Bespoke’s Morning Lineup – 8/9/21 – Happy Mondays

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

We felt that another Warren Buffett quote was in the cards this morning given that Berkshire reported earnings over the weekend. Shares of BRK/B are trading up 1% in the pre-market, so thus far it appears that investors liked what they saw out of Omaha.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including key earnings reports out of Europe and the latest US and international COVID trends.

Also, make sure to check out our Daily Sector Snapshot.

The dog days of August are here, so enjoy it while it lasts. As shown in the chart below of the average absolute daily change of the S&P 500 throughout the calendar year, we remain in a period of low volatility from a seasonal perspective, but things start to really ramp up once we get to September.

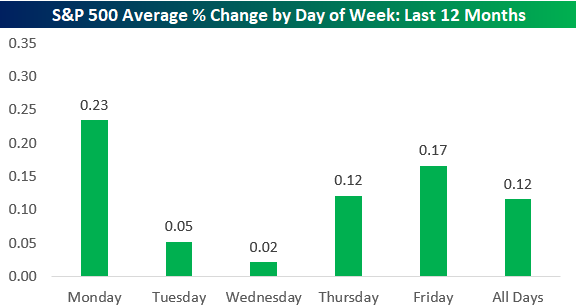

Monday mornings aren’t known for bringing out a lot of cheers and joy, but for the market at least, Mondays have been strong lately. As shown below, over the last 12 months, Monday has actually been the best day of the trading week for the S&P 500 with an average gain of 0.23%.

Want to see more charts like this? Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Bespoke Brunch Reads: 8/8/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Crypto

What if bitcoin went to zero? (The Economist)

An exploration of a hypothetical decline in bitcoin to $0, with ripple effects not just inside the crypto universe but across the global economy. [Link; registration required]

Tech

Ford slated to spend more on EVs than on internal combustion engine vehicles in 2023 by Jordyn Grzelewski (The Detroit News)

R&D is shifting rapidly away from ICE engines and towards EVs, with the iconic American car and truck brand spending more on electrical vehicle development as soon as 2023. [Link]

Tech Startup Financing Hits Records as Giant Funds Dwarf Venture Capitalists by Heather Somerville (WSJ)

Early rounds of venture funding are no longer the lonely preserve of VCs and angel investors, with other much larger pools of capital that typically stick with more staid investments playing a much larger role in early financing. [Link; paywall]

Apple’s iPhones Will Include New Tools to Flag Child Sexual Abuse by Jack Nicas (NYT)

Changes to iCloud and iMessage will allow Apple to identify illegal child pornographic material (a laudable goal) while also opening up previously ironclad safety and privacy infrastructure to government surveillance. [Link; soft paywall]

A Conspiracy To Kill IE6 (Chris Zacharias)

The story of how a rogue engineering crew inside YouTube destroyed Internet Explorer 6 with a simple banner announcement. [Link]

Poppers

This Man Does Not Make Poppers by David Mack (BuzzFeed)

A series of legal loopholes and decisions to look the other way by regulators have left poppers, a staple of the gay party scene, one of the only party drugs that can be widely purchased. [Link]

COVID

How COVID-19 vaccine supply chains emerged in the midst of a pandemic by Chad P. Bown and Thomas J. Bollyky (PIIE)

A deep investigation into how vaccine production supply chains were developed and scaled, with detailed discussion of government and private sector entities and activity in the process. [Link; 60 page PDF]

Main Street Health July 2021 (Homebase)

With the Delta variant ramping up, employment and open locations have slowed, and there wasn’t any evidence that early halts to unemployment benefits in a range of states had a positive impact on employment at small businesses. [Link; 17 page PDF]

Olympics

When All Else Fails, It’s Time to See the Olympic Body Mechanic by Scott Cacciola (NYT)

US track and field athletes have been turning to one of the best-kept secrets in performance sports, a chiropractor with a very unusual and effective approach to dealing with nagging injuries of all kinds. [Link; soft paywall]

Pricey Travel

Disney Releases Sample 3-Day Itinerary of Star Wars: Galactic Starcruiser Hotel Experience by Shannen Michaelsen (WDWNT)

Two days at the newest and most detailed attraction at Disneyworld are going to run into the thousands of dollars for a family of four, but the action-packed schedule may be well worth it. [Link]

The ‘$27.85 Beer’: High-Flying Prices at Airports Spur Port Authority Concessions Audit Order by Jose Martinez and Aria Velasquez (The City)

Airport vendor prices are famously high, but the gouging underway at LaGuardia and other New York airports is on a truly different level. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Daily Sector Snapshot — 8/6/21

The Bespoke Report – 8/6/21

This week’s Bespoke Report newsletter is now available for members.

Summer Fridays in August are typically quiet as a lot of traders and investors have better things on their minds than the stock market. Better things to do than watch the stock market? That’s hard to believe! What was looking like an extremely quiet week turned out to simply be a quiet one with the release of Friday’s stronger-than-expected July Non-Farm Payrolls. But heading into the closing bell, the S&P 500 was basically flat while the Nasdaq was lower. As we headed into the closing bell for the week, though, the old cliché to never short a dull market proved true again as the US equity market saw modest but broad-based gains on the week.

We cover market breadth, technicals, earnings, the economy, and much more in our full Bespoke Report newsletter. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

SPY Snoozefest Coming To An End?

In today’s Morning Lineup, we noted how the major US equity indices have been a bit sleepy with each one having risen less than 1% over the five days ending yesterday. As shown below, that lack of volatility actually extends back to the prior week as well. The S&P 500 (SPY) has generally trended in a sideways range over the past two weeks. That was until today. While yesterday’s move higher brought SPY to the high end of that recent range, the reaction to the strong NFP report is marking a more distinct breakout.

As for just how narrow of a range SPY has traded in, in the charts below we show the distance (in percentage terms) between the intraday high and low over a rolling ten trading day span. While today’s move higher lifted the reading to 1.59%, as of yesterday’s close there was only 1.34% between yesterday’s intraday high and last Tuesday’s intraday low. Going back through the history of SPY, there have only been 146 other days, or just 2% of all days, in which that range was less than 1.5%. In fact, the last time that there was as narrow of a ten-day range as yesterday’s reading was the first trading day of 2018. Click here to view Bespoke’s premium membership options.

Bonds Break Down

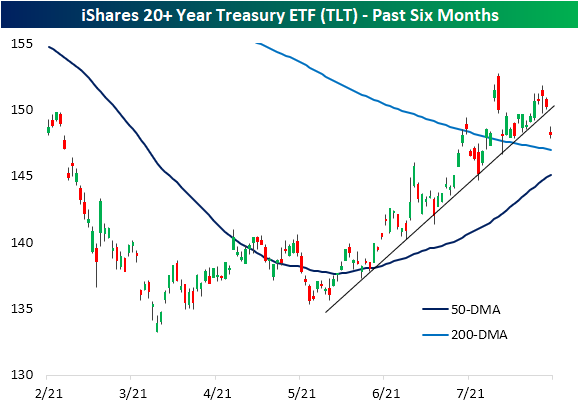

In reaction to today’s better than expected Nonfarm Payrolls report, perhaps one of the most notable moves has been in rates. Whereas the S&P 500 is up a modest 0.15%, the iShares 20+ Year Treasury ETF (TLT) is falling 1.5% as of this writing and is on pace for its biggest single-day decline since June 21st. From a charting perspective, the decline is even more notable. Today’s drop has smashed through the uptrend line that had been in place since the spring. With that line broken, TLT’s 50-DMA is likely to be the next area of support to watch.

As for investment-grade corporate bonds, it is the same story. The iShares Investment Grade Corporate Bond ETF (LQD) is down 0.73% today for its worst day since March 12th when it fell over 1%. As with TLT, that decline has broken the ETF’s uptrend that has been in place for most of the past year, and the next area of potential support is its moving averages. More specifically, LQD is closing in on its 200-DMA which recently crossed above the 50-DMA. Click here to view Bespoke’s premium membership options.

Bespoke’s Top Earnings Triple Plays — 8/6/21

Bespoke’s Morning Lineup – 8/6/21 – Heads We Win, Tails We Win

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Not only our future economic soundness but the very soundness of our democratic institutions depends on the determination of our government to give employment to idle men.” – Franklin D Roosevelt

Economists are expecting to see this morning that the US economy put nearly 900K formerly idle men and women back into the workforce, but after Wednesday’s disappointing ADP report, that’s not such a sure thing anymore. Heading into the report, futures are eerily quiet as the S&P 500, Nasdaq, Dow, and Russell 2000 are all very close to the unchanged level. What makes the quiet even more notable is that yesterday was one of the busiest reporting days of the earnings season. Even bitcoin is down less than 1%. Oh well, it is a Friday in August. Aren’t markets supposed to be quiet? Once the report is released, we’d expect to see some increased movement in futures as a strong report will likely make the case for an earlier taper from the FOMC, while an ADP-like miss would push that timeline out further.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including some trends related to employment heading into today’s Non-Farm Payrolls report, the latest US and international COVID trends including our vaccination trackers, and much more.

Not only has it been a quiet morning in the market, but the last week hasn’t exactly been a thriller. As shown in the snapshot below of major US index ETFs, not a single one has moved up or down 1% in the last week, and outside of the Nasdaq 100 (QQQ), none have actually even moved more than 0.50%. You can all see this in the trading range chart to the right where the only ETF where a ‘tail’ is even visible is in the Dow Jones (DIA). One other thing worth mentioning is that for all the talk about divergences between YTD performance, most index ETFs are up between 15% and 20% YTD. The only real outlier is the Russell 2000 (IWM) which is up a mere 13.6% YTD. We think this illustrates what have been smooth rotations within the market as leadership shifts.