Chart of the Day: 95 Cents on the Dollar

New Orders Blowout

The Institute for Supply Management’s August reading on the manufacturing sector showed a third straight month of accelerating expansionary activity. The headline index rose to 56 compared to expectations of 54.8 and 54.2 in July. That is now the highest level of the index since November of 2018 when it read 58.8.

Breadth across each of the individual components of the report continues to be solid with just about every index higher month over month. The only two indices to fall were both for inventories. The index for Employment along with these indices for Business Inventories and Customer Inventories are also the only ones that remain in contraction as has been the case for the past few months. Employment has been on the rise over the past few months, so it’s not all bad though. Additionally, the declines in inventories may not necessarily be a bad thing as it coincides with strong demand and rising production, meaning strong demand is likely drawing on inventories rather than supply issues.

Demand is extraordinarily strong. Consistent with solid readings for New Orders across regional Federal Reserve manufacturing surveys, the ISM’s reading on New Orders has consistently risen over the past few months and is now around the top 5% of all historical readings going back to 1948. The 6.1 point increase to 67.6 leaves the index at its highest level since the final months of 2003/January of 2004. Prior to that, you have to go all the way back to 1983 to find a time that New Orders were this strong. That is an enormous turnaround compared to where things stood as recently as April when the index was at its low of 27.1; in fact, it is the most the index has risen in four months on record (second chart below). The 40.5 point rise in New Orders in that time surpasses a 39.5 point increase that went from June to October of 1980.

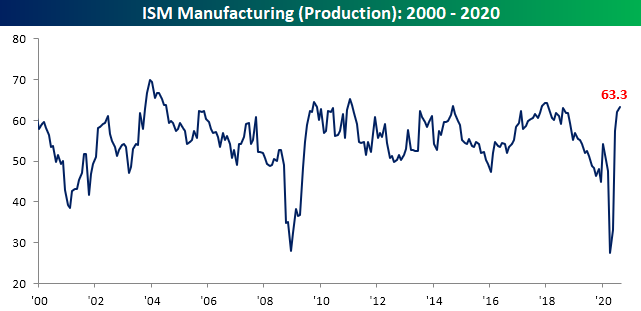

Given the historically strong demand, manufacturers continue to ramp up production. That index rose to 63.3 from 62.1 last month. That is the strongest reading since January of 2018.

Additionally, US manufacturers also appear to be ramping up general trade activity as both indices for Imports and Exports have risen. Export Orders index are at the same levels as January of this year after rising 2.9 points this month while Imports are even stronger at their highest level since June of 2018. Assuming those imports are mostly inputs, that could be a positive sign for future production.

Even though production continues to rise, it still appears that demand is outpacing supply as Backlog Orders also expanded for a second straight month. Backlog orders rose 2.8 points to 54.6. That 2.8 point month over month increase is in the top decile of all monthly changes and leaves the index at the highest level since November of 2018.

Further evidence of demand outpacing output can be seen through inventories. As mentioned earlier, the only areas of the survey that remain in contraction concern inventories. Both Business Inventories and Customer Inventories remain deep in contraction at 44.4 and 38.1, respectively. For Business Inventories, that is the lowest since January of 2014.

For Customer Inventories, that was the largest decline in a single month since December of last year and that is now the lowest level in over a decade with the last time it was this low being June of 2010. With inventories dwindling and demand historically elevated, these should act as tailwinds for future improvements to employment and production (as well as prices)

Click here to view Bespoke’s premium membership options for our best research available.

This is a Recession?

According to the National Bureau of Economic Research (NBER), the US economy peaked in February of 2020 with the economy beginning its downturn in March. With August just finishing, until the NBER says otherwise, we are now six months into the current recession. This morning’s ISM Manufacturing report for the month of August, however, would beg to differ.

Not only did the August report surpass expectations, but it also came in above 50 (expansion territory) for the third straight month. What stood out even more than the headline reading, though, was the commentary section of the report (shown below). Do these sound like the types of responses you would expect to see in a recession? Outside of one comment in the Transportation Equipment sector and another in the Machinery sector, all of the other responses were not only positive but in many cases, they were downright bullish. Interested in staying on top of the latest trends related to the market and economy? Start a two-week free trial to Bespoke Premium by clicking here.

Health Care Relative Strength

You would think that the Health Care sector (XLV) would be one of the best performing areas of the stock market during a global pandemic. While Health Care was a top performer early on during COVID, the sector has been seriously lagging the broad market lately.

Nothing stands out too much in the price chart (first chart below) of the Health Care ETF (XLV) as it is still in a solid uptrend and in fact making new all-time highs. It’s the chart that compares XLV to the S&P 500 that does stand out. In the second snapshot below, we provide relative strength charts of the eleven major sectors versus the S&P 500. A rising line indicates outperformance versus the broad market while a falling line indicates underperformance. As you can see in the yellow highlighted chart for Health Care, the sector has recently given up all of the gains it made versus the market early on during COVID. From late February through the end of April, Health Care dramatically outperformed, but its relative performance has slowly and steadily trended lower since then. The chart almost looks like the COVID case curve in the NYC region! At this point, the Health Care sector is performing right inline with the S&P 500 over the last year. Bespoke Premium members have access to these sector relative strength charts on a daily basis. You can start a two-week free trial to Bespoke Premium by clicking here.

August and YTD Asset Class Performance

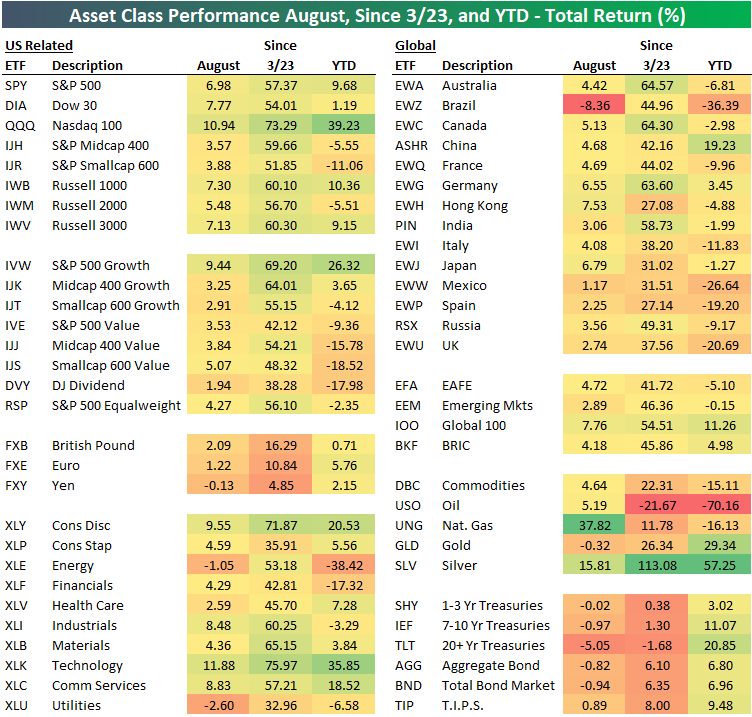

Below is a look at the recent performance across asset classes using key ETFs traded on US exchanges. All performance numbers represent total returns. The S&P 500 (SPY) gained 6.98% in August, but the Dow (DIA) and the Nasdaq 100 (QQQ) did even better with gains of 7.77% and 10.94%, respectively. The tech-heavy Nasdaq 100 has been the biggest winner by far across global index ETFs. It’s up 39.23% year-to-date and 73.29% since the March 23rd low made after the COVID Crash.

While everything is up off the March lows, there is wide performance disparity on a year-to-date basis across sectors, size, and themes like value and growth. Large-cap ETFs are now up solidly on the year, while small-cap ETFs like IWM and IJR are still in the red. Mid-cap value (IJJ), small-cap value (IJS), and the Dow Jones Dividend ETF (DVY) are all still down 15%+ on the year.

Looking at sectors, we saw Technology (XLK), Consumer Discretionary (XLY), Industrials (XLI), and Communication Services (XLC) gain 8%+ in August, while Utilities (XLU) and Energy (XLE) both declined during the month. Year-to-date, Tech (XLK) is up 35.9% while Energy (XLE) is down 38.4%.

Outside of the US, every country ETF tracked in our matrix was up in August with the exception of Brazil (EWZ), which actually fell 8.4%. Year-to-date, EWZ is still down 36.4%, while countries like Italy (EWI), Mexico (EWW), Spain (EWP), and the UK (EWU) are down double-digit percentage points as well. Germany (EWG) is the one European country in our matrix that’s up on the year. China (ASHR) is up 19.23%, which is 10 percentage points better than the S&P 500 (SPY).

Commodities have been all over the map in 2020, with the oil ETF (USO) down 70% YTD while silver (SLV) is up 57%. The natural gas ETF (UNG) had a banner August with a gain of nearly 38%, but it’s still down 16% YTD.

Fixed-income ETFs had a rough August as interest rates moved higher, but across the duration spectrum, Treasury ETFs are still up solidly on the year. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 9/1/20 – So, Do You Think Splits Still Don’t Really Matter?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Although it’s easy to forget sometimes, a share is not a lottery ticket… it’s part ownership of a business.” – Peter Lynch

With the stock split announcements from Apple (AAPL) and Tesla (TSLA) over the last month, we have been reminded by many market experts that stock splits don’t matter as they have no impact on company fundamentals. That’s obviously true, but tell shareholders or short-sellers of AAPL and TSLA that stock splits don’t matter. Since each company announced their respective stock splits since the end of July, they have seen their market caps increase by a combined roughly $700 billion! AAPL is now bigger than the entire Russell 2000, and Tesla is just one General Motors (GM), or $30 billion, from having a larger market cap than Berkshire Hathaway. AAPL’s market cap has been boosted by a blowout earnings report along with the stock split, but the $190 billion in market cap that TSLA has added has come on essentially no substantive news other than the split.

It’s a new month, but we’re seeing more of the same in markets this morning as the Nasdaq is set to open higher while the DJIA lags. The dollar is lower, and commodities are higher. In economic news, PMI data around the world showed modest increases in August with the majority of countries showing manufacturing gauges in expansion territory.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, economic data out of Europe and Asia, trends related to the COVID-19 outbreak, and much more.

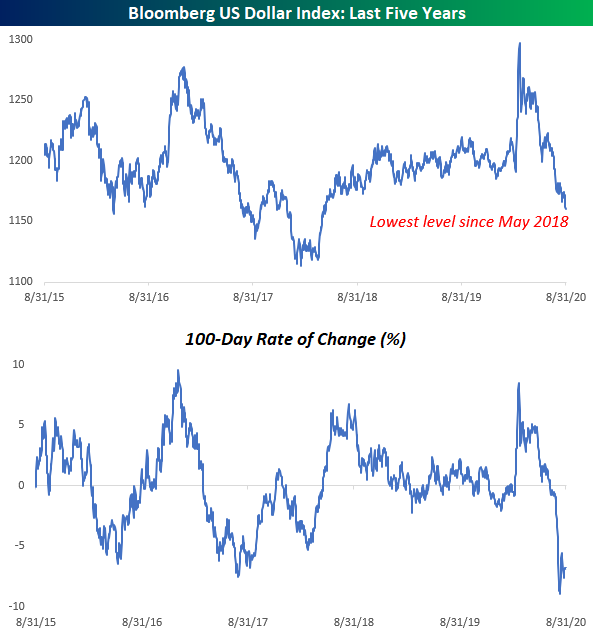

In a month where just about everything went up, the US dollar was lower in August as it has now been for five straight months. This current losing streak is the longest for the US Dollar Index since the six-month period ending in August 2017. Before that only longer streak was a ten-month streak ending in May 2003. Between those two streaks, there were three other five-month losing streaks. In the history of the US Dollar Index, there have only been a total of nine streaks that were longer and eight streaks that were as long. With the Dollar Index already down pretty sharply to kick off September, a six-month losing streak could certainly be in the cards. Better buy those imported goods while you can still afford them!

Daily Sector Snapshot — 8/31/20

Bespoke Market Calendar — September 2020

Please click the image below to view our September 2020 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Chart of the Day: Best Five Months in 82 Years

Dollar Down, Everything Else Up

Better spend that dollar in your pocket quickly, because it isn’t worth nearly as much as it was five months ago. In a month where just about every other financial asset went up, the US Dollar couldn’t say the same in August. The Bloomberg US Dollar Index fell for its fifth straight month and traded at its lowest level in more than two years in the process. It was only a few months ago that investors were seeking shelter in the dollar at the onset of the COVID outbreak in the US, but once the Fed flooded the system with liquidity and subsequently pivoted to a much more dovish stance, that rush into the dollar has shifted to an exodus out of it. Earlier this month, the 100-day rate of change in the Bloomberg US Dollar Index (second chart) reached as low as negative 8.9% and still currently sits at -6.8%. Click here to view Bespoke’s premium membership options for our best research available.