B.I.G. Tips – Fed Days May 2019

Bespoke Market Calendar — May 2019

Please click the image below to view our May 2019 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three premium research levels.

Morning Lineup – It’s Not Just Alphabet

When a stock is set to open down over $100 in reaction to earnings, people notice, even if that decline is coming off a base of $1,200. That’s exactly the case this morning as shares of Alphabet (GOOGL) are on pace to have their most negative gap down in reaction to earnings since the company’s IPO in 2004. For more on how GOOGL tends to perform following negative reactions to earnings, please check out our Chart of the Day.

Even if it is one of the largest companies in the world, there’s a lot more to the economy than GOOGL, and this morning we are seeing that. Since the close yesterday, nearly 150 companies have reported earnings and 68% of those exceeded EPS forecasts, while a pretty impressive 60% have exceeded revenue forecasts.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

In yesterday’s Closer report, we highlighted the fact that a number of secondary indices/sectors that outperformed ahead of the December lows did not make new highs yesterday. Another indicator that hasn’t been keeping up with the equity market is high yield spreads. As shown in the chart below where we have plotted high yield spreads on an inverted basis, for well over a week now, we have seen stock prices make new highs but high yield spreads haven’t been keeping up. If the rally, is going to keep going, spreads will need to catch up.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Chart of the Day: Alphabet (GOOG) Set For Biggest Gap Down on Earnings Ever

The Closer — Friendly Data, Golden (Double) Crosses, Secondary Indices Lag, Ratios — 4/29/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, after what was a quiet day of trading, we recap some of today’s economic data points including Personal Spending which rose by the largest amount on an MoM basis since 2009. We also take a look at the miss in today’s release of Personal Income and PCE. Next, with each having seen a golden cross recently, we review how AMZN, AAPL, and the Financial Sector (XLF) perform after golden crosses. We finish by going over four secondary indices; all of which have failed to make new highs. We also look at the ratios of Consumer Discretionary to Consumer Staples and Technology to Utilities.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

The Fed is Not Alone

On Wednesday, while no change is anticipated, the FOMC’s rate decision and Fed Chair Powell’s subsequent presser are sure to be closely watched by markets. Investors will attempt to get a read on the Fed’s tone following some more positive shifts in economic data and equity markets since the beginning of the year. Over the next two weeks, the Fed is not alone though; like earnings and general economic data, it will also be busy on the central bank front.

On Thursday morning, the Bank of England and the Czech National Bank are also due out with rate decisions of their own. Similarly, neither of these two national banks are expected to make any adjustments in their policy rates. But with global risks like Brexit and a soft global backdrop at play, this expected no change is not a guarantee. For the Czech Republic, previous comments by the CNB seemed even slightly hawkish alluding to accelerating inflation making things a tad more difficult to leave rates where they have been. In APAC next Tuesday, we will also get decisions from the Reserve Bank of Australia and the Reserve Bank of New Zealand. Once again no change is expected for either country, but cuts are seen as more likely than hikes.

One week after the FOMC decision, the Central Bank of Brazil is expected to leave the Selic Rate unchanged as well in spite of dovish tones from the chief policymaker. Coming off of a hike to 1% in their last meeting, Norway’s Norgesbank will cap off next week in Central Bank meetings. Institutional members can always stay up to date with central bank tones and rate decisions with our Fedspeak Monitor and Central Bank Monitors. Start a two-week free trial to Bespoke Institutional to access our interactive Fedspeak and Global Central Bank monitor and much more.

Not Just a Busy Week of Earnings

It may be the busiest week of earnings season, but quarterly reports are not the only catalysts to watch. There is also a heavy slate on the US Economic Scorecard over the next week with 72 releases (including indicator releases, Treasury Auctions, and Federal Reserve member speeches) on the docket. You can always keep an eye on these releases using our Economic Monitors. For today, all of the data is now in with some disappointment. Personal Income and the PCE deflator both missed estimates earlier this morning while the Dallas Fed’s Manufacturing Activity index came in below expectations by the widest margin since September of 2011. Meanwhile, Personal Spending on both a real and nominal basis showed solid improvements while beating estimates. In fact, the nominal number was the strongest MoM print since 2009. Real Personal Spending was also strong with the highest MoM increase since early 2017.

Scheduled for tomorrow is the first quarter’s Employment Cost Index and Conference Board sentiment readings for April in addition to a couple of housing data points. Wednesday morning will see the release of both ISM and Markit manufacturing gauges for the month of April ahead of an FOMC meeting later in the day. While no change in rates is anticipated, this meeting will be followed by comments from Fed Chair Powell which will be closely watched for how the Fed has reacted to more positive tones from economic data in the first quarter. On top of the standard weekly Jobless Claims, preliminary numbers for Nonfarm Productivity and Labor Costs are scheduled for Thursday morning before the open. The Nonfarm Payrolls report is out on Friday after last month’s huge rebound of 196K jobs. There are also a number of speeches on Friday by Fed presidents from around the country. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

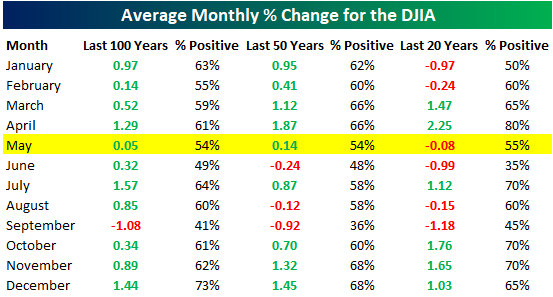

Chart of the Day: May Seasonality + Sell in May

One of the best months of the year from a seasonal perspective (April) is quickly coming to an end, and now investors are set to enter a period of the year that usually produces sub-par returns relative to other periods. There is also a significant difference in performance during the month of May based on whether the stock market is up or down year-to-date through April.

And what about the old saying “Sell in May and Go Away”? Is there any truth to it? Each year the “Sell in May” theory gets trotted out, but we have the data to prove whether investors really should hit the “Sell” button and then wait for six months until November rolls around.

Continue reading this Chart of the Day by starting a two-week free trial to any of our research membership levels.

Update on Earnings and Sales Beat Rates

In last week’s Bespoke Report newsletter sent to clients, we provided our first in-depth read on the first quarter earnings season. Our Earnings Explorer tool that’s available to clients also provides real-time updates so that users can stay on top of overall beat rates as well as results from individual companies. It’s an amazing feature that you should really check out if you have not yet done so! Start a two-week trial to Bespoke Institutional to access our Earnings Explorer and everything else we have to offer.

Below is a snapshot from one section of the Earnings Explorer on our website that shows the rolling 3-month EPS and sales beat rate for US companies reporting earnings. The charts show the beat rates over the last six months, but you can toggle between six months, one year, five years, and all years (20).

As shown, the bottom-line earnings per share beat rate had been trending lower since since late 2018, but in recent weeks it has begun to tick higher, indicating companies are having an easier time beating EPS estimates lately. At the same time, the top-line sales beat rate has been steadily trending lower over the last two months to its current level of 58.54%. Both the EPS and sales beat rates remain above their long-term averages, however.

When it comes to beat rates, we’d always prefer a stronger top-line beat rate than a stronger bottom-line beat rate, because it’s much easier for companies to maneuver an earnings beat than a sales beat. Unfortunately, that’s not the case right now.

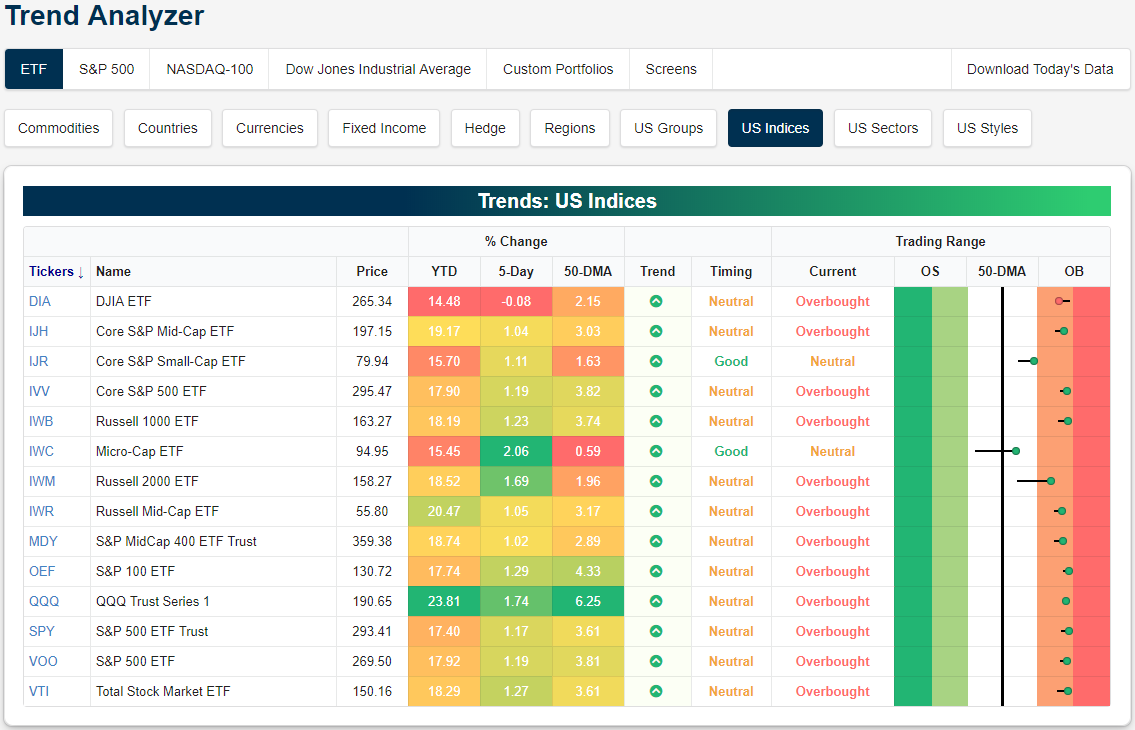

Trend Analyzer – 4/29/19 – Small Caps Looking Solid

As the S&P 500 finished last week at another all-time high, overbought and oversold conditions are largely unchanged from where they have been recently. Twelve of the fourteen major index ETFs are overbought while the remaining two are neutral. While off of extreme overbought levels that a few of the indices briefly touched last week, many of those that are overbought still remain just under extreme levels. With huge losses from certain weak earnings last week weighing heavy on the Dow (DIA), it was the only index to finish last week in the red and less overbought—though it is in fact still overbought. Start a two-week free trial to Bespoke Premium to access our interactive Trend Analyzer and much more.

Pivoting over to the charts of these index ETFs, the large cap indices like the S&P 500 (VOO, SPY, IVV), S&P 100 (OEF), Russell 1000 (IWV), Nasdaq (QQQ), and Total Stock Market (VTI) have perhaps broken out the most distinctively. Each of these ETFs have now clearly taken out resistance at last year’s highs. Conversely, the Dow (DIA) has more distinctively failed to make a move higher. DIA stopped short right at prior highs late last week; brought lower by weakness in earnings of some of the member companies like 3M (MMM). While the Dow at least managed to make its way back up to its previous highs, the small and mid cap indices still have progress to make. Other than the Russell Mid Cap ETF (IWR), each of the small and mid caps still sit well below prior highs. Fortunately for the small caps, current overbought/oversold levels are giving them some room to run to make their way up to new highs as well.