Chart of the Day: Bitcoin Sentiment

Swan Song Bodes Well for Intel (INTC) But for How Long?

After two years at the helm, news broke this morning that Bob Swan will be stepping down from his position of CEO of Intel (INTC). He will be replaced by VMware (VMW) CEO Pat Gelsinger on February 15th. While INTC has been a significant underperformer over the past year—it is the only semiconductor stock in the S&P 500 that is lower than it was one year ago—the immediate response from the market to today’s news has been overwhelmingly positive. As of this writing, the stock is up 8.55% which would be its best day since March of last year around the time of the bear market lows.

Though there is plenty of time left in the day for those gains to be built upon or eaten into, the opening gap was substantial. Opening at $59.50, the gap up of 11.76% was one of the largest for INTC on record. The only times since 2000 that there were larger gaps to the upside were in April of 2001 when the stock gapped up 12.64% on the 11th and 12.21% on the 18th. Going back before 2000, the only upside gap that was even larger was a 29.92% move in October of 1987, not long after Black Monday and when Intel’s stock was trading under $1 on a split-adjusted basis.

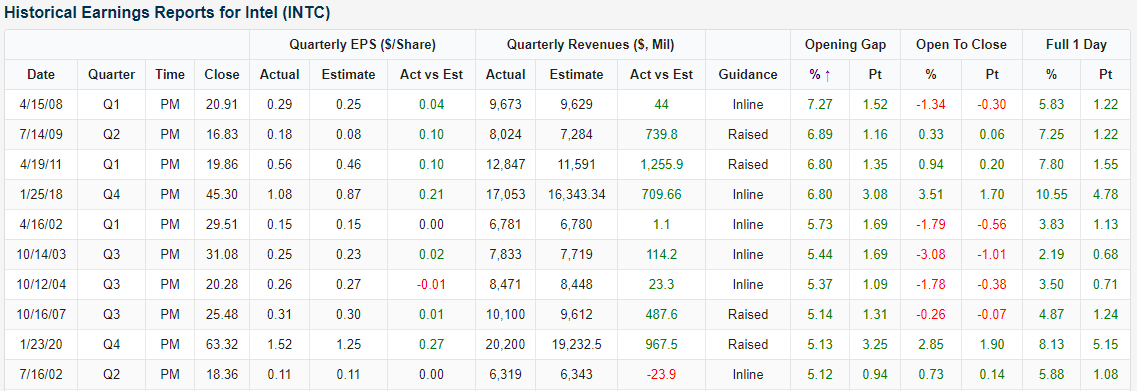

Today’s gap up on the news of a CEO change was also even larger than any move on earnings of the past nearly two decades. As shown in the snapshot from our Earnings Explorer below, the best gap up on earnings news that INTC has experienced since late 2001 was a 7.27% gap following the Q1 results of 2008.

As previously mentioned, there is not much historical precedent for INTC from gaps up as large as today, but of the past four times that INTC gapped up at least 10%, performance in the weeks and months after have generally been pretty negative. The next week has usually seen some further moves higher with the only decline being the second gap up over 10% in April 2001. As for returns throughout the next year, the stock has consistently declined. Like what you see? Click here for a trial to any of Bespoke’s premium membership options.

Impeachment Indicators

The President’s first impeachment proved to be a non-event from both a political perspective and for markets. The possibility of a second impeachment is likely irrelevant to the equity market but could have significant political implications into 2024 and beyond as the Republican Party manages the post-Trump landscape.

Last night, the House passed a request for the Vice President to activate the 25th Amendment and remove the President from office. The Vice President officially declined to do so, which makes impeachment by the House likely either today or tomorrow. The House vote will largely be on party lines, but not entirely. Third-ranking Republican in the House Liz Cheney of Wyoming (daughter of former Vice President Dick Cheney) said yesterday she will vote “yes” on impeachment, and at least four others have joined her as-of this writing. We don’t have a firm estimate on the number of Republicans who will vote “yes” in the House, but we also note that Trump ally and Minority Leader McCarthy (CA) has said he will not formally whip votes against impeachment, raising the possibility that a material chunk of the Republican caucus could side with Democrats.

Of course, the real action will be in the Senate, where the state of play is quite different. While Democrat Joe Manchin of West Virginia has waffled, we think it’s reasonable to expect Democrats to vote as a bloc, delivering 50 of the 67 votes required for conviction should all Senators participate in the final vote.

A number of Republicans have expressed views that support impeachment. Romney (UT), Toomey (PA), and Murkowski (AK) are firm “yes” votes, with Romney already supporting the prior effort and the other two publicly on the record saying they would his time. Other senators including Blunt (MO), Collins (ME), Portman (OH), and Sasse (NE) have expressed openness to the idea of impeachment. Based on assessments of their public stances, we see 24 GOP Senators as “no” votes, and 18 as insufficiently committed either way.

The 7 potential “yes” votes listed above do not include Mitch McConnell, the Republican Senate’s leader. Reports yesterday from a variety of sources reported that he is ‘pleased’ with impeachment efforts, and supports the removal of the President, but at this point, McConnell hasn’t said anything publicly to support this. McConnell is a superlative parliamentary strategist and extremely effective politician. If he does in fact support removal and is willing to whip votes for it, then the 7 other potential “yes” votes will increase given the sheer number of uncommitted Senators and the potential for flips among the 24 “no” Senators. In other words, Mitch McConnell will likely decide the President’s fate, and if yesterday’s reporting is accurate, he is leaning towards impeachment. Below we summarize all 50 GOP Senators into three categories: likely yes, likely no, and no way to tell on the question of conviction.

Conviction of the President in the Senate would functionally remove him from the political scene because he would no longer be able to run for office; if convicted, only a simple majority vote would be required to prevent him from ever again seeking federal office. Therefore for 2024 hopefuls, a “yes” vote could be a simple political calculation that the damage to their primary chances is outweighed by the benefit of not being forced to face the President on the ballot. Regardless of motivations, there are enough potential “yes” votes (especially McConnell and those he would bring with him) that a conviction can’t be ruled out at this stage Also, keep in mind that If a material number of the GOP caucus members abstain from the vote in protest or for other reasons, the number of required votes for conviction drops.

As mentioned above, the possibility of a second impeachment is likely irrelevant to the equity market, especially in the short-term. Regardless of what happens in the House this week, McConnell has already noted that the earliest the Senate would start a trial would be after the inauguration when President Trump will be out of office already and raises questions of whether it is even possible to hold a trial for a President who is out of office. All these are no doubt questions that will be debated in the following days, weeks, and months. Like what you see? Click here for a trial to any of Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 1/13/21 – Easy Going

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” – Benjamin Graham

We’ve had a flurry of central bank officials on both sides of the Atlantic reiterate their stances that they are in no rush to start removing accommodation from the system. In Europe, ECB President Lagarde and council member Villeroy de Galhau both doubled down on their commitment to a 2% inflation target and that they will keep monetary policy loose for as long as needed in order to get the economy back into gear. These comments today follow comments from Fed Presidents Bullard and Rosengren who both also reiterated their commitments to get the economy back to its full potential.

Despite the dovish commentary, futures are modestly lower this morning ahead of the December CPI report. Outside of that report, though, the only other report of note is the monthly Budget Statement later this afternoon. On the political front, the House is expected to vote on impeachment again and at least some Republican members are expected to vote in favor.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, a discussion of the latest report on Machinery Tool Orders in Japan, an update on the latest national and international COVID trends, and much more.

Small-cap stocks have been on roll so far in 2021, but the real action now has been in micro-cap stocks. Through the first seven trading days of 2021, the Russell Micro Cap Index is up 9.4% which is the best start for the index since its inception in 2007. The only other year that was even close was in 2019 when the Micro Cap index was up 8.1% in the first seven trading days of 2021.

The chart below shows the performance of the Russell Micro Cap Index from the close on the seventh trading day of the year through year-end. For all years since 2007, the Russell Micro Cap index has seen a median gain of 11.62% for the remainder of the year with gains 64% of the time. While it’s a very small sample size, in the three prior years where the Micro Cap Index was up over 3% to start the year, the index continued higher for the remainder of the year with gains all three times ranging from 11.9% up to 38.5%.

Daily Sector Snapshot — 1/12/21

November JOLTS: Questions & Answers

Today the Bureau of Labor Statistics updated its monthly Job Openings & Labor Turnover Survey (JOLTS). November’s data showed an uptick in layoffs and firings from a record low rate earlier in the fall. While that was some bad news, hiring has been accelerating. Private sector gross hiring was 4.5% of the labor force in August, and it’s now up to 4.7% in November. That’s a record pace of new hires for any period in the history of the series other than the immediate bounce-back from the initial COVID shock this spring. As for job openings, openings have stabilized a ways below their peak from the last cycle. So while there are lots of layoffs, the story is less negative than it might sound. Like what you see? Click here for a free trial to any of Bespoke’s premium membership options, including our nightly Closer note that regularly features economic analysis of this kind.

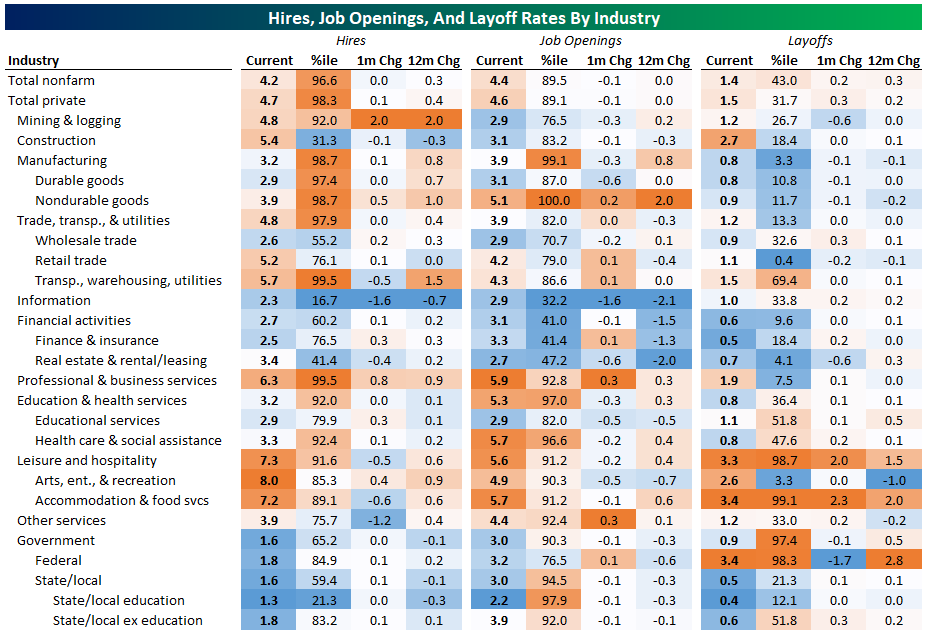

Another interesting dynamic in the JOLTS data is the industry-level results. Hires are strongest versus history in areas that you might expect given the impact of COVID: manufacturing, transportation/warehousing/utilities. Some surprising areas are very weak though: construction and information stand out. As for COVID impacts, you wouldn’t expect strong hires in accommodation and food services, but there they are. Job openings are the highest relative to history in manufacturing but are also extremely high in accommodation & food services as well as state and local education. Finally, we note that layoffs are basically consistent with COVID-driven weakness, plus the effects of Census hiring rolling off for the Federal government.

Chart of the Day: Market Performance After Manufacturing Surges

Bespoke Stock Scores — 1/12/21

Government Problems Pulling Away From Labor Problems for Small Businesses

As we noted in today’s Morning Lineup and an earlier post, this morning’s release on small business optimism from the NFIB was a disappointment as the index missed expectations by a wide margin falling from 101.4 down to 95.9. While the headline number experienced a sharp drop, what businesses report as their most important problem largely went unchanged from November. As shown in the table and charts below, of the ten problems surveyed, half were unchanged MoM. Of those that were higher, “Other” saw the largest increase potentially as a result of rising COVID cases. Meanwhile, Cost/Availability of Insurance and Taxes were the others that saw an increase MoM. On the other hand, Competition From Big Business was less frequently reported as an issue while Quality of Labor saw an even larger decline. That three percentage point drop was the largest since April when that index fell nine points.

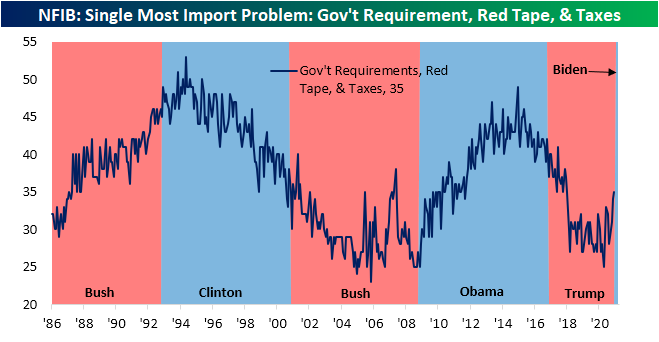

Where things currently stand means that government-related problems are back well above labor-related problems as the biggest issue reported by businesses. On a combined basis, last month saw 30% of respondents report either cost or quality of labor as their biggest issue. That was down to 27% in December while the percentage reporting either government requirements/red tape or taxes as their biggest issue rose from 34% in November to 35% in December.

As we have noted in general with this report, small business optimism has historically been impacted by changes in the political landscape. As shown below, during the past two Republican administrations—which are typically viewed as the more business-friendly party—fewer respondents to the NFIB survey reported either government red tape or taxes as their biggest issues while the opposite was true during the Obama years and early in the Clinton administration. With an incoming Democratic administration that is more likely to favor things like higher taxes and more regulation, this reading is starting to rise once again; erasing much of the move lower that occurred during the Trump presidency. Click here to view Bespoke’s premium membership options for our best research available.

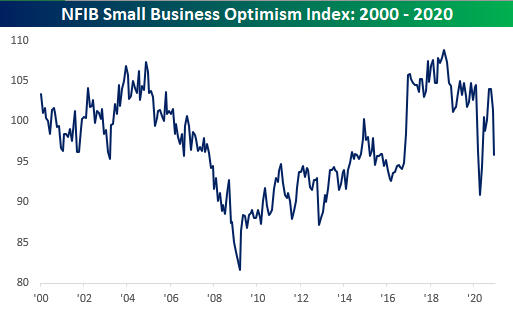

Small Business Owners Didn’t Like the Election Results

Today’s release of the December Small Business Optimism Index from the NFIB saw a large drop as the index dropped from 101.4 to 95.9. After a sharp drop in the wake of the COVID outbreak, the index bounced back nicely but now looks like it’s really rolling over.

Not only was this month’s headline index weak, but it caught economists completely off guard. While the index fell to 95.9, economists were expecting a drop to 100.2. That 4.3 spread between the actual and expected reading was the biggest miss relative to expectations in more than five years (July 2015) and was the third weakest reading relative to expectations since the December 2012 report.

Given the big drop in the headline index and the fact that it was so weak relative to expectations, should we be concerned about a double-dip? As an investor, we should always be worried about what could go wrong, but in the case of this report, you can probably wait for further confirmation from other data. The reason for the skepticism is that you could argue that politics plays a role in this report. To illustrate this, we would note that going back to 2010 (as far back as we have data) and right up through Election Day 2016, the NFIB only topped expectations 42% of the time. Following Trump’s election in 2016, though, this index surged and has since topped expectations 63% of the time. Since Election Day 2020, though, the headline index has now missed expectations three times.

From a longer-term perspective, dating back to 1974, the average reading of the NFIB Small Business Index during Republican administrations has been 100.1 while the average level under Democratic Presidents has been 96.2. Now, that would make sense if the economy was also in a recession more often in those periods, but over that same span, even though the percentages are low for both political parties (<20%), the economy has actually been in a recession a higher percentage of the time during Republican administrations than it has in Democratic administrations.

The lesson to take from all this is that even if it’s often hard to separate when it comes to business or investing (or a lot of other aspects of our lives for that matter), it’s usually best to leave politics outside. Click here to view Bespoke’s premium membership options for our best analysis available.