Morning Lineup – Semi-Concern

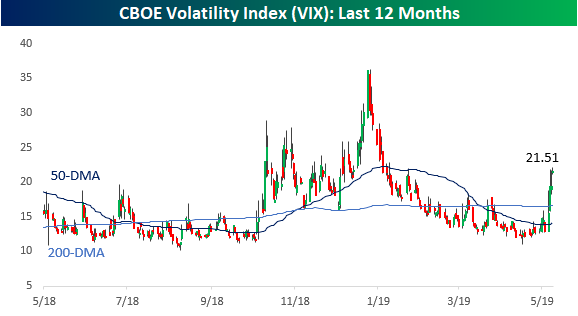

The usual headlines with regards to China are circulating this morning, and there’s more where that came from for the next two days as a Chinese delegation arrives in Washington today. Further complicating things, North Korea launched its second missile test in less than a week overnight which just happened to coincide with a visit from a US envoy to South Korea. Geopolitics are no doubt starting to heat up, and so is the VIX as it poised to close above 20 for the first time since early January!

Outside of geopolitics, there’s also a fair amount of US economic data today after a number of days this week with few or no reports. PPI for April was inline with expectations at the headline level (0.2% m/m) but weaker than expected at the core level (0.1% vs 0.2%). Jobless claims, meanwhile, came in higher than expected at 228K versus estimates for a reading of 220K. On the earnings front, we saw a little bit of a switch this morning as the pace of revenue beats is actually ahead of the pace of EPS beats since yesterday’s close. Of the over 150 companies that have reported since Wednesday’s close, just 56% have exceeded EPS forecasts by 59% have beat top-line forecasts. It would have been preferable to see the switch take place as a result of an improvement in the revenues beat rate rather than a big drop in the EPS beat rate.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

As shown below, the VIX has seen quite a surge in the last week. Last Friday, it wasn’t even a teenager and today it’s over the legal drinking age. My how they grow up!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Price Action, Sector Performance, Carbon Intensity, Fund Flows — 5/8/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the S&P 500’s price action over the past few sessions, highlighting the large amount of buying from open to close. We also take a look at a few cyclical sector’s recent performance versus defensive counterparts. With little in the way of major economic data, we then turn our attention to the relationship between carbon emissions and economic growth. We finish tonight’s report with a look at ICI Fund Flows continued outflows from equities and EIA data showing a large drawdown in crude inventories.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

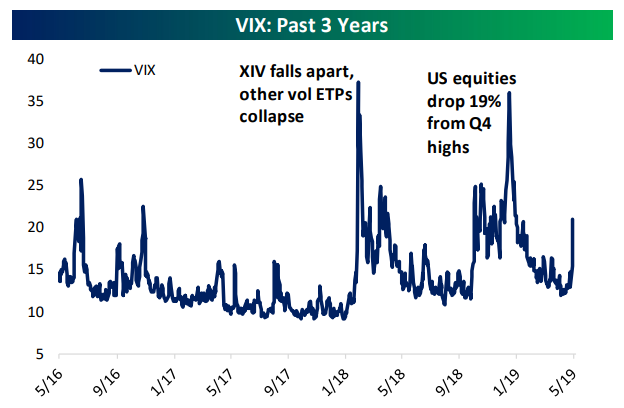

VIX Positioning: It’s Different This Time

With the drop in stock prices over the last few days, equity markets have fallen and the VIX index – a measure of volatility implied by short-term options on S&P 500 stocks – has surged, as it typically does when the market drops. Last night we discussed the situation in our daily post-market note, The Closer. As shown in the chart below, this is the third time the VIX has surged over the last 18 months, with the first being a huge uptick relative to a more modest equity price decline than the huge drop in Q4. That first spike was driven by a collapse of products designed to profit from low or falling volatility.

Similar to the last drop, speculators in volatility futures have built up large short positions in volatility recently. Of the outstanding open interest in VIX-linked futures, about 40% is net short exposure for traders classified as speculators in the CFTC’s Commitment of Traders report. Are we due for another stratospheric move in the VIX as weak hands are shaken out of VIX future shorts?

While a further rise in implied volatility isn’t something we can rule out, this time does look pretty different from the early 2018 volatility market blow-up. First of all, exchange traded products (ETPs) that are exposed to the VIX are very long volatility. In 2017, a huge short position had built up via these ETPs, with a VIX short market cap of almost $4bn. At the time, long volatility ETPs had a combined market cap of less than $1bn. Now, the market cap imbalance is completely reversed: short vol products have only about $500mm in market cap while long vol products are north of $3.5bn. So retail traders – the primary customer base for this type of product – are positioned in the opposite manner. Furthermore, total VIX futures exposure has fallen dramatically. Back in September of 2017, there were more than 704,000 VIX futures open, with more than 650,000 outstanding in mid-January of 2018. Today, that number is 36% below the peak and 31% below where things stood in January of 2018. So not only are retail traders positioned the opposite way, total market size and therefore exposure to the VIX has dropped considerably. Start a two-week free trial to Bespoke Institutional to access The Closer and all of our other market analysis.

Fixed Income Weekly – 5/8/19

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we take a look at the evolution of real yields since before the financial crisis.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

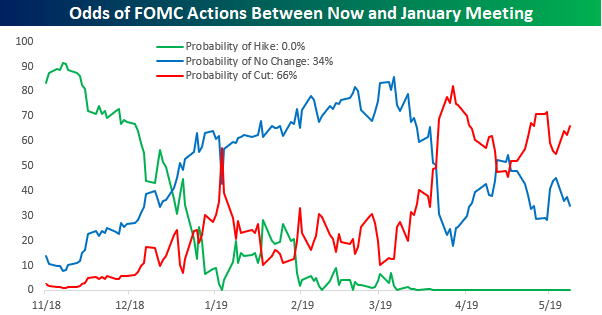

Markets Keep Pushing the FOMC

Heading into last week’s FOMC meeting, futures markets were pricing in close to an 80% chance of at least one rate cut from the FOMC between now and the January 2020 meeting in less than eight months. In his press conference following that meeting, Fed Chairman Jay Powell did his best to reset market expectations by arguing that recent low inflation readings are transitory and by saying that the FOMC wasn’t currently leaning in one direction or the other with respect to its next move on rates.

The result of Powell’s non-dovish remarks (but definitely not hawkish either) was a relatively sharp reversal in equity prices and a re-pricing in the futures markets regarding the likelihood of rate cuts between now and January. By last Friday, the market was only pricing in a slightly better than 50-50 chance of a rate cut by the January 2020 meeting.

In the span of the last three trading days (and a Sunday tweetstorm from the President regarding China), though, traders in Fed Funds futures are once again back to pressing their bets on the possibility of rate cuts. As of this morning, those odds have moved back up to 66%.

Recent moves in the yield curve are also starting to suggest that the FOMC may have to blink. After a brief inversion in late March, the yield curve, which we measure as the spread between the yields on the 10-year and 3-month treasuries, started to steepen again in April, which likely caused a sigh of relief in the halls of the Federal Reserve. Over the last few days, though, the flattening trend has returned with vigor and as of this morning is just one basis point from inversion again. If that happens, there’s a good chance that it won’t sit well with markets.Start a two-week free trial to Bespoke Institutional to access all of our market, earnings, economic, and FOMC analysis.

Chart of the Day – Intraday Pattern Points to Overseas Selling

Morning Lineup – Quick Change

Futures are down again this morning as global equities sell-off in the wake of yesterday’s brutal day in the US. Traders are in no mood to take a stand right now as the uncertainties regarding China and Iran take center stage. The flight to safety has provided a big boost for treasuries, re-flattening the yield curve closer to the inversion zone. And to think, just three trading days ago, the S&P 500 was flirting with a record high close! Change happens fast!

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Each morning on page two of the Morning Lineup, we show the daily percentage of S&P 500 stocks trading at overbought and oversold levels over the last year. In the chart below, we combine those two series to show the daily reading on a net basis. After reaching extreme negative levels back in late December, this indicator saw a sharp rebound at the turn of the calendar and has basically been in positive territory for most of this year. Following yesterday’s shellacking in the market, though, the net percentage of overbought stocks turned negative for the first time since mid-January. While there may have been short-term froth in prices heading into this week, the rekindling of Chinese trade issues as well as geopolitical issues bubbling up in the Middle-East, has been more enough to settle sentiment down in the short-term.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — All About Vol, SLOOS Sags, JOLTS Jump — 5/7/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, with equities down sharply so far this week, the VIX has been headed upwards leading the curve to flatten. We delve deep into what this means for the probability of the VIX dramatically surging like early last year. Next, we turn to yesterday’s Senior Loan Officer Outlook Survey courtesy of the Fed which showed some weaker lending and demand. We show some of this data like credit card, auto, and real estate lending in further detail. We finish off tonight’s Closer with a recap of today’s JOLTS report which was substantially stronger than forecasts.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!