Bespoke Brunch Reads: 8/15/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Vaccines

Job Postings Requiring Vaccination Climb (Indeed)

Indeed’s Hiring Lab is tracking a sharp increase in the number of job postings on the site that require vaccination. Almost 1250 posts per million require vaccination, versus virtually none earlier this year. [Link; registration required]

Suspected saline switch sparks vaccine stir in Germany (Reuters)

A German nurse is suspected of injecting some patients with saline solution instead of actual vaccine has sparked a call for thousands to get re-vaccinated out of an abundance of caution. [Link]

Risk Appetite

How Millennial Investors Lost Millions on Bill Ackman’s SPAC by Michelle Celarier (Institutional Investor)

Desperate to get in on the next big thing, numerous small investors loaded up on calls tied to pre-deal SPACs, only to be gravely disappointed when no post-deal pop emerged. [Link]

Messi joins crypto craze as gets part of PSG fee in fan tokens by Simon Evans (Reuters)

Former FC Barcelona star Lionel Messi agreed to take part of his fee for signing with Paris St Germain in the form of crypto tokens. The fan tokens allow fans to vote on minor decisions related to clubs that issue them. [Link]

Mother Necessity

In Nebraska, a weekly paper is filling its community’s need for news — and booze by Hanaa’ Tameez (Nieman Lab)

When faced with a lack of revenue and a 30 mile drive to the nearest liquor store, a Nebraska paper decided to start selling hooch. The results keep their neighbors both properly lubricated and informed. [Link]

McDonald’s Pushes Diners to Use Trays as Food Bags Run Tight by Heather Haddon (WSJ)

With most customers getting food to go and supplies of paper bags jammed up, workers are having to explain how trays work for dine-in orders as the company’s locations deal with high demand for burgers and not enough bags to put them in. [Link; paywall]

Disaster

Higher but still slim odds of asteroid Bennu slamming Earth by Marcia Dunn (AP)

An asteroid with an orbit that brings it close to Earth will come closer than previously estimated on its nearest pass over the next century, but odds are still very low that it will end up hitting our planet. [Link]

There’s An Earthquake Coming! by Zoey Poll (The NYer)

Early warning systems don’t offer much lead time, but the difference between no warning and even a few seconds is enough to save lives and protect critical infrastructure in earthquake-prone regions around the world. [Link]

Green Commerce

How Much Carbon Comes From a Liter of Coke? Companies Grapple With Climate Change Math by Jean Eaglesham and Shane Shifflett (WSJ)

Figuring out just how much carbon is emitted by companies is not as straightforward as it might seem, and the specific kinds of disclosures investors and regulators are looking for aren’t consistent either. [Link; paywall]

Archaeology

Did archaeologists find the Trojan Horse? (The Jerusalem Post)

A scintillating discovery from Turkey: what could be the actual physical remains of one of the most legendary objects of the ancient world. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – Breakthrough Infections Not Breaking Markets

This week’s Bespoke Report newsletter is now available for members.

Before we get started with a preview of our weekly market recap, below we highlight recent performance across a wide range of ETFs representing various asset classes, national equity markets, and US sectors or indices.

Summer trading means a grind higher around the world. Europe hasn’t had a red day in two weeks, while the US earnings season has been as strong versus expectations as any in the past 20 years so far. We discuss the massive beat rates being recorded across the US earnings landscape, record guidance raises, the impact of the Delta variant versus vaccines both in the US and around the world, an inflection point in numerous sentiment indices, potential bottoming out in US housing inventory, sentiment analysis powered by search trends, the fiscal impact of the infrastructure bill, soaring cryptocurrency prices, the partisan divides visible in economic data, and more. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels.

Daily Sector Snapshot — 8/13/21

University of Michigan Whiffs

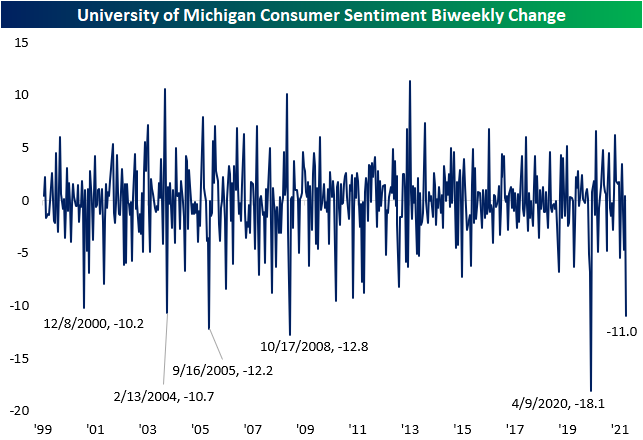

The preliminary reading on August consumer sentiment from the University of Michigan was released this morning, and it was a major disappointment. The headline reading peaked back in April but this month’s preliminary reading collapsed down to the lowest level since December 2011. That decline has been attributed to concerns over the Delta variant. As shown in the second chart below, the 11 point drop from 81.2 at the end of July to 70.2 today was the largest decline between two reports (either the preliminary and the prior final report or the final report and the preliminary reading) since the preliminary reading in April of 2020. The April 2020 reading was the largest drop on record at 18.1 points. Before that, October 2008 was the next largest and last double digit decline.

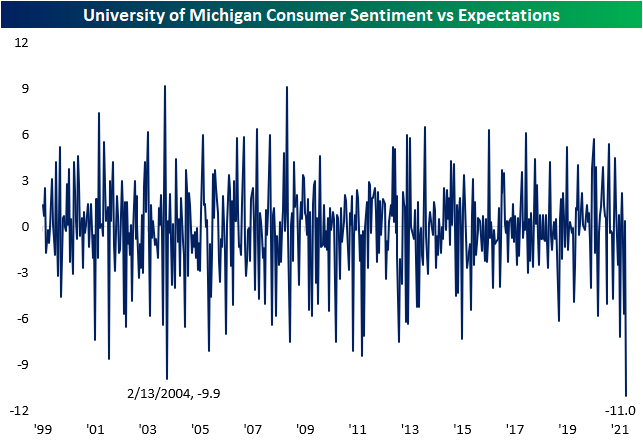

Not only was the release dramatically worse than the last update, but it was a huge miss relative to expectations. Using data from our Economic Indicators Database, today’s release came in 11 points below expectations. The only other month going back to at least 1999 that even comes close was a 9.9 point miss in the preliminary reading in February 2004. Click here to view Bespoke’s premium membership options.

Best Performing S&P 1500 Stocks Year to Date

The average stock in the S&P 1500 (which is a combination of large-caps, mid-caps, and small-caps) is up 25% year-to-date. As shown below, Energy sector stocks are up nearly twice that at 47.1%, while Consumer Discretionary and Materials rank 2nd and 3rd. The two defensive sectors — Consumer Staples and Utilities — are up the least, but they’re still up more than 13% on average. While Technology has had a good run over the last three months, its the third worst performing sector year-to-date when looking at average stock performance.

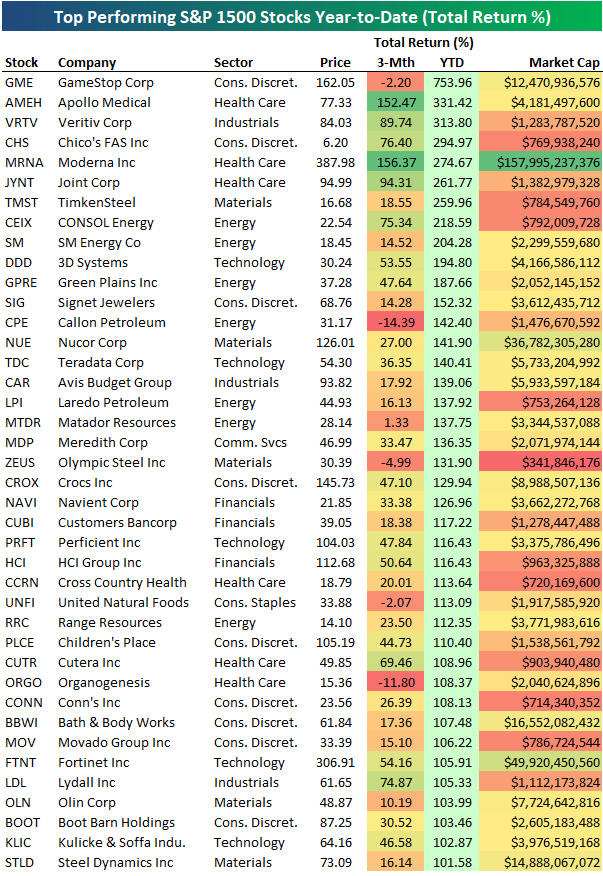

There are currently 40 stocks in the S&P 1500 that are up more than 100% in 2021. Below is a list of these 40 stocks. As shown, GameStop (GME) remains on top by more than double any other name with a YTD gain of 753%. The stock is down 2.2% over the last three months, however. There are two more stocks up more than 300% YTD — Apollo Medical (AMEH) and Veritiv (VRTV). Another six are up more than 200% — Chico’s (CHS), Moderna (MRNA), Joint Corp (JYNT), TimkenSteel (TMST), CONSOL Energy (CEIX), and SM Energy (SM).

Other notables on the list of this year’s biggest winners so far include 3D Systems (DDD), Nucor (NUE), Avis Budget (CAR), Crocs (CROX), and Fortinet (FTNT). Moderna (MRNA) is easily the stock with the biggest market cap at nearly $158 billion.

Over the last three months, there are 41 stocks in the S&P 1500 that have gained more than 40%. Moderna (MRNA) ranks first with a 3-month gain of 156%, while Apollo Medical (AMEH) is hot on its heels at +152.5%. Stamps.com (STMP) ranks third, followed by Joint Corp (JYNT) and Veritiv (VRTV). Other notables on the list of 3-month winners include Livent (LTHM), Fortinet (FTNT), Enphase Energy (ENPH), Dexcom (DXCM), AMD, Albemarle (ALB), NVIDIA (NVDA), Generac (GNRC), and ResMed (RMD). Click here to view Bespoke’s premium membership options.

Value Catching Back Up to Growth

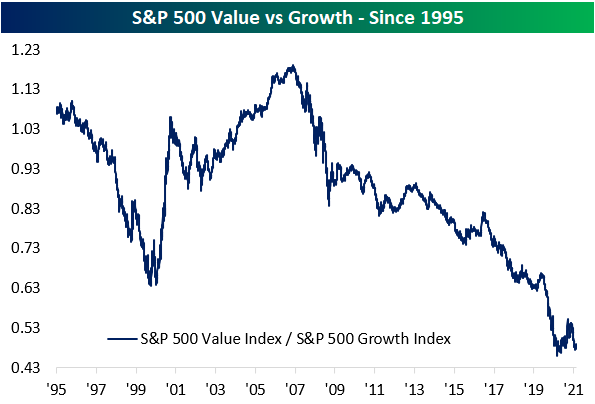

Up until the early summer, value stocks had consistently outperformed growth on a year-to-date basis. But once markets came back from the Fourth of July holiday, S&P 500 growth stocks had overtaken value in terms of year-to-date performance. While the two groups have generally trended higher together since then, in the past week (save for yesterday), the two have diverged as value has rallied and growth has seen a minor pullback. As a result, there is only a 1.3 percentage point difference between the two factor’s YTD performance.

Taking a look at the longer term relative performance of value and growth, the past year’s stint of value outperformance has pretty much been a blip on the radar. As shown below, since the mid-2000s the ratio of value to growth has been in a consistent downtrend (meaning growth outperforms value) that accelerated early on in the pandemic. As could be expected with such dramatic outperformance of growth, the ratio of the two bottomed in the early fall of last year and regained some ground before peaking this past spring. Since then, the ratio of the two has been making a move back down to its lows. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup — 8/13/21

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I was never afraid to go back to Pittsburgh and work in the steel mills.” – David Tepper, when asked where his “preternatural confidence” when making trades comes from.

In the early 1910s, Harry Brearley of Sheffield, England was trying to help the British army solve the problem of erosion on gun barrels. On this day in 1913, his mixture of 12.8% chromium with molten iron produced what turned out to be a rust-less metal. Stainless steel was born, and it would go on to revolutionize modern manufacturing.

Dow futures are higher this morning as index member Disney (DIS) is set to gap higher by more than 5% on a strong earnings report released after the close yesterday. “New economy” stocks like DoorDash (DASH) and AirBnB (ABNB), on the other hand, have thus far failed to impress investors with their earnings reports. Both companies are set to gap quite a bit lower.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Also, make sure to check out our Daily Sector Snapshot.

We referenced steel above because this is a group that has rallied nicely over the last couple of weeks on infrastructure news (and a general bounce in cyclicals). The Steel ETF (SLX) is a way to play the entire group, and as shown below, it just managed to make a new closing high on Wednesday before pulling back a bit yesterday.

Want to see a broader list of infrastructure stocks or more charts and commentary? Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.