Rest of the World Catching Up

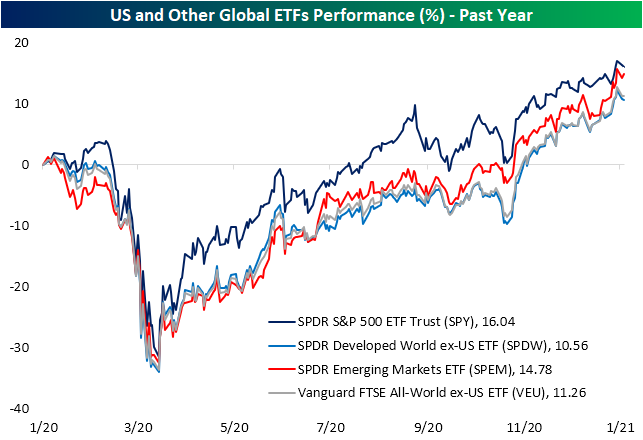

Over the past year, US equities—proxied by the S&P 500 (SPY)—have consistently outperformed global equities more broadly. As shown below, over the past year the S&P 500 (SPY) has risen just over 16%. That compares to 11.26% for the rest of the world as proxied by the Vanguard FTSE All-World ex US ETF (VEU). Breaking that down a bit further by developed and emerging markets, US equities have outpaced both emerging and other developed markets. While emerging markets (SPEM) are right on the heels of the US with just under a 14.78% gain, developed markets (SPDW) have lagged with just a 10.56% gain. So far in 2021, though, the rest of the world has been outperforming the US. Whereas SPY has risen around 1% YTD, VEU is up almost 3 times that. Emerging markets in particular have shown the greatest degree of strength currently having risen 3.87%. Meanwhile, SPDW has gained less (2.7%), though, it is still outperforming the US.

In the charts below, we show the ratio of SPY to these other ETFs. A rising line would indicate that the US is outperforming these other measures of global equities while a downward trending line indicates underperformance of SPY. As shown, the longer-term trend has pretty consistently been US outperformance over the past decade but that has faltered at the tail end of 2020 and into 2021. In the case of emerging markets, the line has been on the decline throughout the second half of 2020 as the ratio has hit its lowest level in a year in the past week. The S&P 500’s underperformance relative to other developed markets (SPDW) has been more recent as that line peaked in early September but the trend remains the same over the past few months with SPY weaker than global equities more broadly. That is further exemplified by the recent downtrend of SPY versus the All World ex US ETF (VEU). Click here to view Bespoke’s premium membership options for our best research available.

B.I.G Tips – Charts We’re Watching

Bespoke’s Morning Lineup – 1/12/21 – Small Businesses Lose Confidence

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“In the midst of chaos, there is also opportunity” – Sun-Tzu

Futures are higher this morning and attempting to regain some of the losses from Monday’s weak start to the week. Both the DJIA and the S&P 500 are on pace to erase more than half of yesterday’s losses, but the Nasdaq is a bit further behind.

We got our first economic indicator of the week today with the NFIB Small Business Optimism Index which dropped to 95.9 versus estimates for a reading of 100.2. That wide gap actually represents the biggest miss relative to expectations since July 2015, but before reading too much into it we would note that over time, this index has tended to have some political undertones to it.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, a discussion of stock performance in Hong Kong, Chinese economic data, an update on the latest national and international COVID trends, and much more.

Yesterday was an interesting day as even though the VIX jumped more than two points, the yield on the 10-year US Treasury was also up by 2 basis points (bps). Normally, on days when the VIX has a big gain, investors are rotating into treasuries and pushing yields lower. The chart below shows the S&P 500 over the last ten years, and each dot represents days where the VIX was up at least two points and the yield on the 10-year also jumped more than two bps. In the last decade, there have only been 14 other days where we saw similar moves with the most recent occurring back in March 2020, but looking through the chart they have occurred at all different points of the market cycle.

Daily Sector Snapshot — 1/11/21

Home Construction Consolidating

On a day when major US equity indices were lower across the board, the homebuilder group staged a nice rally. Below we provide a check-up on the group.

From the March lows until the October high, the iShares Home Construction ETF (ITB) rallied over 170%, but since that high, the ETF has been in consolidation. As shown below, ITB has been fluctuating around its 50-DMA for the past few months making some higher lows and lower highs in the process. The past few sessions have seen some more moves above and below the 50-day with today’s 1.8% gain currently bringing it back above and positive on a year to date basis. Currently, ITB is now 6.23% below its October 15th closing high.

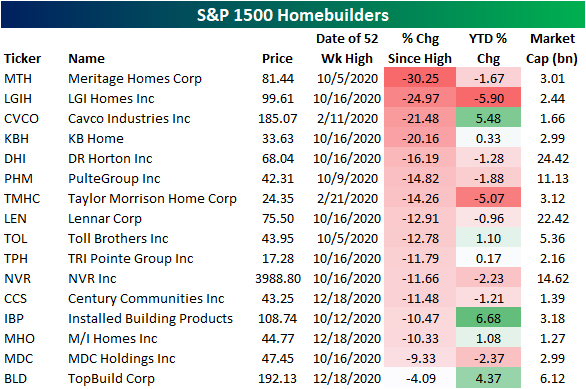

As for the individual homebuilder stocks, below we show the constituents of the S&P 1500 Homebuilders index and the story is mostly the same. After surging from the March lows through October, most of these stocks are down double digits from their respective 52-week highs. Similar to the FAANG names that have mostly traded sideways for the past few months, the homebuilders have quietly been experiencing consolidation as well. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Extreme Oversold Readings for 20+ Year Treasury ETF

Do Strong Starts Mean Strong Finishes?

As we noted in Friday’s Bespoke Report, through the first week of the year the best performing sectors were not what would have been expected. While the S&P 500 rose 1.83% through the first five trading days of the year, the Energy sector rose 9.31%. That is the sector’s best five-day start to a year since at least 1990. Materials was the next best sector notching a 5.68% gain. That is the sector’s second-best start to a year since 1999 when it rose 7.18%. Financials, Consumer Discretionary, and Health Care were also some of the better-performing sectors last week. Of these, there have been even better starts in recent years, although for Financials this year’s start was the best in a decade. While these sectors all led last week, sectors that had been leaders in the past year like Tech and Communication Services underperformed the S&P 500. That begs the question of how these sectors hold up throughout the rest of the year.

As shown in the table above, the best performers at the start of the year have typically traded higher through year’s end, though, they do not tend to remain the best performing sectors YTD come December as shown in the table below. Over the past three decades, there have only been five years in which the best performing sector in the first week of trading ended up being the best performing sector from the end of the first week through the end of the year: 1993, 1994, 1998, 1999, and 2003. Each of those years, that sector was also the same: Tech. In other words, outperformance at the start of a year does not necessarily predicate outperformance for the full year. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day – Health Care’s Big Week

Bespoke’s Morning Lineup – 1/11/21 – Another Case of the Mondays

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If I had nine hours to chop down a tree, I would spend the first six sharpening my ax.” – Abraham Lincoln

Just as Monday was the worst trading day of last week, it’s not shaping up to be much of a good day for the bulls this week either. There’s still plenty of time left in the day, but it’s not getting off to a strong start. In terms of potential catalysts for the market today, there’s little in the way of economic or earnings data, so the focus will likely be on Washington DC and what will transpire in the final days of the President’s term.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, a discussion of China delistings, an update on the latest national and international COVID trends, and much more.

While the US equity market collectively is overbought, there’s quite a bit of dispersion among individual sectors heading into the second full week of the year. As shown in the snapshot from our Trend Analyzer, Consumer Discretionary, Health Care, and Materials sectors are all at ‘extreme overbought’ levels and have ‘poor’ timing scores. Beneath those three sectors, four more are overbought, while four are still at neutral levels. Of those four sectors (Industrials, Consumer Staples, Utilities, and Real Estate), the first two also currently have ‘good’ timing scores.

Bespoke Brunch Reads: 1/10/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Autos

Rivian Is Close to Raising Funds at $25 Billion Valuation by Katie Roof and Edward Ludlow (Bloomberg)

The electric truck company is adding to its total capital raise by “several billion”, bringing total to-date capital raised to at least $8bn; deliveries on its trucks and SUVs are planned to start this year. [Link; soft paywall]

Honda cuts car production on massive chip shortage by Ryosuke Hanada (Nikkei)

Semiconductors are in short supply for the global auto industry, with surging demands for chips used in computers and phones leading to a supply bottleneck for other industries like autos. [Link]

Renewables

The New Green Energy Giants Challenging Exxon and BP by Katherine Blunt and Sarah McFarlane (WSJ)

Utilities based in Florida, Spain, and Italy have become monsters in the world of green energy, going in many ways unnoticed as they accrue tens of billions in capital investment in solar and wind energy projects across the world. [Link; paywall]

Vaccine Rollouts

NC governor activates National Guard to help with COVID vaccine distribution by Adam Wagner and Martha Quillin (News & Observer)

Concerned that North Carolina may be falling behind on vaccinations has lead Governor Roy Cooper to activate the state’s National Guard in order to assist local health departments rolling out access to the inoculations. [Link]

Why West Virginia’s Winning The Race To Get COVID-19 Vaccine Into Arms by Yuki Noguchi (NPR)

A focus on local pharmacies instead of national chains has let West Viriginia administer a huge number of vaccines in a very short amount of time. [Link]

66% of New York City’s Vaccine Doses Sit Unused as Virus Numbers Soar by Joseph Goldstein (NYT)

As a result of Governor Cuomo’s decision to aggressively prioritize vaccine access with huge penalties attached, there are huge numbers of unused vaccines sitting in storage, unused. [Link; soft paywall]

Policy

Most Second Stimulus Payments Reach Household Bank Accounts by Richard Rubin and Laura Saunders (WSJ)

$600 relief payments from the US Treasury have been two-thirds paid out already with more than $112bn hitting consumers accounts over the last week and a half. [Link; paywall]

Comparison of Utilization, Costs, and Quality of Medicaid vs Subsidized Private Health Insurance for Low-Income Adults by Heidi Allen, Sarah H. Gordon, and Dennis Lee (JAMA Network)

In a study comparing the health care received by Marketplace (ACA exchange) and Medicaid recipients, Marketplace users paid 83% more with mixed impact on quality of care and a reduced number of emergency department visits. [Link]

Labor Movement

Google workers launch unconventional union with help of Communications Workers of America by Nitasha Tiku (WaPo)

Tech worker organizing has taken the next step with more than two hundred Google employees launching a union; notably, that union will not seek ratification with a federal agency and therefore won’t have collective bargaining rights. [Link; soft paywall]

Living

Amazon Pledging More Than $2 Billion for Affordable Housing in Three Hub Cities by Nicole Friedman (WSJ)

Amazon has said it will use low-cost loans to build or preserve affordable housing in areas that it has a tech hub presence in. [Link; paywall]

United Van Lines’ National Migration Study Reveals Where and Why Americans Moved in 2020 (United Van Lines)

A fascinating review of where movers are flowing to and from around the country with states like South Carolina, Oregon, South Dakota, and Arizona seeing the biggest inflows while New York, Illinois, Connecticut, and California seeing the biggest outflows. [Link]

Hawaii’s Beaches Are Disappearing by Ash Ngu and Sophie Cocke (ProPublica)

Coastal seawalls are key drivers of coastal erosion, with waves that hit them and rebound dragging sand out to sea instead of washing over it as on a natural beach. The result is that Hawaii’s legendary sands are disappearing. [Link]

Novel Structures

A Tiny Hedge Fund Just Made History by Turning Into an ETF by Katherine Greifeld (Bloomberg)

A Nashville-based hedge fund with $3mm in assets decided to convert its tech-oriented portfolio into an exchange traded fund, the first such transaction in the history of the investment management industry. [Link]

Food

To Make Japan’s Original Sushi, First Age Fish for Several Months by Clarissa Wei (Atlas Obscura)

A fascinating history of the now-ubiquitous raw fish which was originally a cured product that fermented in barrels or other vehicles for months or even years before being served. [Link]

Security

FBI Questioned A Michigan Senate Staffer After Zoom Call About Banning Tear Gas by Alice Speri and Sam Biddle (The Intercept)

A legislative strategy call related to a proposed bill in Michigan was somehow put on the FBI’s radar, either through a report by someone that overheard it or more concerning means. [Link]

Pro-Trump Mob Livestreamed Its Rampage, and Made Money Doing It by Kellen Browning and Taylor Lorenz (NYT)

An alternative to classic social media networks called Dlive offers users the ability to tip livestreamers, and as a mob wrecked the Capitol earlier this week, that’s just what they did. [Link; soft paywall]

Modern Families

The Sperm Kings Have a Problem: Too Much Demand by Nellie Bowles (NYT)

Sperm donors who are most in-demand are having a hard time keeping up with the demand for their product amidst a dramatic uptick in the number of people who are looking for babies. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!