Bespoke Consumer Pulse Report — May 2019

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

No Change in Claims

Weekly Jobless Claims came in unchanged this week for the first time since last September when claims were at 212K in back to back weeks. Initial jobless claims came in at 230 versus forecasts of 215K. Looking back on April, it was a bit of a split month when it comes to this indicator as the first couple weeks came in at 50-year lows while this week and last’s 230K prints were the joint highest readings since early February.

While the past two week’s readings are higher than what we have seen in the past couple of months, it is once again too early to call it any kind reversal higher, especially in the context of these recent lows. Rather, jobless claims have more or less just been steady over the past year, sitting between a range of 210K and 235K for most of this time. Overall, while claims haven’t yet been able to hold the sharp moves lower, employment still appears healthy with the streak of claims coming in below 250K now at 68 weeks while the streak below 300K is at a record 217 weeks.

Start a two-week free trial to Bespoke Premium to access our interactive economic indicators monitor and much more.

The four week moving average for seasonally adjusted claims did see a change this week, rising to 212.5K from 206K last week. Similar to the weekly numbers, the four-week moving average is off of recent multi-year lows (from only a couple weeks ago) but at the same time not necessarily at any sort of concerning highs sitting right around where it was headed into April.

Non-seasonally adjusted claims data ticked down to 204K from 211.8K last week. This print is well below the average for the current week since 2000 but is not as low as we saw for the current week last year. For the same week last year, claims came in at 186.5K. This is the second week in a row that this has happened and the seventh week so far this year that NSA claims have increased YoY. For context, the last time a year saw this happen more was in 2016, when there were ten weeks of year over year increases through the whole year, not just through April!

The Bespoke 50 Top Growth Stocks

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 109.0 percentage points. Through today, the “Bespoke 50” is up 220.9% since inception versus the S&P 500’s gain of 111.9%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke Morning Lineup – Fed Jolt

Futures are up ever so slightly pre-open following yesterday’s post-Fed sell-off. The sell-off gave investors a needed jolt since the biggest drop that the S&P saw in April was just 61 basis points. This AM we’ll be watching the weekly jobless claims print to see if last week’s small jump was just an outlier or something to be more concerned about.

In today’s Bespoke Morning Lineup, we cover US and European earnings, global PMIs, and global auto sales. We also include our regularly updated charts and graphics of market and sector internals that Bespoke subscribers have come to love. This report is all you need to prepare yourself for the trading day ahead. To read today’s Morning Lineup and receive it every trading day going forward, start a two-week free trial to Bespoke Premium.

The Closer — Markets Overreact, Auto Sales Miss, EIA, ICI — 5/1/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we summarize the key points of today’s FOMC decision and Fed Chair Powell’s following conference as well as the market reaction across assets. We move on to the US auto market which is showed some weakness for the month of April. We also look at interest rates on auto loans and auto sales in Canada before turning to today’s big miss in ISM Manufacturing. We finish with our weekly looks at EIA petroleum data and another brutal week of equity fund flows.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: April and YTD Decile Analysis

Small Caps Not In Style

Looking across various investing style ETFs in our Chart Scanner tool, small-cap focused ETFs have significantly lagged mid-cap and large-cap ETFs of similar styles this year. Whereas most of the ETFs are either above or near last year’s highs/all-time highs, small caps are still well below. Starting with a look at dividend-focused ETFs, the small-cap version (DES) surged in the first few months of the year, briefly taking out the lower highs from Q4 2018, but has failed to move considerably higher since. In the past month, DES has been trading in a tight range between the two lower highs from Q4. Conversely, the broader Select Dividend ETF (DVY)—as well as other dividend ETFs like the Vanguard Dividend Appreciation ETF (VIG), S&P Dividend ETF (SDY), and the MidCap Dividend fund (DON)—has seen a more consistent uptrend, distinctively breaking out above last year’s highs.

Earnings focused funds are seeing similar price action. The SmallCap Earnings Fund (EES) is well off of prior highs, stuck between highs from earlier this year and lower highs from late last year like DES. The MidCap Earnings Fund (EZM) has managed to get much closer to its prior highs, but it has in fact been trading sideways right under a range from late last summer. This is while the Total Earnings Fund (EXT) is just below highs from last year. So even while no earnings focused funds have taken out last year’s highs, those that are not small cap focused have performed better.

Even when it comes to growth and value it is the same story. The Small Cap version of growth (IJR) and value (IJS) have both been stuck under lower highs that were established during last year’s sell-off. In recent weeks both IJR and IJS have been trading right in between the upward trending 50-DMA and 200-DMAs that are in downtrends. In the past week each one has begun to push above these 200-DMAs but not in any distinct breakout. Meanwhile, other value and growth ETFs, the Vanguard Value ETF (VTV) and Vanguard Growth ETF (VUG), have been in strong, uninterrupted uptrends right up to new highs. All in all, when it comes to style, market cap has seemed to have played a greater role than other factors. Start a two-week free trial to Bespoke Premium to access our interactive Chart Scanner and much more.

US Strong(ish) GDP Still Beating Rest of World

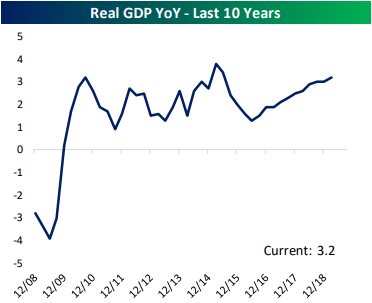

As we discussed in last Friday’s Bespoke Report, US GDP data released last week was a bit of a mixed bag. The headline number solidly beat at a 3.2% QoQ clip, though, the underlying components were weaker including consumption and fixed investment weakening. Domestic Final Private Demand, which excludes government, trade, and inventories, came in 1.12% weaker than the Q4 data at 1.09% QoQ growth for Q1.

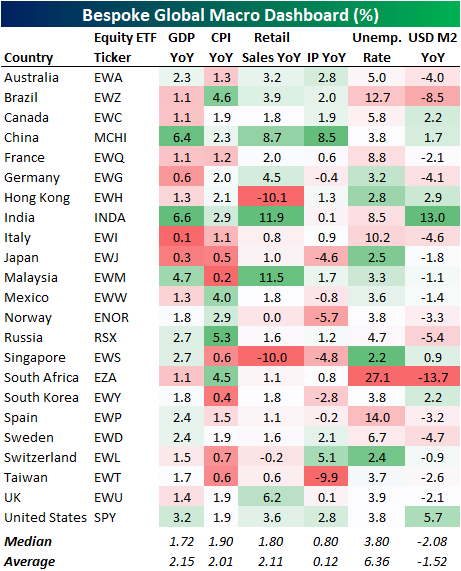

Putting any concerns from the underlying components of GDP aside, the US macroeconomic backdrop is still attractive relative to the 22 other countries tracked in our Global Macro Dashboard. In fact, at 3.2% YoY growth, US GDP growth is the fourth highest of these countries we track behind only emerging market countries China, India, and Malaysia. While China and India are seeing over 6% YoY growth, Malaysia is growing at 4.7%. The next highest GDPs behind the US are Russia and Singapore tied at 2.7% YoY. In other words, the US is blowing other developed nations out of the water in terms of GDP growth. Across the board, most US indicators we look at in the Global Macro Dashboard appear better than the average and median readings for the other countries. The US has the second highest growth rate of M2 money supply which theoretically should be further stimulative to the economy. In manufacturing, Industrial Production has held up fairly well as the US has the joint third highest growth (alongside Australia) of the 22 countries. While not explosive like India or Malaysia, retail sales growth is also better than a majority of other countries while the unemployment rate remains low. Start a two-week free trial to Bespoke Institutional to receive our Global Macro Dashboard and much more.

Interesting Industries

On top of sector ETFs, our Trend Analyzer and Chart Scanner tools have the option to take a look at the ETFs of a number of industry groups as well. Below we highlight several of these.

In the past few weeks, we have repeatedly highlighted that the Health Care sector had dramatically fallen out of favor, turning negative on the year and reaching extremely oversold levels. But since last week, the sector has begun to turn around. While the sector ETF’s chart (XLV) may not have bottomed at any obvious support level, two of the industries within the sector have bounced at interesting levels. The US Medical Devices industry ETF (IHI) fell pretty much vertically, right through the 50-DMA, in this most recent sell-off. Early last week, it came down to the 200-DMA which proved as much firmer support. The ETF bounced off this moving average last Monday (4/22) and has gained just over 5% since. Meanwhile, Pharmaceuticals (PPH) fell right through the 50-DMA as well as its 200-DMA, but it also put in a bottom early last week. The Pharma ETF seems to have found support near the $60 mark, at the bottom of a range from earlier this year and from the spring of 2018.

While Health Care has been rallying, so too has the Financial sector (XLF). XLF is currently the most overbought of the sector ETFs sitting just over 2 standard deviations above the 50-DMA. Of the underlying industries, Financial Services (IYG) and Insurance (KIE) have been notably strong. IYG has a similar chart pattern to the S&P 500, but while the broader index may have reached all-time highs, IYG still has a bit more progress to make. The most recent leg higher in the past month has brought IYG back into its range from late summer/early fall of last year. Currently, it needs to move another few points higher to reach its own all-time highs. S&P Insurance (KIE) on the other hand has been ripping higher, now sitting extremely overbought after a 2.56% gain over the past week (the third best of all industry group ETFs in that time). While this may not provide the best time to hop in (our Trend Analyzer gives the ETF a poor timing score), the push above last year’s highs is worth noting.

Speaking of new highs, both Consumer Goods (IYK) and Aerospace and Defence (PPA) are breaking out above last year’s highs. Both have reached extreme overbought territory at their current levels meaning momentum may carry them a little bit higher, but these highs may not hold for long. Additionally, there may be more short term momentum as these two have some strength in their underlying companies’ earnings reports. Today alone, Estee Lauder (EL) for Consumer Goods and L3 Technologies (LLL) and Harris (HRS) for Aerospace & Defense all reported earnings Triple Plays.

Construction spending data has been a bit mixed in recent months, with today’s print coming in weaker at -0.9% MoM. The Dynamic Building and Construction Portfolio ETF (PKB) has not necessarily been reflective of the weaker prints, rising over 26% year to date. After a strong run through the first four months of the year, PKB closed yesterday back into the lower end of last year’s range. The ETF now has upside towards last year’s highs around $32. Meanwhile, Real Estate (IYR) has been in a steady uptrend all year. In recent week’s, the industry has stumbled, pulling back to the 50-DMA. Whereas IYR was overbought before this, it is now only neutral and has a good timing score in our Trend Analyzer.

IYR is not alone in seeing a pullback in an uptrend. Semis (SMH) have seen the same following some weaker earnings last week from the likes of Intel (INTC). Given the industry’s impressive 33.19% run so far this year, some type of greater mean reversion is increasingly possible, so this pullback should be watched. Start a two-week free trial to Bespoke Premium to access our Chart Scanner tool and much more.