Bespoke Stock Scores — 1/19/21

Chart of the Day: Netflix (NFLX) Earnings

Banks: Where Good News is Bad

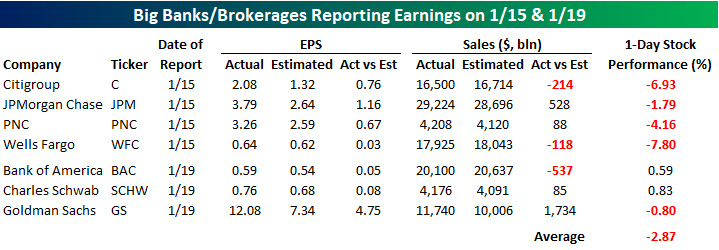

Earnings season is now in full swing, and we’ve already seen reports from seven of the largest and most significant banks and brokerage firms. While the results have been good, investors have been reacting with a sell the news attitude. As shown in the table below, all seven of the major banks and brokerage firms reporting so far have topped EPS forecasts. Revenues, on the other hand, haven’t been as positive relative to expectations with four beats and three misses. Where the real weakness has been, however, is in stock price reactions. Of the seven names reporting, five have either had or are on pace to have a negative one-day reaction to their earnings report, while just two – Bank of America (BAC) and Charles Schwab (SCHW) – are just marginally higher today in reaction to their reports. While these two stocks are higher, we would note that BAC was down 3% in sympathy with the other banks on Friday, so the only one of the seven listed that is at the same levels or higher now than it was at last Thursday’s close is SCHW.

With the seven stocks listed below all beating EPS expectations but averaging a decline of close to 3% in reaction to their earnings reports, we wondered how common it is for EPS relative to expectations to come in so strong in an earnings season but the stocks reacting so poorly. Using our Earnings Database and running some filters, we found just five other quarters in the last ten years where all seven stocks reported better than expected EPS. Interestingly enough, of those five periods, the average one-day reaction of the seven stocks in that earnings season was negative four times. The only earnings season where the seven stocks averaged a gain on their earnings reaction day was the Q4 2018 reporting period in January 2019. The worst reaction of these seven stocks in an earnings season when they all topped EPS forecasts was last earnings season in October when they averaged a decline of 2.95% with five of the seven names declining. It was only three months ago, but already last October seems like so long ago. Not a client? Click here to view Bespoke’s premium membership options including Bespoke Institutional, which provides full access to our Earnings Explorer tool.

Semi Seasonals

One of our Interactive Tools that subscribers have access to provides historical seasonality trends for the S&P 500. Our Seasonality Tool allows users to track historical trends of the broader market, ETFs, and individual stocks over pre-defined and custom time periods over the last ten years. Subscribers who have created custom portfolios can also track the names in these various baskets in order to see which ones have historically performed the best and worst over different time periods.

The gauges below are from the Seasonality Tool, and they show the S&P 500’s median performance over the last ten years for the upcoming week, month, and three months. For each time period, we show the S&P 500’s median change during that span as well as how that performance ranks relative to all other periods throughout the year. Using the one-week time period as an example, the S&P 500’s median performance over the upcoming trading week has been +1.15% over the last ten years. Relative to all other one-week periods throughout the year, it ranks better than 89% of them. For the one-month period, the S&P 500’s 3.11% median performance has been even better relative to other periods, ranking better than 94% of them. Over the next three months, though, the S&P 500’s median gain of 3.17% is not quite as strong, ranking better than only 63% of other three-month periods.

One sector that has been strong during the upcoming one-month period is semiconductors. In our Seasonality Tool, you can track that sector’s performance by looking at the ETF SMH, but below we wanted to summarize the performance of the Philadelphia Semiconductor Index (SOX) in the upcoming one-month period, not just over the last ten years but also going back to 1996. As shown in the table, from the close on 1/18 (or the most recent close before that if 1/18 wasn’t a trading day) through the close on 2/18, the SOX has seen an average gain of 3.53% (median: 4.35%) with gains just over two-thirds of the time. That’s more than twice as strong as the average gain of 1.3% for the SOX over all one-month periods since 1996. Over just the last ten years, the performance of the SOX over the next month has been even stronger with a median gain of 4.85% and gains in every year except 2018.

With a rally of 7% already YTD, the semiconductor group has had a strong run to start the year and heads into this week at overbought levels. It’s going to be hard to keep up at this pace, but at least one factor working in its favor is a seasonal tailwind. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 1/19/21 – Turnaround Tuesday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Most entrepreneurial ideas will sound crazy, stupid and uneconomic, and then they’ll turn out to be right.” – Reed Hastings

It may be the first trading day of the week, but given the declines to close out last week and the fact that futures are higher, it still qualifies as a Turnaround Tuesday for now. There’s nothing in the way of economic data on the calendar, but the pace of earnings is picking up steam. Of the seven companies reporting so far this morning, six have topped EPS and revenue forecasts, and Netflix (NFLX) will report after the close.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, Chinese Industrial Production, an update on the latest national and international COVID trends (which were positive again), and much more.

Below we have provided a snapshot from our Trend Analyzer of each of the S&P 500 sectors showing their performance and where they’re trading relative to their short-term trading ranges heading into this week. Last week was a negative for most sectors, but Energy, Real Estate, Utilities, and Financials all managed to buck the trend and post varying levels of gains. Energy was the strongest sector of the week and it is now up over 12% YTD, and more than 13% above its 50-DMA. As a result of the recent surge, the sector’s timing score is ‘Poor’. On the other end of the spectrum, four sectors currently have ‘Good’ timing scores. Those sectors are Communication Services, Industrials, Technology, and Consumer Staples. Of those four sector ETFs, only Industrials is up YTD while the other three have all dropped 2% or more. While the broader market is up modestly YTD, on a sector by sector basis, it has been an uneven year.

Bespoke Brunch Reads: 1/17/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Retail Rippers

Penny-Stock Peddlers Piling Into Reddit Forum Prompt Rule Change by Sarah Ponczek (Bloomberg)

After an influx of schemes and promotions, moderators of a subreddit focused on low-price shares have moved to ban discussion of cryptocurrencies and any services, newsletters, or other social media accounts. [Link; soft paywall]

TikTok and Discord Are the New Wall Street Trading Desks by Caitlin McCabe, Gunjan Banerji and Mischa Frankl-Duval (WSJ)

There has been rabid interest in hot stocks promoted on social media, driving stampedes of small buyers in to obscure stocks which suddenly go parabolic thanks to the promotion on a range of social platforms. [Link; paywall]

Food & Drink

In Search of Ragu by Matt Goulding (Roads & Kingdoms)

The author goes searching for the plate that best captures the platonic ideal of pasta: rich, complex, and loaded with flavor buried in the depths of Bologna. [Link]

The Seven Essential Southern Dishes by Sheri Castle (Bitter Southerner)

While it’s impossible to completely distill a cuisine as varied and diverse as the South’s into a few dishes, the author gives it a shot. The results may surprise you, but don’t fret: each comes with a recipe to try. [Link]

This artificial ‘nose on a chip’ can sniff out wine, coffee, and noxious gas by Luke Dormehl (DigitalTrends)

A German company has developed a chip that can detect the chemicals that make scents smell to us the way they do. [Link]

Crypto

Lost Passwords Lock Millionaires Out of Their Bitcoin Fortunes by Nathaniel Popper (NYT)

Early adopters that stored bitcoin wallets on hard drives or other external media have millions of dollars at their finger tips but just out of reach. [Link; soft paywall]

Exclusive: Large bitcoin payments to right-wing activists a month before Capitol riot linked to foreign account by Jenna McLaughlin (Yahoo!)

A French programmer sent millions of dollars worth of bitcoin payments to far right activists in the month before the riot which sacked the US Capitol earlier in January. [Link; auto-playing video]

Real Estate

Manhattan Bargain-Hunters Drive a 94% Jump in Apartment Leases by Alex Wittenberg (Bloomberg)

With rents dropping sharply, the number of lease signings for Manhattan apartments has doubled versus a year ago, putting a bid under a bedraggled Manhattan market. [Link; soft paywall]

U.S. banks cast wary eye at mortgage borrowers as forbearance periods end by Imani Moise (Reuters)

With millions of borrowers receiving forbearance on their mortgages, banks are having a hard time trying to figure out whether non-payers are actually financially struggling or are just taking the opportunity to save some payments. [Link]

Tech

Why Joe Biden Can’t Bring His Peloton to the White House by Courtney Linder (Popular Mechanics)

Not averse to an occasional spin class, the President-Elect will have to leave his Peloton bike in Delaware because its Android tablet, internet link, microphone, and camera pose security risks in the West Wing. [Link]

Every Deleted Parler Post, Many With Users’ Location Data, Has Been Archived by Dell Cameron (Gizmodo)

After right-wing social network Parler was kicked off a number of services that were part of its core architecture, hackers exploited a number of vulnerabilities and managed to capture almost the entirety of the social network. [Link]

Medical Breakthroughs

Bupropion and Naltrexone in Methamphetamine Use Disorder by Madhukar H. Trivedi, M.D., Robrina Walker, Ph.D., Walter Ling, M.D., Adriane dela Cruz, M.D., Ph.D., Gaurav Sharma, Ph.D., Thomas Carmody, Ph.D., Udi E. Ghitza, Ph.D., Aimee Wahle, M.S., Mora Kim, M.P.H., Kathy Shores-Wilson, Ph.D., Steven Sparenborg, Ph.D., Phillip Coffin, M.D., M.I.A., et al. (NEJM)

A new study compared the effects of two drugs designed to reduce addiction to methamphetamines and found that while imperfect, there was a significant effect versus placebo. [Link]

Cancer Death Rate in U.S. Falls by Largest Yearly Amount on Record by Brianna Abbott (WSJ)

Thanks mostly to novel treatments for long cancer, recent data shows another huge drop in the cancer death rate to the lowest on record for women and near the lowest on record for men. [Link; soft paywall]

Baseball

He Just Wanted to Play Catch. They Got Relief From Troubled Times. by Mike Wilson (NYT)

A quest for a partner to play catch with led to a full pickup game that allowed all participants to escape the stresses of 2020 and just play ball. [Link; soft paywall]

Mickey Mantle card crushes record after selling for $5.2 million by Dan Martin (NYP)

A 70-year-old baseball card topped the previous record price by more than 20%; it’s one of only about three left in good shape according to experts. [Link; auto-playing video]

Personnel Change

James Simons Steps Down as Chairman of Renaissance Technologies by Gregory Zuckerman (WSJ)

After a huge year for the internally-managed funds at Renaissance Capital but a very bad one for clients, one of the firm’s founders is stepping down. [Link; paywall]

Hippos

Invasion of the hippos: Colombia is running out of time to tackle Pablo Escobar’s wildest legacy by Sarah Kaplan (WaPo)

Hippos that escaped the mansion of Pablo Escobar after his fall have become an invasive species in Colombia, and one that is very close to making a permanent mark on the region’s biosphere. [Link; soft paywall]

PPP

‘It Was a Joke’: Some Small Businesses Got $1 Relief Loans by Stacy Cowley (NYT)

A small number of the five million companies that got loans through the Paycheck Protection Program got loans of less than $99, which comes across as something like a cruel joke. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Daily Sector Snapshot — 1/15/21

The Bespoke Report – 1/15/21 – Can You See The Light?

Global equity markets took a breather this week as a quick debate played out amongst the FOMC over whether asset purchases might be “tapered” this year. Bond markets got a peak of the big fiscal support they priced in last fall and after Democrats retook the Senate on January 6th via Georgia runoffs. COVID prevalence looks to be peaking in the US as vaccine distribution starts to scale up despite an uneven run. And the galaxy of aggressive retail investors continue to press their favorite plays despite a hiccup for renewables stocks this week.

Put together, it feels like investors are starting to see the light, even if that light doesn’t necessarily mean good things for the market as a whole. Earnings season covering calendar Q4 will provide more insight as companies have started to report in earnest.

We discuss all the data and details that mattered this week, including a US earnings preview, reversals in renewable stocks, big gains for highly shorted names, a possible bottom in the dollar, the policy backdrop in China, commodity price action, and more in this week’s Bespoke Report.

This week’s Bespoke Report newsletter is now available for members.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

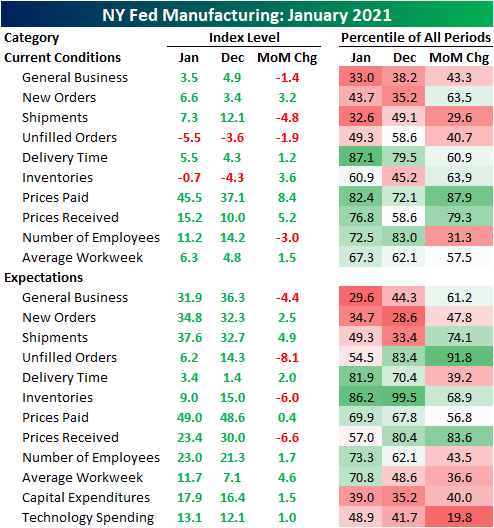

Prices on the Rise in New York

The New York Fed’s reading on the manufacturing sector released this morning showed the region’s manufacturing sector still grew in January but at a slower pace. Rather than the expected uptick to a reading of 6.0, the index fell to 3.5 from 4.9. That is the lowest reading since the last contractionary reading (those below 0) in June.

While the headline number is still consistent with growth it stands at the low end of the historic range. Similarly, demand related readings like New Orders and Shipments remain historically low, albeit still indicative of growth. Of each component in the report, only the indices for Unfilled Orders and Inventories remain in contraction. Meanwhile, in addition to the headline index, the indices for Shipments, Unfilled Orders, and Number of Employees all showed deterioration in January.

Whereas indices like New Orders and Shipments sit at lower ends of their historical ranges, those concerning employment are stronger. The index for Number of Employees showed slowing in hiring in January, though, firms were in fact continuing to take on more workers. Additionally, Average Workweek saw a bit of a bounce after declining in the final months of 2020.

The only indices to see dramatic moves higher in January concern prices. Prices Paid rose from 37.1 up to 45.5 which is the highest level since September of 2018. That 8.4 point increase was in the 87th percentile of all monthly moves for the index. Higher prices are also being passed on to customers as Prices Received was higher rising to 15.2. For that index, the level and move higher were not as dramatic. though. as it is only at the highest level since February of last year. That acceleration in rising prices is consistent with what we saw in the ISM report on the manufacturing sector last week. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 1/15/21 – Big Banks Beat, But…

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

We may have all come on different ships, but we’re in the same boat now.” – Martin Luther King Jr.

Even after an ambitious $1.9 trillion stimulus plan unveiled by President-Elect Biden last night and promises for more in the future, US futures are lower this morning while US treasury yields are lower. There’s a ton of economic data coming up this morning beginning with producer prices, Empire Manufacturing, and retail sales at 8:30. Later, we’ll get reports on industrial production, and University of Michigan consumer sentiment.

It’s a three-day weekend as US financial markets will be closed on Monday in observance of the birthday of Martin Luther King Jr (his actual birthday would have been today). Enjoy the three-day weekend, because earnings season will kick into a higher gear starting next week.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, a discussion of Biden’s stimulus plan, an update on the latest national and international COVID trends (which were all positive), and much more.

Between this morning and Tuesday morning, seven of the largest US banks and brokerage firms will be reporting results. As of this writing, the four reports to cross the wires have been Citigroup (C), JPMorgan (JPM), PNC, and Wells Fargo (WFC). Of these four, all of them beat EPS forecasts while both C and WFC missed revenue estimates. In reaction, all four stocks are currently trading lower with declines of up to 3%. On Tuesday (Monday is a holiday), we’ll get reports from Bank of America (BAC), Charles Schwab (SCHW), and Goldman Sachs (GS).

Below we have provided a snapshot from our Trend Analyzer of each of the large banks reporting today and Tuesday morning showing where they are trading relative to their trading ranges. While we’re just barely halfway into the first month of the year, all seven of these stocks have posted gains that many would have been happy with for an entire year. With the exception of PNC, every other stock in the snapshot is already up over 10% YTD with GS and WFC both up over 15%!

With these strong gains in such a short period of time, though, all of these stocks are trading at short-term overbought levels, while BAC, GS, and JPM are all more than two standard deviations above their 50-day moving average heading into today’s trading. This could be one reason all four of the banks reporting this morning are trading lower even though they all topped EPS forecasts. With high stock prices also comes high expectations, so that’s something to watch in these companies as they report.