It Doesn’t Get Much Worse Than This For Crude Oil

Crude oil prices are down close to 10% today in what is shaping up to be the worst day for crude oil since late 2014. That’s more than five years.

Today’s decline is pretty much a continuation of what has been a one-way trade for the commodity ever since the US drone strike on Iranian general Soleimani. The last time prices were this low was around Christmas 2018.

With today’s decline, crude oil is now off to its worst start to a year in a generation falling 32%. Since 1984, the only other year that was worse was 1986 when the year started out with a decline of 50% through March 6th. If you’re looking for a bright spot, in 1986, prices rose 36% over the remainder of the year. The only other year where crude oil kicked off the year with a 30% decline was in 1991 after the first Iraq war. Over the remainder of that year, prices rose a more modest 5%. Start a two-week free trial to Bespoke Institutional to access all of our research an interactive research tools.

A “Run of the Mill” Drawdown

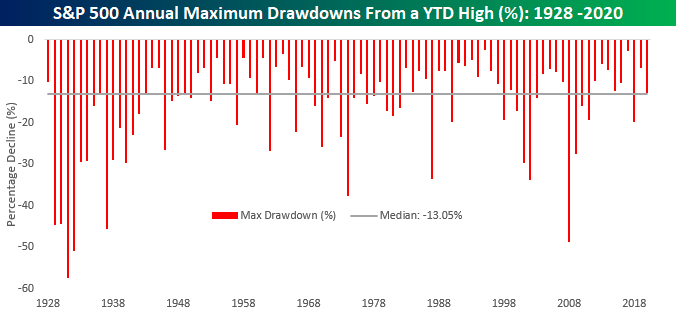

If you’re like us, you’ve heard a lot of people reference the recent equity declines as a sign that the market is pricing in some sort of Armageddon in the US economy. While comments like that make for great soundbites, a little perspective is in order. Since the S&P 500’s high on February 19th, the S&P 500 is down 12.8%. In the chart below, we show the S&P 500’s annual maximum drawdown by year going back to 1928. In the entire history of the index, the median maximum drawdown from a YTD high is 13.05%. In other words, this year’s decline is actually less than normal. Perhaps due to the fact that we have only seen one larger-than-average drawdown in the last eight years is why this one feels so bad.

The fact that the current decline has only been inline with the historical norm raises a number of questions. For example, if the market has already priced in the worst-case scenario, going out and adding some equity exposure would be a no brainer. However, if we’re only in the midst of a ‘normal’ drawdown in the equity market as the coronavirus outbreak threatens to put the economy into a recession, one could argue that things for the stock market could get worse before they get better, especially when we know that the market can be prone to over-reaction in both directions. The fact is that nobody knows right now how this entire outbreak will play out. If it really is a black swan, the market definitely has further to fall and now would present a great opportunity to sell more equities. However, if it proves to be temporary and after a quarter or two resolves itself and the economy gets back on the path it was on at the start of the year, then the magnitude of the current decline is probably appropriate. As they say, that’s what makes a market! Start a two-week free trial to Bespoke Institutional to access all of our research an interactive research tools.

Long-Term Treasuries Go Haywire

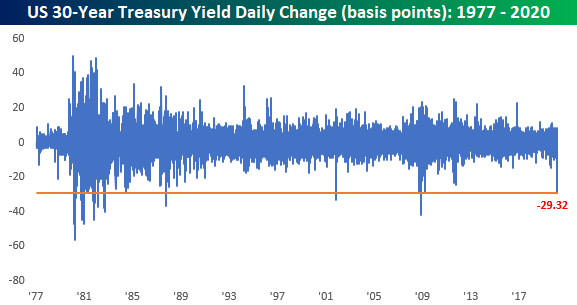

Take a good luck at today’s moves in long-term US Treasury yields, because chances are you won’t see moves of this magnitude again soon. Let’s start with the yield on the 30-year US Treasury. Today’s decline of 29 basis points in the yield will go down as the largest one-day decline in the yield on the 30-year since 2009. For some perspective, there have only been 25 other days since 1977 where the yield saw a larger one day decline.

That doesn’t even tell the whole story, though. As shown in the chart below, every other time the yield saw a sharper one-day decline, the actual yield of the 30-year was much higher, and in most other cases it was much, much higher.

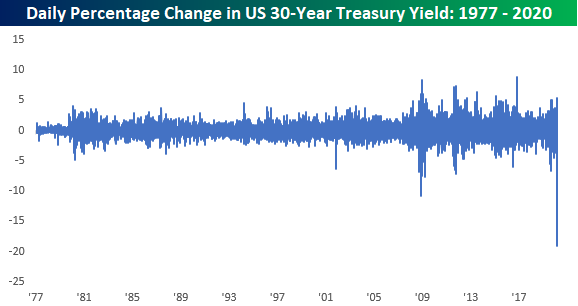

To show this another way, the percentage change in the yield on the 30-year has never been seen before, and it’s not even close. Now, before the chart crime police come calling, we realize showing a percentage change of a percentage is not the most accurate representation, but we wanted to show this for illustrative purposes only.

Finally, with long-term interest rates plummetting we wanted to provide an update on the performance of the Austrian 100-year bond. That’s now back at record highs, begging the question, why is the US not flooding the market with long-term debt? Start a two-week free trial to Bespoke Institutional for full access to our research and interactive tools.

Bespoke’s Morning Lineup – 3/6/20 – Corona Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

With headlines likely to get worse before they get any better, investors are once again in no mood to buy equities heading into a weekend. Equity futures are down over 2% and getting worse as treasury yields sink like a stone. After breaking below 1% for the first time ever earlier this week, the yield on the 10-year is now at 0.72%.

Today’s Non-Farm Payrolls report for February came in extremely strong with headline payrolls coming in at 273K versus expectations for a gain of 175K. Unfortunately, all of this data is from early February, so no one is likely going to care.

Read today’s Bespoke Morning Lineup for the latest stock-specific news of note, updates on the coronavirus, and a recap of economic data coming out of Europe.

The price chart of Europe’s STOXX 600 is really something to behold. Less than a month after hitting 52-week highs, the index is now knocking on the door of 52-week lows. It’s rare enough to see this type of a reversal in an individual stock, but for a benchmark equity index of an entire continent, it’s nuts. With a decline of over 3% today, the STOXX 600 is now less than 2% from hitting that level. As we discussed in the Morning Lineup, this is just a further illustration of how before the coronavirus breakout started, the global economy was starting to accelerate.

The Closer – Plunging Rates, Glittering Gold – 3/5/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the continued decline in small caps relative to the S&P 500 and outperformance of momentum stocks relative to value stocks. Next, we review the rapid changes in financial stress indices from the St. Louis Fed and Goldman Sachs. We also show the gold market’s reaction. Turning to economic data, we review today’s manufacturing data and Bloomberg Consumer Comfort.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Performance Proxies A Pandemic Portfolio

Bespoke’s Sector Snapshot — 3/5/20

Newsletter Writers Turning Bearish

In an earlier post, we detailed how AAII’s weekly sentiment survey has shown respondents have become increasingly polarized taking bullish and bearish stances. Another sentiment survey of newsletter writers from Investors Intelligence, on the other hand, leans more distinctively bearish. This survey’s reading on bullish sentiment fell to 41.7% in the latest week which is the lowest reading since January of last year. Granted, at that time bullish sentiment reached much lower levels bottoming at 29.9%.

Meanwhile, bearish sentiment is at its highest level since March of last year. Like bullish sentiment, while it is at one of its highest levels in some time, it also topped out at much higher levels just over a year ago. Bearish sentiment peaked at 34.6% in the first week of January of 2019, 14.2 percentage points higher than current levels.

While the Investors Intelligence survey does not have a reading on neutral sentiment like AAII does, it does survey respondents for those “looking for a correction”. With the S&P 500 having fallen 12.76% from the February 19th closing high to Friday’s closing low, price action has met the definition of a correction and as such the number of respondents reporting that they are looking for a correction has surged to 37.9%. That is the highest reading since June of last year when it reached 38.8% and in the 93rd percentile of the past decade’s readings. Overall, bearish sentiment has generally taken over now which is positive from a contrarian’s position, but as recently as the past year, there is a precedent of it being even higher. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Investors Polarized

Despite continued volatility for equity markets over the past week, bullish sentiment has picked back up this week, rising to 38.74% from 30.43%. Last week’s reading marked the lowest level for AAII’s reading on bullish sentiment since October, but this week’s 8.31 percentage point jump brings it right back into the middle of the past few years’ range and within one percentage point of the historical average of 38.08%.

While bullish sentiment is not at any sort of high or low, bearish sentiment has risen to a nearly equal reading of 39.64% which is the highest level since October when it was several percentage points higher in the mid-40s. This leaves bearish sentiment fairly elevated with regards to its historical average of 30.35% but not quite to any extreme degree (over one standard deviation above that average).

The same cannot necessarily be said for neutral sentiment which has now fallen over one standard deviation below its historical average. Neutral sentiment cratered 8.81 percentage points this week down to 21.62%. That is the lowest level, the biggest one week decline, and the first time it has fallen one standard deviation below its historical average since late December of 2018. If the choppy price action over the past week wasn’t enough confirmation, this sentiment data points to investors being increasingly polarized along the bullish and bearish lines.

Looking at past times that sentiment became similarly polarized, the bulls have tended to be on the right side of history. The table below shows past times since the beginning of the AAII survey that neutral sentiment was one standard deviation or more below its historical average while bullish and bearish sentiment were within normal ranges. As depicted, this is the first time that this has occurred since November of 2012 when each sentiment reading was within just a few tenths of a percentage point of current levels. Again, the performance of the S&P 500 following these sentiment readings has had a positive bias. Other than one week later which sees performance more inline with other periods, the S&P 500 has typically outperformed and has consistently traded higher. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

The Bespoke 50 Top Growth Stocks — 3/5/20

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 114.5 percentage points. Through today, the “Bespoke 50” is up 237.0% since inception versus the S&P 500’s gain of 122.5%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.