm’s (QCOM) breakout on the news of the settlement with Apple (AAPL), but if it trades much lower and falls below potential support (same level where rallies failed multiple times in the second half of 2018) that would not only spell trouble for the group but most likely the entire Technology sector as well. Start a two-week free trial to Bespoke Premium to receive our updated market thoughts as they are published.

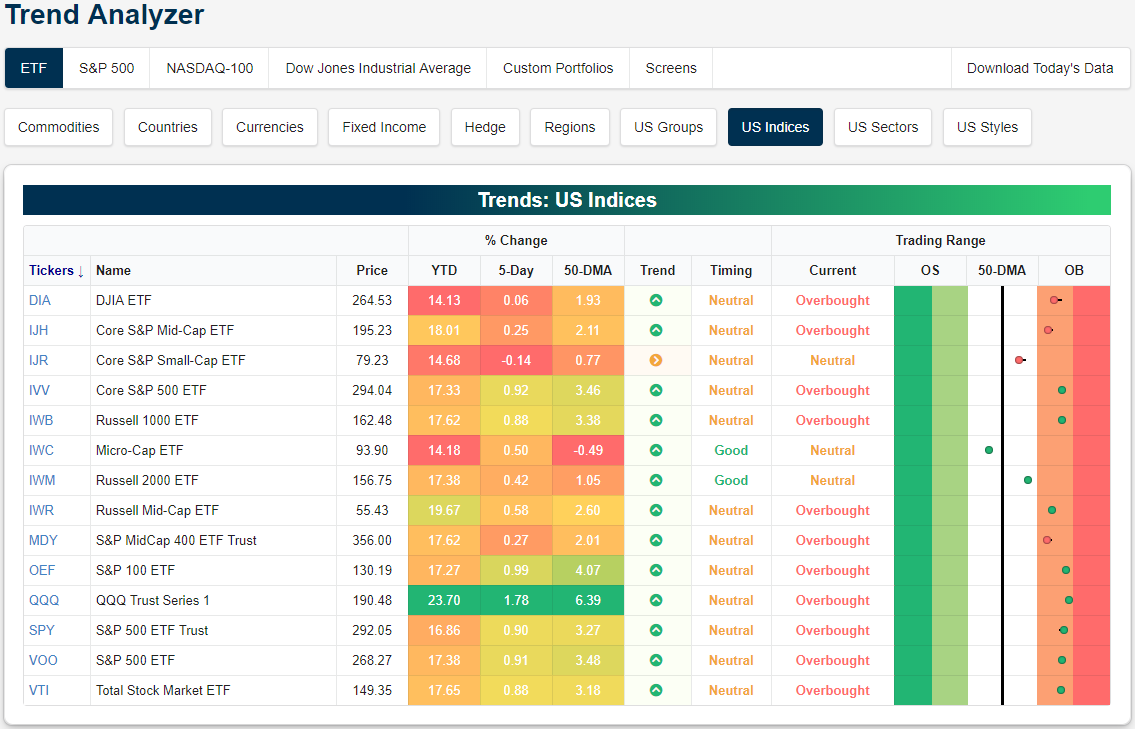

Trend Analyzer – 4/26/19 – Nasdaq (QQQ) Ripping

In the past week, stocks managed to reach all-time highs, but in the past couple of days have seen declines leading to a slight pullback in overbought levels. Earlier in the week, there had been as many as four extremely overbought major index ETFs, and today there are not any. On the other end of the spectrum, both the Core S&P Small Cap (IJR) and Russell 2000 (IWM) had been oversold earlier this week before moving back to neutral levels.

Performance over the past week have been somewhat positive with all but the Core S&P Small Cap (IJR) rallying. Meanwhile, the Nasdaq (QQQ) has handily outperformed rising over 1.5%.

Start a two-week free trial to Bespoke Premium to access our Trend Analyzer and much more.

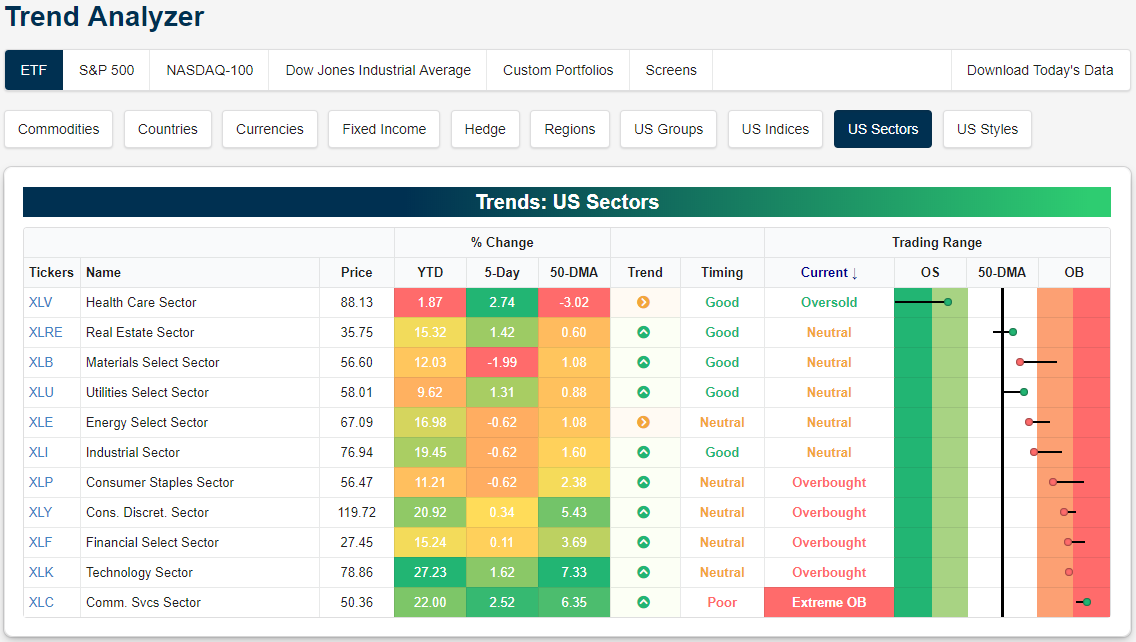

Turning to the individual sectors, conditions are a tad less overbought than the major indices. Currently, five of the sectors are overbought with only Communication Services (XLC) sitting at extreme levels on the back of a 2.52% gain over the past week. Another five are neutral, and the Health Care Sector (XLV) is still oversold. While it is still oversold, XLV is looking much better than it has in the past couple of weeks. After heavy selling brought the sector well more than 2 standard deviations below the 50-DMA, the sector has rallied 2.74% in the past week (the best of the sectors) and is much less oversold.

Morning Lineup – Notable Earnings Misses

There’s a negative tone to the futures market this morning after some notable earnings disappointments since yesterday’s close. First, Intel (INTC) reported after the close yesterday and issued disappointing guidance, sending shares down 8%. It’s not often that INTC trades down that much in reaction to earnings. Using our Earnings Explorer tool, we found only six other quarters since 2001 where the stock gapped down 8%+ on an earnings reaction day. INTC’s weakness is also casting a pall on the entire semiconductor sector, which had been leading the market. Another notable earnings miss to note is Exxon Mobil (XOM), which literally just reported weaker than expected earnings, missing the consensus EPS forecast of 69 cents by 14 cents and also reporting revenues shy of expectations.

While INTC and XOM were two notable misses, the overall tone of earnings since yesterday’s close has been pretty positive. Of the 125+ companies that have reported, 65% have exceeded EPS forecasts while 53% have managed to exceed revenue estimates. In terms of guidance, 8 companies raised forecasts going forward while only 5 lowered the bar.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Each Thursday afternoon in our Sector Snapshot report, we provided up to date charts of S&P 500 sectors looking at each sector’s trading range, percentage of stocks above their 50-day moving average, ten-day A/D line, relative strength, and P/E ratio. In looking through the relative strength charts yesterday, one interesting trend that stood out was the relationship between the Health Care and Technology sector. Looking at the chart below, it’s pretty easy to see that just about all of the rotation out of the Health Care sector that began towards the end of last year went right into Technology.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Distributions, Argentina, Global Trade, Home Vacancy, Durable Goods — 4/25/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we discuss the distribution of EPS growth rates and forward multiples for S&P 500 stocks. We then delve deep into Argentina, which has seen asset prices decline including its Peso falling to new lows today while CDS spreads price in a high chance of long-term debt default; we provide some context to these declines. Moving onto economic data, monthly global trade volumes and industrial production released today once again showing weakness. In US data, we show quarterly homeownership and rental vacancy numbers and durable goods.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Neutral Sentiment Hits Multi-Year High

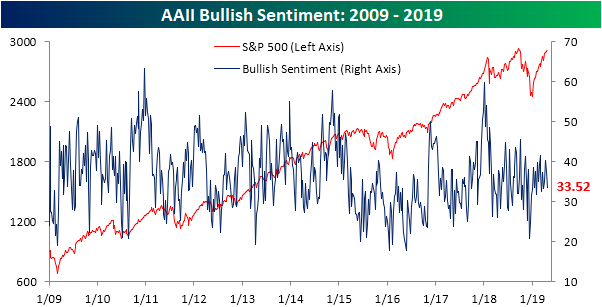

Since the Q4 2018 sell-off, bullish sentiment as seen through AAII’s weekly survey has remained relatively stable off of its lows established in December. For most of the year, it has remained in the 30’s briefly pushing above 40% a couple of times. This week it came in on the lower end of this range with 33.52% of investors reporting bullish sentiment, down from 37.56% last week. While this is at the lower end of the recent range, it by no means at any sort of extreme on a longer-term perspective. This is a bit of a divergence from sentiment seen through the Investor Intelligence survey, which recently saw bullish sentiment reach its highest levels since mid-October. Bearish sentiment readings in the same survey are at their lowest since the same time last year and more closely resembling the AAII survey. Start a two-week free trial to Bespoke Premium to access our interactive economic indicators monitor and much more.

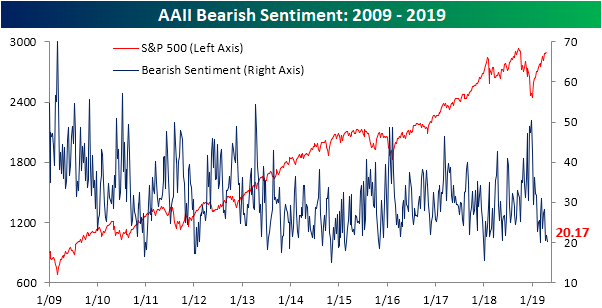

Expanding further on bearish sentiment, it remains very low as the market reached a new all-time high in the past week. Only 20.17% of investors responded as bearish this week. That is the second lowest reading of the year; the one lower occurrence being back in late February when it read 20%. Somewhat similar to bullish sentiment, this is well below the historic average for bearish sentiment (30.31%). But unlike bullish sentiment, the percentage of bears is currently sitting at a bit of an extreme; just over one standard deviation below that historic average.

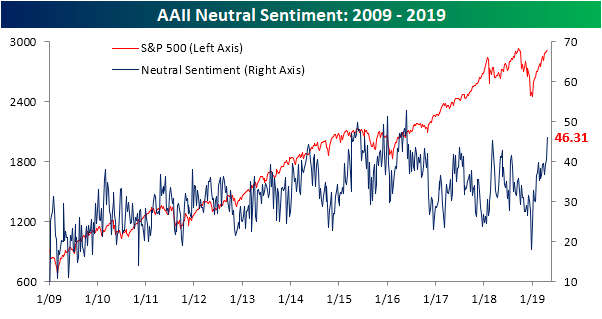

While bearish sentiment is right around lows again, neutral sentiment has continued to surge. 46.31% of investors are reporting to have a neutral sentiment towards the stock market; the highest level since May of 2016. This is the second week in a row that neutral sentiment also came in over one standard deviation above the long term average. Since the beginning of the survey in 1987, this is only the 13th time that neutral sentiment came in high by historical standards as bearish has simultaneously come in low by historical standards.