Chart of the Day – Semi Underperformance

Biggest Earnings Winners and Losers

More than 2,000 public companies released quarterly earnings during the Q1 reporting period between April 10th and May 16th. On average, these stocks fell 0.57% on their earnings reaction days, so collectively, investors were net sellers on earnings this past season. (For a stock that reports before the open, its earnings reaction day is that trading day. For a stock that reports after the close, its earnings reaction day is the next trading day.)

There were 25 stocks that gained more than 20% on their earnings reaction days this season, and there were 108 that gained more than 10%. Below is a list of the very best performers. As shown, Control4 (CTRL) ranks at the top with a one-day gain of 39.6% when it reported on May 9th. While the company missed revenue estimates, it announced that it was being acquired for $23.91/share — 39.66% above the price it closed at prior to its earnings report.

The same thing happened to the 2nd best performer on earnings this season — Aquantia (AQ). AQ reported earnings on May 6th, and while it missed both EPS and revenue estimates, it announced that it had been bought by Marvell Technology for $13.25/share.

Behind CTRL and AQ, the next best three stocks on their earnings reaction days this past season were Impinj (PI), Zix Corp (ZIXI), and Enphase Energy (ENPH). PI and ZIXI both gained nearly 35%, while ENPH gained 29.3%. Other notables on the list of biggest winners include Sohu.com (SOHU), MercadoLibre (MELI), US Steel (X), and Twitter (TWTR).

While there were 25 stocks that gained more than 20% on their earnings reaction days this season, there were 31 that fell more than 20%. Additionally, there were 108 stocks that gained more than 10%, but there were 157 that fell more than 10%. In other words, there were more big losers than winners.

At the top of the “biggest losers” list is Stamps.com (STMP), which fell 55.75% on May 9th after its evening report on May 8th. For STMP, it was its second 50%+ decline on earnings in a row — something that had never happened for any stock in our Earnings Database dating back to 2001!

Behind STMP, we saw Conduent (CNDT) and Puma Biotech (PBYI) both fall more than 38%, while Tenneco (TEN) fell 37.5%. Other notables on the list of biggest losers this past earnings season include Fluor (FLR), iRobot (IRBT), MarineMax (HZO), Sleep Number (SNBR), and 3D Systems (DDD). With every company on the list below experiencing a one-day drop of more than 17% recently, this is not a distinguished list that you want to be on if you’re a publicly traded company! Start a two-week free trial to Bespoke Institutional to access our Earnings Explorer tool and everything else we have to offer.

Rotation Into Defensives

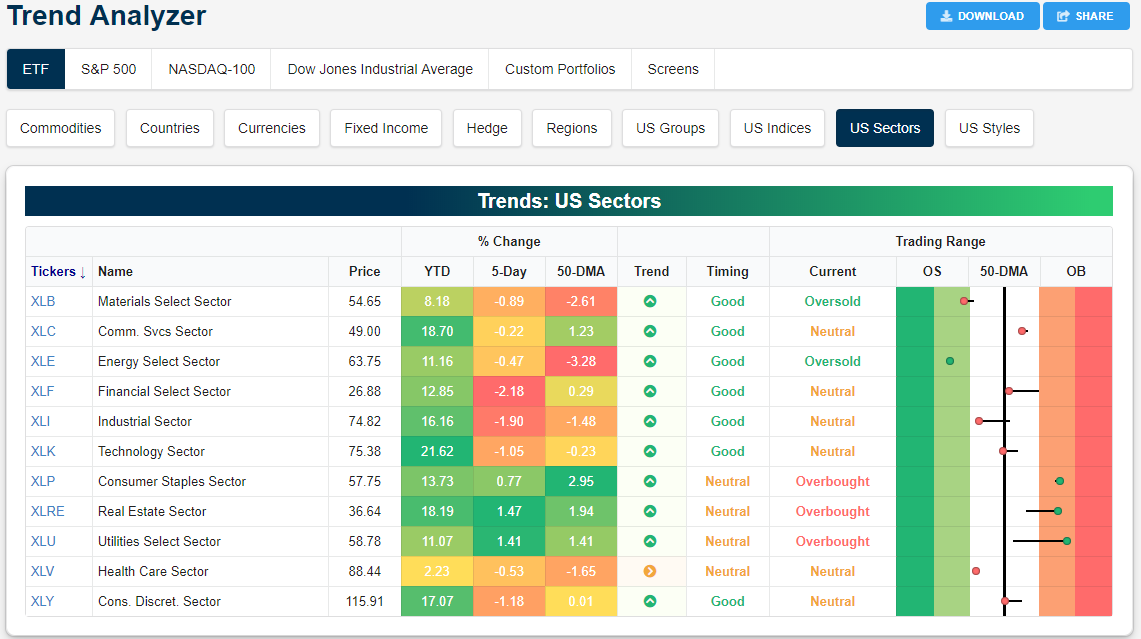

This May so far has not been the kindest to equities as Friday marked another down week. With markets facing this selling, investors have been dumping more cyclical sectors for defensives. As shown in our Trend Analyzer below, Financials (XLF) and Industrials (XLI) saw the worst of last week’s declines as XLF fell the most at 2.18% with XLI not far behind down 1.9%. Technology (XLK) and Consumer Discretionary (XLY) were also notably weak falling over 1%. As these more cyclical sectors saw sizeable declines, defensives rallied. The Real Estate sector ETF (XLRE) and the Utilities sector ETF (XLU) rose 1.47% and 1.41%, respectively, as Consumer Staples (XLP) managed to gain 0.77%. This brings all three to firmly overbought levels, whereas XLRE and XLU had actually been neutral only a week ago. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.

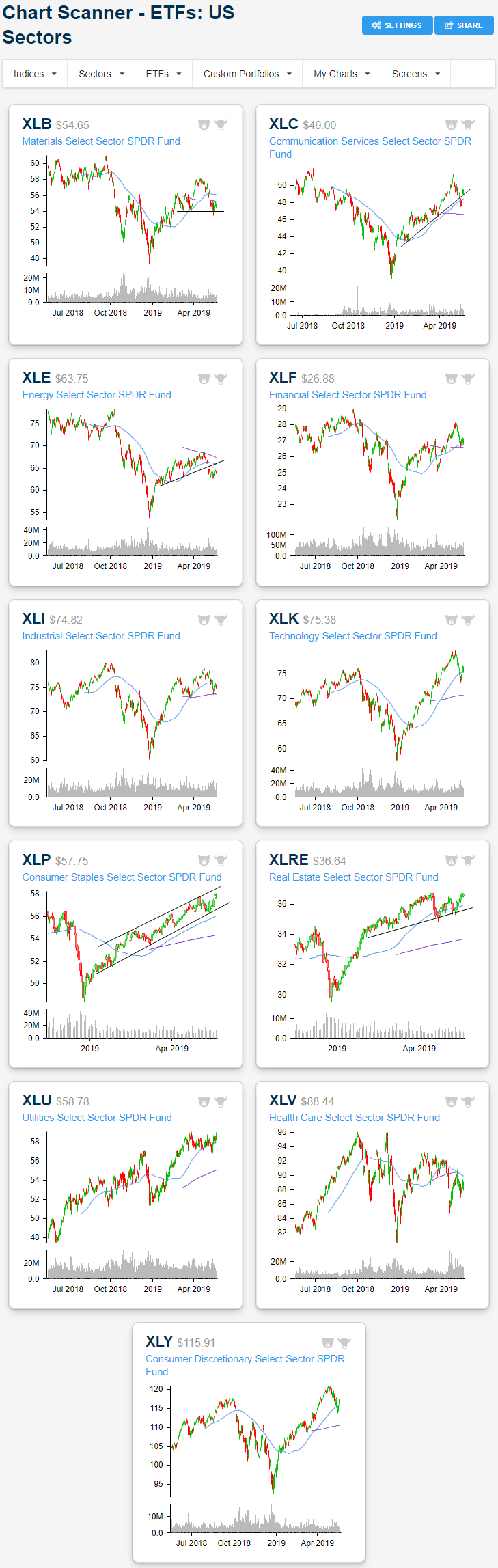

Turning to the charts of these sector ETFs, while there may have been declines over the past few weeks, there also has not been any outright collapses. In fact, most sectors have fallen to, rather than through, logical support levels over the past few weeks. For example, despite a brief dip below, Materials (XLB) has been trading tightly between March lows and the 200-DMA. Meanwhile, for XLI and XLF, the 200-DMA has acted as support with recent lows bouncing right off of these moving averages. Similarly, Consumer Discretionary (XLY), Tech (XLK), and Communication Services (XLC) have been hovering around their 50-DMAs in their recent pullback. For XLC and XLY, this recent pullback has also seemed to have found a bottom at the lower end of the sectors’ uptrend channels. The same cannot be said for XLK which has more distinctively broken through its uptrend. Defensives, on the other hand, are at the tops of their uptrend channels or are eyeing a new break higher. Continuously weak this year, Health Care (XLV) is still the only sector that has been making consistently lower lows.

Here Comes Summer!

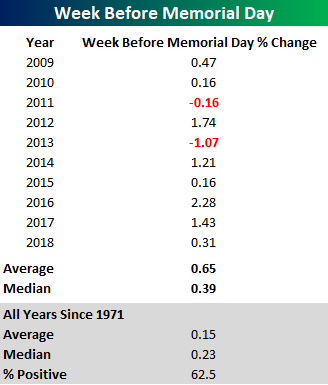

With Memorial Day right around the corner, we wanted to look at how the S&P 500 has historically performed leading up to the first unofficial weekend of summer. While the day to honor the sacrifice of Americans who have died while in service of the US military was historically observed on May 30th, beginning in 1971, Memorial Day was moved to the last Monday of May. With Memorial Day falling on the 27th of May this year, it’s on the earlier side (earliest it can be is May 25th while the latest is the 31st). Also, as an added bonus, because of the way the calendar falls this year, there are 15 weeks between Memorial Day and Labor Day versus the traditional 14. So while it may have been a lousy spring for many areas of the country this year, look on the bright side: at least we’ll get an extra week of summer!

In terms of market returns, the S&P has tended to see modestly positive returns in the week leading up to Memorial Day, averaging a gain of 0.15% (median: 0.23%) with positive returns 62.5% of the time. Relative to all one week periods, those returns are slightly better than average but nothing to a significant degree. More recently, though, the returns have been a bit better. In the ten years since the lows of the Financial Crisis, the S&P 500 has seen an average gain of 0.65% (median: 0.39%) during the week leading up to Memorial Day weekend with positive returns in all but two years. Start a two-week free trial to Bespoke Institutional to access our seasonality tools and so much more.

US Equity Indices Start the Week Below 50-DMAs

Below is a snapshot from our Trend Analyzer tool of the six major US index ETFs. As you can see in the “Trading Range” section to the right, all six ETFs are currently trading below their 50-day moving averages as we get set for a lower open to start the new trading week. (For each ETF, the dot represents where it’s currently trading within its normal range, while the black, vertical line represents each ETF’s 50-day moving average.)

The small-cap Russell 2,000 (IWM) is trading the furthest below its 50-day moving average and has just moved into “oversold” territory, which means it’s more than one standard deviation below its 50-DMA. The Dow 30 (DIA) is the next closest to oversold territory at -1.19% below its 50-DMA. The Nasdaq 100 (QQQ), S&P 500 (SPY), and Total Stock Market (VTI) ETFs are all just barely below their 50-DMAs. Start a two-week free trial to Bespoke Institutional to access our interactive equity market tools and much more.

Below is a snapshot of the six US index ETFs from our Chart Scanner tool so you can see how each one has been trending lately a little more closely.

YTD Total Returns Across Asset Classes

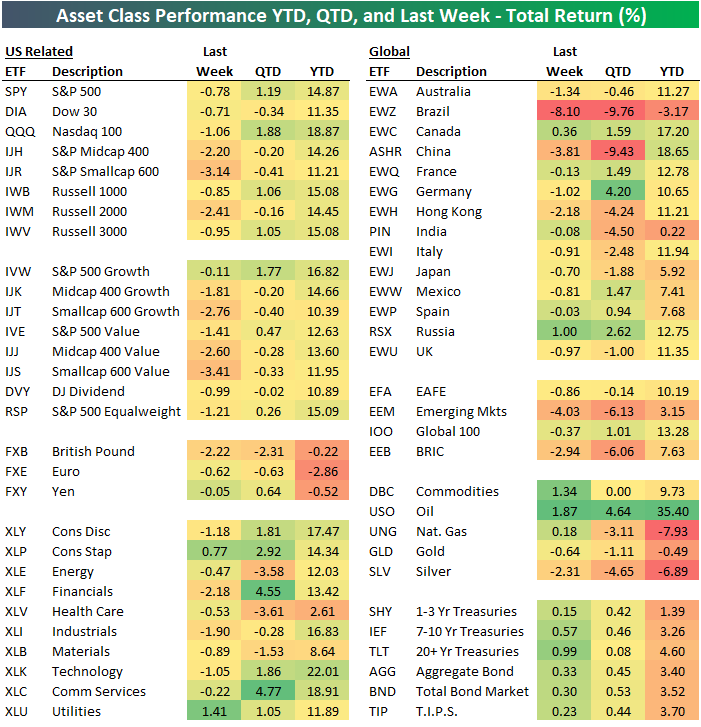

With the S&P 500 set to open lower by 0.70% to start the new trading week, below is an updated look at recent asset class performance using our key ETF matrx. For each ETF, we show its performance (total return %) last week, quarter-to-date, and year-to-date. As shown, SPY is currently up 1.19% in Q2, but it’s still up 14.87% year-to-date. The Dow 30 (DIA) is underperforming SPY by more than 3 percentage points on a YTD basis, while the Nasdaq 100 (QQQ) is outperforming SPY by 4 percentage points. Small-caps and mid-caps are in the midst of a rough patch with declines of 2%+ last week. However, the Russell 2,000 (IWM) is up nearly the same amount as the large-cap S&P 500 (SPY) for the entirety of 2019 so far.

Defensive sectors like Consumer Staples (XLP) and Utilities (XLU) have seen buying lately as investors rotate out of cyclicals a bit. Quarter-to-date, Communication Services and Financials are up the most with gains of more than 4%, while Health Care (XLV) and Energy (XLE) have been the biggest losers with declines of 3.5%+. Year-to-date, however, Technology is up the most with a 22% gain, followed by Communication Services (XLC) and Consumer Discretionary (XLY). Health Care is lagging badly in 2019 with a gain of just over 2%.

Outside of the US, we’ve seen quite a bit of divergence lately. Quarter-to-date, both Brazil (EWZ) and China (ASHR) are down more than 9%, while Hong Kong (EWH) and India (PIN) are pretty deep in the red as well. On the flip side, Germany (EWG) is up 4.2%, while Russia (RSX) is up 2.6% and Canada (EWC) is up 1.6%.

Oil (USO) is up the most of any asset class on a year-to-date basis with a gain of 35.4%, but natural gas (UNG), gold (GLD), and silver (SLV) are all in the red on the year. Fixed income ETFs rallied last week, leaving them all up roughly 3-4% year-to-date. Start a two-week free trial to Bespoke Institutional to access our interactive equity market tools and much more.

Morning Lineup – Weekend to Weakstart

We hope you enjoyed your weekend because it’s looking like a weak start to the trading week. Futures were actually in positive territory overnight but have been sinking ever since Europe opened for trading. The culprit once again is trade concerns with China, and the technology sector is bearing the brunt of the weakness following Friday’s blacklisting of Huawei by the US.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day.

With tech facing much of the selling this morning, semiconductors have been especially weak. Making matters worse for the sector this morning is that Morgan Stanley is recommending that investors reduce exposure to the sector. This is sure to make what has already been a weak technical picture for the sector worse as the sector was already down nearly 13% from its late April high heading into today. If that 200-DMA around 1,300 breaks this week, it wouldn’t be a good sign for the technology sector. Watch how the sector reacts to opening weakness this morning for any signs of investor interest.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 5/19/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Driving

Smartphones are driving Americans to distraction (The Economist)

After sharp declines from the mid-2000s to the mid-2010s, road deaths have started to rise again with smartphones and the distracted driving they create a prime culprit. [Link; soft paywall]

New Research Confirms That Ride-Hailing Companies Are Causing a Tonne of Traffic Congestion by Bryan Menegus (Gizmodo)

Ostensibly, ride-sharing could reduce the number of cars on the road by improving utilization rates, but the new demand for transportation they create could also be driving an increase in the number of vehicles on the road. New research suggests it’s the latter. [Link]

Tech Tracker: Burger King to deliver to L.A. motorists stuck in traffic by Nancy Luna (Nation’s Restaurant News)

Hungry but stuck in traffic? Burger King initially tested delivery of fast food to drivers stuck in traffic via motorcycle in Mexico City, and is now bringing the service to Los Angelenos. [Link]

Malfeasance

The Spectacular Implosion of Dr. Cho’s ‘Nefarious Network’ by Sheridan Prasso and Benjamin Robertson (Bloomberg)

A shadowy network of entities controlled by a Hong Kong doctor has come crashing down, giving rare insight into the hidden world of stock manipulation in the city’s equity markets. [Link; soft paywall]

Boeing MAX: A Tale of Two Crashes by Mariano Zafra, Robert Wall, Elliot Bentley, and Merrill Sherman (WSJ)

A remarkable and beautifully executed visualization of the crashes caused by faulty software included in the Boeing 737-MAX planes which killed hundreds of people. [Link; paywall]

Weird History

‘Kisse myne arse’: Doctor’s notes reveal bizarre medical cases from 400 years ago by Leslie Katz (CNET)

Doctors’ notes from 17th century England were recently digitized and put online for the review of the public and are full of amusing anecdotes from the various patients. [Link]

Blow up: how half a tonne of cocaine transformed the life of an island by Matthew Bremner (The Guardian)

The story of a drug smuggling operation gone awry and the sudden arrival of a tidal wave of pure cocaine in a small island in the Azores, and how it wreaked havoc on the locals. [Link]

Social Studies

When Mike Bezos came to America by Neal Karlinsky (Amazon)

How the father of Amazon CEO Jeff Bezos ended up in the United States after the Cuban Revolution. [Link]

SAT to Give Students ‘Adversity Score’ to Capture Social and Economic Background by Douglas Belkin (WSJ)

The SAT is a gateway to elite educational institutions in the United States, and its administrator (the College Board) is trying to level its playing field and remove the effects of bias from results. [Link; paywall]

‘I Don’t Want to See Him Fail’: A Firm Takes a Chance on Ex-Inmates by Ruth Simon (WSJ)

A tight labor market is creating opportunity for released inmates, but those opportunities create difficult situations for employers who are invested in both human beings they employee and the businesses they run. [Link; paywall]

Marketing

The Best Ideas Are the Ones That Make the Least Sense by Rory Sutherland (Entrepreneur)

A catalogue of some of the most ridiculous – but profitable – exercises in marketing that consumers have ever been offered. [Link]

NBA Is the Real Loser After Failing to Send Zion to New York or L.A. by Scott Soshnick (Bloomberg)

Huge media markets in New York and Los Angeles had a shot to land the unique talent of Duke freshman Zion Williamson, but the out-of-the-way New Orleans Pelicans were the ones to land the number one pick. [Link; soft paywall]

Climate Change

Louisiana Unveils Ambitious Plan to Help People Get Out of the Way of Climate Change by Christopher Flavelle and Mira Rojanasakul (Bloomberg)

Southern Louisiana is sinking, forcing the state to plan for a future where the sea gradually forces residents out of its path. [Link; soft paywall]

Economic Research

Multinationals, Offshoring and the Decline of U.S. Manufacturing by Christoph E. Boehm, Aaron Flaaen, and Nitya Pandalai-Nayar (NBER)

A new set of research suggests that multinational firms have been an especially potent force for job losses via offshoring in the US manufacturing sector. [Link]

Uber

How the Promise of a $120 Billion Uber I.P.O. Evaporated by Mike Isaac, Michael J. d la Merced, and Andrew Ross Sorkin (NYT)

An inside line on how Uber went from an estimated $120bn worth to a bit more than half of that in public markets post-IPO. [Link; soft paywall]

Uber CEO to employees: Our stock could still be the next Facebook or Amazon by Brian Sozzi (Yahoo!)

After the largest decline in dollar value for any IPO in the US since the 1970s, Uber management sought to shore up internal morale with a letter begging employees to keep the faith. [Link; auto-playing video]

Podcasting

Podcast Growth Is Popping in the U.S., Survey Shows by Jaclyn Peiser (NYT)

Edison Research reported that one in three people in the United States listen to a podcast at least once per month, strong growth versus one in four last year as the audio format gains steam. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Trade Tenor Typically Trying

This week’s Bespoke Report newsletter is now available for members. Stocks started the week poorly but found excuses to rally midweek, just not enough to get all the way up to breakeven since last Friday. Global economic data continued to look mostly soggy, though not across the board. There was a lot of US data this week, but also important releases from China, Japan, and the Eurozone that we discuss in detail. We also take a look at recent earnings in Europe which have exceeded expectations modestly.

One piece of positive economic data we focus on in the week’s report is the ratio of Leading to Coincident indicators published each month by the Conference Board. As shown below, the ratio is rising again after bottoming out in January. While not at a new high, its behavior is looking distinctly different from the typical pre-recession backdrop. Ahead of recessions, the ratio plunges very consistently, a marked difference to the current sideways range. We discuss further in this week’s full report.

We cover everything you need to know as an investor in this week’s Bespoke Report newsletter. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 5/17/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!