Bespoke 2021 Special

Bespoke Investment Group has been providing investors with clear, actionable analysis since our founding in 2007, and we’re currently working hard on our biggest and most important report of the year — The Bespoke Report 2021 Market Outlook and Investor Toolkit.

It’s not hard to describe the contents of this report because it simply has it all. This report prepares you with everything you need to know for the year ahead, and it’s a must-read for all investors.

How can you gain access to our annual Bespoke Report? It’s easy. Join one of our three membership levels now with our “2021” special offer and the report is included. What is the “2021” special? You’ll get one month of any membership level for just $20, then you’ll get 20% off the regular monthly rate going forward. Join now because this special is only available for a limited time! Choose an option below to sign up now. Click here if you’re looking for more details on what’s included with each membership level.

Bespoke 2021 Special — Bespoke Newsletter

Bespoke 2021 Special — Bespoke Premium

Bespoke 2021 Special — Bespoke Institutional

Bespoke Brunch Reads: 10/4/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Clean Energy

Compact Nuclear Fusion Reactor Is ‘Very Likely to Work,’ Studies Suggest by Henry Fountain (NYT)

“Hot” fusion has been the energy of the future for decades, and there’s no reason to suspect that it’ll come soon, but recent research is showing some modest progress. [Link; soft paywall]

Solar’s Future is Insanely Cheap (2020) by Ramez Naam (Ramez Naam)

An overview of the absolutely staggering rate of decline in solar prices and why those declines are likely to continue, pushing the cost of new solar watts far below the operating cost of natural gas and coal plants. [Link]

Education

University lockdowns: a whole new way to fail young people by Robert Shrimsley (FT)

Frustration over steps to reduce transmission of COVID on university campuses after a failure to introduce a mass testing regime in the UK. [Link; paywall]

The Students Left Behind By Remote Learning by Alex MacGillis (The NYer)

As with so many aspects of COVID, the costs of remote learning are not born evenly by wealth and lower income students. [Link]

‘Roadschooling’ 101: Families Make Remote Learning Work in an RV by Julie Jargon (WSJ)

Families that can afford it are taking advantage of remote schooling to hit the road, spending months wandering American roads and national parks with pauses for video chats. [Link; paywall]

Teachers Find Higher Pay and Growing Options in Covid Pods by Nancy Keates (WSJ)

Higher-income families are getting together for small-group learning with private teachers that bypass many of the risks of the public school system. [Link; paywall]

Retail Investing

A 32-Year-Old Trader Is Driving 21,000 Amateur Stock Investors by Edward Robinson and Justina Lee (Bloomberg)

A feature allowing users to automatically copy trades of other platform users has fueled growth for UK-Israeli brokerage eToro. [Link; soft paywall]

The Rise of Retail Investing In The U.S. (Morning Consult)

A highly-detailed, very long overview of the retail investment landscape: what motivates retail investors, who they are, and how they use investing platforms. [Link; 55 page PDF]

New Swath Of ETF Closures Fuels Record Pace by Heather Bell (ETF.com)

It shouldn’t be a surprise that an industry which innovates as quickly as ETFs do with a huge proliferation of products also cuts losers, and that’s what’s been going on lately. [Link]

Local Challenges

Vermont was making progress against opioid deaths. Then coronavirus hit. by Hilary Swift and Abby Goodnough (South Florida Sun-Sentinel)

Opioid-related deaths are surging across the country as the disruption of COVID drives current and recovering addicts into despair and spirals of use which too often end in tragedy. [Link]

‘Crisis point’: How the Gallatin Valley’s hot housing market leaves people behind by Melissa Loveridge (Bozeman Daily Chronicle)

Homes in Gallatin County, Montana are surging thanks to COVID; the median single-family home is listed for $575,450 in August, almost 10x median income for the county. [Link]

Travel

Some Travelers Miss Flying So Much, They’re Taking Planes to Nowhere by Dasl Yoon and Joyu Wang (WSJ)

Travelers are taking flights to nowhere, sometimes facilitated by package “tours” that don’t involve actually landing, in a desperate bid to regain a sense of normalcy. [Link; paywall]

Amazon jumps into virtual tourism, offering live one-on-one experiences around the world by Todd Bishop (GeekWire)

Remote tourism is a brand new concept that AirBnB has already introduced and Amazon is now putting into beta, allowing walking tours, cooking classes, and other experiences from the comfort of home. [Link]

False Positives

Clinical evaluation and diagnostic yield following evaluation of abnormal pulse detected using Apple Watch by Kirk D Wyatt, Lisa R Poole, Aidan F Mullan, Stephen L Kopecky, and Heather A Heaton (JAMIA)

Only 11% of patients whose Apple Watches alerted them to an abnormal pulse received an explicit diagnosis, suggesting the device could create over-use of health care by Apple Watch owners. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — October Silly Season

We got a major October surprise to close the week, and it really does feel more like silly season than a surprise. We discuss the implications of the President’s positive COVID test for both markets and the election. Speaking of November’s election, we break down the outlook based on national polling, discuss the Senate and why a split Congress might be a disaster for the prospects of fiscal stimulus, and the growing evidence (including insistence from FOMC officials) that more easing is necessary. That evidence includes this week’s jobs report and the personal income and spending numbers released earlier in the week, both of which we discuss in detail. Seasonality, international markets, co in this week’s Bespoke Report.

This week’s Bespoke Report newsletter is now available for members.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 10/2/20

Make Up Your !@#$%^&* Mind!

You: Where do you want to go for dinner tonight?

Them: How about Italian?

You: Sure, sounds good.

Them: I also heard that new Greek place is good.

You: I’m fine with that.

Them: No, we can do Italian.

You: K.

Them: If that’s what you want to do.

You: You’re the one that suggested it.

Them: But you were quick to agree.

You: OK. Let’s do Greek then.

Them: I guess that’s fine.

You: Perfect.

Them: But I was in the mood for Italian. You always pick.

You: I didn’t pick anywhere and don’t care. Just pick a place.

Them: Well if you are going to argue about it, I don’t want to go.

You: Seriously?

Them: Goodbye.

You: Fine.

Them: Fine!

We’ve all had versions of this conversation where you or the person you were talking to just couldn’t make up their mind. At the end of the day, it only causes trouble and plans are ruined.

The market is having its own back and forth this year trying to decide between growth and value. Just today, growth stocks are getting slaughtered while value stocks are up marginally. As an example, the Russell 1000 Growth index is down 1.8% on the day while the Russell 1000 Value index has managed to rally 0.25%. The chart below shows the daily performance spread between the Russell 1000 Growth index and the Russell 1000 Value index for each day in 2020. Today’s performance spread between the two indices marks the ninth time this year that value has outperformed growth by more than two percentage points. At the other extreme, there have also been eight trading days where growth outperformed value by more than two percentage points.

So how does this year’s frequency of days where the performance spread between the two indices was more than two percentage points stack up to other years? The chart below shows the daily performance spread between the two indices going all the way back to 1990. Over the last thirty years, the only two periods where we saw a frequency of these large daily dislocations was back in 2008 and the period spanning 2000 and 2001. In fact, with 17 days this year where the performance spread between the two indices was greater than two percentage points, the only other years that saw a higher frequency of large dislocations were 2000 (54) and 2001 (28). If you think the market has been indecisive this year, in 2000 we saw these types of daily dislocations an average of once per week. Click here to view Bespoke’s premium membership options for our best research available.

Anti-Social Media Stocks

Social media has been one of the most popular and controversial sectors of society over the last decade, and the performance of Facebook (FB) since its IPO illustrates the strength of a business that thrives on people keeping tabs of each other with a steady helping of ads in between. It hasn’t always been a smooth ride for Facebook (FB), though. Remember the ‘technical error’ on the day of the IPO back in May 2012? From there, things didn’t get much better quickly. In September 2012 the stock was down in the low $20s after its IPO at $38, and a Barron’s cover story said the stock was worth just $15. Facebook (FB) never did get down to $15 per share. Ironically enough, it’s now 15 times higher than its lowest ever closing price of $17.73 that it traded at right before the Barron’s article. The chart of Facebook since its IPO shows that the road forward hasn’t always been smooth, but for Facebook, it has been a success.

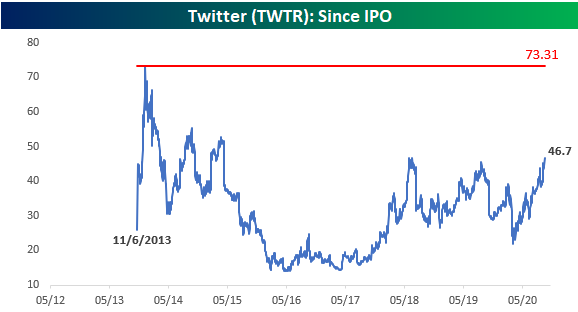

The performance of Facebook (FB) suggests that it has been good to be a social media stock over the last several years, but for other stocks in the sector, life as a public company has been anything but likable. Let’s start with Twitter (TWTR) which came public just after FB started to break out. TWTR’s IPO price was $26 per share, but it immediately traded up above $70 before the end of 2013. For the next two years, though, TWTR did nothing but trade lower. It wasn’t until shortly after President Trump took office that the stock started to bottom out and rally again. At its current level of $46, TWTR is above its IPO price but still down more than 35% as it tries to break above two prior highs at similar levels in mid-2018 and mid-2019. Will the third time be the charm or a strikeout?

Finally, there’s Snap (SNAP). Of the three publicly traded social media companies, SNAP is easily the most popular among kids, but even with that popularity, most of its time as a public company has been forgettable. The stock IPO-ed at $17 on 3/1/17 just as TWTR was near its post-IPO lows. Despite the tough environment that TWTR experienced, within two days SNAP was up over 50% and above $27. Like everything else on the app, though, SNAP’s gains quickly disappeared, and by the end of December 2018, it closed below $5 per share. In the less than two years since that low in December 2018, SNAP has made an impressive comeback, and as of yesterday’s close was within 50 cents of a new closing high. It took Facebook (FB) a year to take out its IPO price, but from there it was off to the races for the stock. In SNAP’s case, it has taken more than three years to even get back near its initial IPO highs, but now that it’s close to those levels again, shareholders are hoping it will have been worth the wait. Click here to view Bespoke’s premium membership options for our best research available.

Bed Bath & Beyond (BBBY)

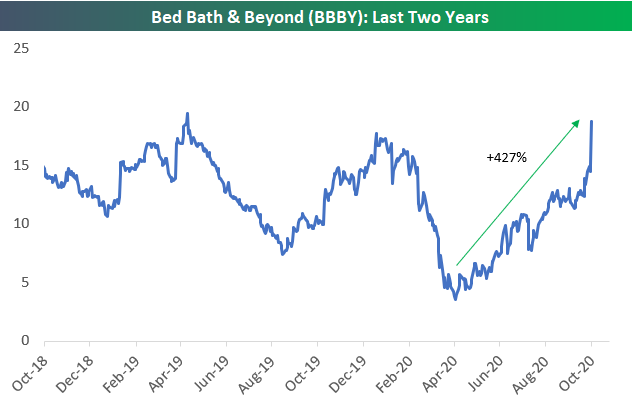

Coming into yesterday, Bed Bath & Beyond (BBBY) had fallen in reaction to ten of its last thirteen quarterly earnings reports. The stock exploded higher in reaction to this quarter’s report, however, with a one-day gain of 25.13% yesterday. As shown below, there have only been two other days in BBBY’s history that have seen a bigger one-day gain. On March 24th of this year, the stock jumped 28.25%, while back on March 30th, 2000, the stock rose 30.22%.

As the table shows, following prior 15%+ one-day gains for BBBY, the stock has typically pulled back over the next week, but over the next three months, the stock has averaged an additional gain of more than 26%.

Since its low of $3.56/share back on April 2nd, BBBY is now up 427%!

The recent gains for BBBY have finally given shareholders a “higher high” on the long-term price chart. Yesterday’s gain pushed shares above highs seen last December. For a stock that went from $80 in late 2013 to the mid-$3s earlier this year, it’s a start! Now that this downtrend has been broken, technicians will be looking for a “higher low” to be established and a new uptrend to take hold. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 10/2/20 – October Surprise

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Every morning I jump out of bed and step on a landmine. The landmine is me. After the explosion, I spend the rest of the day putting the pieces together.” – Ray Bradbury

Just when you thought things couldn’t get more chaotic, we got the news late last night that the President, his wife, and an aide tested positive for COVID. Obviously, we wish the President and everyone else around the world who has come down with this virus a speedy recovery. Time will only tell how the President’s diagnosis will impact the election, but with the added amount of uncertainty, you can’t fault investors for taking some chips off the table heading into a weekend.

With the news regarding the President’s positive COVID test, you may have forgotten that there was a jobs report this morning. The results were mixed but more negative than positive with Non-Farm Payrolls missing expectations (661K vs 859K) due to a larger than expected decline in government jobs from the loss of census workers. The Unemployment Rate, however, came in a bit lower than expected at 7.9% versus expectations for a level of 8.2%.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

Earlier this week, we noted that the relative strength of the semiconductors had hit a new record high, which was a positive sign for the broader market. Taking a look at the semis from another angle, below we show the cumulative A/D line of the Philadelphia Semiconductor Index (SOX). After moving basically sideways for well over a month now, the SOX’s cumulative A/D line now looks to be breaking out of that range as it has moved to new highs in the last two days. Can the SOX itself be far behind?

Bespoke’s Consumer Pulse Report — October 2020

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Slight Shifts in Sentiment

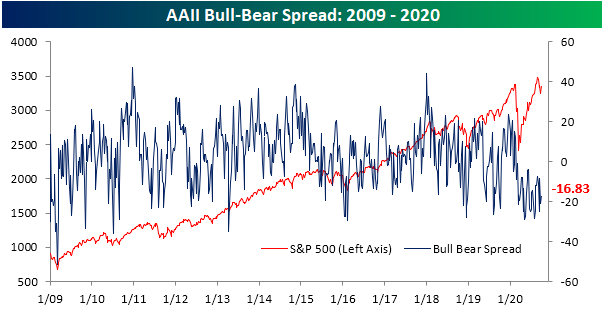

Over the past week, the S&P 500 has turned higher erasing a portion of September’s losses. With the index currently fighting to hold above its 50-DMA, bullish sentiment has risen slightly. AAII’s reading on bullish sentiment rose to 26.24% from 24.89% last week. While more than a quarter of respondents are reporting as bullish again, that is still less than nearly one-third total (32.02%) we saw two weeks ago.

Those gains in bullish sentiment took from the bearish camp. Bearish sentiment fell from 45.99% to 43.07%. Like bullish sentiment, that is right in the middle of the past few weeks range.

Of course, that means that the bull-bear spread remains deep in negative territory. The record steak of negative readings in the spread has now risen to 32 weeks long.

The losses to bearish sentiment mostly went towards neutral sentiment as this reading rose to 30.69% from 29.11% last week. That brings neutral sentiment to its highest level since July 30th. Click here to view Bespoke’s premium membership options for our best research available.