Bespoke’s Morning Lineup – 9/8/20 – Now This Looks More Like September

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Invest for the long haul. Don’t get too greedy and don’t get too scared.” – Shelby M.C. Davis

It looks like traders were a little late to realize that it was September. After two days of gains to kick off the month, things have gotten a bit dicier in the last several days, and today is not looking good at all, especially for Technology. In economic news, the calendar is light today with the only release being the NFIB Small Business Optimism index. That report was better than expected but hasn’t had much of an impact on sentiment.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

The Nasdaq 100 is poised to open down more than 3% this morning putting it back in the territory of a 10% correction. One positive (for now) is that the Nasdaq 100 tracking ETF (QQQ) remains above Friday’s intraday low of 271.80 as well as its 50-DMA, which is lower than that ($269.19). These will be two levels to watch throughout the trading day today.

Bespoke Brunch Reads: 9/6/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Elections

What if Facebook Is the Real ‘Silent Majority’? by Kevin Roose (NYT)

Political polling and betting markets show a pretty clear advantage for former Vice President Joe Biden in November, but Facebook is the heartland for conservative enthusiasm around Donald Trump. [Link; soft paywall]

U.S. Election Priced as Worst Event Risk in VIX Futures History by Michael P. Regan (Bloomberg)

The VIX futures curve is badly kinked around October’s contract, which is tied to options covering the period of the US election. [Link; soft paywall]

Exclusive: Dem group warns of apparent Trump Election Day landslide by Margaret Talev (Axios)

Leaving the slightly hyperbolic headline aside, there is a very real possibility that mail-in/absentee voting creates big differences between in-person results and the actual vote totals come election day. [Link]

Trump’s popularity slips in latest Military Times poll — and more troops say they’ll vote for Biden by Leo Shane III (Military Times)

In 2016, Military Times polling showed a 46-37 positive favorability for the President, but today that has more than flipped with a 50-38 unfavorable tilt among uniformed service members; respondents report they plan to vote 41-37 for Biden versus 41-21 advantage for President Trump in October 2016. [Link]

Generation Generalities

When It Comes to Gen Z’s Brand Preferences, the Most Important Influencers Are Their Parents by Alyssa Meyers (Morning Consult)

A recent poll shows that the youngest group of Americans are the most likely to take cues on preferred brands across a range of products from their parents. [Link]

It’s time to dispel the biggest myth about millennials by Myles Udland (Business Insider)

An oldie but a goodie from Myles Udland (now at Yahoo! Finance) arguing that Millennials’ preferences were not some sort of landmark departure from the prior American way of life but in fact just the same old story. [Link]

Dystopia

Targeted by Kathleen McGrory and Neil Bedi (Tampa Bay Times)

A detailed investigation of the Pasco County, Florida approach to crime prevention which involved invasive intelligence gathering, aggressive harassment of citizens picked out on an ad hoc basis, and general disregard for civil rights that created more crime than it prevented. [Link]

Amazon Drivers Are Hanging Smartphones in Trees to Get More Work by Spencer Soper (Bloomberg)

Drivers are competing to get orders from Whole Foods’ delivery service by hanging phones in trees near the distribution center which then pass on requests to their devices. [Link; soft paywall]

Learning At Home

Mom’s Hilarious Video Sums Up How Confusing This School Year Is For Everyone by Carolina Bologna (Huffpost)

Faced with massive frustration over the patchwork backdrop of remote and in-person learning, a mom parodied the painful experience of learning online. [Link]

Parents on TikTok mock people with disabilities for the ‘New Teacher Challenge.’ These women are reclaiming their images by Scottie Andrew and Kat Jennings (CNN)

A social media trend that sets up disabled people as the boogeyman and teaches their children to fear those same disabled people is a painful example of how what may seem innocuous fun can be deeply hurtful. [Link]

Hot Back-to-School Items During Coronavirus Are Tents, Webcams by Austen Hufford (WSJ)

Protective products, keyboards, webcams, and tents are all in huge demand as schools struggle to prevent the return of students from creating COVID hotspots. [Link; paywall]

Whales

SoftBank unmasked as ‘Nasdaq whale’ that stoked tech rally by Kana Inagaki, Katie Martin, Robert Smith and Robin Wigglesworth (FT)

In addition to buying the underlying stocks, SoftBank has reportedly bid up the call options of many of its US tech investments in an effort to push up investments even faster; that behavior may explain some of the massive tech rally we’ve seen in recent months. [Link; paywall]

Buffett’s 1977 Letter Hints at Why He Likes Japan Trading Houses by Stephen Stapczynski (Bloomberg)

Recent Berkshire Hathaway purchases in five Japanese conglomerates are in large part explained by his long-term focus on understandable, long-term, and competently run operations which are not extremely expensive. [Link; soft paywall]

Moving

New Yorkers Flee for Florida and Texas as Mobility Surges by Steve Matthews and Alexandre Tanzi (Bloomberg)

While mobility across state lines has sagged in recent years, 2020 is seeing a surge in movement from New York and New Jersey to warmer climates like Florida, Texas, and the rest of the Sunbelt. [Link; soft paywall]

Pandemic Purchases

In a Pandemic, Boats Are No Longer a Bad Investment by Alex Lauer (Inside Hook)

Loaded with operating costs and depreciation, boats have long been viewed as a great way to do away with large quantities of cash. But new and used boat sales have exploded during the pandemic as people look for ways to be outdoors and have some fun without getting on a plane or staying in a hotel. [Link]

Who Profits From Amateurism? Rent-Sharing in Modern College Sports by Craig Garthwaite, Jordan Keener, Matthew J. Notowidigdo, and Nicole F. Ozminkowski (NBER)

New research suggests that college sports effectively transfers resources away from black and lower income students and towards students who are white and higher income. This will not surprise many who have spent time close to college athletics departments. [Link]

Amazon Air

Amazon wins FAA approval for Prime Air drone delivery fleet by Annie Palmer (CNBC)

Drone delivery is now permitted to move forward for Amazon, who joins UPS and Google gaining approval for its automated airborne delivery fleet. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Laboring Into Labor Day

This week’s Bespoke Report newsletter is now available for members.

The Nasdaq 100 was more than 30% above its 200-day moving average on Wednesday, which was the most extended it has been above its 200-day since the Dot Com boom of the late 1990s. Even after a big two-day pullback to close out the week, the Nasdaq 100 remains 22% above its 200-day. You know an index is extended when a bear market decline of 20% wouldn’t even put it below its 200-day!

In this week’s Bespoke Report, we analyze the market’s drop over the last two days and try to determine whether it’s the start of a longer-lasting correction or simply a blip within a long-term uptrend.

We also take a look at this week’s big economic releases, including Friday’s better-than-expected Nonfarm Payrolls report and the monthly ISM manufacturing and services readings for August.

We close the report with a deep dive into each of our Bespoke Model Portfolio holdings. If you want to know why we like each of the stocks in our most popular growth portfolio, this week’s report provides a detailed look.

To read this week’s Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 9/4/20

Airports Getting a Little More Crowded

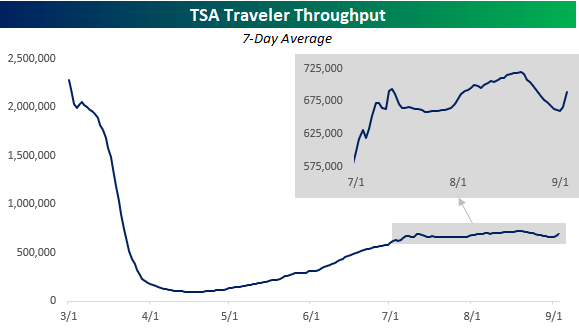

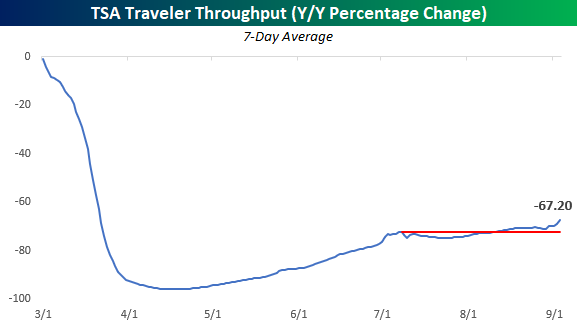

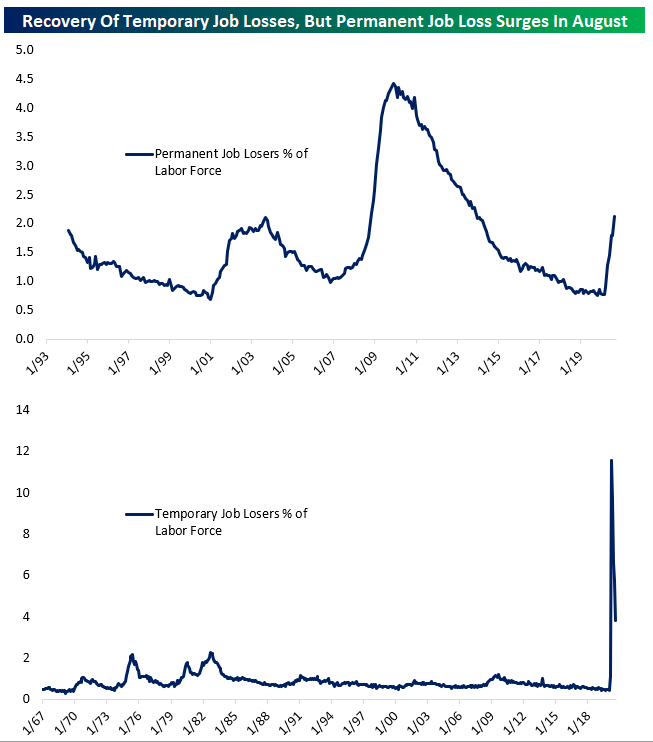

Recent economic data has been making a habit of surprising to the upside as the pace of recovery from the pandemic lows has consistently surprised most economists. While improved, the picture isn’t perfect. This morning’s non-farm payrolls report, which was better than expected at the headline level, showed a concerning increase in the number of permanent job losses (people looking for work that left their prior job on an involuntary basis). Also, looking at more real-time indicators of activity like TSA passenger throughput at the country’s airports appears to have leveled off after rising off the lows in May and June. This begs the question, has the low hanging fruit been fully harvested?

In some ways, the answer to this question is yes. In March and April, pretty much everything shut down. As awareness of the virus and how to deal with it grew, though, businesses that were little impacted have resumed operations. While those businesses have resumed activity, there are still a number of businesses such as ones in the travel, leisure, beauty, and hospitality sectors that remain weak in part because the demand hasn’t returned but also because government orders prohibit them from re-opening in full or even at all. As concerns from the public start to ease and restrictions are lifted, these sectors should also start to improve.

While the pace of the recovery has slowed, it doesn’t yet appear to be rolling over. Take the passenger data in the chart above. While it appears to have stalled out in the last two months, part of the decline is the result of seasonal factors. The chart below takes the same data as the chart above but compares the throughput levels to where they were a year ago and shows the y/y percentage change. On this basis, passenger traffic is still down an eye-popping 67% compared to a year ago, but yesterday’s level was actually the highest reading since late March and has actually been accelerating to the upside. It’s possible that where Labor Day falls on the calendar this year could be impacting the y/y change, so we’ll have to see where things shake out in the next week, but even with that caveat, the pace of air traffic looks better on a y/y basis than on an absolute basis. Like what you see? Try out a Bespoke subscription to receive our weekly Bespoke Report in your inbox this evening. Click here to start a two-week free trial now!

August 2020 Headlines

B.I.G. Tips – S&P 500 2%+ Declines From a Record High

Bespoke’s Morning Lineup – 9/4/20 – Let’s Try This Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The eyes are more exact witnesses than the ears.” – Herclitus

Yesterday was an ugly day, although many people we spoke with were surprised that both the S&P 500 and Nasdaq had similar but larger reversals back in June, so it’s not as though the move was unprecedented. There’s no arguing the market was a bit frothy, especially in large-cap tech, heading into Thursday’s rout, so some mean reversion is to be expected.

In the short-term, the worst may not be over for big-tech. It remains the most overbought sector of the market, and continued tensions with China, the latest being reports that the country will increase support for its domestic semiconductor industry, only adds to the tensions.

In Europe, the region is seeing its second straight day of disappointing economic data. The focus for the short-term in US markets, though, is the August Non-Farm Payrolls report. Economists were expecting 1.35 million jobs, the Unemployment Rate is expected to drop back below 10% to 9.8%, and average hourly earnings are expected to remain unchanged. The actual results were much stronger than expected. While job creation was only slightly better than expected (1.371 million), the Unemployment Rate dropped to 8.4%, and Average Hourly Earnings increased 0.4%.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

As mentioned above, even after yesterday’s sell-off, many sectors remain overbought. In fact, the only sectors not trading more than a standard deviation above their 50-day moving averages (DMA) are Utilities, Health Care, and Energy. Energy is also the only sector currently trading below its 50-DMA, while Technology is still trading 7.2% above its 50-DMA, which ranks third of the eleven sectors just slightly behind Communication Services (+7.24%) and Consumer Discretionary (+7.23%).

Under The Surface, The Labor Market Weakened In August

Headline statistics from the Bureau of Labor Statistics Employment Situation Report on Friday morning showed further labor market recovery from COVID. But under the surface, August had significant labor market deterioration. While payrolls beat, the unemployment rate fell faster than expected, wages were stronger than expected, and hours worked rose against expectations, the number of Americans who are on permanent layoff (involuntarily unemployed and looking for work) rose by more than 500,000, and their share of the overall labor force is now the same as during the peak of the early-2000s recession.

While the huge drop in temporarily laid-off workers that has been ongoing for several months continued, widening of permanent job loss suggests that the labor market is still deteriorating as businesses close, reduce output, or are forced from re-opening thanks to the ongoing economic impact of COVID. While the headline numbers were welcome, it’s important to understand that they don’t tell the full story. Please note both charts below show data for all periods it is available. For more on the jobs report, try out a Bespoke subscription to receive our weekly Bespoke Report in your inbox this evening. Click here to start a two-week free trial.

The Bespoke 50 Top Growth Stocks — 9/3/20

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 154.0 percentage points, which hit a new high this week. Through today, the “Bespoke 50” is up 304.8% since inception versus the S&P 500’s gain of 150.8%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.