The Bespoke Report – 1/29/21 – “Power to the Players”

This week’s Bespoke Report newsletter is now available for subscribers. Here’s the intro:

Just when you thought you saw it all, along comes the saga of GameStop (GME). The stock’s rally, which actually has been going on for months but really went into orbit in the last few weeks, seems to make no fundamental sense. GME is basically the Blockbuster of video games. It sells physical versions of video games that most players are now buying digitally or streaming. None of this was news to anyone paying attention, and the stock had been a favorite of the short-selling community for years. If you were just coming to the eureka moment that the GME business model faced structural headwinds, you probably shouldn’t be in the investment business.

With such a stiff secular headwind howling in its face, GME’s surge has been completely written off as market manipulation and a concerted effort by the reddit community to take out the short-sellers. And when you see charts like this, it’s not fundamentals driving the stock. The trading in GME was originally written off as a bunch of ‘video-game playing yahoos’ on message boards blindly following each other, but in the story of GME that has emerged, there was a method to the madness. Fitting to GameStop’s motto, it was a “Power to the Players” moment, where we were reminded of the quote, “Within every lie, there is usually a hint of truth, and within every truth, there is always a hint of a lie.”

To read this week’s full newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Daily Sector Snapshot — 1/29/21

B.I.G. Tips – Retail Tossed Out With The Trash

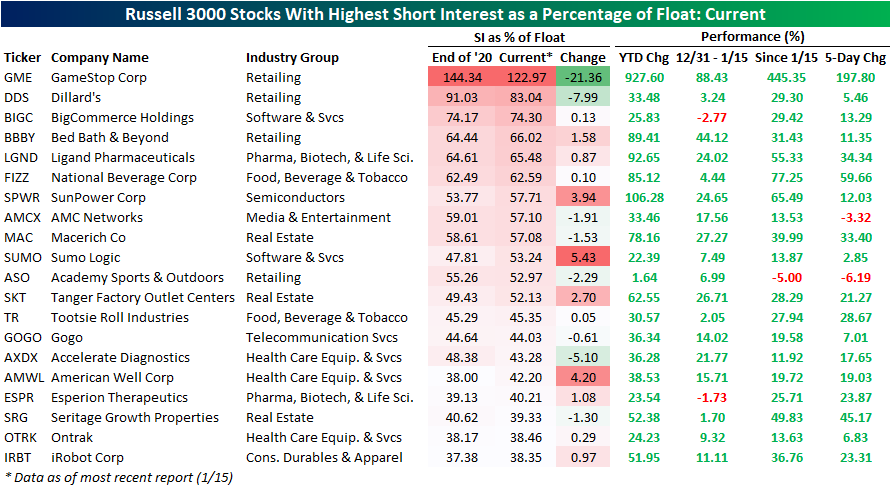

Most Heavily Shorted Stocks at the End of 2020 and Now

In the table below, we show the 20 stocks in the Russell 3000 that currently have the highest short interest as a percentage of float. It should come as no surprise that GameStop (GME) still tops that list with 122.97% of float short as of the most recent data for mid-month. That is even after a 21.36 percentage point drop from the end of 2020 when 144.34% of shares were short. It was also the most heavily shorted stock then. The runner-up is Dillard’s (DDS) which currently has 83.04% of shares sold short compared to over 90% at the end of 2020. Again, despite that sizeable decline in the percentage of shares sold short, it was also the second most heavily shorted stock one month ago. Of the rest of the top 20, there are six other names with lower short interest than the end of last year. Looking across the rest of the most heavily shorted stocks, Sumo Logic (SUMO), American Well Corp (AMWL), and Sunpower (SPWR) are the stocks that have seen their short interest as a percentage of equity float rise the most. In terms of stock price performance, SPWR has been the one with the biggest rally having doubled YTD. The only other stock that has doubled YTD in this cohort has been GME.

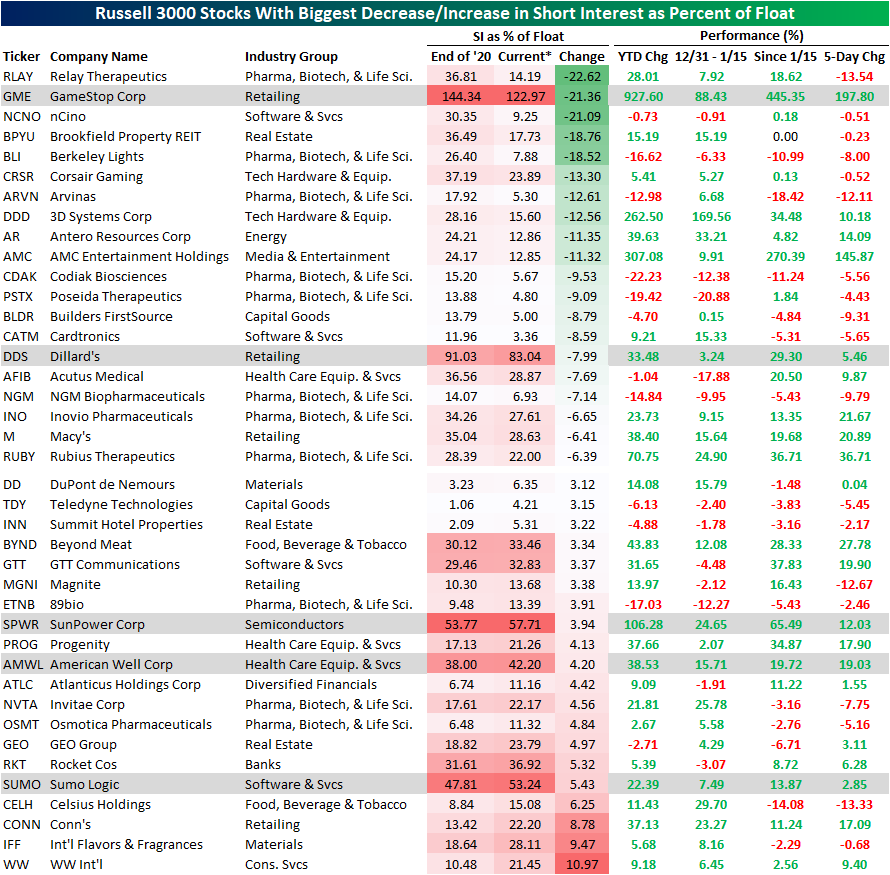

In the table below, we show the stocks that have seen the biggest changes in the percent of shares sold short between the end of 2020 and the most recent data as of January 15th. Those currently in the top 20 most shorted stocks are highlighted in gray. Across the entire Russell 3,000, 1,777 stocks have seen their short interest as a percent of short move lower in the two week period from the end of December to mid-January. As shown, even after the massive short squeeze that has taken place, GME is actually not the stock that has seen the biggest decline in shorts. Relay Therapeutics (RLAY) holds that title with a 22.62 percentage point decline. That is even though the stock has experienced a relatively smaller move than some of its peers. Granted, a number of other stocks like nCino (NCNO) and Berkeley Lights (BPYU) to name a few have actually moved lower so far in 2020 and have also seen their short interest decline significantly. On the other end of the spectrum, WW International (WW) has seen its short interest rise the most. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 1/29/21 – One Down…

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Look at market fluctuations as your friend rather than your enemy. Profit from folly rather than participate in it.” – Warren Buffett

We’re just about through the first month of 2021, and if you thought this year would be less chaotic than the last, don’t hold your breath. In a fitting end to what has been a crazy month in the markets, shares of GameStop (GME) and the other heavily shorted stocks out there are rallying on news that Robinhood would allow clients to trade the stocks again. The company drew on its credit lines and raised new capital last night to shore up its balance sheet, so hopefully, that will prevent a repeat of yesterday’s chaos.

In markets today, futures were already lower but are near their lows of the morning after JNJ released preliminary results of its COVID vaccine. While the initial numbers showed that the vaccine was effective, the overall efficacy doesn’t appear to be as strong as the Pfizer and Moderna vaccines already in circulation. One difference between the JNJ study and others, though, is that JNJ’s study took place during a period when other variants of the virus were in circulation, so more details on this will likely be forthcoming.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, economic data out of Europe, an update on the latest national and international COVID trends, and much more.

Shares of Caterpillar (CAT) are bucking the negative tone this morning after the company reported positive earnings results. One positive aspect of CAT’s results for the broader economy was that machinery sales saw a significant improvement. While overall machinery sales on a three-month average basis are still down on a global basis, they improved from a decline of 11% to a drop of just 2%. That’s the least negative level since November 2019.

The Bespoke 50 Top Growth Stocks — 1/28/21

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 444.8% excluding dividends, commissions, or fees. Over the same period, the S&P 500 is up in price by 174.2%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

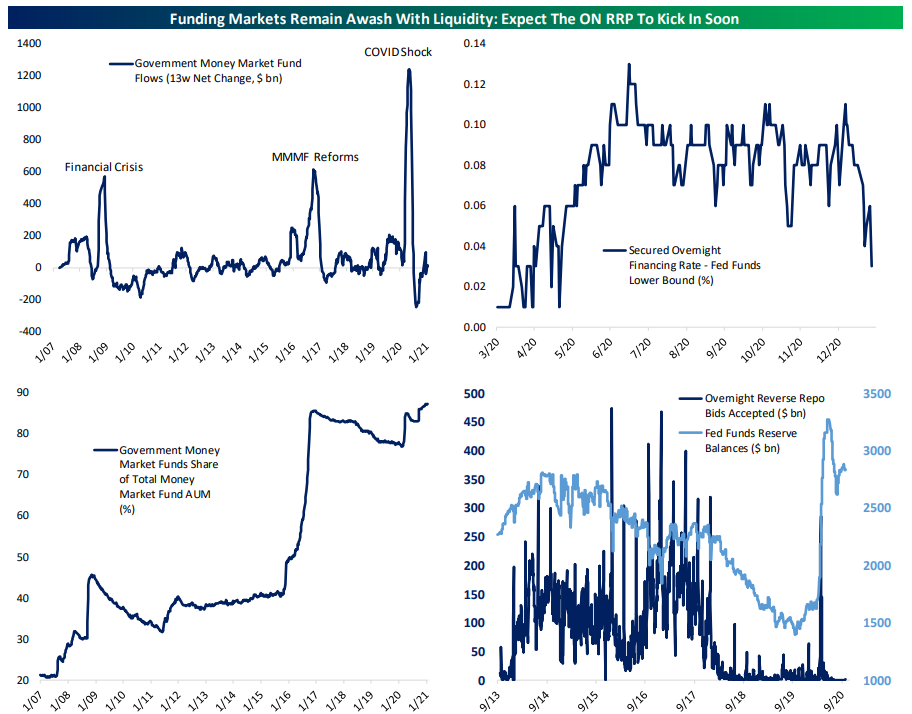

Funding Markets Full of Cash

US funding markets are awash with liquidity thanks to ongoing QE purchases by the Fed and the progression of fiscal policy since the end of the year, as well as normal seasonal tailwinds that see more liquidity after year-end balance sheet constraints would roll off. Funding markets refer to collateralized, short-term lending via repo and related wholesale cash transactions.

Government money market funds that are allowed to conduct repo operations as well as buying Treasury and Agency debt are seeing roughly typical inflows, but those come on top of record share of overall money market funds. As a result, repo rates have been plunging. The secured overnight financing rate, which tracks the volume-weighted general collateral repo rate has fallen to 3 basis points above the bottom of the Fed Funds target range. While repo rates falling below the Fed Funds target range wouldn’t be a catastrophe and some parts of the market have gotten there, it’s not in the FOMC’s interest to have funding rates trading far outside its target policy rate range on a regular basis.

The solution already exists, of course: the NY Fed has a standing overnight reverse repo facility first introduced back in 2013 which is likely to start draining cash as investors seek higher returns than the repo markets offer. Reserve scarcity, which roll-off brought to bear in 2018 and 2019, is now reserve plenty, and so many reserves exist that the NY Fed will start draining them with reverse repos. Reserve balances will continue to grow this year thanks to QE purchases and an expected decline in the balance of the federal government’s transaction account at the Federal Reserve. Like what you see? Click here for a free trial to any of Bespoke’s premium membership options, including our Fixed Income Weekly note that features market analysis of this kind.

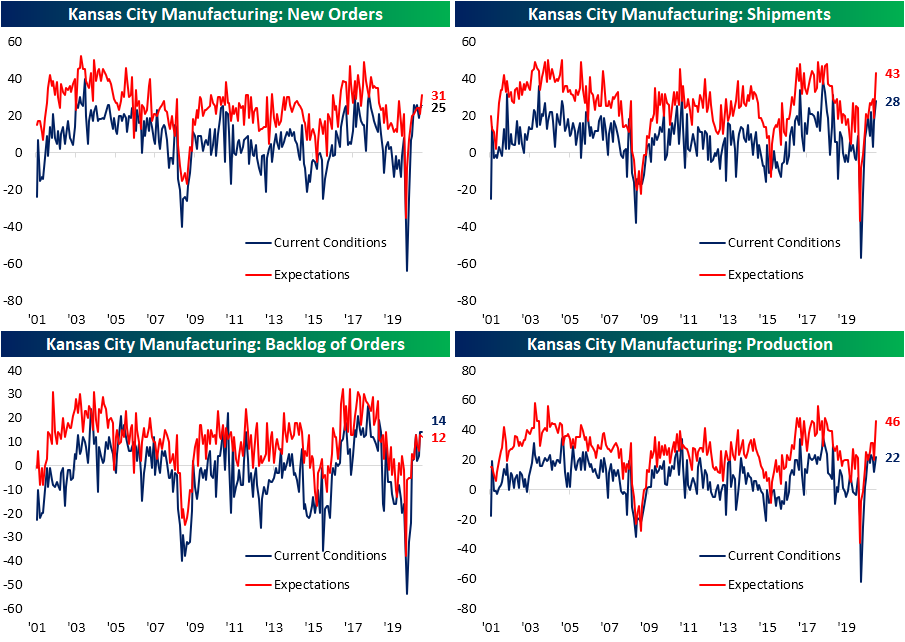

New High for the Kansas City Fed

Similar to the Philly Fed’s index and Markit’s preliminary reading on the manufacturing sector, the Kansas City Fed’s manufacturing index exceeded expectations with a strong reading in January. The index was expected to decline to 13 from last month’s reading of 14. Instead, the index rose to 17 which is a new high for the pandemic period and is also the highest level since July of 2018. Similarly, the index for expectations was considerably higher as it now sits at the highest level since September of 2018. These readings are consistent with further acceleration in the growth of the region’s manufacturing economy.

Breadth across the report’s components was very strong with all but two (Backlog of Orders and Materials Inventories) higher month over month. Only the index for Finished Good Inventories is in contraction, but even this index saw a move higher that stood in the top 94% of all monthly changes. Additionally, a number of components are in the top decile of their historical ranges. The indices for future expectations, on the other hand, were not quite as strong, but those also generally point to an optimistic outlook.

Demand appears to be healthy as the indices for New Orders, Backlog of Orders, Shipments, and Production all came in at the top 10% of historical readings. While New Orders and Production sit just below their highs from October, Shipments and Backlog of Orders are at the highest levels since November of 2018. As for expectations, each of these indices with the exception of Backlog of Orders reached the highest levels since 2018 as well.

Just as we have seen in various other readings on the manufacturing sector recently, prices continue to rise for both inputs and final goods. The reading on Prices Paid for Raw Materials rose to a new high of 65. That is a level that has not been seen since April of 2011. As for prices passed onto customers, the index for Prices Received for Finished Products did not see as dramatic of a move higher. With an increase of 10 points (to 19) in January, it is at the highest level in two years. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Weekly Sector Snapshot — 1/28/21

Shorts and Bad Breadth Shakes Sentiment

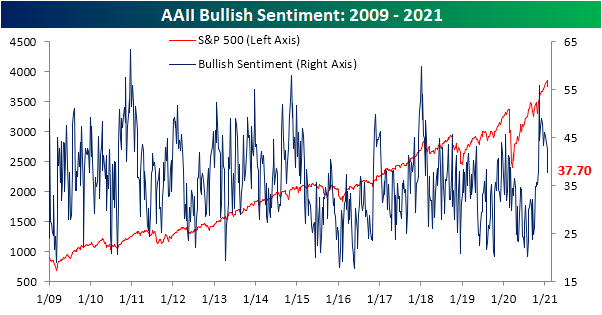

Outside of the outrageous moves of heavily shorted names, breadth in recent days has actually been on the weak side. As a result of weakening breadth coupled with people questioning the likelihood of a bubble given the oddity of those shorted stocks’ moves, investors appear to have turned a bit more cautious. AAII’s reading on bullish sentiment dropped 4.8 percentage points from 42.5% down to 37.7%. That is the first sub-40 reading since the first week of November and is the lowest reading since the last week of October. The week over week decline was also the largest since the 11.49 percentage point decile coming off the recent peak in mid-November.

The losses in bullish sentiment were met with a 3.8 percentage point increase in bearish sentiment. That brings bearish sentiment to the highest level since the week of October 8th. Additionally, this was a fourth consecutive week that bearish sentiment has risen; the longest such streak since four weeks of increases during the bear market from the weeks of February 20th through March 12th.

Sentiment has been increasingly less in favor of the bullish camp over the past few weeks, but this week marked the first time since the week of October 15th that bullish sentiment was outweighed by bearish sentiment.

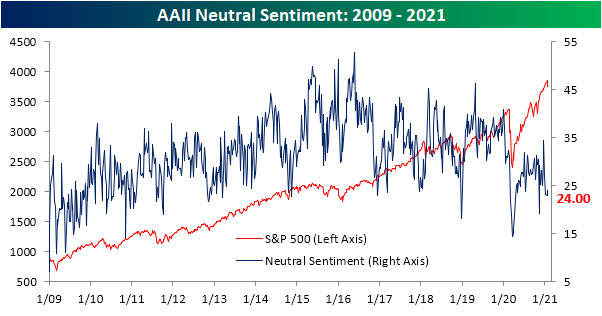

Not all of the losses to bullish sentiment went to bears though. Neutral sentiment was likewise higher with 24% of respondents reporting as such. While higher, that is still below where the reading has stood for most of the past year. Click here to view Bespoke’s premium membership options for our best research available.