Bespoke’s Morning Lineup – 9/23/20 – An Epic Push and Pull

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Cash combined with courage in a time of crisis is priceless.” – Warren Buffett

It’s not often anymore that you can say the Congress passed a bill on a bipartisan basis, but that’s what happened last night as the House passed a spending bill to keep the government open through December 11th. The way things are going, one couldn’t be faulted for asking if we’d all be better off if they did close, but we already have enough to debate.

US futures are mixed this morning as the DJIA futures lead the way on the back of Nike’s (NKE) strong earnings report after the close last night. With the stock up over 15% in the pre-market, NKE is on pace for its most positive reaction to earnings in at least 20 years. While DJIA futures trade higher, both the S&P 500 and Nasdaq are indicated to open flat to slightly lower.

Over in Europe, equities have reacted positively to some stronger than expected flash manufacturing PMIs in the region. However, while the manufacturing sector shows strength, the flash PMIs for the services sector generally missed expectations. Looking ahead to today, US flash PMIs for both the Manufacturing and Services sectors will be released at 9:45 eastern, and there’s a heavy dose of Fedspeak kicking off at 9 AM and going on through the entire day.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

While growth has been the overall leader YTD, we’re starting to see an epic tug of war between growth and value investors. After a record eleven straight months of the Russell 1000 Growth index outperforming the Russell 1000 Value index, through last Friday, the value index was outperforming growth in September by the widest margin since March 2001. Just when it looked like value investors were going to go on a run, though, growth has come roaring back this week. Over the last two days, the Russell 1000 Growth index is outperforming Value by over 3.6 percentage points. So far this year, there have only been two other periods with a wider performance spread over a two-day period, and before this year the last time there was a wider spread was in October 2008.

The chart below shows the rolling two-day performance spread between the Russell 1000 Value and Growth indices. Since 1995, there have been three distinct periods where the performance spread widened out to extreme levels – the late 1990s/early 2000s, the Financial Crisis, and now.

Daily Sector Snapshot — 9/22/20

Nike (NKE) Laces Up for Earnings

Prior to the last week or so, Nike (NKE) shares had been pushing to all-time highs on a near-daily basis. Heading into its earnings report after the close today, NKE has pulled back a bit but remains in a strong uptrend channel that formed off of its March COVID Crash lows.

While Nike’s share price is in a strong uptrend, the same can’t be said for the company’s quarterly sales. As was the case with most Consumer Discretionary companies, Nike has seen sales plummet during the COVID lockdowns. When Nike last released earnings back in June, it reported quarterly sales that were down nearly 40% year-over-year. NKE also missed sales estimates by nearly a billion dollars with actual sales of $6.31 billion versus consensus estimates of $7.26 billion.

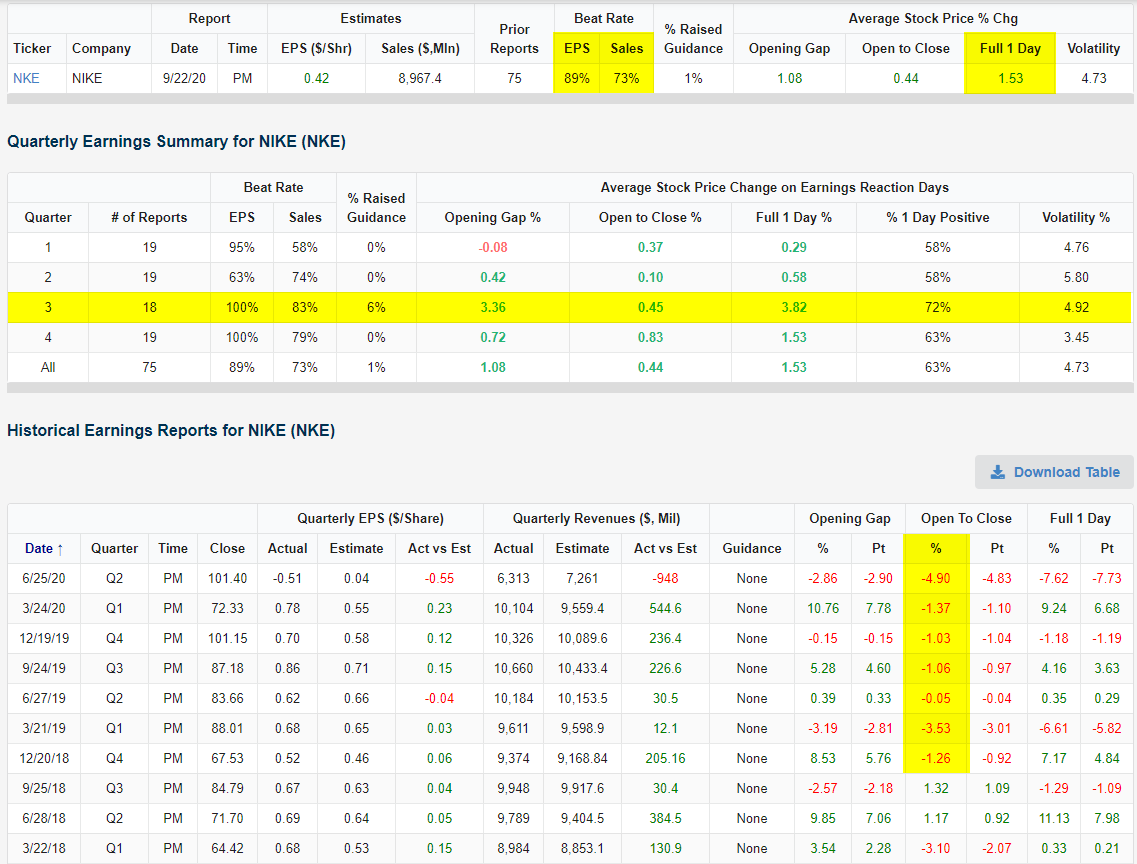

All of the snapshots in this post come from the interactive section of our website, which Bespoke Premium and Bespoke Institutional members have access to. Below is a snapshot of our earnings gauges for Nike from our Earnings Explorer tool. NKE has historically beaten consensus EPS estimates 89% of the time since 2001, while it has topped sales estimates 73% of the time. In terms of share price reaction to earnings, NKE has historically responded positively to its quarterly report 63% of the time. Our proprietary Bespoke Earnings Score compares how NKE’s share price performs when it beats and misses estimates compared to the average company, and in that regard, NKE leans slightly bullish.

Below is a further breakdown of Nike earnings from our Earnings Explorer tool You’ll see that this quarter, consensus analyst estimates are looking for earnings per share of 42 cents and sales of $8.97 billion. If NKE manages to hit its sales estimate, it will still be down more than $1.6 billion versus the same quarter last year.

In terms of earnings seasonality, Nike’s Q3 report has actually been the most bullish for the stock of any quarter. As shown in the Quarterly Earnings Summary section below, NKE has exceeded EPS estimates 100% of the time on its Q3 report, and it has beaten sales estimates 83% of the time. NKE has averaged a one-day gain of 3.82% in reaction to its Q3 earnings report with positive returns 72% of the time, which is the most bullish of any quarter.

Finally, we’d note that recent quarters have seen NKE shares sell-off during intraday trading hours after its initial gap higher or lower at the open. When a company reports earnings either after hours or in the pre-market, shares immediately react either positively or negatively in after-hours trading. This after-hours move causes the stock to either “gap up” or “gap down” at the open of trading. Most of a stock’s official one-day move on earnings happens at the open, but we also track how stocks perform during regular trading hours (9:30 AM ET to 4 PM ET) after they report earnings. In regards to NKE, you’ll see in the third table below that the stock has actually traded lower from the open to the close of trading following its last seven quarterly earnings reports. Start using our Earnings Explorer for the stocks you care about most with a two-week free trial to Bespoke Institutional today!

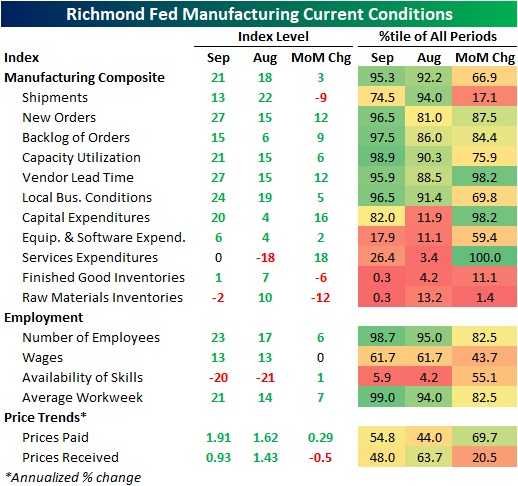

Two Year High for the Richmond Fed

This morning the Richmond Fed released its September reading on the manufacturing sector which showed continued improvement in the Fifth District. The headline index rose 3 points from 18 in August to 21 in September. Tha’s the fifth consecutive monthly increase in the headline index and the third month in a row of expansionary readings. That leaves the index at its highest level in two years.

The headline index as well as a number of its components is now in the top 5% of all readings. Components with historically high readings include New Orders, Order Backlogs, and Capacity Utilization. Breadth in this month’s report was also strong with every index besides Services Expenditures, Availability of Skills, and Raw Materials Inventories sitting in expansion territory. Most indices also rose this month with the only outliers being the index for Shipments, Prices Received, Wages, and the indices for Finished Goods and Raw Material Inventories.

Although the index for Shipments was lower, it remains at solid levels while other readings of demand like New Orders and Backlog of Orders continue to indicate strong order growth versus the prior month. Given this, inventories are dwindling. As shown below, the indices for Finished Good Inventories and Raw Material Inventories are both in the bottom 1% of historical readings with Raw Material Inventories showing a contractionary reading for only the second month ever. June of 2018 was the only time that Finished Good Inventories were lower and April of 2004 was the only lower reading for Raw Material Inventories.

Meanwhile, Employment continues to improve with the index for Current Number of Employees rising to 23 from 17 this month. That is in the 98th percentile of all readings with the last time the index was this high being June through August of 2018.

Not only are businesses bringing workers back, but they also appear to be raising expenditures elsewhere. Some of the indices that saw the largest month over month increases were those surrounding expenditures. For example, Service Expenditures rose from a contractionary -18 to 0 which was the biggest monthly gain on record. Meanwhile, the index for Capital Expenditure’s 16 point increase was likewise one of the largest on record. That also leaves this index at its highest level since in nearly two years.

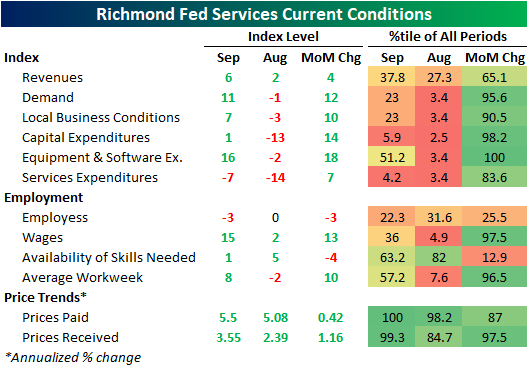

In addition to the regional Fed’s look at the manufacturing sector, the Richmond Fed also includes readings on the service sector. As shown below, while there is not an all-encompassing number like the manufacturing composite, September marked a broad pivot into expansion for most indices of the services economy after multiple months of contractionary readings. Some indices, like the one for Equipment and Software Expenditure, even experienced their largest one-month gains on record. The same is even applicable to the indices for future expectations in the services sector. Of those indices, Equipment and Software Expenditure and Services Expenditures, both saw their biggest one-month gains ever while several others were in the 90th percentile or better of monthly moves. Granted, those gains still only leave them at the low ends of their historical ranges. In other words, conditions improved, but not to the same extent as the manufacturing sector.Click here to view Bespoke’s premium membership options for our best research available.

Bespoke Stock Scores — 9/22/20

Chart of the Day: Growth vs. Value Duke It Out

Silver (SLV) Slides Back Below Its 50-DMA

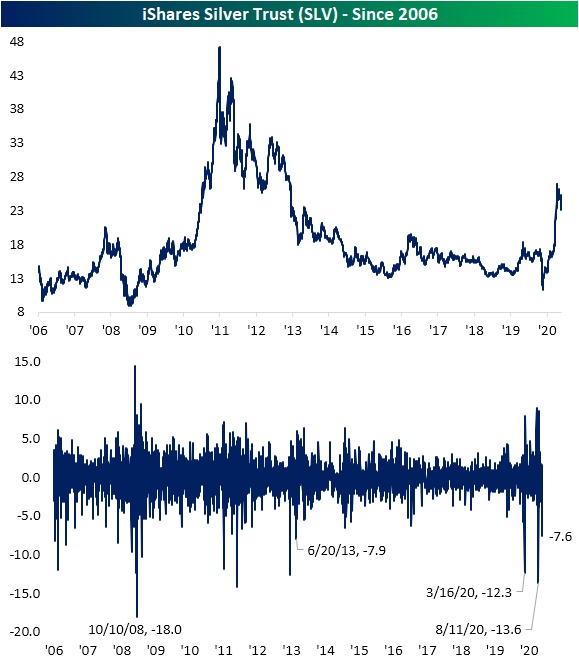

The Silver Trust ETF (SLV) is currently sitting on a year-to-date gain of more than 35% even after falling 16.15% since its early August high. Yesterday’s session had a significant part to play in those recent declines as SLV had a rough start to the week with a decline of 7.6%. As shown below, since SLV began trading in 2006, there have only been 21 days (0.58% of all trading days) in which SLV has fallen greater than 7% in a single day with yesterday marking the 19th worst day on record. In what has been a volatile year, that was the biggest decline since August 11th’s 13.6% drop; one day after its 52-week high. Prior to that, there was a 12.3% decline on March 16th, but before that, you would have to go back to 2013 to find another day with as large of a move.

One other thing that yesterday’s drop marked was a fall back below SLV’s 50-DMA. SLV has been trading above its 50-DMA every day since May 7th (94 consecutive trading days). That brings to an end the second-longest streak on record that SLV spent above its 50-DMA. The only longer such streak was one that lasted exactly 100 days that came to a close on January 13th, 2011. Back during that streak, SLV had risen 59% compared to the 79.1% rally from May through yesterday. Click here to view Bespoke’s premium membership options for our best research available.

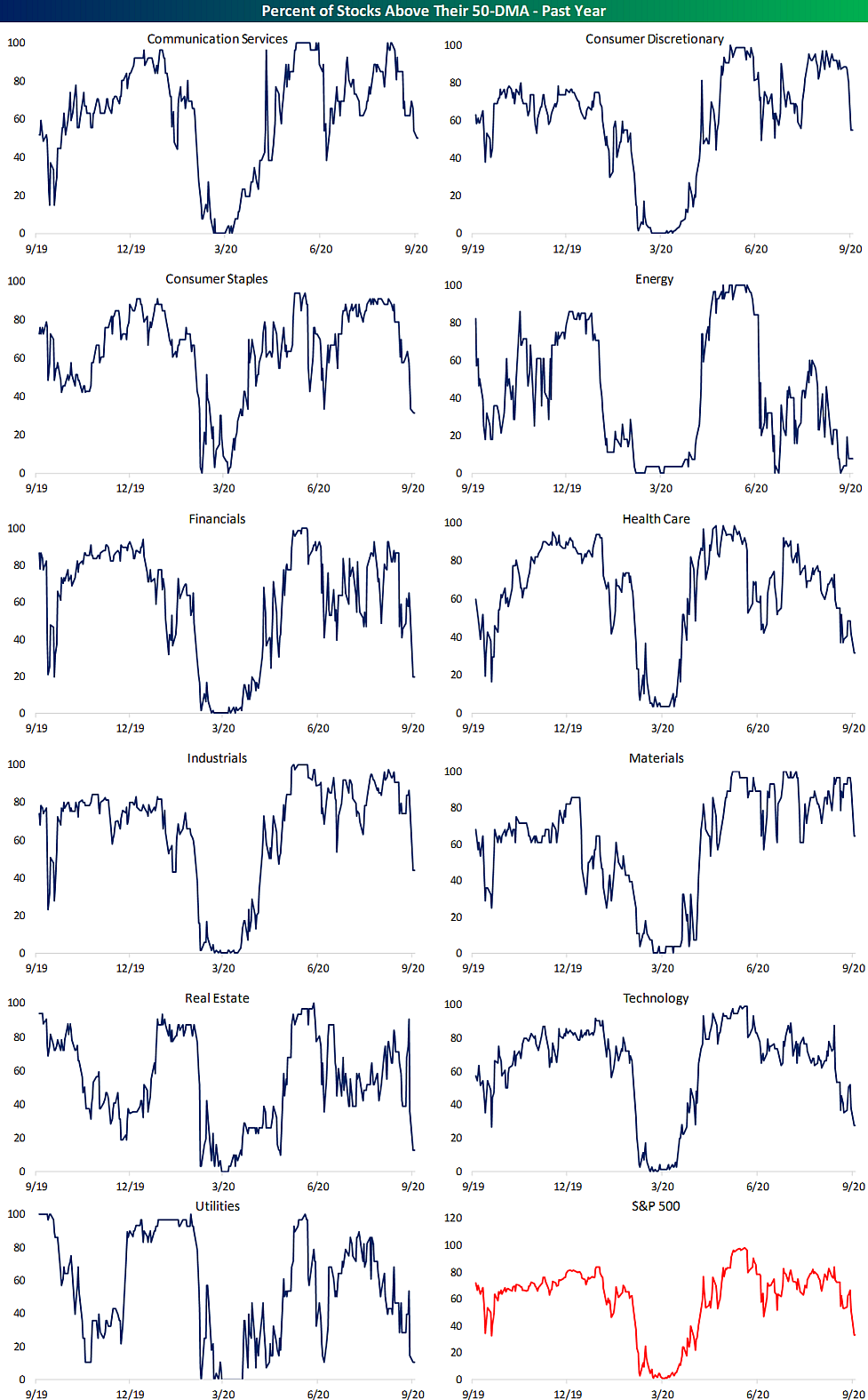

Sector Mean Reversion

With the S&P 500 seeing another decline yesterday, the index finished the day roughly 1.9% below its 50-DMA. As shown in the charts from our Sector Snapshot below, that is the furthest below its 50-DMA since April 21st; about one month after the bear market low. As for the eleven major sectors, the majority are likewise below their moving averages. The worst of these is Energy which finished the day yesterday 10.7% below. The second worst sector, Real Estate, is much closer to its 50-DMA at only 3.59% below its 50-DMA. On the other hand, Industrials and Materials are the only sectors above their 50-DMAs at 0.76% and 1.05%, respectively. That is not to say they are not trending in the same direction as the other sectors, though. As shown below, even though they are currently above, these two sectors are seeing falling 50-DMA spreads just like every other sector.

A higher number of individual stocks in each sector are also falling below their 50-DMAs. Yesterday’s session marked a bit of a tipping point for the percentage of stocks trading above their 50-DMAs. We finished last week with 52.48% of S&P 500 stocks trading above their 50-DMAs, but at yesterday’s close, only 33.27% were above. Other than yesterday, since the second half of April there was only one other day (June 26th) that less than half of S&P 500 stocks closed above their 50-DMAs. Similarly, the 19.21 percentage point drop in the percentage of stocks above their 50-DMAs for the S&P 500 was the largest single-day decline since June 24th (20.04 percentage points). Prior to that you would have to go back to the start of the COVID bear market, February 24th, to find another day with a bigger single-day drop in this reading.

Looking across the sectors, Energy, Utilities, and Real Estate have the fewest stocks above their 50-DMAs. Meanwhile, Communication Services, Consumer Discretionary, and Materials all still have at least 50% of stocks above. Materials boasts the strongest reading at 64.29%. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup — Apple Picking — 9/22/20

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“In the middle of difficulty lies opportunity.” – Albert Einstein

All eyes will be on Powell and Mnuchin this morning as they testify in front of the House Financial Services Committee today regarding the CARES Act. We’ll also get Existing Home Sales for August at 10 AM. Futures are trying to stabilize after yesterday’s decline, but the foundation for any rally today has so far been on shaky ground. Finally, in the UK PM Boris Johnson is calling for increased restrictions to help ward off a building second wave of the COVID outbreak in that country.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, discussion of the political ramifications of the upcoming SCOTUS fight, trends related to the COVID-19 outbreak, and much more.

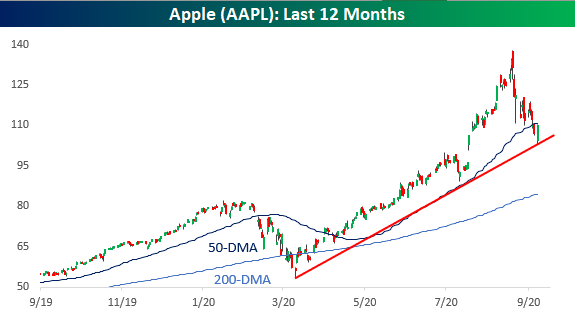

In yesterday’s Chart of the Day, we took a look at historical bear markets for Apple (AAPL) in the post-iPod era, including a look at the typical length and magnitude of decline for the stock during other periods when it dropped 20% or more. Yesterday, the stock had a bit of a respite from the selling as it bounced right at the support of its uptrend off the March lows. The bounceback in Apple helped to stabilize the entire market and technology specifically, but it wasn’t quite able to move back above its 50-DMA so that technical level will loom on the stock today.