Bespoke’s Morning Lineup – 8/27/20 – Flirting With Greatness

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.” – Warren Buffett

Besides the Powell speech coming up in a half-hour, we have a bunch of economic data to contend with this morning. Revised GDP for Q2 showed a modestly lower decline than expected (-31.7% vs -32.5%). Initial jobless claims were essentially right in line with forecasts, although continuing claims were higher than expected.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, economic data out of Europe and Asia, trends related to the COVID-19 outbreak, and much more.

August is on pace to be a month unlike any other for the S&P 500 over at least the last 25 years. Through Wednesday’s close, the S&P 500 tracking ETF (SPY) was up 6.4% month to date. Even more impressive than the gain, though, has been the consistency of the rally. So far this month, SPY has only finished the day lower three times in eighteen trading days. That’s an 83% win rate!

How does that stack up to history? The chart below shows SPY’s percentage of up days by month dating back to its inception in 1993. Not only has there never been a month with a higher percentage of up days, but there have only been six others where the percentage of up days even touched 75%. There are still three trading days left in August, but even if all three days finish lower, SPY will have finished higher on more than 70% of all trading days this month. Rallies like the one we have seen in August are obviously great if you are long equities, but enjoy them while they last because they won’t last forever.

Daily Sector Snapshot — 8/26/20

COVID Concerns and Case Counts

In Monday’s Closer, we took a look at data from YouGov’s COVID-19 Public Monitor which surveys people from countries around the globe on various COVID related topics such as if they were worried about contracting COVID-19, do they wear a mask when out in public, and do they avoid crowds.

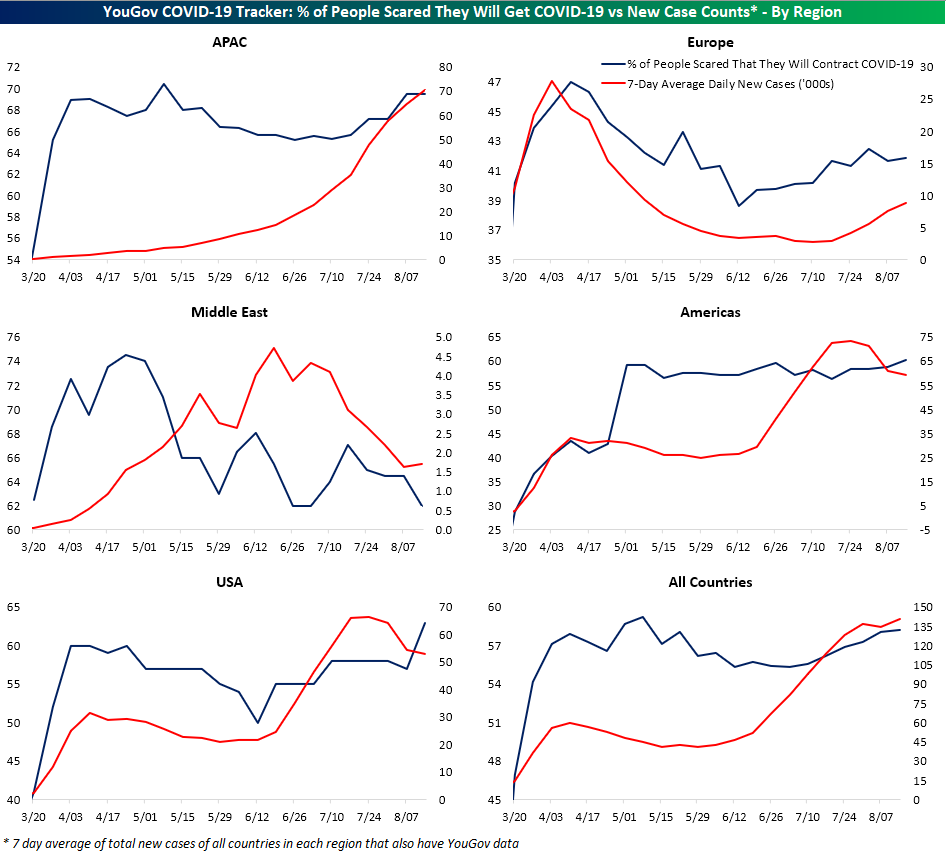

In the charts below, we show the average readings of these survey results (blue line, left axis) across the countries of each region that have data available compared to the seven day average of total new case counts for those same countries in each region (red line, right axis). Broadly speaking and as could be intuitively expected, as case counts rise, higher shares of people report being more concerned about contracting the virus. European countries (Denmark, Finland, France, Germany, Italy, Norway, Spain, Sweden, and the UK) perhaps show this relationship the most cleanly as cases fell through the spring alongside concerns of contraction, but from June through the most recent readings earlier this month, concerns and case counts have steadily risen. Since July, APAC countries (Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, Philippines, Singapore, Taiwan, Thailand, and Vietnam) have similarly seen worries over catching COVID climb as the averages for daily new cases for those countries have also risen. Granted, worries were on the decline up through July despite rising cases. Meanwhile, US worries about catching the virus were at their highest levels yet as of early August, and that is even though case counts have been on the decline since the second half of July.

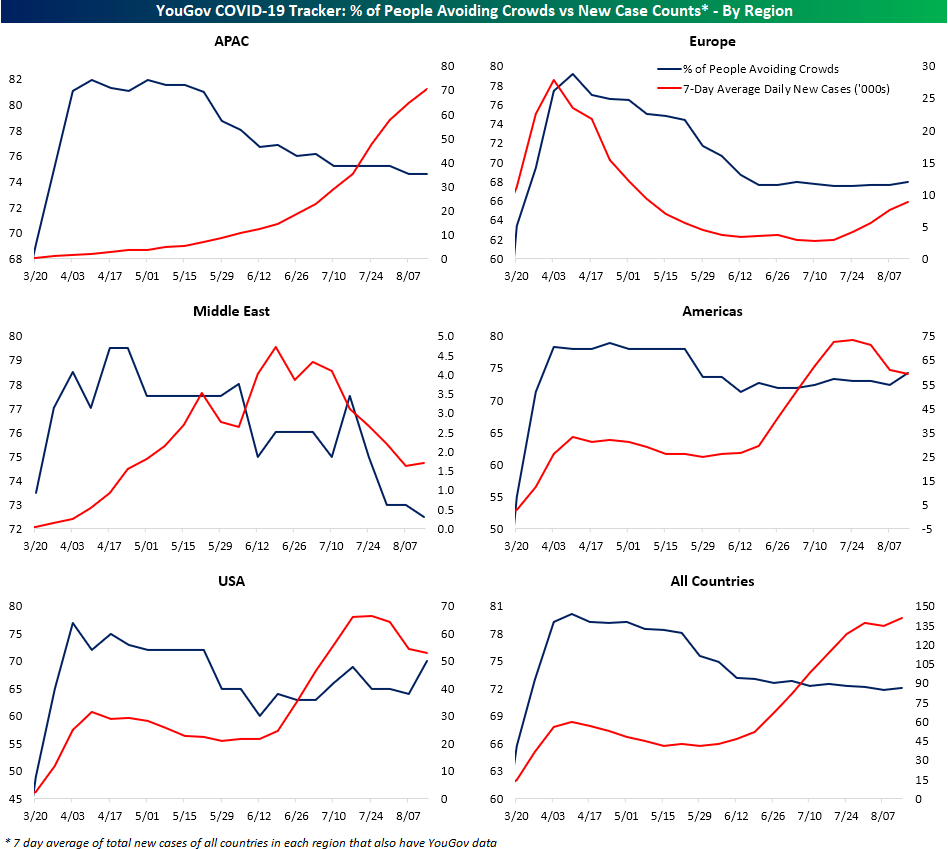

Fortunately, Americans seem to be proactive. As shown below, as those concerns have risen, a higher share of Americans have reported that they wear a mask when they go out in public. That potentially could be one of many factors in the recent decline in case counts. Granted, there has been a growing trend around the globe of more people wearing face masks, and that inverse relationship between masks and new cases is not necessarily shared in regions like Europe. As shown in the top-right chart, despite a record number of Europeans who say they wear a mask in public, COVID cases are back on the rise.

As for another spread mitigation measure, avoiding crowds, the same can be said for the US. As case counts have declined more people have been avoiding crowds. In Asia and Europe, though, fewer people have been avoiding crowds compared to earlier in the pandemic which may help to explain why case counts are rising. Click here to view Bespoke’s premium membership options for our best research available.

Biggest Beats Provide Big Bumps for HPE, CRM, and PLAN

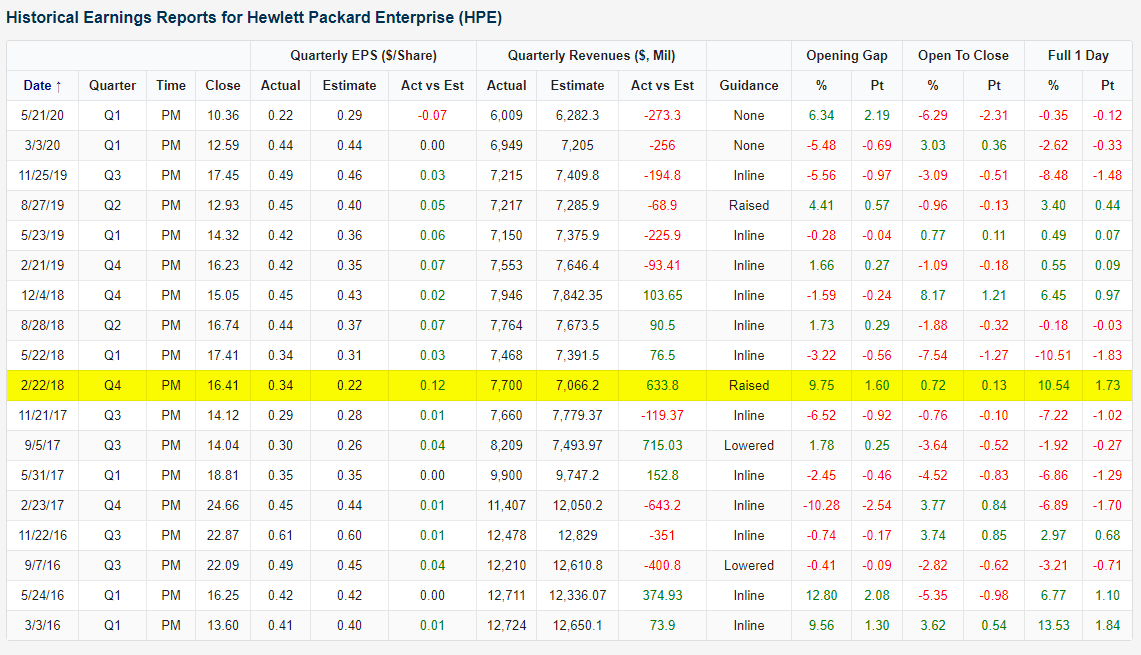

With earnings season now in the rearview, the earnings front has been fairly quiet with retailers along with a handful of other big companies like salesforce.com (CRM) taking up the bulk of the calendar. While the new addition to the Dow reported a strong quarter last night with EPS exceeding estimates by $0.77 and sales coming in at $5.151 billion versus estimates of $4.9 billion, another former Dow component, Hewlett Packard Enterprise (HPE), reported a triple play. A triple play is considered the gold standard on earnings and is when a company beats estimates on the top and bottom line as well as raises guidance. For HPE, this was the first triple play since Q4 2018 (as shown in the snapshot of our Earnings Explorer below) as EPS was 9 cents above estimates and sales were $6.8 billion compared to estimates of $6.06 billion. The stock is up over 6.5% in response today. That is the best response to earnings since that last triple play.

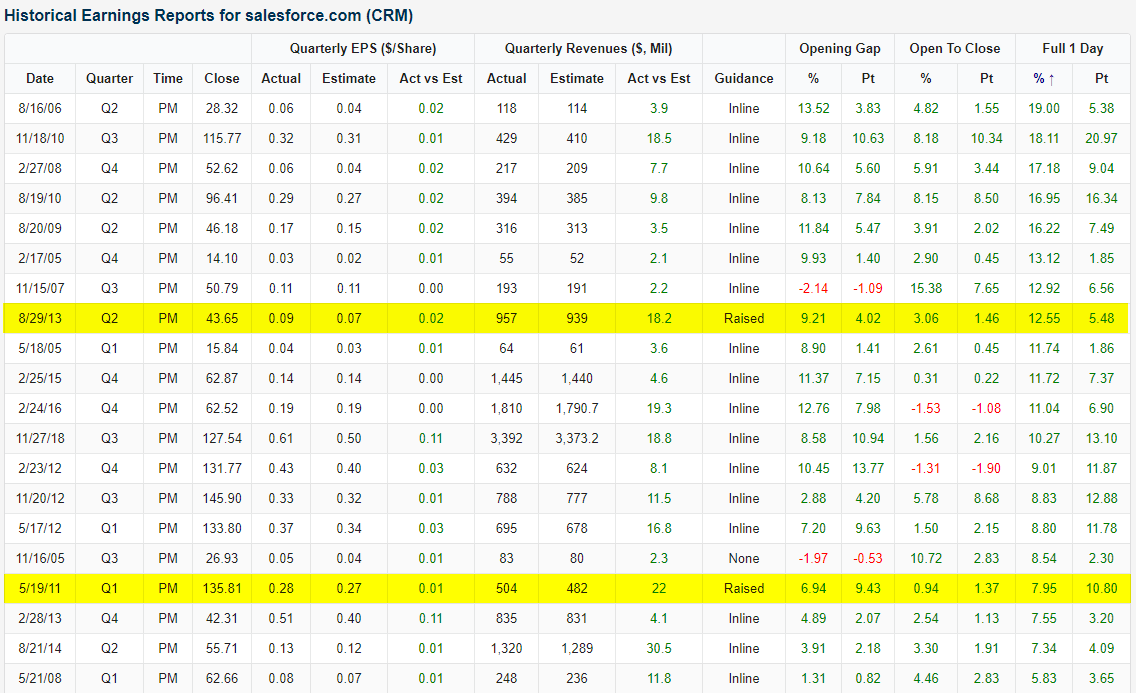

As for CRM, the stock is rallying by much more with a gain of over 25% today in response to these strong earnings. As shown below, those gains put the stock on pace for its best response to earnings on record, exceeding the prior record of a 19% rally back in Q2 of 2006. Of the 20 other top reactions to earnings, only two were triple plays.

A frequent flier in the triple play club, Anaplan (PLAN), also reported in the past 24 hours and the results are basically a combination of HPE and CRM’s earnings. Like HPE, PLAN reported a triple play with a loss of 4 cents per share versus estimates for a loss of 12 cents. Revenues were up 26% YoY to $106.5 million; roughly $3 million better than expected. But unlike HPE, and more similar to CRM, the stock is getting a massive upwards boost from these results with the stock higher by over 25%. Just like CRM, that is on pace for the best earnings day reaction to date.

As for where those moves leave these stocks from a technical perspective, HPE is breaking out of the past year’s downtrend thanks to this boost on earnings and is now at the upper end of the range that it has traded in for most of 2020. Meanwhile, CRM is much more elevated as it has been in a long term uptrend, and today’s gains bring it well into new all-time high territory. PLAN’s big gains, on the other hand, have not even resulted in a 52-week high but is now sandwiched between the post IPO highs from the summer of last year and February of this year. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: No Selling in salesforce.com

Bespoke’s Morning Lineup – 8/26/20 – Gulf Coast on Watch

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Stock market bubbles don’t grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.” – George Soros

It’s been a relatively quiet pre-market session today as US futures are trading modestly above or below the flat line depending on the index. The economic calendar is also on the quiet side and there is very little in the way of major earnings reports on the calendar. The Gulf coast is on watch this morning as Hurricane Laura has been upgraded to a category 3 storm and is likely to intensify further.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

One characteristic of a stock market bubble is the near-universal belief that equities can only go higher. Based on yesterday’s weaker than expected Consumer Confidence report, not only are Americans worried about their overall economic well being, but they’re also not exactly bullish on the stock market. In the question where respondents are asked their views on the stock market, the percentage of respondents who expect stock prices to go up stands at just 36.5% while 34.8% expect the equity market to go down. When practically an equal number of US consumers expect stock prices to go up as go down, that hardly sounds like an investor base plagued with unbridled optimism.

Daily Sector Snapshot — 8/25/20

Bespoke Stock Scores — 8/25/20

Fifth District Flies While Future Outlook Falls

This morning, the Richmond Fed released the results of their monthly manufacturing survey for the month of August. The report showed a solid expansion of activity in August albeit on waning optimism for the future. General manufacturing activity in the Fifth District continued to expand in August with the index rising 8 points to 18. That is the highest level since an equivalent reading in October of 2018. That eight-point increase is still fairly large relative to the rest of history (in the 80th percentile of all month over month changes), but it was actually the least volatile move in the index since March.

In the tables below we show the results of this month’s survey for each of the sub-indices of the report for both current conditions and future expectations. While the indices for current conditions broadly improved—as evident through the headline number’s rise—expectations have declined dramatically. As shown in the second table, last month saw most readings in the top percentiles of all historical readings for the indices for future conditions, but this month every index with the exception of Capital Expenditures has fallen with those declines in the bottom 2.5% or worse of all monthly moves. This was the first time since October of 2015 that all but one of the 17 indices for future expectations fell in the same month. Sentiment towards the future saw a pretty significant turnaround in the span of a month.

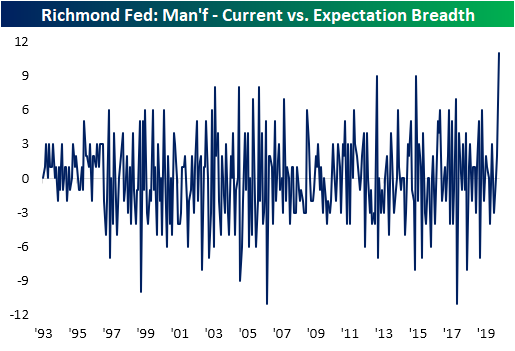

The big divergence between the moves in the indices for future expectations and current conditions can be illustrated in the chart below. In it, we show the spread between the counts of indices for current conditions rising less the number for future expectations that are rising MoM. With 12 current conditions higher compared to only 1 for future expectations, this spread was at its highest level on record.

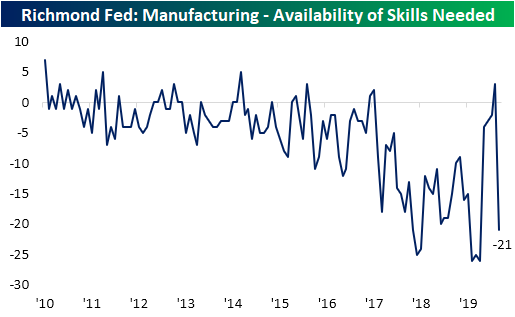

Future indices were not alone in experiencing historically big moves though. As shown below, the index for the Current Number of Employees climbed to its highest level since March of last year thanks to a 20 point jump in August. That is the most this index has gained in a single month ever. Additionally, that marked the first expansion in employment since February. But on the other hand, the index for Availability of Skills Needed plummeted by 24 points to a contractionary reading of -21. That marks a return to contractionary readings after a one month break in July and the lowest level for this index since March. In other words, businesses are beginning to ramp up hiring, but they are struggling to find workers with the right skills.

Alongside labor, capital is also on the up and up with the indices for Equipment and Software Expenditure and Capital Expenditure both moving into expansionary territory for the first time since March. For Capital Expenditures, this month’s increase was in the top decile of historical moves as well. Meanwhile, Business Services Expenditure remains weak but likewise improved in August rising from -23 to -18.

In addition to the manufacturing indices, the Richmond Fed also released service counterpart indices. These have fared far worse throughout the pandemic with most readings continuing to sit in contraction territory, but there has continued to be some improvement. August saw all but one of these indices for current conditions increase. This brought the indices for Revenues, Employees, and Wages all out of contraction. But, like the manufacturing report, future expectations hit the brakes. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.