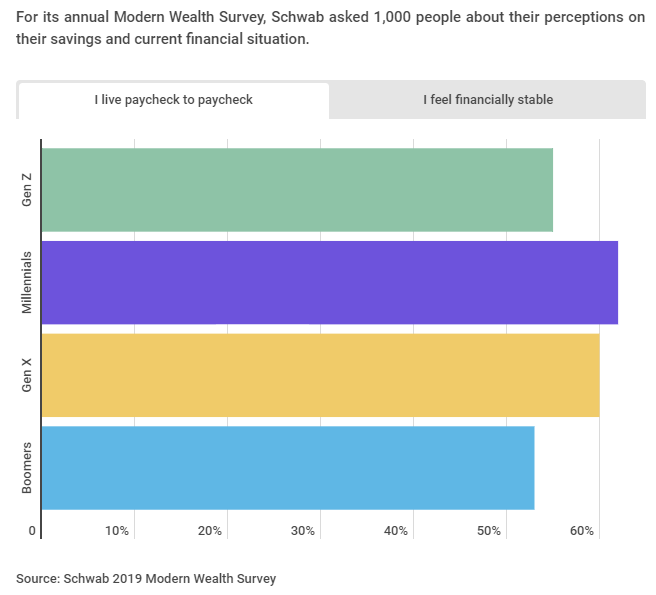

Paycheck to Paycheck: Millenials vs Everybody Else

Although the US economy remains strong, a recent article published by CNBC suggests that millennials continue to struggle to make ends meet. Citing a report from Charles Schwab, the article highlighted that “Almost two thirds of millennials say they’re living paycheck to paycheck and only 38% feel financially stable.” In comparison to baby boomers, millennials are spending nearly $120 more monthly on “non-essential” purchases, which include dining out, entertainment, luxury items and vacations. The article continues by explaining why millennials are having a pessimistic attitude towards the economy and one of the main conclusions was due to a lack of financial literacy.

One factor behind the high level of millennials feeling strapped? Two words. Student loans. Within the article, there was an additional survey conducted by LightStream (the online lending division of SunTrust Bank) that concluded around 40% of millennials from ages 20 to 35 have higher credit card debts as well as higher debt in general. One of the main contributing factors to rising debt stems from increasing student loan burdens that millennials face. “The median amount of loan debt millennials carried was $19,000, significantly higher than Gen Xers’ balance of $12,800 at the same age.” According to Pew Research Center, the number of households with student loan debt has nearly doubled from 1998 to 2016.

While the financial picture for millennials appears increasingly tight, that picture doesn’t necessarily seem to be an accurate depiction of the broader US consumer base. To illustrate this, we would highlight a recent chart from our monthly Consumer Pulse survey.

Each month in this report, we survey of 1,500 to 2,000 Americans to get their views and attitudes on the economy by focusing on six main sections: Sentiment, Labor Markets, Personal Finances, Housing, Activity and Investors. This report gives us a great insight into the current trends playing out in the US economy and allows us to spot inflection points in specific areas with respect to employment, spending, budget, investing and other trends. To stay up to date on the latest trends and issues facing US consumers, sign up to gain access to our Consumer Pulse Report.

One question we ask in each month’s survey is whether consumers feel they are living paycheck to paycheck. In this month’s survey, 36.9% of consumers responded affirmatively to that question. While that may sound high, as shown in the chart below, that’s the lowest level we have seen since we started running the survey back in July 2014. So while millennials, which are admittedly a large share of the US consumer pie, continue to feel financially ‘strapped’, the picture for all US consumers is not as bad and the trend is moving in the right direction.

Bespoke Morning Lineup – Inverted Again

Weak economic data out of China, Japan, and other regions of the world has investors clamoring for the safety of treasuries this morning, pushing the yield curve (10-year vs 3 -month) back to inverted levels. At other areas of the curve, the two-year yield dropped to its lowest level since February 2018.

US economic data has come in mixed so far with the Philly Fed Manufacturing report exceeding expectations and coming in at its highest level since November, but Retail Sales missed expectations falling 0.2% compared to expectations for growth of 0.2%.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day.

While Retail Sales in the US were a downer, the same indicator in China was even a bigger disappointment. On a YTD basis, retail sales through the month of April grew 8%. That may sound pretty positive at the surface, but it’s actually the slowest pace of growth since June 2003!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Eurozone Macro, Consumer Credit, Import and Export Prices — 5/14/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the Eurozone’s economic surprised over the past few months while real yields are setting up in a bear flag pattern. We also highlight copper’s weakness. Then we turn to today’s release from the New York Fed to take an in-depth look at the debt of the American consumer. We finish with a look at today’s release of Import and Export Price Indices.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Small Businesses Still Confident

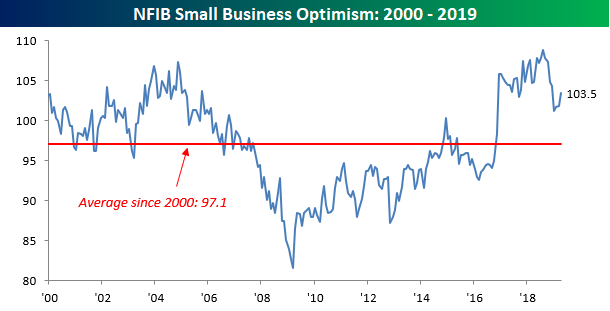

Trade wars. What trade wars? While markets are freaking out about the latest tweets from the President related to trade tensions with China, small business owners are grinding away and becoming increasingly confident after sentiment took a hit late last year and earlier this year due in part to the government shutdown and tighter Fed. In this month’s report from the NFIB, overall sentiment came in at a level of 103.5 compared to expectations for a reading of 102.0 and last month’s reading of 101.8. We’re still quite a ways from the cycle high of 108.8 reached last August, but also still comfortably above the historical average reading of 97.1. In the words of the NFIB, “Overall, the Index remains at a historically very strong level, consistent with solid growth, keeping the economy at full employment. There is no recession in sight this year.”

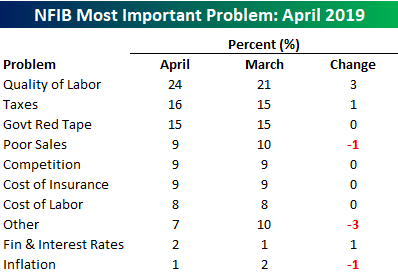

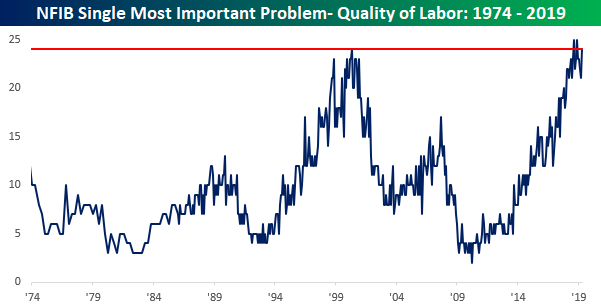

In each month’s report, one area we like to focus on is the section of the report where small business owners are asked what the single most important problem they face is. In this month’s survey, Labor Quality continued to top the list with nearly a quarter of respondents saying they are having difficulty finding qualified workers. That’s up from 21% last month and isn’t far off the record high of 25% we saw in August and November of 2018. As shown in the chart below, there have only been three other months in the history of this report where either as large or a larger percentage of small business owners cited Labor Quality as the biggest problem. The first was in May 2000, while the other two were in the second half of 2018.

Strangely enough, while Labor Quality is a big issue, the cost of labor has been much less problematic as just 8% of small business owners cited it as their most important problem. That’s unchanged from March and is right in the range of where it has been for the last two years. That’s a positive from an inflation perspective as wages play such a large role in prices and with just 1% of small business owners citing inflation as their biggest problem, they don’t seem particularly worried about the prospect of rising prices. Start a two-week free trial to Bespoke Institutional to access all of our research and interactive investor tools.

Bespoke Stock Scores — 5/14/19

Chart of the Day: Tariffs Terrifying Retail

Trend Analyzer – 5/14/19 – Oversold Shift

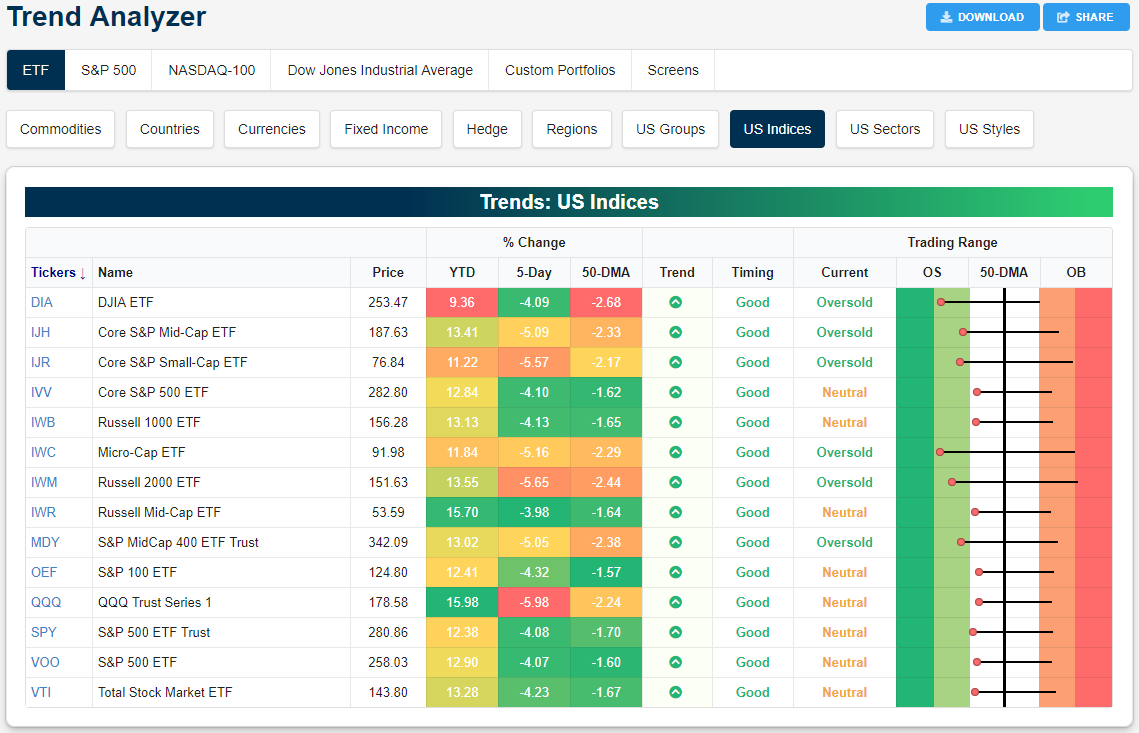

Tacking onto the past week’s losses, yesterday was the first decline of over 2% in more than five months for the S&P 500 (SPY). Currently, every major index ETF has now declined over 4% in the past five days. Small caps and mid caps, in particular, have gotten hit hard as each one has fallen over 5%. Meanwhile, the Nasdaq (QQQ) has more dramatically underperformed, currently sitting just under 6% below where it was last week at this time. QQQ has still outperformed all other major index ETFs on a year to date basis, though. There is also no longer any major index ETF sitting above the 50-DMA. Whereas last week the group was entirely overbought, they head into trading today at either oversold levels or neutral and on the cusp of oversold. As seen through the long tails across each name in our Trend Analyzer, the movement towards this lower end of the ETFs’ trading ranges has been rapid. But this pullback provides a good timing opportunity considering each one is still in an uptrend over the past six months. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer and much more.

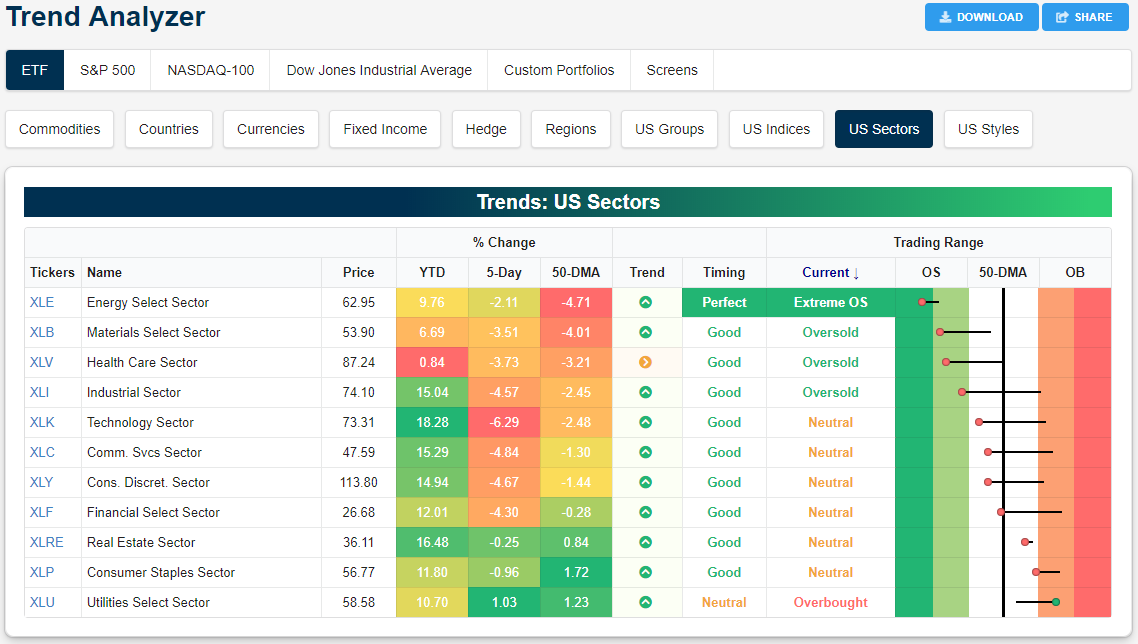

Like the broader market, declines can be seen across the eleven sectors as only Utilities (XLU) has managed to edge out a gain over the past week. XLU is now up just over 1% and is also the only sector ETF to sit in overbought territory. Other defensives like Real Estate (XLRE) and Consumer Staples (XLP), while not positive, have held up better than their peers. These two have only seen declines of less than 1% versus losses upwards of 6.29% from Technology (XLK). Despite XLK’s steep declines in the past week, it actually has yet to push into oversold territory. Along with six other sectors, XLK is in neutral territory, but similar to most other sectors, XLK has fallen below its 50-DMA. Only XLRE, XLP, and XLU have managed to hold above their respective 50-DMAs. Some have fallen far enough below the 50-DMA to now sit in oversold territory, with Energy (XLE) doing so to an extreme degree. This is in part due to volatile oil prices over the past few days. The silver lining once again is that each of these (except for the overbought XLU) have good timing scores and XLE actually has a perfect timing rating.

Bespoke Morning Lineup – Hoping for a Turnaround

Global equity markets are attempting to rally back from the plunge yesterday thanks to trade headlines. The bounce appears to be mostly a function of the same kind of headlines, if not even more speculative in nature, but the move higher has been pretty consistent with Europe up 1% and US equities poised to gap up by about 63 bps. The market continues to be dominated by trade-related headlines, but at some point soon, tweets and headlines just aren’t going to cut it, and investors are going to demand concrete results.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day.

The list of oversold stocks is really starting to pile up. Through yesterday’s close, 18.6% of stocks in the S&P 500 were at short-term overbought levels while 38% were oversold. That net reading of 19.4% is the most negative reading since January 7th.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Oil Volatility, Fastenal Sales, Inflation Expectations — 5/13/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a recap of oil’s volatile session as well as LYFT and UBER’s rough trading. We then review the theory that equity markets are more prone to sudden and sharp drops. Next, we look at Fastenal (FAST) monthly sales which are a good proxy for the broad economy. We finish with a deep look at the New York Fed’s consumer expectations survey on inflation.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!