Bespoke CNBC Appearance (9/29)

Bespoke co-founder Paul Hickey appeared on CNBC’s Closing Bell on Tuesday to discuss various market topics including the impact of the dollar on the performance of large-cap stocks. To view the segment, click the image below. Click here for a free trial to Bespoke’s research offerings and gain instant access to our latest market thoughts.

Chart of the Day: Third Time the Charm?

Bespoke’s Morning Lineup – 9/30/20 – They Did it Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Full of sound and fury, signifying nothing.” – Macbeth

In the markets and life in general, the most hyped events almost always fail to live up to expectations, and while last night’s debate was eagerly anticipated, it was a big disappointment that devolved into shouting and name-calling devoid of any substance. The seven words from Macbeth summed it up best.

In other news this morning, ADP Employment topped expectations by 100K (749K vs 649K), and the Chicago PMI was so strong that they released it early (62.4 vs 52.0 expected). The second revision to Q2 GDP also came in slightly less disastrous than expected (-31.4% vs -31.7%).

The initial reaction to last night’s debates in the betting markets was clearly in Biden’s favor. Over at electionbettingodds.com, the odds for Biden to win the November election jumped back nearly to new highs after rising 4.9 percentage points in the last day to just under 60%. Trump’s odds, conversely, dropped more than four points to below 40%.

Daily Sector Snapshot — 9/29/20

Bespoke Stock Scores — 9/29/20

B.I.G. Tips – S&P 500 Surrounding The Election

Chart of the Day: Brimming With Confidence

Global Activity Still Bouncing Back, But Remains In A Hole

Overnight we got a bunch of cyclical data that is helpful in showing where the global economy currently sits across regions and categories, similar to Markit PMIs.

Korea, Sweden, and the Eurozone all released indices of manufacturing and services sector sentiment that are not directly comparable on a like-for-like basis (as is the case with Markit PMIs) but do tend to send similar messages about the state of the global economy. We show them in the chart below, presented as a Z-score (current reading less average, measured in standard deviations) which normalizes them for their volatility and to the same scale.

As shown, economic activity continues to bounce broadly from the extreme lows of Q2, but September readings are still generally well below the pre-COVID norm and are below average. Similar to the US economy, global activity is still bouncing, but is far from pre-COVID levels in our view. This analysis was originally published in our pre-open report — The Morning Lineup — this morning. Click here to start a free trial to Bespoke Institutional and receive our daily Morning Lineup for the next two weeks, featuring more commentary and data on macro markets.

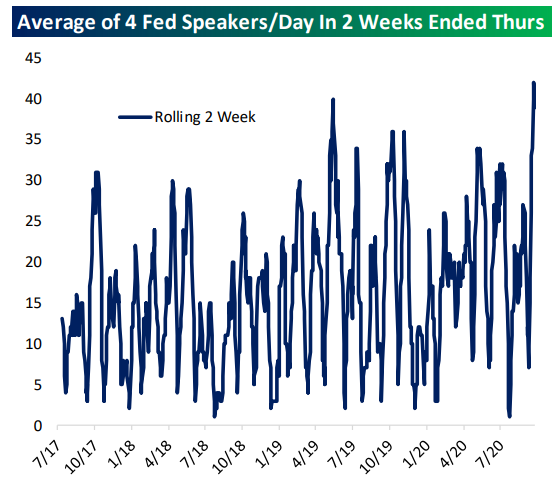

Fed Speak Surges

There are six scheduled Fed speakers today, including multiple appearances from Governor Quarles. That’s a lot to keep track of and it may feel like that’s the new normal after an absolute deluge of public comments from FOMC members following the introduction of their new long-term monetary policy strategy in September and more detail around its implementation at the September policy meeting. The result is a record number of headlines from FOMC members. By our count, based on actual public appearances through September 28th and scheduled appearances the rest of the week, the two weeks ending Thursday will have been the busiest slate of Fed speakers since we began tracking all public comments from the FOMC in mid-2017.

As for what they’ve been saying, we note two themes: first, outright dovishness about the outlook, but also an insistence that more fiscal policy is necessary even as more and more members of the FOMC come to the realization that there won’t be any more fiscal support until next year. As shown below, using our rolling 20-speech average assessment, we grade the recent run of Fed speakers as one of the most dovish since our tracking began. For a full summary of all speeches, make sure to check out our Fedspeak Monitor, which is regularly updated with brief summaries of FOMC comments (and links to their full speeches when possible). This analysis was originally published in our post-market macro report — The Closer — last night. Click here to start a free trial to Bespoke Institutional and receive our nightly Closer for the next two weeks, featuring more commentary and data on macro markets.

Bespoke’s Morning Lineup – 9/29/20 – Another Seasonal Tailwind

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“There is only one side to the stock market; and it is not the bull side or the bear side, but the right side.” – Jesse Livermore

There’s nothing like ending one week with a gain of 1.6% and starting the next with another 1.6% rally. Even after the 3%+ gain over the last two days, though, the S&P 500 still was not able to close above its 50-DMA yesterday. It traded above there for part of the day on Monday but finished the day just shy, closing two points below its 50-DMA. Futures have been trading on either side of the flat line this morning, as investors digest the gains of the last two trading days ahead of tonight’s debate between President Trump and former Vice President Biden.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, economic activity in the manufacturing and services sectors, trends related to the COVID-19 outbreak, and much more.

Like the old adage to “sell in May and go away,” there’s another less well-known axiom that says to ‘sell Rosh Hashanah and buy Yom Kippur’. While there’s not much in the way of a good explanation behind the saying, with Yom Kippur ending Monday night at sundown, we wanted to provide a quick look at how the strategy has performed this year and in the past. Even with this September being as weak as it has been already, we were a bit surprised to see that the S&P 500 was positive during the Rosh Hashanah to Yom Kippur period this year. With a gain of less than 1%, though, Monday’s rally basically accounts for the entire positive move.

Longer-term, the ten-day period between the two holidays has been negative more often than positive. Since 2000, the S&P 500 has seen an average decline of 0.92% (median: -0.50%) with gains just 43% of the time. In the two weeks after Yom Kippur, though, performance has been much better with the S&P 500 averaging a gain of 0.99% (median: 1.04%) and positive returns 75% of the time. For the remainder of the year, performance has been even stronger with the S&P 500 averaging a gain of 4.13% (median: 5.75%) with positive returns 70% of the time.

Since the S&P 500 rose during the period this year, does that mean we can expect the opposite trend to also play out in the next two weeks and for the remainder fo the year? Not necessarily. In the eight prior years since 2000 where the S&P 500 was positive in the Rosh Hashanah to Yom Kippur period (shaded years in the table), the S&P 500 averaged a gain of 2.14% (median: 1.59%) over the next two weeks with gains all eight times. For the remainder of the year, the S&P 500 saw an average gain of 4.08% (median: 7.02%) with gains 75% of the time.