Daily Sector Snapshot — 10/6/20

Background Checks Decline For Third Month in a Row

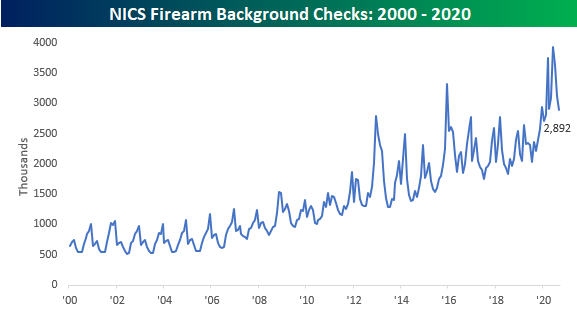

After surging during the COVID lockdowns and the summer protests and riots around the country, US background checks for firearms have declined for three straight months now. During the month of September, background checks totaled 2.892 million which was down by more than 200K relative to August and more than a million from the 3.931 million record high in the month of June at the height of the national unrest. While background checks are down sharply from their recent peak, we would note that prior to 2020, there were only two other months (December 2015 and December 2019) that saw higher readings than this September.

On a y/y basis, background checks have also dropped sharply from their recent peak of 79.2% in July. That reading was the second-largest y/y increase on record behind only the 81.2% increase in January 2013 at the start of President Obama’s second term. Here again, though, a y/y increase of over 30% is still large. Going back to 2000, there were only 11 other months outside of 2020 where the y/y reading was above 30%, while this year there have no been seven in just nine months.

Below we have provided snapshots of the two publicly traded gun manufacturers – Smith and Wesson (SWBI) and Sturm Ruger (RGR). The charts for both stocks look like spitting images of each other as they both saw big rallies in the Spring that really got going in early June as unrest spread across the country. The rallies in both stocks actually stalled out about a month after gun sales peaked, bringing both stocks back down near levels they traded at in early June. In recent days, though, as Biden has widened his lead in the polls, both stocks have started to attract renewed interest. Click here to view Bespoke’s premium membership options for our best research available.

Relative Strength Reversal?

Since the pandemic began, Consumer Discretionary and Technology stocks have consistently outperformed while Energy has lagged. Evident in the relative strength lines versus the S&P 500, these trends are still very much holding true, but there have been some interesting changes recently. For starters, Technology’s relative strength line remains in its uptrend—indicating outperformance relative to the S&P 500 over the past year—but at the start of this month the line put in a lower higher. Meanwhile, the relative strength line of Communication Services has been generally trending lower for some time now, but has more recently collapsed to some of its lowest levels since the spring.

Conversely, some other sectors have seen their trends turning around. Utilities and Real Estate are some of the most obvious examples of this with clear breakouts of their downtrends that have been in place for much of the past year. Health Care and Financials are now looking to join those two defensive sectors as they are right near their downtrend lines. Consumer Staples has also begun to trend slightly higher. Of the other sectors, the relative strength lines of Consumer Discretionary, Industrials, and Materials all continue to trend higher with some bounces in the past few days. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke Stock Scores — 10/6/20

Chart of the Day: 20+ Year Treasury ETF (TLT) Breaking Down

Bespoke’s Morning Lineup – 10/6/20 – Quiet Night in the Markets

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Beyond this, the problem is universal. It is that governments are now held responsible for the welfare of the people. The aspirations of the people can outrun their ability to pay for them, and nobody has yet found a way to create answers to the aspirations out of thin air.” – Adam Smith, The Money Game

It was a dramatic night on the political landscape with President Trump’s return to the White House, but in the markets, it was a quiet night ahead of a slow day for data. The only notable event on the calendar is a 10:40 eastern speech by Fed Chair Powell.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, German factory orders, trends related to the COVID-19 outbreak, and much more.

While the S&P 500 has convincingly moved back above its 50-DMA and traded to its highest level since September 16th, gold still has about another 1.5% to go to get back above its own 50-DMA. Gold prices have rallied $80 (4%) off their recent lows, but in the process are now bumping up right against a short-term downtrend from its recent high. How gold reacts in the next couple of days will answer whether this most recent bounce results in a fourth lower high or the beginning of a new leg higher.

September 2020 Headlines

Daily Sector Snapshot — 10/5/20

Chart of the Day – A Good Start to the Week

How COVID Upended the French Fry Industry

The third quarter has come to an end, which means that the Q3 earnings season will be in full swing before you know it. This week, though, only a handful of names are scheduled to report. One of the bigger names reporting is Lamb Weston (LW) which reports Wednesday before the open. What exactly is Lamb Weston? If you’re unfamiliar with the company, a google search comes up with the listing below, which shows that the company describes itself as a producer of “Innovative Frozen Potato Products,” or what most of us call French Fries. The company is one of the leading suppliers of french fries and other frozen potato products to the foodservice and retail sectors. In the retail sector, you may better know the company by its “Grown in Idaho” brand found in supermarket freezers.

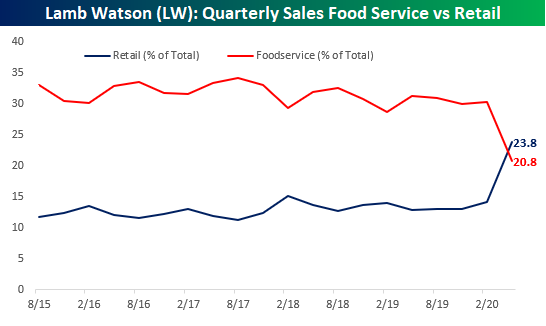

French fries have to be one of the most stable businesses in America. When given the option, who doesn’t choose a side of fries to go with their burger? One problem with french fries, though, is that unless you have a deep fryer in your kitchen, they’re never as good at home as they are at a restaurant. For that reason, companies like Lamb Watson (LW) have always had a much higher percentage of their sales coming from the food-service channel than the retail channel. That was until COVID. The chart below shows the quarterly sales breakdown for LW between foodservice and retail segments in the United States. The company also has other units like International which comprise the rest of its sales.

For years now, Lamb Watson has seen a pretty consistent trend of sales in its Foodservice and Retail segments. Foodservice consistently accounted for around 32% of total sales while the company’s Retail unit was much smaller accounting for less than 13% of total sales. In the span of just one quarter, though, LW’s sales mix completely reversed with Retail seeing its share of total sales nearly double from 14.1% up to 23.8% while Foodservice sales saw its share of sales plummet by a third falling from 30.2% down to 20.8%. With restaurants closed, subpar french fries were better than no fries at all and within a matter of weeks, french fries in the grocery store were just as scarce as toilet paper.

In the company’s last earnings conference call, it noted the shift from restaurants to retail but also noted increased costs associated with re-tooling manufacturing for the added demand, so the company should manage to adjust to the shifting demand profile. When you think about COVID and its impact on different sectors of the economy, french fries probably weren’t the first thing most people would think about, but just because it wasn’t top of mind doesn’t mean that the impact was insignificant. Earnings season is almost here. To stay on top of the latest trends with company reports, make sure to check out or Interactive Earnings Explorer tool. Click here for a free two-week trial!