Morning Lineup – That Color You See is Called Green

Futures were already higher on little more than equities being sharply oversold and treasuries being extremely overbought, so we were due for at least a short-term bounce. The positive momentum has been aided by some dovish comments from Chicago Fed President Evans just now and somewhat conciliatory language from the Chinese regarding trade. There’s a lot more Fed commentary on the schedule for today, though, so they will likely send a message to the market either way. Either the market has it entirely wrong pricing in multiple cuts over the next several months, or they will signal they are coming around to the market’s view.

Please click the link below to read today’s Bespoke Morning Lineup for more of our recap of this morning’s market performance overseas as well as our view that stocks don’t have to plunge if the Fed doesn’t cut rates as aggressively as the market is pricing in.

Markets appear to be on pace to unwind much of the moves we saw yesterday, but we would be remiss not to point out the drubbing that the high yield market has seen in recent days. As shown in the chart below, high yield spreads (plotted on an inverse basis in the chart below) have widened out to their highest levels since early January. In just the last two days alone, spreads have widened out by more than 35 basis points, which is the biggest two-day move since December.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

S&P 500 and 10-Year Treasury Yields Converge

One of the most bullish cases for equities now is the fact that the S&P 500’s dividend yield and the yield on the 10-Year Treasury Note have fully converged. In early Q4 2018, “risk-free” yields on the 10-Year were at 3.23% versus a dividend yield of just 1.9% for the S&P 500. With the yield on the 10-year falling more than 110 basis points since its peak in early November 2018, it makes the stock market significantly more attractive relative to risk-free rates at this juncture. Choose one of Bespoke’s three premium subscription options for our most actionable research.

The Closer – Tech Smashed, Twos Surge, ISM Tank, Tweaked Home Improvement – 6/3/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, as tech got smashed today as companies like GOOGL, FB, and AAPL are all now under investigation, we review what it means relative to the broader market. We then turn to what the front end of the UST curve is saying in regards of rate cuts and the probability of a recession. Next, we review the ISM Manufacturing report and the construction spending numbers for April.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Beautiful Reversal From Ulta (ULTA)

Equalweights Triumph

As if all the talk of tariffs hasn’t been enough, with Washington appearing to take aim at some of the largest US companies (Apple, Alphabet, Amazon.com, and Facebook), the market cap weighted S&P 500 is suggesting a much weaker equity market environment than you would get by looking at the performance of individual stocks today. We’ll have to see how things shake out into the close, but the equal-weighted S&P 500 (where each stock has a weighting of 0.2% compared) is outperforming the S&P 500 (where each stock’s weighting is based on market cap) by nearly a full percentage point. Performance disparities in favor of the equal-weighted index that are this wide are not very common. In fact, the last time we saw a wider one day performance disparity was ten years and two days ago on 6/1/09.

The chart below shows the daily performance spread between the two indices going all the way back 20 years. From 1999 through 2002, as the tech bubble was bursting, these types of occurrences were commonplace. Then again during the Financial Crisis, their frequency began to increase. But after the last occurrence in June 2009, there has only been one day where we have seen even close to a performance gap that was this wide, and that was a week after the election on 11/14/16. If these types of moves become more common, it will suggest a much weaker equity environment going forward. Start a two-week free trial to Bespoke Institutional to access all of our research and interactive tools.

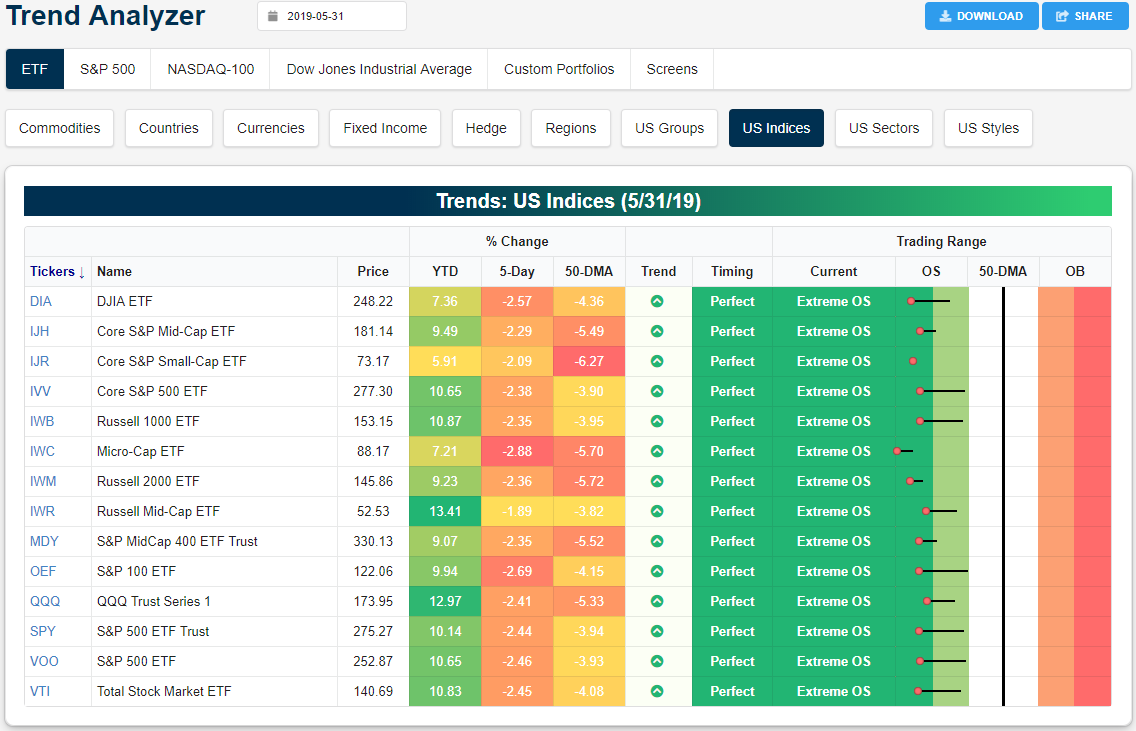

Trend Analyzer – 6/3/19 – Extreme Beginnings

Last month’s declines extended into the final days of May bringing all of the major US index ETFs deeper into oversold territory. The Micro-Cap (IWC) has gotten the most oversold as it sits over 3 standard deviations below its 50-day moving average. This comes as it fell 2.88% last week; the greatest decline of these ETFs. While the rest are not quite as extended to the downside, they are in fact all extremely oversold (2 or more standard deviations below the 50-DMA). As seen by the long tails to the right in the trading range section of our Trend Analyzer tool, some of these ETFs, particularly large caps, had been only barely oversold at the beginning of last week. But these same ones saw some of the largest losses last week bringing them to their currently extreme oversold levels. For example, the S&P 100 (OEF) and Dow (DIA) both fell 2.69% and 2.57% last week, respectively. With the exception of the previously mentioned Micro-Cap ETF (IWC), small and mid caps held up slightly better. The declines though were still steep as only the Russell Mid-Cap (IWR) fell by less than 2%. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

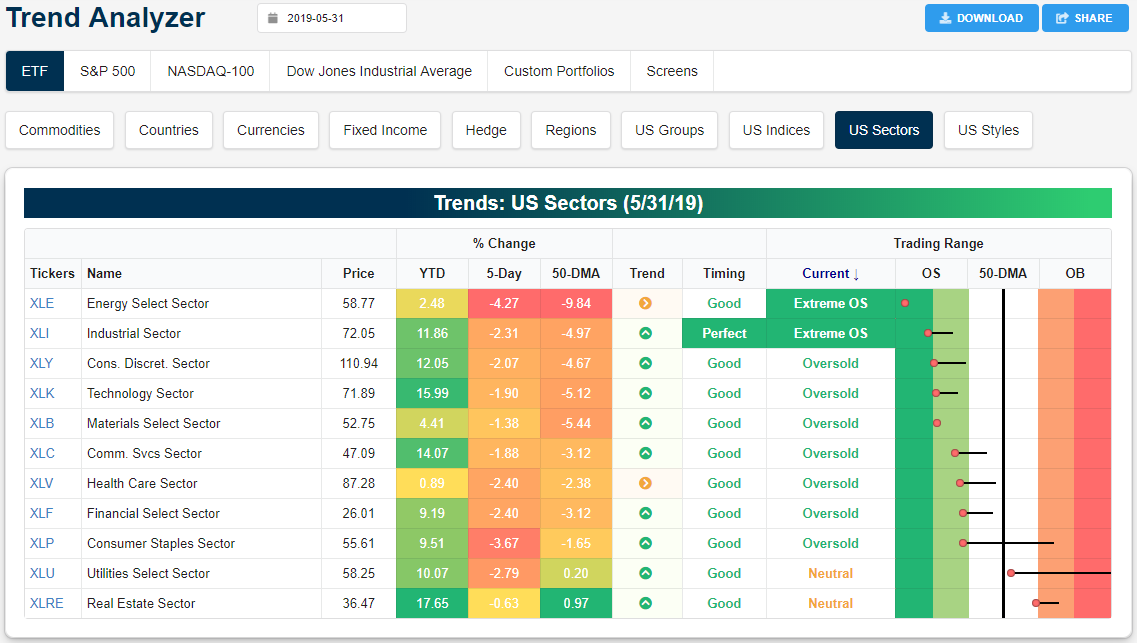

No sector has been safe from selling but defensives had been holding up better recently. Last week, though, this was not so much the case. Utilities (XLU) fell 2.79% last week while Consumer Staples fell 3.67%. Similarly, XLP had been overbought and has now fell through the 50-DMA into oversold territory. Energy (XLE) has also taken it on the chin as oil saw steep declines last week. XLE fell the most of all sectors last week with a 4.27% decline.

95% Gone

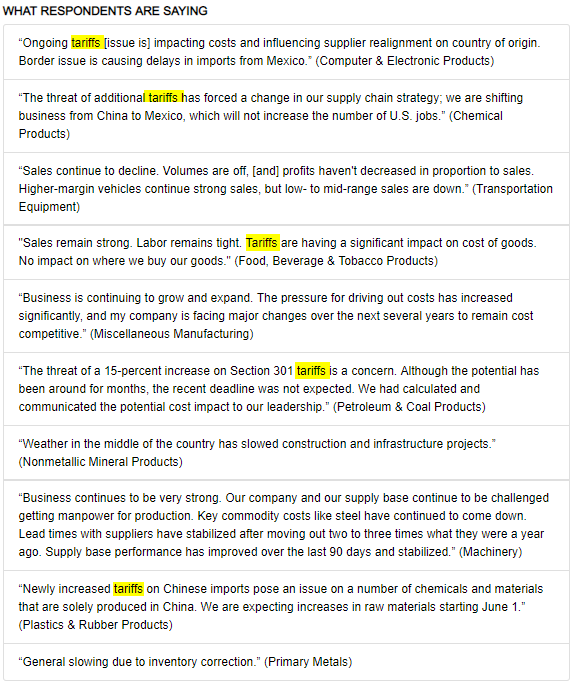

Back in the fourth quarter of 2016, in the immediate aftermath of the 2016 Election, sentiment towards manufacturing in the US surged. Right before the election in October 2016, the ISM Manufacturing index was at 51.7 and eventually rallied all the way to a peak of 60.8 in August 2018. For the last nine months, though, manufacturing sentiment has been falling off a cliff as the impact of tariffs (both actual and threatened) put a damper on sentiment. In the latest monthly ISM Manufacturing survey, the headline index dropped from 52.8 down to 52.1 to its lowest reading since October 2016. With this month’s decline, now, 95% of the post-election gains have been re-traced. Start a two-week free trial to Bespoke Institutional to access all of our research and interactive tools.

As just an example of how tariffs are impacting sentiment, take a look at the commentary section of this month’s report. Of the nine comments included in the section, five cited tariffs as an issue. The second comment was especially notable where a respondent from the Chemical Products industry said that tariffs in imports “…will not increase the number of U.S. jobs.”

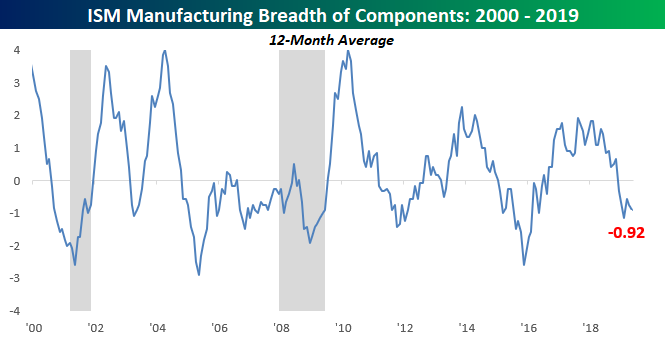

As far as the breadth of this month’s report is concerned, the sub-components were evenly split between gains and losses relative to April’s levels, but the majority were down relative to where they stood last year at this time. The only two that showed increases were Business Inventories and Customer Inventories. On the downside, Production, New Orders, Backlog Orders, Supplier Deliveries, and Prices Paid all saw double-digit declines. Prices Paid has been a real notable decliner, dropping more than 25 points from where it was last year!

Looking at how breadth in the individual components of the ISM Manufacturing report have trended over time, the chart below shows the net number of components showing m/m increases on a 12-month average basis. Through May, the 12 month average for the Manufacturing sector was -0.92, which surprisingly isn’t the weakest reading we have seen in the last few months. At least the pace of decline isn’t still accelerating.

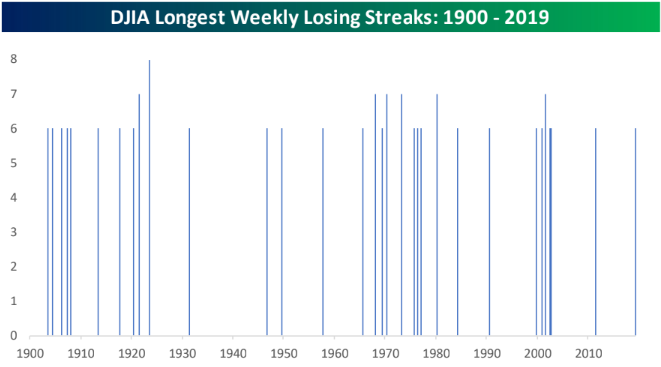

Dow Losing Streaks; Market Internals

The Dow Jones Industrial Average is currently riding a six-week losing streak for the first time in more than five years. In last week’s Bespoke Report newsletter (read it here), we noted the chart below which shows the longest weekly losing streaks for the Dow since 1900. As you can see, it’s very rare that we get to seven, with only seven prior occurrences. And there has only been one eight-week losing streak for the Dow since 1900! Start a two-week free trial to Bespoke Institutional to access all of our research and interactive tools.

As you can imagine, a six-week losing streak for the stock market does a number on internal indicators, some of which are highlighted below. This is a snippet from our Morning Lineup sent to clients each morning, so if you’re interested in staying up-to-date on these readings, you can find them in this report.

As shown in the top left chart, the S&P 500 has moved into extreme oversold territory relative to its 50-day moving average. The second chart on the left shows the percentage of stocks in the S&P that are overbought vs. oversold. While not at the extremes we saw at the end of 2018, the percentage of oversold stocks is definitely elevated right now at 52.8%.

The bottom left chart shows the relative performance of stocks versus bonds over the last year. The recent rally for Treasuries coupled with the decline for stocks has left stocks underperforming bonds over the last 12 months.

On the right-hand side of the snapshot, we first provide a number of additional market metrics, with the arrow signifying the one-week change of each reading. The second section on the right shows sector trading range levels, and here you can see that every sector except Utilities is currently oversold. Finally, the third table on the right shows that commodities are extremely oversold while Treasuries are now extremely overbought.

Morning Lineup – Still Cloudy on the Tariff Front

There wasn’t a whole lot of news in either direction over the weekend over the escalating tariff situation between the US, China, and the ever-growing list of other countries that the current administration has threatened. As a result, US futures are moving in the path of least resistance (lower), while rates are lower. That being said, yields and equity futures are off their overnight lows.

It’s a big day for economic data to kick off the week and it’s going to be a busy week in terms of Fed speakers, so if the FOMC was looking for an opportunity to send a message to the markets that they are incorrect in pricing an 88% chance of a cut by September, now is the time to do it.

Please click the link below to read today’s Bespoke Morning Lineup for more of our thoughts on the latest from the latest international manufacturing PMI readings for the month of May as well as an early look how European auto sales are shaping up for May.

With the continued weakness in the equity market last week, the percentage of oversold US stocks is really starting to pile up. As shown in the chart below, through Friday’s close, nearly 40% of all S&P 500 stocks were trading more than one standard deviation below their 50-DMA. The last time we saw a reading this negative was on January 3rd.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 6/2/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Food

Moneyball for Cattle Is Creating an American Steak Renaissance by Lydia Mulvaney and Michael Hirtzer (Bloomberg)

Cheap, accessible genomic testing is reducing uncertainty and raising quality in the top tier of US beef herds. [Link; soft paywall]

6 Hot Takes About the Right Way to Make a Peanut Butter and Jelly Sandwich (Bon Appétit)

A compendium of analysis on the right way to make the most time-honored of American snacks, but no consistent result: smooth, crunchy, bread type, jam flavor… [Link]

Chinese Repression

Four Is Forbidden by Yangyang Cheng (ChinaFile)

A remarkable narrative about growing up in a society where the great traumas are suppressed in the name of political expediency; noteworthy as we approach the anniversary of the massacre at Tiananmen Square in early June. [Link]

‘If I disappear’: Chinese students make farewell messages amid crackdowns over labor activism by Gerry Shih (WaPo)

In the height of ironies, the Chinese Communist Party has been detaining and disappearing Marxist students who are pushing back against inequality and corruption in the ostensibly communist nation. [Link; soft paywall]

Labor Markets

Child Care Is Expensive, But Providers Themselves Struggle To Get By by Elly Yu and Martin Austermuhle (American University/WAMU)

While childcare costs have spiraled dramatically higher and out of reach of many working families, the actual workers who keep an eye on the little ones haven’t seen their extremely low wages push much higher, an apparent conundrum. [Link]

Google’s Shadow Work Force: Temps Who Outnumber Full-Time Employees by Daisuke Wakabayashi (NYT)

The majority of people who work “at” Google are temporary employees or contractors, making full-time employment status and the benefits that come with it nothing but a dream for most of the people who keep the company running. [Link; soft paywall]

Politics

What Republicans And Democrats Are Doing In The States Where They Have Total Power by Perry Bacon Jr (FiveThirtyEight)

The concept of “revealed preference” is a useful tool from economics; forget what someone says they’ll do, what will they actually do? This article attempts to illustrate revealed preference of both parties by looking at state-level policies put into place over the last couple years when either party has full control. [Link]

Rep. Josh Gottheimer Is A Really, Really Terrible Boss, Former Staffers Say by Ryan Grim (The Intercept)

An amusing set of anecdotes related to a run-of-the-mill meeting with constituents held by a New Jersey Democrat with some extreme sensitivity to his public image. [Link]

Where Democrats And Republicans Live In Your City by Rachael Dottle (FiveThirtyEight)

The great sort has created a geographic fissure between red and blue states, as well as between rural and urban areas. But there are also large splits within cities that create plenty of local polarization within metropolitan areas. [Link]

Higher Education

UIC to offer in-state tuition to students from any of the 573 tribal nations in US (University of Illinois at Chicago)

In a first (as far as we are aware) the University of Illinois at Chicago is offering in-state tuition discounts to students from any of the 573 American Indian and Alaska Native tribal nations scattered around the country. [Link]

The Books of College Libraries Are Turning Into Wallpaper by Dan Cohen (The Atlantic)

While students still expect libraries to be full of books, most of that expectation is driven by aesthetics: the Yale Library has seen a 64% decline in book checkouts over the past decade. [Link]

Public Health

Measles Cases Reach Highest Level in More Than 25 Years, C.D.C. Says by Liam Stack (NYT)

Thanks to misinformation and the following decline in vaccination rates, measles is making a massive comeback; decisions to avoid vaccination has put thousands of children at risk of a disease that widespread vaccination had at one point all but eliminated. [Link; soft paywall]

Conspicuous Consumption

Someone Bought a $400,000 Diamond Ring at Costco by Matthew Boyle (Bloomberg)

In its report on quarterly results this week, Costco management noted a “significant diamond ring purchase, in the $400,000 range”. [Link]

“Salvator Mundi” was pulled from the Louvre’s blockbuster Leonardo da Vinci show. by Nate Freeman (Artsy)

A massive Leonardo da Vinci show is set to open in Paris this October, but curators are excluding a work sold for $450mm at Christies in November of 2017. The furor relates to who actually painted the work, either the master himself or other painters studying under him. [Link]

Trash

Treated like trash: south-east Asia vows to return mountains of rubbish from west by Hannah Ellis-Petersen (The Guardian)

Developed countries have been shipping massive volumes of trash to Southeast Asia, with plastics and discarded technology piling up in the Philippines, Indonesia, Vietnam, and Malaysia. National governments are starting to get sick of it. [Link]

Don’t Overestimate The ‘Semi’ In Semiautonomous Cars by Alex Davies (Wired)

Semiautonomous driving features can be a problem for consumers because they are inconsistent in terms of features and functionality, creating dangerous gaps between what consumers expect and what cars are designed to do. [Link; soft paywall]

Foreign Relations

The Moment Merkel Realized Trump Changes Everything for Germany by Patrick Donahue (Bloomberg)

A tick-tock detailing the frame of mind for German Chancellor Angela Merkel as she grapples with the failure of the United States in dealing with its long-term allies. That phenomenon will extend beyond the current President’s term as hard-won credibility has been squandered. [Link; auto-playing video, soft paywall]

The Lighter Side

The Kentucky Derby, as Told by the Horses by John Kenney (The New Yorker)

What would horses who run the Kentucky Derby have to say about the race if they were able to tell us what is on their minds? [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!