More New Lows for Claims

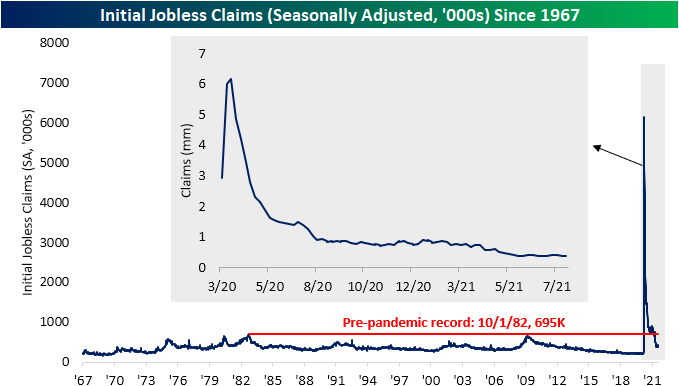

Initial jobless claims matched expectations at 375K this week. That is a 12K decline from last week’s upwardly revised level of 387K (originally 385K) while also marking the third week in a row in which initial claims have fallen. Additionally, that brings claims to the lowest level since the start of the pandemic.

Taking into account both unadjusted regular state and pandemic unemployment assistance (PUA) programs, claims were actually slightly higher this week. Combined claims rose from 420.13K to 425.07K. Albeit higher, that is still the second-lowest level of the pandemic period. The slight increase was entirely a result of PUA claims which rose by nearly 10K. Most of that increase was on account of a 6K increase in Michigan. Meanwhile, non-seasonally adjusted regular state claims continue to have seasonal tailwinds, falling by 5.2K.

Continuing claims showed further improvement falling to 2.866 million at the end of July versus 2.98 million the prior week. With back-to-back declines, continuing claims are once again at pandemic lows. Florida, Texas, and New Jersey were the states to report the largest declines.

Including all programs adds another week’s lag to continuing claims meaning the most recent print is through the week of July 23rd. Total combined claims fell to 12.07 million that week with sizable declines across programs. Pandemic Emergency Unemployment Compensation (PEUC) saw the largest decline with claims falling 393.6K that week, and PUA and regular state claims were also not far behind with over 300K declines of their own. Those offset a 159.2K increase from the extended benefits program. Overall, while continuing claims broadly continue to trend lower, there are still 8.7 million claims between pandemic programs (PUA and PEUC) now with less than a month until the programs’ expiration. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup — 8/12/21

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If I knew I’d live this long, I would have taken better care of myself.” – Mickey Mantle

On this day in 1974, Yankees icons and close friends Mickey Mantle and Whitey Ford became the first teammates inducted into the Baseball Hall of Fame on the same day. Twenty years later on August 12th, 1994, MLB players would go on strike, resulting in the World Series not being played for the first time in 90 years.

Investors are awaiting weekly initial jobless claims due out at 8:30 AM ET. Ahead of the print, the 10-Year Treasury yield is up 2 bps to 1.35%. Financials have lit fire this month as the 10-Year yield has risen more than 20 bps from a low of 1.12% on August 4th. The Financials ETF (XLF) and big banks like Morgan Stanley (MS), Goldman (GS), and JP Morgan (JPM) should continue to trade in line with bond yields.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Also, make sure to check out our Daily Sector Snapshot.

As mentioned earlier, long-dated Treasury yields have risen sharply over the last week or two, which means bond prices have traded lower. Below is a snapshot of the fixed income ETFs in our Trend Analyzer tool that have fallen the most over the last week (see the entire screen here). As shown, even after the big pullback, most of these ETFs remain above their 50-day moving averages. They could bounce right off of support at their 50-DMAs and yields could go right back to falling again. However, there’s also still plenty of room for these to fall before they reach oversold or extreme oversold levels. If bond ETFs keep falling, Financials stocks should keep rallying.

The Financials sector had been in stuck in a rut for the past few months, but the huge rally this week actually left the sector at a new all-time closing high yesterday. This closing high “confirms” the sector’s uptrend, and the bull market can continue on. We’ll be watching to see if the sector can leg significantly higher and establish a new trading range. Of course, that will likely depend on the direction of Treasury yields.

Want to see more charts like this? Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Daily Sector Snapshot — 8/11/21

Chart of the Day: Infrastructure Breakout

Cyclical Sector Turnaround

In today’s Morning Lineup, we noted the charts of the sector ETFs for Materials (XLB), Financials (XLF), and Industrials (XLI) and how each sector has begun to catch a bid this month. Of the eleven sectors, Financials are up the most in August with just under a 6% gain. Utilities are actually the runner-up with a 3.09% gain in spite of the coincident uptick in rates this month. Materials and Industrials are also up nicely with gains of 2.42% and 1.55%, respectively. Shown another way, below are relative strength charts of each of these sectors from our Sector Snapshot. When these lines are rising, they indicate the sector is outperforming the broader market and vice versa when the line is trending lower. Recently, each of these sectors have seen sharp turns higher after having been in downtrends for most of the spring and summer. In the case of Financials and Materials, those downtrends actually broke multi-month uptrends that had been in place since late 2020. The bounce in the relative strength line of Industrials, on the other hand, comes as it tested the past year’s uptrend line. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup — 8/11/21

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Blessed are the young, for they shall inherit the national debt.” – Herbert Hoover

US equity futures are bouncing a bit after the headline monthly CPI released at 8:30 AM ET came right inline with expectations.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including activity in Washington DC, key earnings reports out of Europe and the latest US and international COVID trends.

Also, make sure to check out our Daily Sector Snapshot.

While the S&P 500 has been making new highs in a steady uptrend for the last couple of months, international equities have yet to really break out of their sideways ranges. That is, until this week. As shown below, the Bloomberg World equities index has just broken out to new highs above what proved to be a pretty stiff resistance level. This is a positive technical development.

As we have highlighted numerous times in recent weeks and months, international equities have been underperforming US equities for more than a decade, and at some point we expect this trend to reverse in a secular fashion.

Want to see more charts like this? Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Daily Sector Snapshot — 8/10/21

Bespoke Stock Scores — 8/10/21

Chart of the Day: Earnings Season Rundown

Labor Concerns Grow and Inflation Worries Ease For Small Businesses

The NFIB released their July reading on small business sentiment this morning. In today’s Morning Lineup, we highlighted the strength in labor market indicators included in the report. Included in that was the percentage of survey respondents reporting either the cost or quality of labor as their most important problem. As shown below, 9% and 26% reported as such respectively. On a combined basis, that is 35% of respondents reporting either of these issues as their biggest problem. That is the highest percentage since November 2019 when 36% reported as such. Government-related concerns came in as the biggest problem for the next largest share of businesses. 31% reported either taxes (19%) or government requirements and red tape (12%) as their biggest problems, up from 29% on a combined basis last month. While higher month over month, that is still multiple percentage points below the recent high of 35% from May. The other biggest issue that comes in behind labor and government is inflation. 11% of respondents reported that they worry about cost pressures which is actually down from 13% the prior month. While improved, that is still one of the highest readings to date outside of the string of record or near-record readings in 2008. Click here to view Bespoke’s premium membership options.