Chart of the Day: TGIM

S&P 500 Performance Following 1%+ Lower Opens

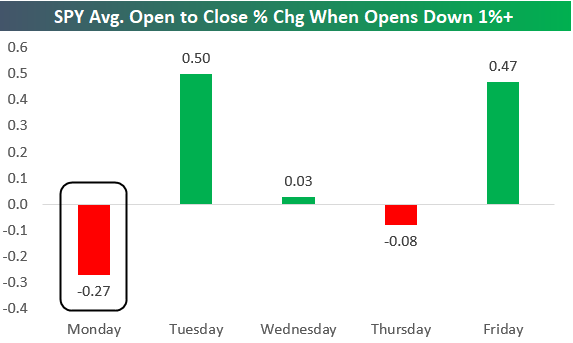

The S&P 500 SPY ETF opened lower by more than 1% this Monday morning after no progress was made between the US and China on trade. When SPY opens down 1% or more, how does the ETF typically perform during regular trading hours from the open to the close? Since 1993 when SPY began trading, the ETF has averaged a decline of 0.27% from the open to the close when it opens down 1%+ on a Monday morning. As shown in the chart below, Monday is the worst day of the week for a 1%+ open lower.

When SPY has opened down 1%+ on Tuesdays or Fridays, it has actually bounced back very nicely throughout the trading day with an average open to close change of ~0.50%. On Wednesdays and Thursdays, the open to close change is basically flat following a 1%+ gap down.

Based on historical price action, big opens lower on a Monday typically see continued selling throughout the trading day, while Tuesdays and Fridays see buyers step in. Start a two-week free trial to Bespoke Institutional to access our thought-provoking investment research and all of our interactive investor tools.

Trend Analyzer – 5/13/19 – Off of Overbought

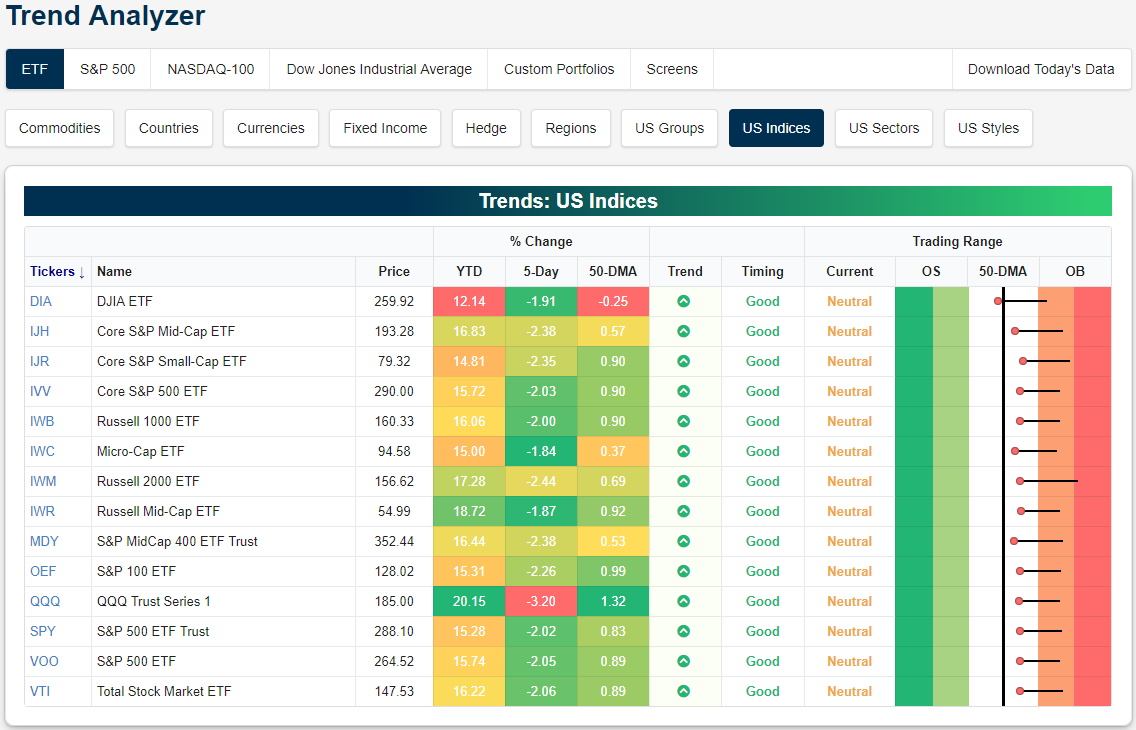

The major index ETFs have worked themselves off of overbought levels following last week’s declines which were some of the steepest of any given week so far this year. Each of these ETFs were hit fairly hard with most declining over 2% while the Dow (DIA), Russell Mid Cap (IWR), and Micro-Cap ETF (IWC) held up fairly better falling less than 2%. On the other hand, the Nasdaq (QQQ) fell the most with a 3.2% decline, the only one to decline over 3%. In spite of this, QQQ is still the only index ETF to have risen over 20% on a year to date basis. Additionally, QQQ is now sitting the highest above the 50-DMA, and it’s the only one over 1% above. Looking on the bright side of this recent pullback, every one of the major index ETFs has held onto its uptrend and now has a good timing score according to our Trend Analyzer tool. Unfortunately, this could all change after the open today given that US equity futures are down 1.5%. It will be important to see where things stand after the close today to see if support levels held. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer tool and much more.

While on the Dow (DIA) closed on Friday with price below the 50-DMA, the rest found support at the 50-DMA on a closing basis. Looking at the individual charts though, many opened on Thursday or Friday right around these levels. Intraday, each of these did in fact fall below the moving average. With futures indicating a lower open this morning, many of these are not likely to hold onto this support with the 200-DMA the next place to watch. At the same time, if intraday buying keeps up like it has, it is equally as likely that the 50-DMA can be retaken.

Bespoke Morning Lineup — Another 1%+ Monday Open Lower

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. This morning we take a close look at how SPY usually trades following big gaps lower of 1%+ at the open.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespokecast Episode 30 — Petr Pinkhasov — Now Available on iTunes, GooglePlay, Stitcher and More

We’re happy to announce that the newest episode of Bespokecast is now available to the general public both here and via the various podcast platforms. Be sure to subscribe to Bespokecast on your preferred podcast app to gain access to our full collection of episodes. We’d also love for you to provide a review as well!

In this new episode of Bespokecast we sit down with Petr Pinkhasov of Jade Market Analytics. Petr is the founder of Jade and has a unique perspective on macro markets. His research focuses on cross-asset relationships, identifying repeating patterns in prices, and trade construction. Over the course of his career, Petr has worked at a variety of macro-oriented investing shops, including the family office run by former Quantum Fund fixed income and foreign exchange head Victor Niederhoffer. His perspective is very quantitatively focused and takes an approach that listeners will find unique. You can follow Jade Markets on Twitter here.

To listen to our newest episode or subscribe to the podcast via iTunes, GooglePlay, OvercastFM, or Stitcher, please click the button or links below. Please note that third-party podcast feeds may update at a lag of a few hours to this blog post.

Bespoke Brunch Reads: 5/12/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Dark Underbellies

‘I’d Have These Extremely Graphic Dreams’: What It’s Like To Work On Ultra-Violent Games Like Mortal Kombat 11 by Joshua Rivera (Kotaku)

There’s a psychic toll for workers that are charged with sculpting the vivid, over-the-top violence of modern videogames, combining meticulous hyperrealism with obscene displays. [Link]

Young Real Estate Flippers Get Their First Taste of Losing by Prashant Gopal (Bloomberg)

After riding a wave of surging real estate prices that have rewarded rapid buying and selling of properties after superficial upgrades, younger flippers are running into softening demand in markets with extreme price levels and slowing volumes. [Link; soft paywall]

Verizon, T-Mobile, Sprint, and AT&T Hit With Class Action Lawsuit Over Selling Customers’ Location Data by Joseph Cox (Vice)

Groups of consumers are filing suit with major telecoms operators, claiming that sales of their location data to bounty hunters violated their rights as customers. [Link]

New Frontiers

They Got Rich Off Uber and Lyft. Then They Moved to Low-Tax States. by Kate Conger (NYT)

Young employees of major tech unicorns have hit bids on their equity stakes and headed for other states with lower tax rates, property prices, and stress levels. [Link; soft paywall]

Nashville Wants to Be the Next Austin, But Tennessee Won’t Make It Easy by Erik Larson (Bloomberg)

The latest in a string of examples (others include Georgia’s recent abortion law or North Carolina’s fight over trans peoples’ access to bathrooms) that pit state-level attitudes towards social issues against cities eager to access business and consumer demand with different perspectives, opening up questions of state versus municipal rights. [Link]

Disruption

From lab to table: Will cell-cultured meat win over Americans? by Laura Reiley (WaPo)

Following the IPO of one of the largest meat substitute companies, consumers are getting more and more access to meat substitutes, with lab-grown alternatives also on the horizon. [Link; soft paywall]

Why Every Company Needs to Think Like an Entertainment Company by Mark Purdy and Gene Reznik (Harvard Business Review)

As the attention economy builds steam, more and more companies are forced to think about their business as the provision of media to consumers, forcing them to compete with a different set of products than the ones they offer. [Link]

The End of App Stores Is Rapidly Approaching by Owen Williams (Medium)

Applications are using native browser frameworks to create the kind of experience an installed application offers, without forcing users to navigate through a gated portal like app stores. [Link]

Elon Musk and Jeff Bezos’ bids to build US military rockets could reshape national security by Tim Fernholz (Quartz)

The three-way race to sell orbital launches to the US military (between SpaceX, Blue Origin, and the United Launch Alliance) is creating a unique expansion of capacity, reducing cost and also forcing the companies to push the envelope as they compete for both military and civilian customers. [Link]

In the Age of Analytics, Scouts Are Looking for Life After Baseball by Stephanie Apstein (Sports Illustrated)

With the sport increasingly reliant on analytics to identify talent, the old-fashioned qualitative judgment of baseball scouts is getting less and less respect. [Link]

Radical Desalination Approach May Disrupt the Water Industry by Holly Evarts (Columbia University School of Engineering)

A new approach for dealing with hypersalinated brines (water from industrial processes that are a growing environmental risk) may create new sources of fresh water. [Link]

An AI System Spontaneously Develops Baby-Like Ability to Gauge Big and Small by Dana G. Smith (Scientific American)

A neural network that wasn’t trained to count has been shown able to distinguish between numbers of things, a potential advance in “AI” techniques. [Link]

NBCU has announced the launch of shoppable ads on linear TV by Mariel Soto Reyes (Business Insider)

New ads on NBC channels will allow watchers to directly access the product for sale using QR codes displayed during the commercial. [Link]

Economic Research

Who Pays for the Minimum Wage? by Péter Harasztosi and Attila Lindner (AEA)

Minimum wage changes in Hungary present a chance to examine the effects of minimum wage increases. The authors estimate 75% of the increase is paid for by consumers, increasing substitution of labor for capital, and job-losses are concentrated in industries with higher price elasticity. [Link]

Second Chance: Life without Student Debt by Marco Di Maggio, Ankit Kalda, and Vincent Yao (NBER)

The largest private owner of student debt wasn’t able to prove chain of title on thousands of its loans. As a result, some borrowers that sued got debt relief. By comparing outcomes for borrowers who had their loan cancelled and borrowers who didn’t, the authors identify a perfect natural experiment which is unusual. The impact: higher geographical mobility and higher rates of job change, leading those who received debt relief to pursue better opportunities and see income increase by more than $4000 (~two months salary) over three years. [Link]

China

CBS Censors a ‘Good Fight’ Segment. Its Topic Was Chinese Censorship. by Julia Jacobs (NYT)

Producers for an American-aired CBS program cut a segment dealing with Chinese censorship, a sign of the increasing reach of Chinese interests around the global economy. [Link; soft paywall]

Revealed: new evidence of China’s mission to raze the mosques of Xinjiang by Lily Kuo (The Guardian)

As part of its effort to erase the identity of the Uighur in its Xinjiang province, China’s government is now destroying mosques and other holy sites that are sacred to the Islamic minority. [Link]

Fed up Canada tells U.S. to help with China crisis or forget about favors by David Ljunggren (Reuters)

Canada’s role in the ongoing dispute between the US and China (via extradition over a Huawei executive detained in Vancouver) is leading to fractures in the longstanding geopolitical alliance. [Link]

Investing

A Quirk of the Calendar Is Messing With Stocks by Jeff Sommer (NYT)

Recent long-term equity market return improvements (typically over a 10 year window) have been driven by huge losses from 2007 – 2009 falling out of the reference window. [Link]

BlackRock Strategist Says Yield Curve Is Losing Predictive Power by Esteban Duarte (Bloomberg)

“It’s different this time” are a famous quartet of words prognosticators tend to forget, but Blackrock strategist Gargi Chaudhuri is comfortable uttering them in response to concerns over the shape of the yield curve. [Link; soft paywall]

Investors pull billions from quant king AQR as performance slumps by Tom Teodurczuk (Financial News)

Giant quantitative hedge fund AQR has seen its assets slump thanks to significant underperformance across its numerous strategies. [Link]

Money Woes

Stop Wasting Money on Unnecessary Monthly Subscriptions by Joanna Stern (WSJ)

Subscription-based business models have proliferated, but customers are often stuck with a litany of monthly payments for services they don’t want or need. [Link; paywall]

Parents are going into debt over their kids’ extracurricular activities (NYP/Marketwatch)

With a need to fill children’s free time, a recent survey revealed that parents’ expectations children will earn money from an activity are willing to fund the cost of extracurriculars with debt. [Link]

Too Much of A Good Thing

It’s Time to Break Up Facebook by Chris Hughes (NYT)

One of the co-founders of Facebook is taking a page from the Progressive Era, calling for a breakup of the giant enterprise that he thinks is doing harm to society thanks to its scale. [Link; soft paywall]

How TED (And Its Copycats) Gutted the Market for Ideas by Nilofer Merchant (Barron’s)

Live speakers at conferences and events are increasingly being asked to forego fees for their time and effort, with hosts demanding that they accept the benefits of exposure instead. [Link; paywall]

Batteries

A war is brewing over lithium mining at the edge of Death Valley by Louis Sahagun (LAT)

The massive volumes of lithium required to supply the modern battery industry has sparked a hunt for supplies of lithium, the relatively rare mineral found in salt deposits around the world. [Link; soft paywall]

Cardboard Re-Imagined

The hot new product Amazon and Target are obsessing over? Boxes by Mark Wilson (Fast Company)

How marketers at major e-commerce players are turning an item of expense into an opportunity using a bit of ink and some creativity. [Link]

Dogs

Why is this interesting? – The Dog Edition by W. David Marx (Why is this interesting?)

A short history of how human beings have guided the development of dog breeds as a function of our own culture. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Tweet Policy

The S&P 500 was down this week, but we were very happy with the action late in the trading day on Thursday and Friday. Buyers willingly stepped in after European markets closed on both days to end the week. We highlight this action in multiple charts in this week’s Bespoke Report, which you can access when you start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 5/10/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

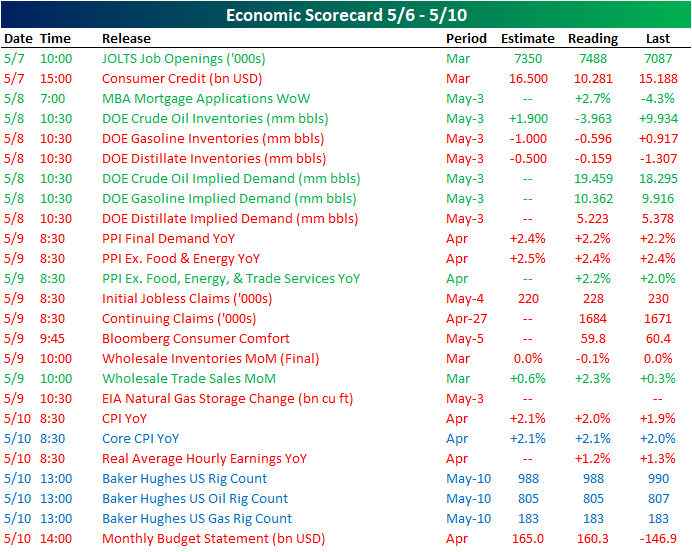

Next Week’s Economic Indicators – 5/10/19

Macroeconomic data took a back seat to earnings and tariff tweets in what was a pretty quiet week of data. There were only 25 releases on the radar with most missing estimates or coming in below the prior period. With no releases on Monday, the JOLTS report kicked things off on Tuesday showing 7.488 million job openings in March versus expectations of 7.350 mln. Consumer Credit data for March also came out Tuesday coming in below both the consensus forecast and February’s print. Weekly mortgage applications were stronger this week rising 2.7% while DOE petroleum data showed a draw on crude inventories, though, gasoline and distillates both fell less than expected. Producer inflation data came out on Thursday, coming in unchanged versus March. Headline PPI was expected to grow 2.4% in April rather than the 2.2% reading we got. CPI data was released later in the week with similar results.

Things will be pretty quiet again next week, with one fewer data release than this week. Once again, nothing is scheduled to come out on Monday, but Tuesday will see NFIB’s small business optimism and Import and Export Price indices. Wednesday will be the busiest day of the week by far with Retail Sales out in the morning, followed up by Industrial Production, NAHB Homebuilder Sentiment, and TIC Flows. Other than Industrial Production and Homebuilder sentiment, lower readings are expected across the board. Housing Starts and Building Permits for April are scheduled to come out Thursday morning in addition to the Philly Fed’s Business Outlook Index for May. Each of these releases is expected to show improvements from the previous month. Finally, we will round out the week with the Leading Index and University of Michigan Sentiment on Friday. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Global Data Surprises Bottoming Out, Driven By China

Over the past couple of months, Chinese data has provided a much-needed shot in the arm for global economic surprise indices. Recent data since March has been on a tear relative to expectations in China. Industrial production, fixed asset investment, and exports are some good examples of recent data that has handily beat. For the global picture, that’s helped push the Global Economic Surprise index off multi-year lows, even if it’s still in negative territory. In other words, even though global economic data has come in weaker than expected over the last few months, things are less bad now than they were earlier this year. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.