Chart of the Day: You Don’t See This Very Often

Fixed Income Weekly – 3/4/20

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we discuss how disjointed fixed income pricing has gotten as a result of equity market declines and Fed easing.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

No Sickness In Services

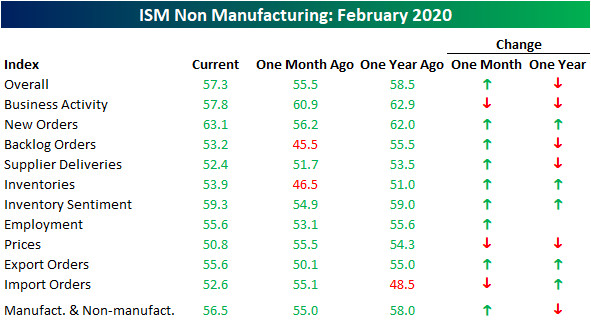

ISM’s Non-Manufacturing index has now risen for three straight months for the first time since the three months ending in August of 2014. Up to 57.3, the index is at its highest level since February of last year. Likewise, the composite reading (including both the service and manufacturing indices) has now risen in back-to-back-to-back months for the first time since April 2016. The index is now at 56.5, and is healthily above the recent multiyear low of 52.9 from September. That 56.5 reading is also the highest the composite has been since February of last year.

As with the Manufacturing Index which we discussed on Monday, due to the timing of the survey the full effects of the outbreaks of Covid-19 outside of China are not fully represented in this report as those occurred later in the month. But even more limited to China, just as the manufacturing report did, company comments highlighted the coronavirus as a growing concern nonetheless. From these comments, the impacts of the virus do not appear to be extremely widespread at the moment with only three industries referencing it. While Construction and Health Care industries have noted concrete effects in the form of “increased lead times for critical items” and “major back-orders” for items like masks and gloves, the mining industry failed to mention more specifically what consequences have already taken effect. For both the Manufacturing and Non-Manufacturing reports, expect mentions of the virus to be much more prevalent in the commentary section next month.

Breadth in this month’s report was strong with every category now sitting in expansionary territory, two of which—Backlog Orders and Inventories—were not last month. Additionally, all but three categories (Business Activity, Prices, and Import Orders) rose from one month ago. Compared to one year ago, breadth is more mixed.

New Orders were a bright spot rising to 63.1 which is tied with June of 2018 for the strongest reading since July of 2015 when the New Orders index was just slightly higher at 63.4. Prior to that, you would need to go back to 2004 through 2005 when there were several months of higher readings. Additionally, the month-over-month increase of 6.9 points was the sixth-largest increase on record and the largest since a 7.6 point increase in January of 2018. While this could change in next month’s report, this shows that at least prior to the coronavirus outbreaks outside of China, activity in the services sector was near historically strong levels.

Backlog Orders echoed this trend. The index rose 7.7 points which was the largest month-over-month jump in Backlog Orders since May of 2018. Again, this seems to point to solid demand for the service sector.

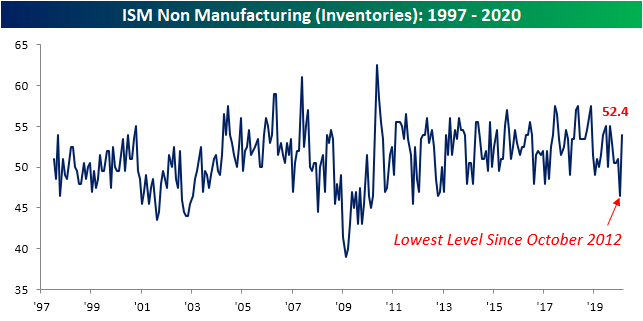

To handle this stronger demand and get ahead of future impacts from the coronavirus, businesses have also increased inventories. After falling to 46.5 last month, the lowest level since October of 2012, Inventories rose back into an expansionary level at 52.4. That was the largest increase in a single month since April of 2014.

Despite this strong demand, the index for Prices Paid has continued to slide falling to 50.8. While not indicating falling prices (readings under 50), it is the weakest reading since May of 2017. While low this month, this index is yet another category that could see a quick turnaround in the coming months assuming shortages from the coronavirus leads to higher prices as is beginning to be seen with some commodities. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Global Macro Dashboard — 3/4/20

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Here’s One Place Where Corona is Showing Up in the Economic Data

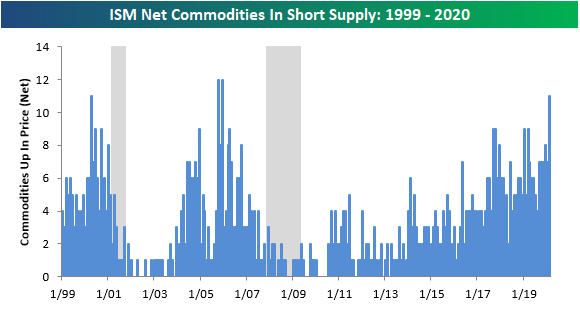

This morning’s ISM Non-Manufacturing report for the month of February was impressive at the headline level despite growing concerns over the impact of the Covid-19 virus. One aspect of the report where the outbreak is starting to show up is in the survey where companies are asked what commodities are in short supply. In this month’s survey, ISM noted that 11 commodities were in short supply among companies in the Non-Manufacturing sector. The chart below shows the number of commodities in short supply on a monthly basis with recessions highlighted in gray. Going back to 1999, there have only been two other months where a larger number of commodities were in short supply and that was in the months immediately following Hurricane Katrina.

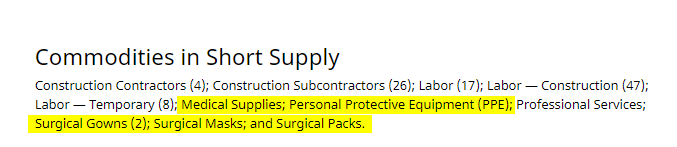

Looking at the commodities that were flagged as being in short supply in February, five can be directly related to Covid-19. As shown below, Medical Supplies, Personal Protective Equipment, Surgical Gowns, Surgical Masks, and Surgical Packs are all flying off the shelves. Start a two-week free trial to Bespoke Institutional for full access to all of our economic research and tools.

Bespoke’s Morning Lineup – 3/4/20 – Super Wednesday

Due to unscheduled maintenance issues with our email provider, subscribers may not receive the email of today’s Morning Lineup in a timely manner. We apologize for any inconvenience but we just wanted to let you know that if you did not receive this morning’s copy, it is not related to any changes in your email settings.

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

After positive results for Joe Biden in the Super Tuesday Democratic primaries, the former VP has established himself as the current front-runner to challenge President Trump in November. Over at electionodds.com, Biden now has a 75.5% chance of winning the nomination, which is almost a full 60 percentage points ahead of Bernie Sanders. Those numbers are certainly comforting for Biden, but we would remind people that as recently as 2/24, the roles were completely reversed with Biden at 5.5% and Sanders over 50%!

The biggest story of the night, though, was that the Democratic primaries have become a two-person race. With poor showings from both Bloomberg and Warren, they are out of the running now as even Hillary Clinton is ahead of them in the betting markets.

Read today’s Bespoke Morning Lineup for a discussion of Biden’s impressive performance in Super Tuesday voting, news on coronavirus, global PMI data from the Services sector, and the latest stock-specific news of note.

The Closer – Super Lose – 3/3/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the market reaction to today’s rate cuts and where equities stand relative to short term rates. We then take a look at the record low yields in the US and abroad. Next, we show just how much bonds have outperformed equities before reviewing credit markets. We finish by looking through derivative markets.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/3/20

S&P 500 Dividend Yield Now 100+ Basis Points Higher Than 10-Year Treasury Yield

The yield on the 10-Year Treasury tipped below 1% today for the first time ever as the Fed cut rates by 50 bps. That is a record low yield for the 10 Year. Meanwhile, the past few days have seen the S&P 500’s dividend yield rise to some of its highest levels in over a year. This leaves the S&P’s dividend yield at 2.1% today. That means holding the various levels of risk and other factors constant, stocks are yielding over 1% more than the 10-Year yield. That sharp divergence in yields is shown in the chart below.

Since the mid-2000s, the spread between the S&P’s dividend yield and the 10-year yield has only moved above one on one other occasion, and that was near the depths of the Financial Crisis in December 2008. Start a two-week free trial to Bespoke Institutional to access our interactive tools and full library of research.

Covid-19 Cases and Mortality Rates By Country

One of the factors that makes it so hard for investors to grapple with the Covid-19 coronavirus is that there really aren’t very good numbers related to the mortality rate, and if you look at the mortality rates by individual countries, they vary widely. Reasons for the variance range from lack of available testing infrastructure to a general distrust of statistics being reported by certain governments. With those two caveats in mind, a look at current infection and mortality rates shows a disconcerting picture from a US perspective. The table below shows the number of cases and deaths due to the coronavirus broken down by country. These figures were pulled from the incredibly useful Johns Hopkins Coronavirus monitor, and we only included countries that have reported more than ten cases of Covid-19.

The table below is sorted by mortality rate from highest to lowest, and here is one case where the US doesn’t want to be winning. With a current rate of 5.6%, the mortality rate from confirmed Covid-19 cases in the US is higher than any other country in the world including Iran which comes in at 3.3%. Obviously, the lack of available testing in the US from a shortage of test kits has resulted in fewer tests than other countries, so the number of confirmed cases in the US is likely a lot lower than the number currently flowing around undetected. However, the fact that the US even finds itself here in the first place isn’t the most comforting thing for Americans already worried about the spread of the virus! Receive full access to all of our analysis, including the latest coronavirus news and how it’s impacting the markets, by signing up for a free two-week free trial to Bespoke Institutional today.

The chart below shows the ten countries/regions with the highest mortality rates from the Covid-19 outbreak. The US is nearly a full two percentage points above China (3.7%) and a full three percentage points above every other country besides Iran. Again, as testing expands in the US, the number of cases will undoubtedly rise as milder cases are detected, but even in that case, testing procedures capacity in the US should have been a lot faster to ramp up.