Dollar Down, Everything Else Up

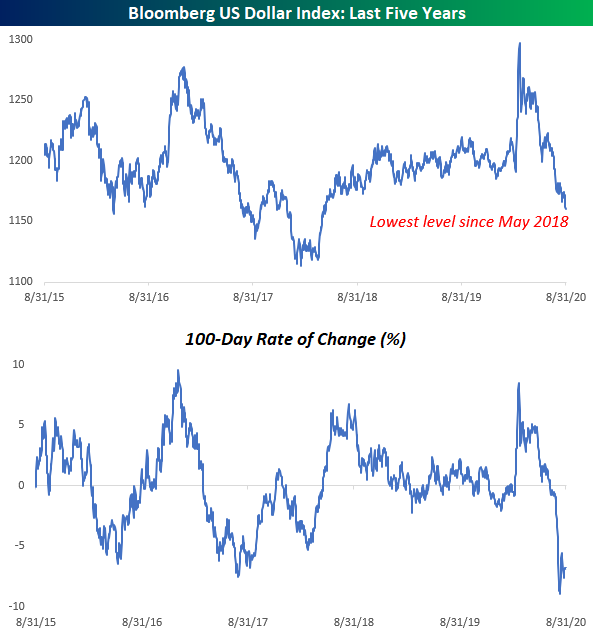

Better spend that dollar in your pocket quickly, because it isn’t worth nearly as much as it was five months ago. In a month where just about every other financial asset went up, the US Dollar couldn’t say the same in August. The Bloomberg US Dollar Index fell for its fifth straight month and traded at its lowest level in more than two years in the process. It was only a few months ago that investors were seeking shelter in the dollar at the onset of the COVID outbreak in the US, but once the Fed flooded the system with liquidity and subsequently pivoted to a much more dovish stance, that rush into the dollar has shifted to an exodus out of it. Earlier this month, the 100-day rate of change in the Bloomberg US Dollar Index (second chart) reached as low as negative 8.9% and still currently sits at -6.8%. Click here to view Bespoke’s premium membership options for our best research available.

Texas Ticking Higher

This morning, the Dallas Fed released their monthly reading on the manufacturing sector. For the first time since February, the index showed an expansionary reading, rising from -3 in July to 8 in August. That is the highest level since February of last year. Meanwhile, the index for the six-month outlook of general business conditions reversed last month’s decline and now stands at 20.4. That is the highest level since November of 2018.

Overall, this month’s report indicated that conditions continued to improve in August with most measures of business expanding rather than in contraction as was the case for the past few months. Breadth was strong with all but one index, Finished Good Inventories, now showing expansionary readings. Breadth in terms of the month over month improvements was not quite as strong though with four different indicators declining.

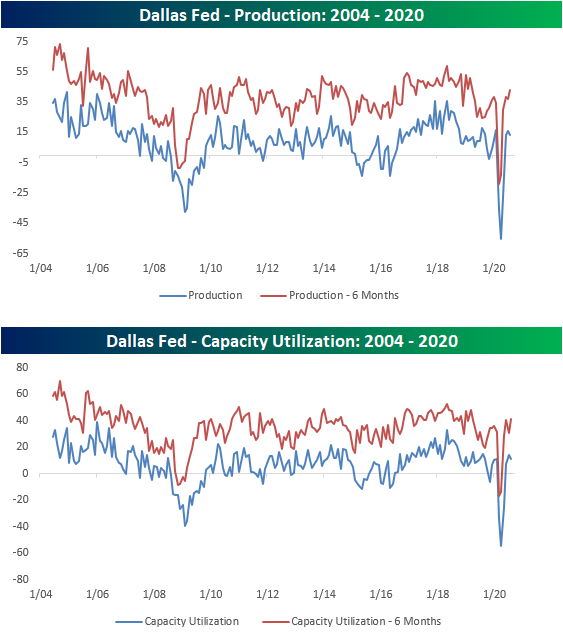

Two of those indices that fell from July were for Production and Capacity Utilization. Although both were lower in August, these indices are still indicative of expanding (but less so than July) production that is similar to levels prior to the pandemic. Meanwhile, future expectations are still optimistic with the six-month outlook indices for Production and Capacity Utilization at their highest levels since March of last year.

Contrary to companies decelerating production, demand appears to remain strong and improving. New Orders rose to 9.8 which is the highest since January. Not only are new orders rising but they are doing so at a strong pace. New Orders Growth rose to a two year high of 11.8. As a result of stronger demand and weaker production, Unfilled Orders remain elevated around some of the highest levels of the past two years, though, this index did in fact fall slightly from July. Those orders are also getting out the door as Shipments rose to 23.3 which is the highest since August of 2018.

With demand stronger and production pulling back slightly, inventories are at historically low levels as businesses continue to fulfill orders. The index for finished good inventories fell down to -17.3 from -9.9. That is the 17th consecutive month with lower inventories, the second-longest such streak on record behind one that came to a close at 21 weeks in February of 2010, and the lowest reading in over a decade.

Although businesses cut back on production, they did not cut back on their labor force. The index for employment and hours worked both ticked up indicating growth in the number of employees and how long they worked. Employment rose to its highest level since last September and hours worked is now at its highest level since September of 2018. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke Matrix of Economic Indicators – 8/31/20

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Travels Stocks Flying High

After a massive surge on earnings, salesforce.com (CRM) finished last week up over 30% on the week which left it as the most overbought stock in the S&P 500 as shown in the snapshot of our Trend Analyzer below. While Technology stocks seeing strong performance has been a staple of the new COVID economy with other strong recent performance and extremely overbought readings from names like Adobe (ADBE) and Microsoft (MSFT), there is another interesting dynamic of the stocks that are currently the most overbought in the index.

As shown in the snapshot of our Trend Analyzer above as well as in the following table, the 40 most overbought stocks in the S&P 500 have a large representation of re-opening stocks. These names include many travel-related stocks like Expedia (EXPE) and Booking Holdings (BKNG) as well as other travel adjacent names such as hotels and resorts: Marriott (MAR), Hilton (HIL), Las Vegas Sands (LVS), and MGM Resorts (MGM)—Wynn Resorts (WYNN) is not included on the list but just missed as the 41st most overbought stock in the S&P at the moment. Airlines like Alaska Air (ALK) and some restaurants also find themselves in this group of extremely overbought reopening stocks with representations from Darden Restaurants (DRI) and Starbucks (SBUX). As shown, these extreme overbought readings come on double-digit gains for many of these names over the past week alone, and that is on top of already strong performance since the bull market began. Whereas many of these were the hardest hit (in the bottom 50 worst performing stocks) during the bear market running from February 19th to March 23rd, since the new bull market began on March 23rd, some of these same stocks have been the top performers in the index. For example, MGM Resorts was one of the 20 worst performing stocks from 2/19 through 3/23, but since 3/23 it has been the ninth-best performer in the index.

Given that these stocks are currently extremely overbought, this may not pose as the most opportune time to jump in on them, but the charts have been at or approaching interesting levels. In the charts from our Chart Scanner below we show 12 of these stocks. Each one has been in a solid uptrend since the bear market low with highs being put in place back in late spring. With respect to those spring highs, it is a mixed picture. While some stocks like Delta Air Lines (DAL) and Hilton (HIL) have yet to move above those prior highs, others like Booking Holdings (BNKG) and MGM Resorts (MGM) have begun to make new highs. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 8/31/20 – Icing on the Cake

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein

The last day of August and the first day of the week are on pace for gains, but futures are trading off their highs from earlier this morning. It was a busy weekend on the political scene as polling and betting markets continue to show a much tighter Presidential race and race for control of the Senate as well. What does that mean? Even more political ads for the next two months than you would have expected!

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, economic data out of Asia, trends related to the COVID-19 outbreak, and much more.

2020 has definitely been the year or large-cap Nasdaq stocks. Besides rallying more than 35%, the Nasdaq 100, which tracks the Nasdaq’s largest stocks, has traded higher on more than 64% of all trading days so far in 2020. We’ve been updating the chart below throughout the summer, and it shows the percentage of up days for the Nasdaq 100 by year. While 2020 has often been near the top of the rankings, through 167 trading days, no other year in the Nasdaq 100’s history (since 1985) has had a higher percentage of positive days. The only years that have even been close were 1995 (63.5%) and 2017 (63.5%).

Bespoke Brunch Reads: 8/30/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID

New Thinking on Covid Lockdowns: They’re Overly Blunt and Costly by Greg Ip (WSJ)

Back in March and April, detailed research around COVID transmission wasn’t available, so lockdowns were used in order to avoid the catastrophic overload of hospitals seen in Italy and Wuhan. Since, better understanding of the spread suggests looser restrictions on gatherings, mask wearing, and shifting activities outdoors are all preferable to full lockdowns in terms of the economic tradeoffs involved. [Link; paywall]

Biogen conference likely led to 20,000 COVID-19 cases in Boston area, researchers say by Jonathan Saltzman (Boston Globe)

A new study attributes a staggering 20,000 cases of COVID to an international Biogen (BIIB) conference in Boston during the month of February; it turned just a few cases from different parts of the world into a mass of infections for attendees and local people alike in one of the most stark “super-spreader” events from this pandemic. [Link; soft paywall]

Personal measures taken to avoid COVID-19 (YouGov)

Survey data tracking the experience and response to COVID from respondents around the world, including a number of both developed and emerging markets with outbreaks of varying sizes. [Link]

Their school refused to require masks, but bans spaghetti straps. These girls protested — and won. by Caroline Kitchener (The Lily)

Two girls were frustrated that their school had enforced a rigorous dress code, but wasn’t willing and claimed to be unable to enforce mask-wearing. Their protest over the contradiction forced the school to introduce mask wearing. [Link]

Conquering Disease

Africa declared free of wild polio in ‘milestone’ by Naomi Scherbel-Ball (BBC)

Widespread vaccination appears to have eradicated polio in Africa, leaving Pakistan and Afghanistan as the only remaining wild disease reservoirs left. [Link]

Groceries

Walmart’s Supermarket Rivals Are Eating Into Its Grocery Share by Matthew Boyle (Bloomberg)

While still dominant in grocery, Walmart is facing huge competition and shifting wallet share in that market due to COVID and its impact on the eating and spending habits of American consumers. [Link; soft paywall]

Local News

City officials cheekily vow to name sewage plant after John Oliver following his anti-Danbury rant by Bryan Alexander (USA Today)

After a rant on his Last Week Tonight show targeting Danbury, CT, the town is planning to name its sewage treatment plant after the comedian. [Link]

In Southfield, a ‘thorough investigation’ into how woman declared dead returned to life by James David Dickson (The Detroit News)

A Michigander was still alive while being delivered to a funeral home after half an hour of revival attempts appeared to have failed; she is now recovering in an area hospital. [Link]

Is This The Top?

Former House Speaker Paul Ryan Starts Blank-Check Company by Maureen Farrell (WSJ)

Blank-check companies that go public with the intention of buying a private company and therefore skirting the IPO process have seen a surge in popularity and interest, and former Vice Presidential candidate Paul Ryan is getting in on the game. [Link; paywall]

Counter-Hacking

Tesla employee foregoes $1M payment, works with FBI to thwart cybersecurity attack by Simon Alvarez (Teslarati)

When he was approached by a Russian national seeking a way to deploy malware at Tesla, a Nevada employee flipped and helped the FBI nab the attempted heist. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – “That’s a Keeper”

This week’s Bespoke Report newsletter is now available for members.

We just published our weekly Bespoke Report newsletter, which covers all of the major events of the week, including the economy, sentiment, politics, and the Covid outbreak. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Below we have updated our ETF Asset Allocation Matrix which summarizes the performance of key ETFs across the spectrum of asset classes this week, this month, and YTD.

Weeks don’t get much more positive than this one. Outside of the Utilities sector ETF (XLU) and a number of fixed income ETFs, every other ETF was up on the week. Leadership this week was centered in large caps, growth, Technology, Communication Services, and even—hold on to your hats– Financials! Among individual countries, Brazil, China, and India all traded up over 3%. Commodities were also strong on the week with all five of the ETFs tracked in our Matrix gaining more than 4%.

Looking through the various MTD performance numbers, they look more like returns you would see for an entire year! The Nasdaq 100 ETF and the Tech sector Spyder (XLK) are both up over 10% MTD. The only laggards of note have been Brazil (EWZ), Long-Term Treasuries (TLT), and the Utilities sector ETF (XLU).

Year to date, eight ETFs are up over 20%, led by Silver (SLV) which has gained more than 50%, while just three ETFs (Energy—XLE, Brazil—EWZ, and Mexico—EWW) are down more than 20%.

Daily Sector Snapshot — 8/28/20

New Lows for Dividend Yields, Still Better Than Treasuries

Back at the February all-time highs prior to the pandemic bear market, the median dividend yield for S&P 500 stocks was 2.19%. With the S&P 500 back at all-time highs, the median yield is now down to just 1.65%. As shown in the chart below, the trailing 12-month dividend yield spiked to 2.7% at the March 23rd low, but with the market’s rapid rally and some companies cutting their payouts, that yield has ground lower and now stands at just 1.72%. In just this past week, it took out the mid-January low around 1.77% and is now at the lowest levels since November of 2004.

As we have in the past, in the charts below we plot the S&P 500 dividend yield versus the yield on the 10 year Treasury. The past few years have seen some back and forth between which of these assets yield more, but since mid-January, equities have been the clear leader. Even though the dividend yield is at some of its lowest levels in over 15 years and the 10 year Treasury has seen a significant rally this month with its yield now at 0.728%, equities still yield over a full percentage point more than the 10 year Treasury. That difference in yields is well off the peak of 192 bps at the bear market low on March 23rd, but even with that decline, the spread remains well above any period outside the past few months and the Global Financial Crisis. Click here to view Bespoke’s premium membership options for our best research available.

FANG Explosion

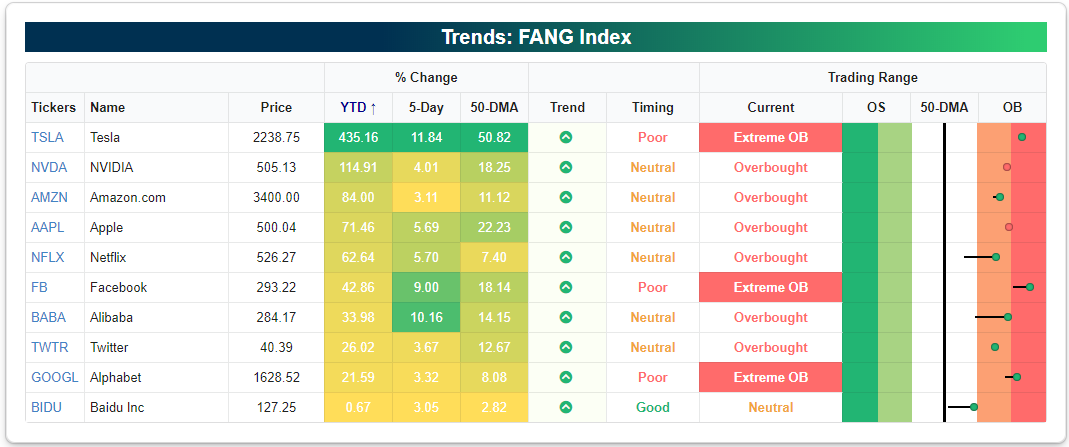

The ten members of the NYSE FANG+ index went on an epic run in the mid to late–2010s that many thought was “bubble” like at the time. From early 2016 to mid-2018, the FANG+ stocks went up 200%. After peaking in June 2018, though, the FANG+ index fell nearly 50% before finally finding a floor. After the big decline in late 2018, many investors moved on from the FANG trade, but now anyone that did is kicking themselves.

The FANG+ stocks went on another big run in 2019 and early 2020 only to collapse 34% during the one-month COVID Crash in late February and early March. Since making its COVID-Crash low on March 18th, however, the FANG+ index has experienced one of the most remarkable runs that any investor can expect to see in their lifetimes. As shown in the second chart below, the FANG+ index is up more than 60% over the last six months, and it has more than doubled since its March 18th low. Those prior highs made back in 2018 are now a distant memory with the index now ~85% above that level. Click here to view Bespoke’s premium membership options for our best research available.

Below we compare the NYSE FANG+ index since its inception in 2014 to the S&P 500. The performance disparity continues to get wider and wider with the FANG+ index up 455% and SPY up 74% over the same time frame.

The NYSE FANG+ index is made up of the four FANG stocks (FB, AMZN, NFLX, GOOGL) plus six additional names that have certainly contributed their fair share to the index’s performance. Stocks like NVIDIA (NVDA), Apple (AAPL), and Tesla (TSLA) stand out the most, with Tesla of course being the most epic winner of them all. Year-to-date, TSLA is up 435%, and it’s now 50% above its 50-day moving average. If you’d like to track the FANG+ stocks or any other portfolio of your choosing, you can do so with our Custom Portfolios tool on our website. Simply start a two-week free trial to Bespoke Premium or Bespoke Institutional to gain access to our Custom Portfolios tool and the rest of our popular Interactive Tools. You’ll also gain access to a rich library of equity research to keep you on top of the market.