The Bespoke 50 Top Growth Stocks — 9/24/20

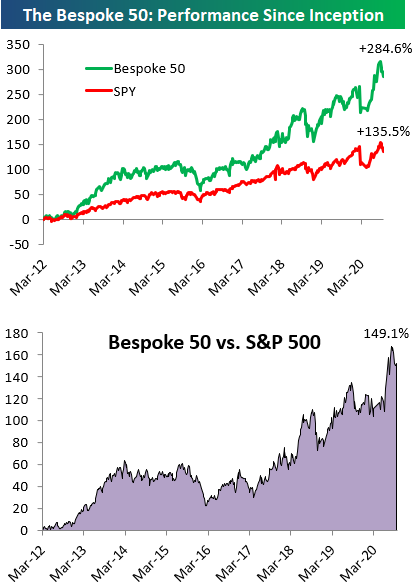

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 149.1 percentage points, which hit a new high this week. Through today, the “Bespoke 50” is up 284.6% since inception versus the S&P 500’s gain of 135.5%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bullish Sentiment Slipping and Sliding

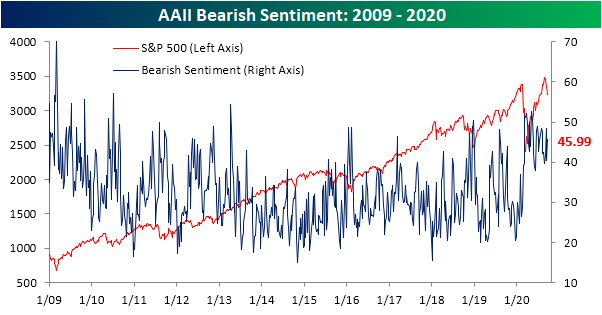

Last week, when the S&P 500 was appearing to hold up at support at its 50-DMA, bullish sentiment managed to significantly rise to 32.02%. But in the week since then, the S&P 500 has taken another leg lower, falling below its 50-DMA and is now 9% from the September 2nd high. Today the index even briefly met the technical definition of a correction (10% decline from a high) on an intraday basis. Given this, bullish sentiment, as seen in the American Association of Individual Investors‘ weekly survey, has likewise taken a sizeable turn lower. Just 24.89% of responding investors this week reported as bullish. While lthis is a low reading, this week’s reading is actually slightly higher than two weeks ago (23.71%) following the initial drop from the highs.

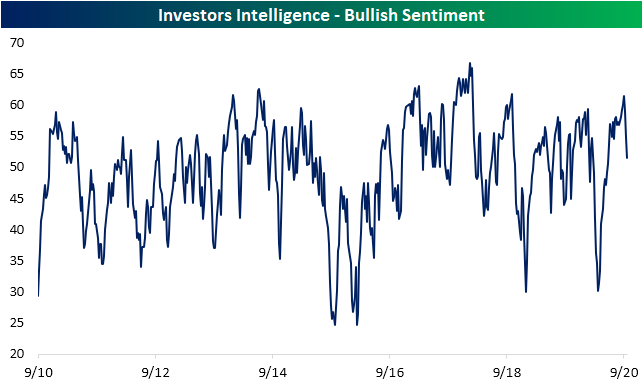

While the AAII survey has consistently held a bearish bias over the past few months despite the market rally, the Investors Intelligence survey of equity newsletter writers has been more optimistic. That is until the past few weeks. 51.5% of respondents to this survey are now reporting as bullish which is the lowest reading since the last week of May. Back at the September 2nd high, this survey showed 61.5% of respondents as bullish; the most since October of 2018. The 10 percentage point drop in that time was the largest decline in three weeks since March.

As a result of the losses in bullish sentiment, bearish sentiment in the AAII survey rose from 40.39% to 45.99%. Just as with bullish sentiment, there was a higher reading of 48.45% two weeks ago in the wake of the initial drop off the highs, but this week’s move returns bearish sentiment to levels seen throughout the spring and first half of summer.

With the inverse moves in bullish and bearish sentiment, the bull-bear spread widened to the low end of the past several month’s range at -21.1. The record streak of negative bull-bear spread readings has also continued to grow, now extending to 31 weeks.

Neutral sentiment was also higher this week rising to 29.11%, bringing the reading up to the same level as July 23rd. Click here to view Bespoke’s premium membership options for our best research available.

“The Captain Has Turned on the Fasten Seat Belt Sign”

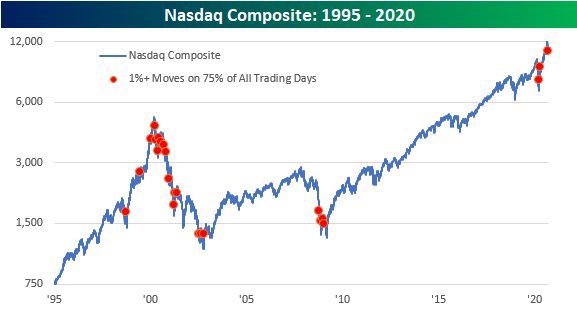

Since most of us haven’t been on planes in quite a while, it’s been some time since we last heard the above statement warning of turbulence ahead. If only we had one for the market. While there’s still another week left in the month, this September is on pace to be one of the most volatile in terms of the frequency of 1% daily moves (up or down) for the Nasdaq Composite. The table below on the left shows the daily percentage moves of the Nasdaq so far in September. Of the 17 trading days so far including today, all but three have seen one-day moves of at least 1%, and on one of those three days (9/2), the daily move was 0.98% or just shy of 1%. We would note that the Nasdaq has been fluctuating multiple times today between a move of above or below 1%, so depending on where things settle today, the percentage of 1% days this month will be either 82.4% or 76.5%.

If today’s move settles at 1% or more, this month will be on pace to rank as number eight in terms of the highest frequency of 1% daily moves (table on left). It is also on pace to be just the 24th month since 1970 where the Nasdaq moved 1% or more on at least three-quarters of all trading days. Looking through the table, the majority of other months were from the late 1990s through 2002, but there were also a handful of occurrences during the financial crisis and earlier this year.

The chart below of the Nasdaq since 1995 includes red dots indicating each month where the Nasdaq moved 1%+ on at least 75% of all trading days. During the run-up and crash from the dot-com boom, there were occurrences on both sides of the peak, but the vast majority of them came after the peak and then occurred periodically right up through the low in October 2002. During the Financial Crisis, there were four straight months of occurrences spanning October 2008 through January 2009. More recently, March of this year saw the fifth-highest percentage of 1% days at 86.4%, and then in April, just over 76% of all trading days saw 1% moves. With a number of indicators and trends in the market lately, the two periods that keep popping up are the late 1990s to early 2000s and the Financial Crisis, and in the case of a high frequency of 1% daily moves, the same can be said. Keep those air sickness bags handy! Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Navigating Renewables Stocks

Is Seasonality Driving Claims?

Seasonally adjusted initial jobless claims have stubbornly remained in the elevated upper 800K range with this morning’s release rising by 4K to 870K. That was worse than expectations of a reading of 840K which would have marked a 26K improvement from last week. While it was not an improvement, claims have been fairly stable with this week’s increase not being particularly large as it only leaves initial claims at their highest levels since the first week of September when they were at 893K. In fact, although comparisons to pre-September readings are not perfectly like for like on account of the recent changes to the seasonal adjustment methodology, since the pandemic began the only smaller weekly move was a 2K decline in mid-July.

On a non-seasonally adjusted basis, claims were also higher rising to 824.5K from a pandemic low of 796K last week. But just as with the seasonally adjusted number, that only brings claims to the highest level since two weeks ago. As shown in the second chart below, assuming this year follows the seasonal patterns that have been observed in the past, the 37th week of the year (last week) has, on an average basis, been the seasonal low for jobless claims with a steady rise in claims through New Year’s. That means that this week’s increase in non-seasonally adjusted claims could just as well be a factor of seasonality as a material worsening in the data.

Meanwhile, seasonally adjusted continuing claims also missed expectations of 12.275 million with a reading of 12.58 million. While higher than expected, that was lower from last week’s upwardly revised 12.747 million. Again, the caveat applies of comparisons not being perfectly like for like due to changes in seasonal adjustment, but that would mark the lowest continuing claims reading since the first week of April.

Although the headline number for initial jobless claims was higher this week, including Pandemic Unemployment Assistance (PUA) total claims were actually lower. Initial PUA claims fell from 675K to 630K marking the lowest level of PUA claims (as well as total claims) in a month. While that is still a massive number of people filing for unemployment, it is an improvement and puts this week’s print right inline with the average of what has been observed since the beginning of August.

As for continuing claims, there was a steep drop in PUA claims for the most recent week (the first week of September). Claims dropped from 14.5 million to 11.5 million. That is the fewest continuing PUA claims since the first week of August. Combined with the standard unadjusted continuing claims, there were 24 million total claims which, while still a massive number, is the lowest reading since April. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 9/24/20 – It Could Be Worse

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“For September so far this year the spending by $BAC customers both on debit and credit cards is up–spending overall is up.” – Brian Moynihan, CEO Bank of America

Futures have been modestly lower for most of the morning, but we have a busy day of Fed speakers on the schedule, and jobless claims were just released. Both reports came in higher than expected. Initial claims came in at 870K versus expectations of 840K while continuing claims were more than 300K above consensus forecasts (12.58 million versus 12.275 million). The only other economic data on the calendar is New Home Sales at 10 AM (estimate – 890K) and KC Fed Manufacturing (estimate – 14).

While the labor market appears to be slowing, or even weakening a bit, it was somewhat encouraging to hear Bank of America CEO Brian Moynihan say in an interview on CNBC this morning that both spending and checking account balances in its customer accounts is higher this September than it was last September.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, economic data in Europe, trends related to the COVID-19 outbreak, and much more.

Yesterday was a lousy day for bulls capping off what has been a lousy month. It could be worse. It has now been three weeks (14 trading days) since the S&P 500’s high on September 2nd, and during that span, the index has declined nearly 9.6%, which is just shy of the technical definition of a correction.

Now, rewind six months. Half a year ago this morning, we were all coming in to our desks (or more accurately, at our kitchen counters, a corner of the bedroom, or maybe down at a table in the basement) and looking at a market that had just lost more than a quarter of its value in the same span (14 trading days). By just about all accounts, things were looking bleak. In the six months that followed, though, the S&P 500 has rallied more than 40% in what, even after the declines of the last three weeks, has been one of the strongest six-month rallies in the history of the stock market.

In a B.I.G. Tips report yesterday, we looked at prior periods where the S&P 500 saw similar moves over a six-month stretch to see how the S&P 500 performed going forward. If you haven’t already, make sure to read it over.

B.I.G. Tips – This is No Way to Celebrate

The chart below shows the rolling six-month rate of change for the S&P 500 dating back to the late 1920s. Even after the declines of the last three weeks, the current rally off the March lows represents the strongest six-month rate of change for the S&P 500 since 2009, and before that, you have to go all the way back to the early 1930s. Additionally, the last six months now ranks as just one of nine periods in the S&P 500’s history where it rallied 40% or more in a six-month period. The declines this month haven’t been enjoyable, but let’s keep things in perspective.

In a newly published B.I.G. Tips report, we looked at prior periods where the S&P 500 rallied 40%+ in a six-month span to see how it progressed going forward. Did the rally borrow from future returns? Did is precede even more gains ahead? For anyone with more than a passing interest in what to expect going forward, make sure you check out this report. To see it, sign up for a monthly Bespoke Premium membership now!

Chart of the Day: Record Crash Concerns

Restaurant Stocks Getting Burnt

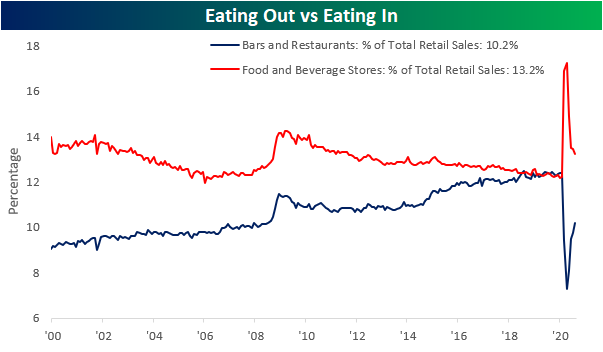

In our recap of last week’s retail sales report, we noted how there is evidence of a trend of Americans returning to spending habits prior to the pandemic. Namely, that can be seen through spending at bars and restaurants which was the strongest category in August having grown 4.71% month over month. The past decade has seen spending at bars and restaurants as a percentage of total retail sales gaining share and eventually overtaking spending at food and beverage stores. In other words, Americans began to spend more eating out than eating in; that is up until the pandemic. COVID’s reversal of this trend reached an apex in April, but more than half of that move has since been erased. Now bars and restaurants account for 10.2% of total retail sales versus 13.2% for food and beverage stores. So while bars and restaurants have taken a big hit and are far from out of the woods, recent months have seen improvements.

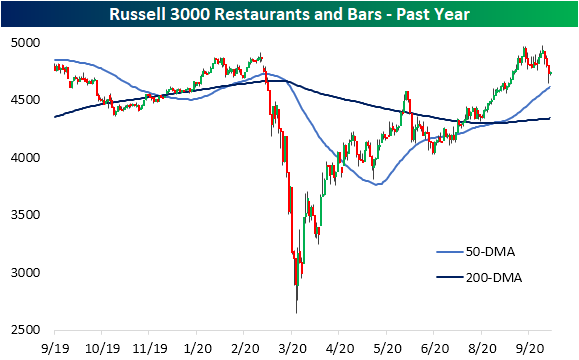

While aggregate spending data for bars and restaurants is not yet back to pre-pandemic levels, the Russell 3000 Restaurants and Bars group has managed to recover all of its COVID-Crash declines. Since its low in mid-March, the index has been trending higher having rallied 63.8%.

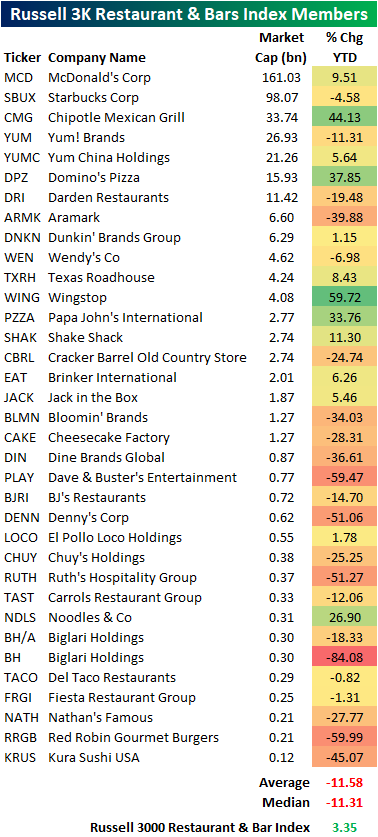

This index includes 35 stocks with a variety of niches ranging from fast food like McDonald’s (MCD) to coffee chains like Starbucks (SBUX) and Dunkin (DNKN) to less grab-and-go oriented chains like Dave and Buster’s (PLAY). Although the index may look like it has held up well at face value and is currently positive on a year to date basis, under the hood the individual stocks of the index are painting a weaker picture. Whereas the cap-weighted index is up 3.35% YTD, the average stock in the index is down 11.31%. In other words, the strength of the index is not so much a factor of broad strength of restaurant stocks, but instead is a result of solid performance of some key large-cap players like Chipotle (CMG), McDonald’s (MCD), and Domino’s (DPZ) to name a few. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke CNBC Appearance (9/22)

Bespoke co-founder Paul Hickey appeared on CNBC’s The Exchange yesterday (9/22) to discuss the current setup of Apple (AAPL) and the broader market in general. To view the segment, please click on the image below. Click here to view Bespoke’s premium membership options for our best research available.