Bespoke Stock Scores — 1/26/21

Slightly More Confident

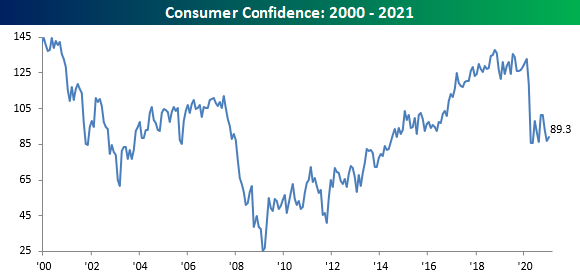

While a number of economic indicators have seen tremendous rebounds off their COVID lows, one that sticks out as a major outlier has been Consumer Confidence; that remained the case in January as well. In this month’s report, overall confidence rose from 87.1 up to 89.3 compared to expectations for an increase to 89.0. As illustrated in the chart below, after the initial plunge last Spring, Consumer Confidence has been bouncing up and down for the last ten months at levels well below the pre-Covid peak.

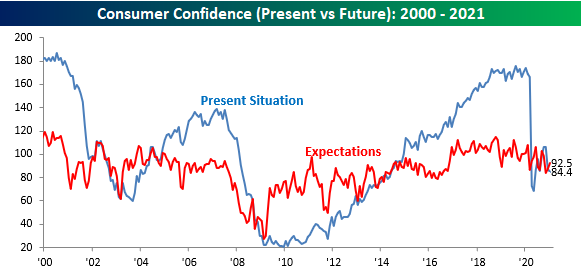

Whether you look at consumer sentiment towards present conditions or the future, it’s a similar picture. Expectations were already much lower heading into COVID, so they didn’t fall nearly as much, but after the plunge in the Present Situation Index, consumers feel roughly the same about the present as they do about the future.

With all the positive news about the vaccine rollout and the market at record highs, why aren’t consumers more confident? Chalk it up as a case of “It’s a recession when your neighbor loses his job; it’s a depression when you lose yours.” As shown in the chart below, the gauge of “Jobs Plentiful” embedded in the Consumer Confidence report remains extremely weak, and if you look closely, it’s also showing some signs of rolling over. When consumers are worried about hanging on to their jobs, it’s going to be hard for them to be confident.

There have been some crazy moves in the stock market, so we were surprised to see that consumer optimism towards the stock market actually fell this month. In this month’s survey, just 34.8% of consumers said they expect stock prices to increase, while nearly an equal number expect stock prices to decline. In this survey, at least, it doesn’t appear as though consumers are anywhere close to irrationally exuberant.

Lastly, we wanted to highlight where consumers expect interest rates to go. Back in April at the height of the pandemic, the percentage of consumers expecting interest rates to rise was nearly equal to the percentage that expected rates to fall. Since then, though, we’ve seen a steady increase in the percentage of those expecting rates to rise. Granted, when rates are at or near zero, it’s hard to expect rates to go any lower, but with little improvement in both overall confidence and the percentage of consumers viewing the job market as getting better, you wouldn’t expect to see half of all consumers anticipating a higher rate environment. Click here to view Bespoke’s premium membership options for our best research available.

Richmond Area Manufacturing Receding

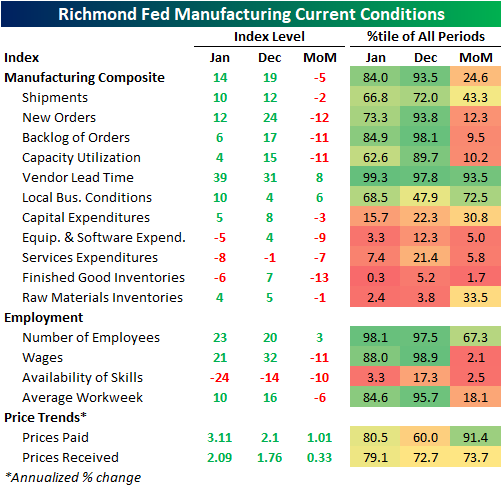

Just like yesterday’s reading out Dallas, this morning’s release of the Richmond Fed’s Manufacturing survey was disappointing relative to expectations. Forecasts were calling for the index to hold steady at the December reading of 19. Instead, it fell 5 points to the lowest level since July. Like the Dallas Fed’s survey, this reading points to a still-growing but also decelerating manufacturing sector in the Fifth District that also goes contrary to other strong readings like those from Markit and the neighboring Philly Fed; both released last week.

That decline in the headline number was shared in most of the underlying components. Of the 17 sub-indices, 12 were lower month over month. For some of these, those declines were historically large and brought the indices to the bottom percentiles of historical readings. Currently, there are now four indices indicating contraction. Two have to do with expenditures, one with finished good inventories, and the other for the availability of skills. As for the indices for future expectations, breadth was similarly weak.

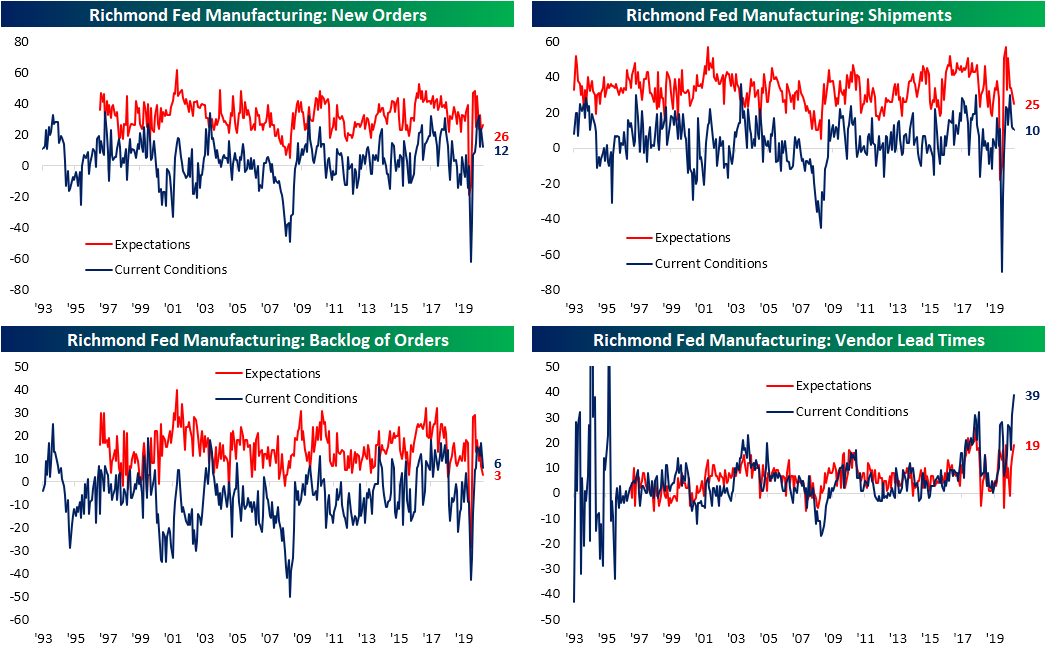

New Orders erased all of the move higher from December as it came in at 12, just as it did in November. With New Orders growing at a slower pace, the Backlog of Orders likewise grew at a more muted pace. That index fell to 6, the lowest reading since August. The 11 point MoM drop was also in the bottom decile of all monthly moves. Given the deceleration of these two, Shipments likewise pulled back. The index for Shipments fell to 10, the lowest reading since the last contractionary reading back in June. While that slowdown in shipments is likely in part due to some slowing in demand, supply issues also appear to be a potential issue. Higher readings in the Vendor Lead Time index means that suppliers’ products are taking longer to reach the surveyed manufacturers. This month, the index rose to a reading of 39. That is in the top 1% of all readings in the history of the survey. The only higher readings came early in the survey’s life in December of 1994 (282) and January of 1996 (75).

As orders still grow, manufacturers are taking on more employees. The index for the Number of Employees rose from 20 in December to 23 in January. That ties the pandemic highs from September and October for the highest reading since August of 2018. Similarly, the index for expectations for Number of Employees made its way higher in January. At 34, the index has only been higher once back in September. Although employers are taking on more people and expect to keep doing so at a historic rate, both of the indices for Wages and the Average Workweek were lower. Regardless, they both remain at historically strong levels and consistent with further growth. Additionally, one of the components of the report that is the most at an extreme is the index for Availability of Skills. The index dropped another 10 points in January and now sits in the bottom 3% of all readings since the series begins just over a decade ago. In other words, firms are experiencing a historic shortage of labor with desired skills.

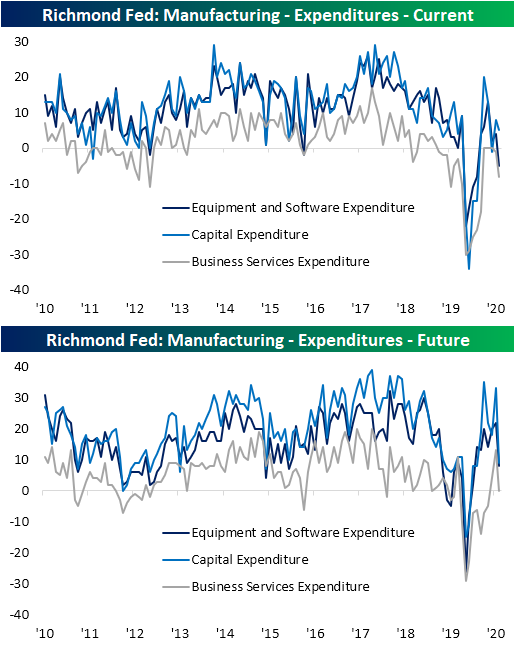

Contrary to the increase in employment, firms are cutting costs elsewhere. For the current conditions indices of the three expenditure related topics, each one was lower in January with Equipment and Software Expenditure and Business Services Expenditure both falling into contractionary territory.

Finally, just as we have seen in other manufacturing surveys, prices are showing further acceleration for both prices paid and received. Prices paid came in at the highest level since April of 2019 and prices received at the highest level in 11 months. Click here to view Bespoke’s premium membership options for our best research available.

Chart of The Day: Looking For REITurns After DHI Blows The Doors Off

B.I.G. Tips: Charts We’re Watching — 1/26/21

Bespoke’s Morning Lineup – 1/26/21 – Short Circuit

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Every once in a while, the market does something so stupid it takes your breath away.” – Jim Cramer

We’re continuing to see some crazy moves in the market once again this morning. Take a recent tweet from Elon Musk where he said that he ‘kinda’ loves Etsy. In reaction, the stock is up over 8% in the pre-market. Etsy has a market cap of about $25 billion, so that tweet alone was worth about $2 billion.

Elsewhere in the markets, US futures are higher on the heels of a rally in Europe. The overnight pattern heading into this morning is the complete opposite of yesterday. Whereas yesterday it was Europe that was trading lower after a strong session in Asia, today its Europe rallying after a so-so Asia session.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports in Asia and Europe, Economic data out of Asia, an update on the latest national and international COVID trends, and much more.

Shares of GameStop (GME) are up another 19% in the pre-market this morning, and while a move like that in what just a few weeks ago was considered a washed-up company would normally raise eyebrows, but after the insanity we’ve witnessed in the stock over the last few days, today’s move is nothing. While this year’s moves in GME have been the biggest outlier, it’s part of a broader trend where traders have been targetting stocks with the highest short interest.

The chart below is from Monday’s Closer and shows the performance of Russell 3000 stocks so far this year grouped into deciles based on short interest. There has been a clear trend where stocks with higher short interest have outperformed their peers with lower short interest, but the most heavily shorted stocks stand in a league of their own gaining 22%! The deciles of stocks with the second and third highest average short interest levels are also both up over 10%, but they’re only up half as much as the most heavily shorted stocks.

So, which stocks make up this basket of most heavily shorted stocks? We don’t have enough space to list all of them, but in the table below we show the 16 stocks in the Russell 3000 that had more than 40% of their float sold short as of year-end. Topping the list is GameStop (GME) which had more than 100% of its float sold short as of year-end. Year to date, that stock is up an incredible 307%. The other stocks, however, haven’t been slouches either. Every single one of them is up at least 10% YTD, and half of them are up at least 50%. 50%!!!!

Daily Sector Snapshot — 1/25/21

Disappointment Out of Dallas

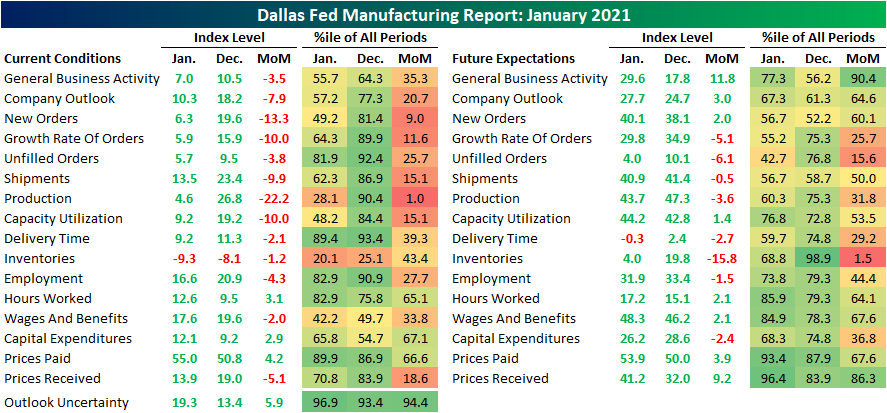

Following very strong readings from the Philly Fed and preliminary Markit PMIs last week, the Dallas Fed’s Manufacturing report released this morning disappointed. The headline index came in at 7 compared to forecasts of a reading of 12 and last month’s adjusted reading of 10.5. That reading is still consistent with overall growth in the region’s manufacturing sector, but at a slower pace as the index fell to the lowest level since August.

The index for General Business Activity was far from being the only one to fall month over month. As shown below, breadth in this month’s report was terrible. Of the 17 different indices for current conditions, 13 fell month over month. That brought several of these readings from the top decile of historical readings down to the middle of their historical ranges. While the pullbacks were significant, only inventories remain in contraction. Meanwhile, breadth was a little bit better for the indices for future expectations.

One area that saw declines across the board were the indices concerning demand. As shown below, the indices for New Orders, New Order Growth Rate, Unfilled Orders, and Shipments were all lower in January. All of these are now at the lowest levels since June, or July in the case of order growth rate. These lower readings are still indicative of growth, but at a slower rate.

Just as we have seen in other recent manufacturing reports, survey respondents are reporting price increases. The index for prices paid rose to a reading of 55 from 50.8 in December. That is nearly in the top decile of all readings as the index sits at the highest level since April of 2011. The index for future expectations similarly ticked higher reaching its highest level since March of 2012.

While prices paid were higher, the same sort of acceleration in prices was not observed for prices received. The index for prices received fell from 19 down to 13.9. Although lower month over month, that is still around some of the highest levels of the past couple of years. Additionally, expectations are calling for prices received to follow the path of prices paid. The index for future prices received rose to the highest level since 2017 which was also in the top 5% of all readings.

Similar to prices received, the current conditions index for wages and benefits fell this month, but the index for future expectations rose much more sharply and to one of the highest readings of the past couple of years. In other words, although price hikes were not observed, they are foreseen on the horizon. For wages and benefits, that expected uptick comes as hiring continues with the index of employment remaining in expansionary territory. Additionally, hours worked rose this month from 9.5 to 12.6; the highest in September of 2018. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: S&P 500 Stocks Falling Below Their Moving Averages

Bespoke’s Morning Lineup – 1/25/21 – More Crazy Moves Beneath the Surface

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” – Robert Kiyosaki

It’s a mixed picture in futures markets this morning as the S&P 500 is set to open marginally higher while the Nasdaq is indicated up about 1%. At the individual stock level, the crazy moves of last week are continuing today as GameStop (GME) is up over 50% again, and a number of other high short interest and story stocks are trading up sharply in the pre-market. Economic data is on the light side this morning with just the Chicago Fed National Activity Index and the Dallas Fed Manufacturing Index.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, German sentiment data, an update on the latest national and international COVID trends, and much more.

The year is just three weeks old, but already we’ve seen some big moves in individual sectors. With its gain of 11%, the Energy sector has stolen the show, but the 5% gain in the Consumer Discretionary sector is nothing to sneeze at either. On the other end of the spectrum, Consumer Staples has already given up 3.8% this year while Industrials is down just marginally (-0.2%). The broader S&P 500 as a whole is up a respectable 2.3% on the year, and four other sectors – Materials, Financials, Technology, and Telecom Services – all have YTD gains within half of one percent of the overall market.

The gap of nearly 15 percentage points between the best and worst-performing sectors so far this year is one of the larger ones we have seen through the first 14 trading days of a year dating back to 1990. As shown in the chart below, just three years (2009, 2001, and 2000) have seen larger disparities to start the year while a number of other years have seen disparities nearly but not quite as wide as the one this year (1992, 1999, and 2006).