Fixed Income Weekly – 5/1/19

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we discuss which areas of fixed income have delivered the largest absolute and risk-adjusted returns this year, and why they have posted such strong numbers.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Closer Report — Global Macro Outlook — May 2019

Bespoke macro strategist George Pearkes recently gave a presentation on our global macro outlook at the 2019 NAAIM (National Association of Active Investment Managers) Uncommon Knowledge National Conference. If you’re a Bespoke Institutional member, you can read it by logging in here. If you’re not yet a member and would like to read the report, please start a two-week free trial to Bespoke Institutional.

Trend Analyzer – 5/1/19 – Energy Tanking, Healthcare Coming Back

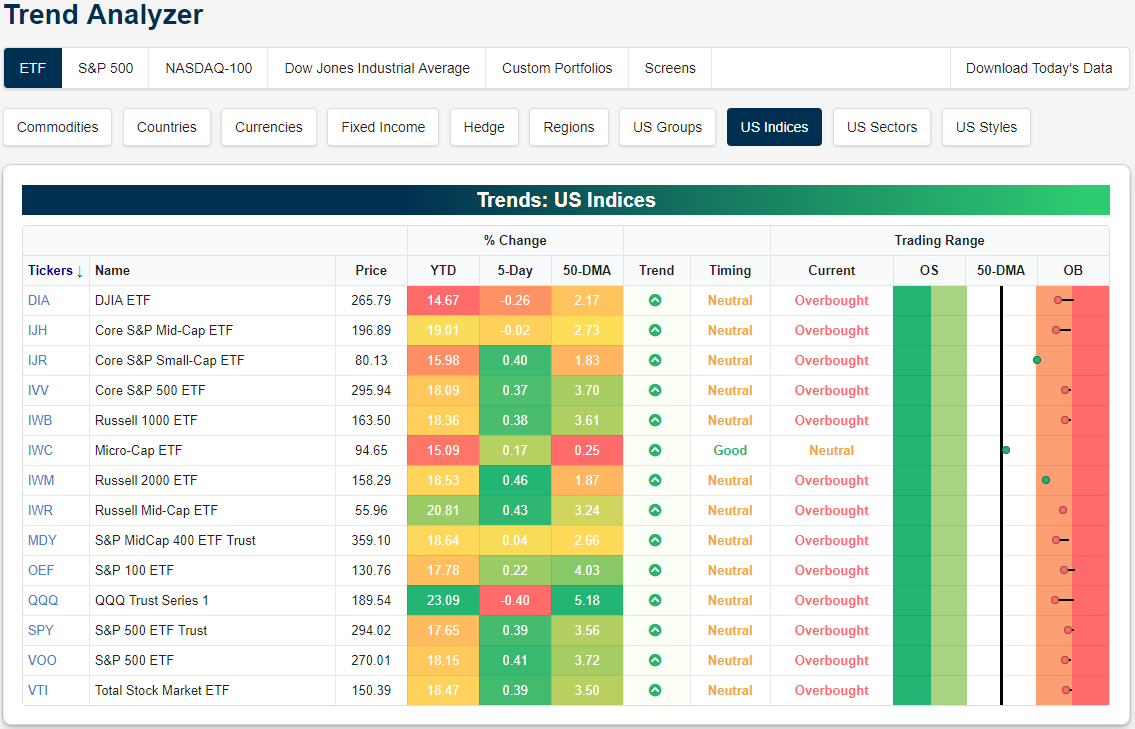

The major index ETFs are starting off May generally overbought with only the Micro-Cap ETF (IWC) sitting in neutral territory. Ahead of today’s FOMC meeting, most of the major index ETFs are up modestly over the past week with the Russell 2000 (IWM) having risen the most. On the other end of the spectrum, the Nasdaq (QQQ) has fallen 0.4% in the same span of time. Other large caps have also lagged behind with the Dow (DIA) down -0.26% and the S&P 100 (OEF) only up 0.22%. The only other ETF to see a loss in the past week is the Core S&P Mid Cap (IJR). Each of these underperforming ETFs are also coming off of extreme overbought levels, so these declines are warranted.

Start a two-week free trial to Bespoke Premium to access our interactive economic indicators monitor and much more.

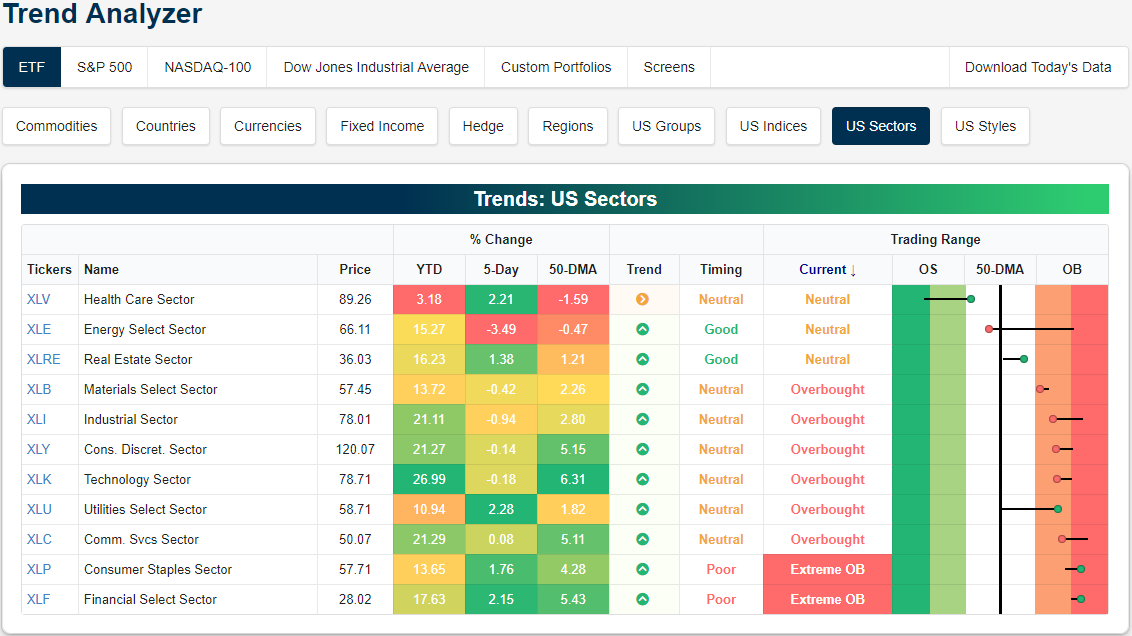

Turning to the individual sectors, Consumer Staples (XLP) and Financials (XLF) have become extremely overbought following strong gains over the past week. While both of these sectors have been strong, Utilities (XLU) have been even stronger, bouncing off the 50-DMA in the past week for a 2.28% gain. We have repeatedly highlighted Health Care’s (XLV) weakness in the past month as the sector reached extreme oversold levels. The worst for the sector seems to be over for now as it has moved back into neutral territory. It is still grossly underperforming on a YTD basis, only up 3.18% versus all other’s sectors double-digit returns. Meanwhile, Energy (XLE) has hit a bit of a rough patch having fallen 3.49% in the past five days. After sitting at extremely overbought levels, it has collapsed through the 50-DMA.

Bespoke’s Global Macro Dashboard — 5/1/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Morning Lineup – New Month, Same Trend

Welcome to what has historically been the start of the toughest six month period for US equity markets. While the May through October period may not be the market’s best time of year, it is starting off on a positive note as all of the major averages are pointing to higher opens. The driver of this morning’s strength isn’t any sort of positive sentiment coming out of Asia or Europe, because those markets are all closed for the day. No, the key today is earnings. In yesterday’s note, we said it’s not all about Alphabet (GOOGL), and we’re seeing that play out again today as more than 65% of the nearly 200 companies that have reported since yesterday’s close exceeded EPS forecasts and a very impressive 63% beat revenue forecasts!

Outside of earnings, the ADP Private Payroll report was just released and came in at 275K, topping expectations by 95K for the strongest report relative to expectations since February 2017 and the 6th best report relative to expectations since 2006.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

With another month of positive returns in the books, we wanted to provide a quick update on how the S&P 500’s current performance over the short and long-term stacks up to historical averages. Current annualized returns for the S&P 500 over the last one, two, five, and ten years are all above the historical average. The only time window where returns have been subpar is over the last twenty years where the 6.0% annualized gain is well below the long-term average of 11.0%. Keep in mind, though, that this is a period that encompasses two bear markets where the S&P 500 lost half of its value.

In terms of where the current one, two, five, ten, and twenty year returns stack up in percentile terms, for the most part, they aren’t terribly stretched. For the one, two, and five year periods, returns are all less than the 60th percentile, while 20-year returns are only in the 4th percentile. Again, the only period that is elevated is the ten-year time frame where the S&P 500’s annualized return is better than three-quarters of all other ten-year windows.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Overrated Rebalancing, EURUSD Pop, US Data Dollop — 4/30/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin by evaluating the theory that monthly rebalancing has been driving the market at month’s end. In FX, we then take a look at the dollar’s weakness versus the euro. Turning to macro data, we review this morning’s release of MNI’s Chicago PMI which is pointing to a questionably bad ISM Manufacturing reading. We also look at today’s pending home sales data and the S&P/Case-Shiller home prices before finishing with an update on the Employment Cost Index.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – May Intra-Month Performance

Bespoke Matrix of Economic Indicators: 4/30/19

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke Stock Scores — 4/30/19

Consumers Confident About Jobs Again

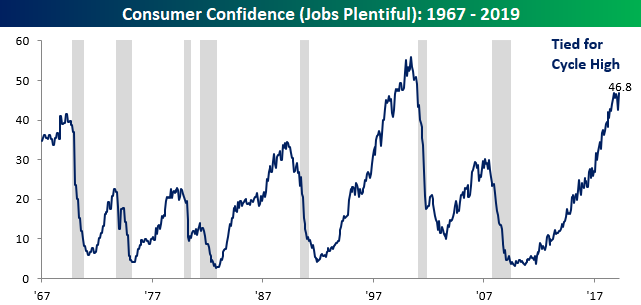

Consumer Confidence for the month of April was released earlier this morning and handily topped expectations coming in at a level of 129.2 vs 126.8. Despite the rebound, the headline confidence reading remains well off its cycle high reading of 137.9 from six months ago back in October.

One reason for the bounce in sentiment was jobs. After a sharp decline in sentiment towards the employment environment last month, the percentage of consumers who feel that jobs are ‘plentiful’ erased all of February’s weakness and is once again back at its highest levels of the economic cycle. That didn’t take long! This is an important development given the fact that this reading tends to roll-over ahead of recessions. When we saw the sharp decline last month, it raised some concerns, but now that it’s right back at its prior highs, those fears can be set aside.

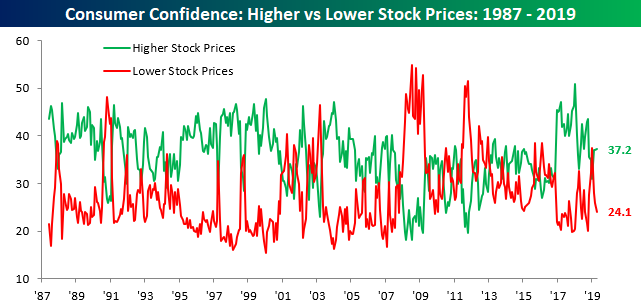

Finally, with sentiment improving and the stock market rallying, consumers are feeling more confident about the stock market too. In this month’s survey, the percentage of consumers expecting higher stock prices rose to 37.2% from 37.1%, while the percentage expecting lower stock prices dropped from 25.8% down to 24.1%. While it is never a good thing to see complacency towards the market on the rise, these readings aren’t near the extreme levels we saw at points in 2018. Start a two-week free trial to Bespoke Institutional to access our full suite of market and economic research.