Jobless Claims Unfazed By Covid-19

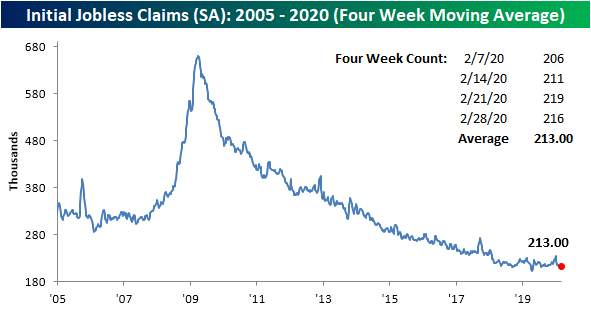

While schools are closing and events are being canceled as precautions to stem the spread of the coronavirus, initial jobless claims have yet to show any negative impact. Claims actually fell slightly this week down to 216K from 219K last week. That is about in line with expectations of a 215K print. Overall, claims still point to a healthy US labor market that has not seen any significant impacts from the coronavirus.

The recent multi-month low of 203K rolled off the four-week moving average this week, replaced by the higher 216K reading and caused the average to reach 213K. That is the highest level for the four week average since the week ending January 24th when it stood at 214.75K. That is also still well below the highs from late last year in the low 230K’s.

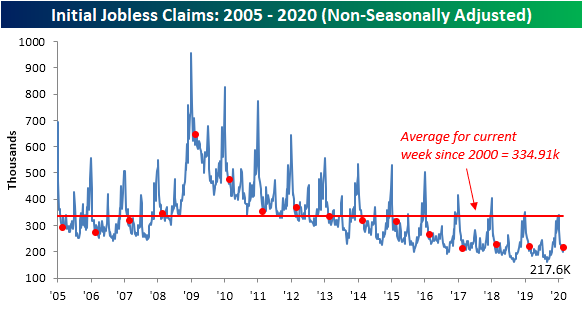

Non-seasonally adjusted (NSA) claims ticked higher by 18.3K this week to 217.6K. That leaves jobless claims slightly lower year-over-year and still far below the average for the current week of the year since 2000 as shown in the first chart below. Additionally, while the week to week fluctuations in the NSA number should not typically be given too much weight, we wanted to highlight that the week-over-week uptick in unadjusted claims was just about what could be expected for the current week of the year. As shown in the second chart below, the ninth week of the year has averaged an increase of 17.6K; similar to the actual change of 18.3K observed this week. In other words, before seasonal adjustment, this week’s increase likely has more to do with seasonality than any coronavirus effects.

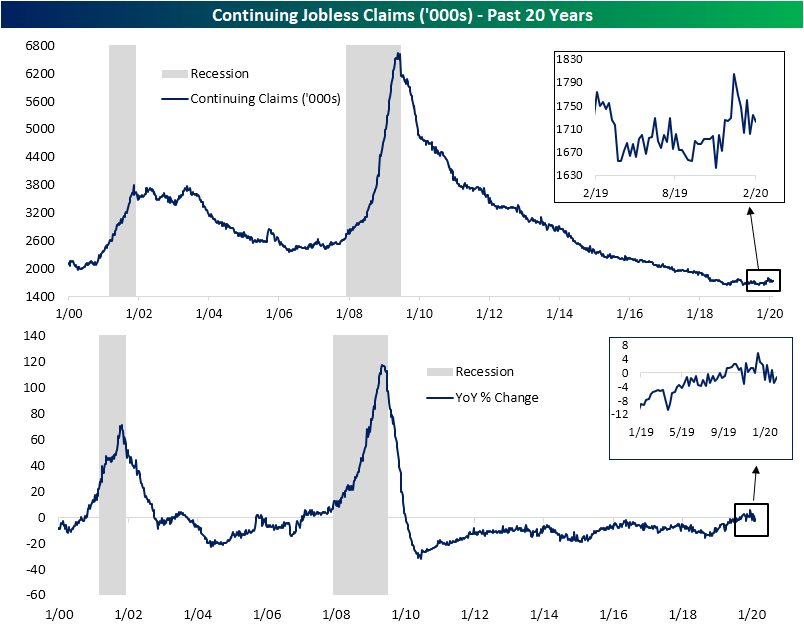

While less timely given they are released at a one week lag to initial claims, continuing claims are also not showing any signs of stress from the coronavirus. It is quite the opposite actually. After showing frequent year-over-year increases over the past few months for the first time of the current economic cycle, this week marked the first back-to-back YoY declines since early September. While two weeks do not make a trend, that is a welcome improvement after the past few months. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Central Banks Trim Around The Globe

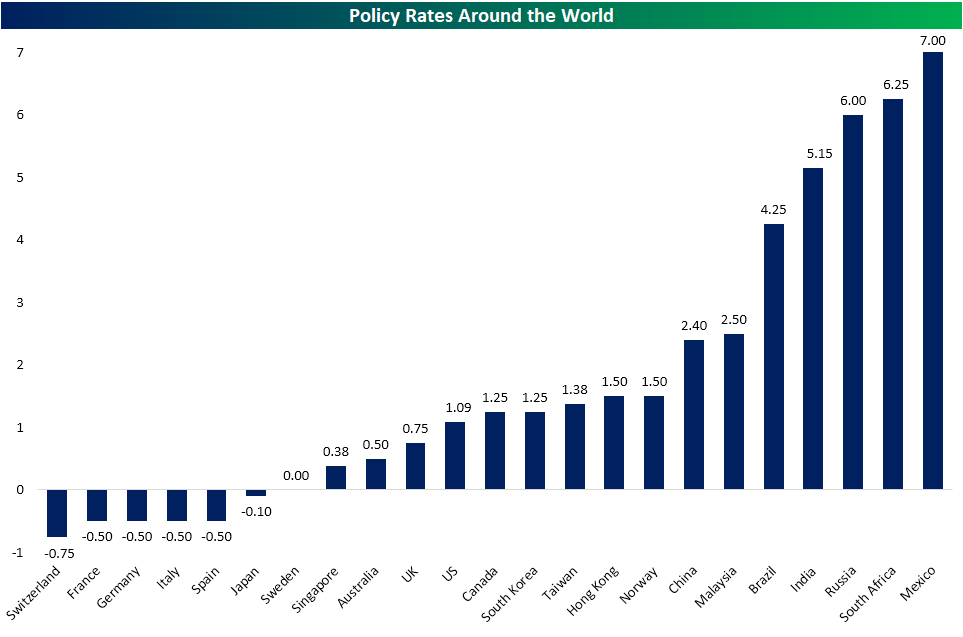

In the wake of the coronavirus sparking growth concerns around the globe, central banks have stepped up to the plate through cutting rates. The chart below shows the countries in our Global Macro Dashboard that have cut their policy rates since our January 8th report, the day after the WHO identified Covid-19. Yesterday, the Bank of Canada cut its policy rate from 1.75% down to 1.25%; joining the Central Bank of Malaysia, the Fed, and subsequently Hong Kong in cutting rates by 50 bps. Singapore has come down slightly less by 43 bps. Australia, Brazil, Russia, South Africa, and Mexico have also cut rates by a quarter-point. Despite being patient zero and perhaps the country most affected by the virus, China has cut rates by just 10 bps; the least of any of the countries that have cut rates.

Even though it cut rates by 25 bps, Mexico still has the highest policy rate at 7% followed by South Africa (6.25%) and Russia (6%). While recent cuts have not sent any additional country’s policy rate into negative territory, the ECB countries, Japan, and Switzerland all have negative rates at the moment. As for the US, the effective Fed Funds rate is now at 1.09% which leaves it on the lower end of the range of policy rates which stand at 1.75% on average (median: 1.25%). Start a two-week free trial to Bespoke Institutional to access our Global Macro Dashboard and more.

Bespoke’s Morning Lineup – 3/5/20 – 52-Week High? In China?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Futures are sharply lower this morning, but not enough to erase all of yesterday’s gains. Jobless claims were just released and came in 1K higher than expectations (216K vs 215K). Given the weakness in equities, the yield on the 10-year is not surprisingly back well below 1.0%. A lot can change between now and the close, so we’ll see how the day shakes out as the number of cases rise, events get canceled, more schools close, and companies continue to lower guidance.

Read today’s Bespoke Morning Lineup for the latest stock-specific news of note, updates on the coronavirus, and a discussion of the latest proposed OPEC cuts in oil production.

US futures are lower, and the S&P 500 is already 7.5% from its record close in February. Don’t look now, but one major economy’s equity benchmark saw a 52-week high on a closing basis overnight, and it was China! China’s CSI 300 has now fully recovered all of its losses from the coronavirus outbreak after a 2.5% gain overnight. Now, before you dismiss it all as China propping up its market by prohibiting investors from selling, we would note that the US-based ETF that tracks the index (ASHR) also closed yesterday within 2.5% of its 52-week high. In other words, investors can freely buy and sell the Chinese market.

The US is another story. Equities are still sharply off their highs. Yesterday, we noted the emerging uptrend in both the S&P 500 and Russell 2000 on an intraday basis. One thing to note about yesterday’s rally is that for both indices, the market closed right before they were able to make a higher high. With both indices now poised to open sharply lower, the first important level to watch is yesterday’s low in the S&P 500 of roughly 3,033.

The Closer – A Second Bite at the 4% Apple – 3/4/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the market reaction to today’s rate cuts and where equities stand relative to short term rates. We then take a look at the record low yields in the US and abroad. Next, we show just how much bonds have outperformed equities before reviewing credit markets. We finish by looking through derivative markets.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/4/20

Bespoke’s Consumer Pulse Report — March 2020

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Health Care Caring About Politics

Stocks experienced an impressive rebound today with the S&P 500 up around 4.25%. One of the best performing sectors today was Health Care which gained 5.76%. Performance has been even more impressive for the Health Care Providers and Services industry which was up over 12%. The major catalyst has been Joe Biden’s strong performance on Super Tuesday placing him as the front runner for the Democratic ticket. Betting markets (ElectionBettingOdds.com) now give the former Vice President an 83% chance of being Trump’s challenger come November as shown in the chart below. Over the past year, no Democratic candidate has been given this much certainty to win the nomination. Biden’s surge in the past couple of days has borrowed from not only those who have dropped out of the race like Bloomberg, but also from more progressive candidates like Bernie Sanders and Elizabeth Warren. With those more progressive candidates who threaten to shake up the Health Care space on the decline, Health Care stocks have had reason to run. Today’s response by these stocks to Sander’s decline in the polls is perhaps a more dramatic version of the same dynamic as we saw in late 2019 during Senator Warren’s rise and subsequent fall as the Democratic favorite. Start a two-week free trial to Bespoke Institutional to access our interactive tools and full range of research.

Bespoke CNBC Appearance (3/4/20)

Bespoke co-founder Paul Hickey appeared on CNBC’s Squawk Box this morning to discuss markets and where they stand after the recent declines. To view the segment, please click on the image below.

Chart of the Day: You Don’t See This Very Often

Fixed Income Weekly – 3/4/20

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we discuss how disjointed fixed income pricing has gotten as a result of equity market declines and Fed easing.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!