Daily Sector Snapshot — 9/2/20

Technology Today vs. History

One near constant of 2020 has been the outperformance of Technology stocks. Both during the bear market and in its aftermath, Technology stocks—many of these businesses being insulated or benefiting from the pandemic—have consistently outperformed. Given this outperformance of Technology, lofty valuations, and more, there have been parallels drawn between now and the Dot Com era.

In the charts below, we show the long-term ratios of the S&P 500 Technology sector to other major indices as well as the other sectors. As shown, the Tech sector’s outperformance (rising line) versus basically everything else is clearly evident with the line having risen sharply over the past few years. Currently, Technology in relation to the S&P 500, Russell 2000, Dow, and Dow Transports are all around some of their highest levels since the Dot Com era. Of these, the ratios of Tech to the S&P 500 and Dow are the most elevated and of most concern. On the other hand, the ratio of Tech to Transports is far more muted, and Tech to small caps is also not as dramatically high as the Dot Com days. For these two, there were also even more elevated readings back in the early 1970s; over two decades before the Dot Com boom and bust.

When comparing Technology to other sectors, it is a more mixed bag. The ratio of Technology to Communication Services is the only one that is around a record high. As for the other sectors, the readings are much less extreme. While there are elevated readings like in the case of Financials, Materials, and Energy, they are either not yet at a new high or have other readings prior to the 1990s that are higher just like the ratio of Technology to the Dow Transports. Meanwhile, Technology versus Consumer Discretionary and Health Care are actually more on their low end of historical readings. In other words, Technology has been a massive outperformer and these readings certainly raise an eyebrow, but are perhaps not as extreme as the 1990s or even other years prior to that. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

A Little Gun-Shy

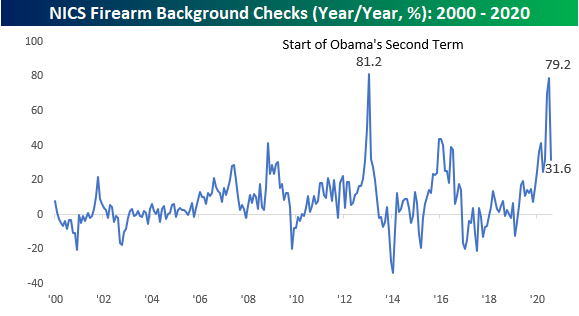

As unrest has erupted around the country this year, Federal background checks for firearms have been rising to record levels. Just three months ago, in June, there were a record 3.931 million background checks. In July that total declined by nearly 300K to 3.639 million. Figures for the month of August were released earlier today and showed an additional decline of 524K to 3.115 million. While August’s decline was the largest m/m decline in background checks going back to 1998, the total number of background checks was still the 6th highest monthly total on record, and all but one (December 2015) of the five months that saw larger numbers of background checks were all this year (March, May, June, and July).

Despite what was one of the largest monthly declines on record, the y/y change in background checks was still more than 30% which while down from the 79% y/y rate in July is still a blistering pace. Start a two-week free trial to Bespoke Institutional to access all of our research and interactive tools.

Chart of the Day: Who’s Next?

Not Much Pickup in New Highs

Every day in our Daily Sector Snapshot, we provide a look at the net percentage of S&P 500 stocks that are making new 52-week highs (percentage of new 52 week highs minus the percentage of new 52 week lows). Even though the S&P 500 has continued to hit new highs recently, the same cannot be said for much of the individual stocks that the index is comprised of. Historically for the S&P 500 when it has reached all-time highs, the average reading on the net percentage of new highs has stood at 12.35%. Today, it is around 5 percentage points lower at 7.33% and is off the post bear market low peak of 10.1% from July 23rd. The same can also be said for each of the eleven sectors. At the moment there is only one sector, Materials, that is currently at its highest level since the bear market low. Every other sector is currently off-peak with no stocks reaching new highs in Energy, Real Estates, and Utilities. Meanwhile, Consumer Staples has seen its share of stocks at new highs fall the most dramatically recently with the reading as of yesterday’s close the lowest since August 13th. Financials also continue to show positive readings but those remain far more muted than what was observed prior to the pandemic. On the other hand, unsurprisingly the sector with the highest net percentage of new highs currently is Technology at 16.9%, but that too is off the peak of nearly 20% from just about a week ago. Granted, for Tech that reading has generally been trending higher recently as it also has for Health Care, Industrials, Communication Services, and Consumer Discretionary. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup – 9/2/20 – Strong September Starts

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“I’m totally used to deflation. Deflation is finished.” – Richard Fisher

Does somebody want to tell the market that the calendar says September? After the strongest first-day of September for the S&P 500 since 2010, global equities are in rally mode again today with Europe up nearly 2% and S&P 500 futures trading higher by over half of a percent.

ADP Employment for August just came out, and the headline reading missed expectations by a mile (428K vs 1,000K). While that’s a big miss, we would note that last month’s report was an even bigger miss relative to expectations (1,67K vs 1,200K), and even after that big miss, the NFP report two days later exceeded expectations by nearly 300K (1,763K vs 1,480K).

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

With a rally of 0.75% yesterday, the S&P 500 kicked off the month with its best start to a September since 2010. Gains of this magnitude are not particularly common for the start of September. Since 1928, yesterday was just the 23rd time that the S&P 500 kicked off September with a gain of more than 0.50%. The table below highlights each of those occurrences along with the performance of the S&P 500 for the remainder of the month. In the 22 prior occurrences, the S&P 500 saw a median gain of 1.27% for the remainder of the month with positive returns 59% of the time. That may not sound like all that big of an advance, but for all months of September, the median performance from the close on the first trading day of the month has been a decline of 0.10% with gains slightly less than half of the time.

Daily Sector Snapshot — 9/1/20

Bespoke Stock Scores — 9/1/20

Zoom Video (ZM) Now The Best Performing Nasdaq 100 Stock YTD

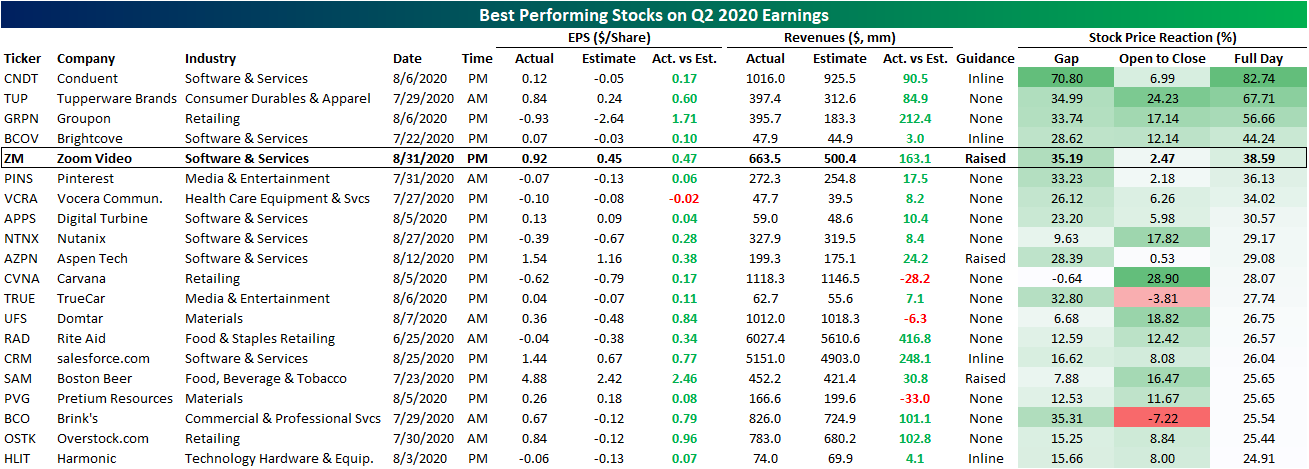

Zoom Video Communications (ZM) is the talk of the town today after reporting a triple play after the close last night. ZM reported EPS and guidance more than double estimates and revenues one third higher than forecasts. In response to the blowout quarter, the stock has surged over 38% in today’s trading. That is the best single day for the stock since it IPO’ed back in April of last year.

Using data from our Earnings Explorer, in the table below we show the 25 stocks that have seen the biggest positive price reactions to second-quarter results this year. As shown, ZM’s massive surge of buying today leaves it as the fifth best performing stock behind Brightcove (BCOV), Groupon (GRPN), Tupperware (TUP), and Conduent (CNDT). CNDT saw the biggest one-day gain on earnings of these when it rose over 82% on August 7th. One notable difference between ZM and the other top 5 best performers is intraday performance. Whereas ZM has only risen around 2.5% intraday, TUP, GRPN, and BCOV all rose double digits from open to close, and while it did not rise double digits, even CNDT saw much stronger performance intraday. Of the top 25 best reactions to earnings, in addition to ZM, there were only two other triple plays (EPS and sales beat plus raised guidance): Aspen Tech (AZPN) and Boston Beer (SAM).

Not only does ZM find itself on a “best of” list in terms of reactions to earnings, but with the massive boost from today’s performance, ZM has now overtaken Tesla (TSLA) as the best performing Nasdaq 100 stock in 2020. In the table below we show the top-performing quarter of the index YTD through today. As shown, the COVID economy staple tops the chart with an over 540% gain compared to the runner up — Tesla (TSLA). In terms of market cap, ZM is now the 28th largest stock in the index having added roughly $72.9 billion year to date. For comparison’s sake, that is roughly $0.5 billion less than the current value of Goldman Sachs (GS). Given these massive moves, the stock is very much trading at a premium (which we discussed in more depth in today’s Morning Lineup) and is very elevated versus its moving averages. ZM is currently 65% above its 50-DMA and 174.64% above its 200-DMA. The only comparable overbought stock in the index at the moment is TSLA. Click here to view Bespoke’s premium membership options for our best research available.