NSA Claims Break Below 300K

For the first time in four weeks, seasonally adjusted jobless claims came in higher with claims ticking up to 353K. Additionally, last week’s reading was also revised 1K higher to 349K. Albeit higher, this week’s print does remain at the low end of the range since the pandemic began and is less than 100K away from the March 13, 2020 level of 256K (the last print before claims rose into the millions).

It continues to be a point in the year that regular state claims have the benefit of seasonal tailwinds. The current week of the year has historically only seen claims rise week over week 16.7% of the time on a non-seasonally adjusted basis. This week, claims fell by 11.7K resulting in the first sub-300K print of the pandemic. While regular state claims were lower, PUA claims rose for a fourth week in a row even with the program’s expiration (September 5th) rapidly approaching. This week’s 9.63K increase was the largest of the past few weeks bringing PUA claims up to 117.71K. That is the highest level since the week of April 23rd.

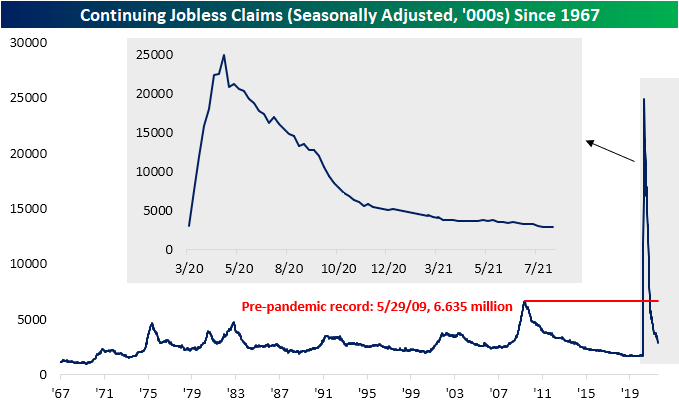

Seasonally adjusted continuing claims were also disappointing this week. Last week’s print was revised higher by 45K to 2.865 million, and while this week’s number was lower at 2.862 million, it was worse than expectations for a decline to 2.72 million. Thanks to that higher revision, claims have now fallen for three weeks in a row and are once again at pandemic lows.

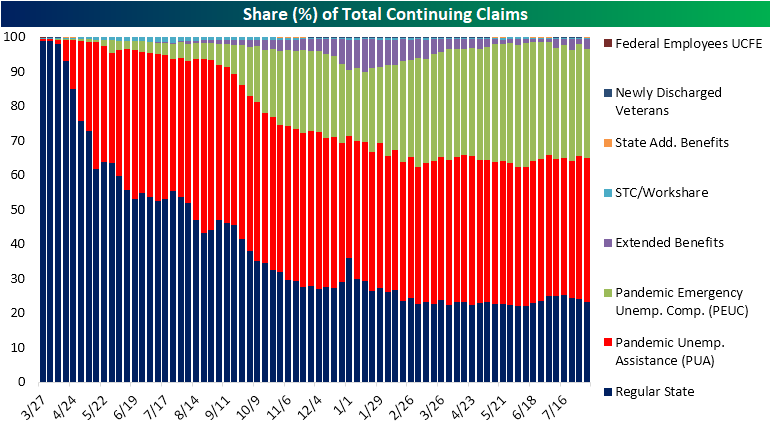

Including all other programs adds another week of delay so the most recent read on continuing claims across all programs is through the week of August 6th. Total claims rose to 12.02 million that week versus 11.84 million in the final week of July. Two of the largest programs, regular state and Pandemic Emergency Unemployment Compensation (PEUC), saw significantly lower claim counts that were offset by increases in PUA and extended benefit claims. PUA claims rose back above 5 million due to a 104.71K increase erasing most of the decline from the second half of July. Extended benefits remain particularly volatile, and this week saw another big move with claims rising 173.5K. At 351.4K, this program is at one of the highest levels since April. While there are still several weeks until the data would catch up, through those most recent readings there are 8.8 million slated to lose benefits with the September 5th expiration for pandemic programs. Click here to view Bespoke’s premium membership options.

Subway Traffic Holding Up

Earlier this week, we took a look at the decline in airline passenger traffic in recent weeks and noted that while some of the declines may be related to the Delta-variant, seasonality was likely a decent contributor to the slowdown. With summer winding down and schools getting back into session, vacation season is winding down and diminishing the need for air travel. At the same time, business travel remains depressed and therefore isn’t there to pick up the slack.

It’s only one data point, but along these lines, we were surprised to see that subway ridership in New York City has seen little in the way of a negative impact on ridership in recent weeks. On a good day, the last place most people want to be is on the subway, and if you’re worried about catching COVID, it’s one of the first places you would avoid. The chart below shows weekly turnstile traffic on NYC subways going back to 2015 with red dots marking comparable weeks to the most recent data.

The first thing that stands out on this chart is that subway traffic still has a long way to go before getting back anywhere close to normal levels. From 2015 through 2019, subway traffic was gently drifting lower but was still pretty consistently above 30 million riders per week. At the depths of the shutdowns, ridership plummeted down to 2.6 million riders and has slowly climbed higher ever since. In the week ending 8/14, ridership totaled just under 12 million riders. While that is up over 50% from the same week last year, it is still well below the average of 30 million for the same week of the year from 2015 through 2019. At this point, ridership would have to increase by 150% just to get back to pre-pandemic levels.

Looking a little closer at the ridership numbers, we found it interesting to see that while ridership usually declines in August (look at the line before the red dots in each of the years before 2020), this year we haven’t seen nearly as large of a drop. To put it in percentage terms, from 2015 through 2019, weekly ridership in the current week of the year dropped an average of 5.6% relative to its level from four weeks earlier. This year, though, the decline has been close to half that at 3.3%. In the grand scheme of things, this isn’t an enormous difference, but if the surge in COVID cases was causing more cautious behavior, we would have expected to see an even larger decline. An alternative explanation for a smaller than normal decline in ridership levels could be due to the fact that many of the people riding the subway now have little in the way of alternative options for commuting and are in fields where summer vacations aren’t as typical as those in other occupations. Ultimately, it’s probably a little of both, but seeing subway ridership levels hold up even as COVID cases surge is a trend we didn’t expect to see. Click here to start a Bespoke Premium trial and receive access to all of our market analysis and commentary.

Travel & Leisure Bounces

After trending lower for the last few months in what now looks like an anticipatory move in advance of the current COVID wave, travel & leisure stocks have bounced back in a big way over the last week. Every one of the travel & leisure stocks in the snapshot below is up 5%+ over the last week, with MGM Resorts (MGM) up the most at +9%. The three cruise stocks — Norwegian (NCLH), Royal Caribbean (RCL), and Carnival (CCL) — have bounced 7-8% over the last week, while the airlines are up between 5-6%.

A week ago, most of these travel & leisure stocks were trading in oversold territory, but they are all back in “neutral” territory now, meaning they’re between one standard deviation above and below their 50-DMAs. The hotels and cruise stocks have largely crossed back above their 50-DMAs, while the airlines are still sitting below them.

As you can see, even though they’ve had a rough time over the last few months, all of these travel & leisure stocks are still in the green on a year-to-date basis, with MGM and American Airlines (AAL) up the most at 33.7% and 27.77%, respectively.

The underperformance of these names well ahead of the current COVID wave and their recent bounces in the midst of the wave serves as an important reminder that it’s often the case that the markets knew the headlines you’re reading today months ago. Click here to start a Bespoke Premium trial and start building your own custom portfolios.

Mega-Cap Tech Snapshot

Bespoke members have the ability to build “custom portfolios” that allows them to easily track the stocks and ETFs they care about most. One simple custom portfolio that we’ve created tracks the eight mega-cap Tech stocks. Below is a snapshot of these eight stocks as they appear in our “Custom Portfolios” tool. If you wanted to track your own stocks and ETFs in a similar fashion, simply start a Bespoke Premium trial and click on the “Custom Portfolios” page once you’re logged in.

As shown below, all eight of the “mega-caps” are up over the last five trading days, but NVIDIA (NVDA) is the clear standout with a massive gain of 16.66%. The recent move higher for NVDA leaves it up 70% on the year and 12.4% above its 50-day moving average! It also puts the stock in extreme overbought territory, which means it’s more than two standard deviations above its 50-DMA.

While Amazon (AMZN) is up 3% over the last week, it’s still 4.8% below its 50-DMA and in oversold territory. Apple (AAPL) is the only mega-cap that’s not overbought or oversold but rather neutral, meaning it’s trading within one standard deviation above or below its 50-DMA. Facebook (FB), Alphabet (GOOG), Microsoft (MSFT), Netflix (NFLX), and Tesla (TSLA) are all overbought, but unlike NVDA, they’re not in extreme territory.

On a YTD basis, none of the mega-caps are in the red, but three are just barely positive. Amazon (AMZN) is up 1.3% YTD, Netflix (NFLX) is up 1.27% YTD, and Tesla (TSLA) is up 0.78% YTD. That’s about as close to flat as it gets, and we’re already nearly eight full months into the year already. Behind NVDA’s 70% gain, Alphabet (GOOG) is up the second most in 2021 at +63.2%, followed by Microsoft (MSFT) at +36.67% and Facebook (FB) at +34.86%. Apple (AAPL) is sitting on a YTD gain of just over 12.33%. That’s a solid move, but it’s well behind the S&P 500’s YTD gain of 19%.

Bespoke members can also easily see price charts of all the stocks or ETFs in the custom portfolios that they create. This is a helpful way to monitor technicals across baskets in an efficient manner. Instead of having to look through price charts one by one, you can quickly see them all on the same page. Looking at the price charts of the eight mega-caps, you can see that Apple (AAPL), Facebook (FB), Alphabet (GOOG), Microsoft (MSFT), and NVIDIA (NVDA) are all in long-term uptrend channels, while things have been much more choppy for Amazon (AMZN), Netflix (NFLX), and Tesla (TSLA). Click here to start a Bespoke Premium trial and start building your own custom portfolios.

Bespoke’s Morning Lineup – 8/26/21 – A More Equal Rally

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Nothing great was ever achieved without enthusiasm – Ralph Waldo Emerson

Futures are mixed heading into the second to last trading session of the week, and there has been little change even after initial claims and the revision to GDP. Generally speaking, the reports came in close to expectations with little in the way of surprises. For the rest of today, markets will be watching for commentary from Fed officials ahead of tomorrow’s Jackson Hole speech from Fed Chair Powell. This morning, KC Fed President Esther George, who is a non-voter, suggested that it’s time for the Fed to start removing stimulus, and right now St. Louis Fed President Jim Bullard (another non-voter this year) is striking the same tone, although he has had these views for some time now. All week long, the market has been betting that Powell would take a dovish tone in tomorrow’s speech, but after the rally of the last five days, maybe that has become too priced in at this point.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

After underperforming the market-cap-weighted index for months, the equal-weighted S&P 500 has recently started to get back on track and has been reaching new highs itself as well. After bumping up against resistance multiple times in the spring and early summer, the equal-weighted index briefly broke out to new highs in late July and early August before pulling back last week on concerns over Afghanistan and a Fed taper. The index pulled back to its 50-DMA, but like the market-cap-weighted index, it has bounced back nicely and finally hit a new high again in yesterday’s trading.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Daily Sector Snapshot — 8/25/21

B.I.G. Tips – Low Volume Gains

Chart of the Day: The Montana Curve

Opposite Day For Retail Triple Plays

There were two earnings Triple Plays in the past 24 hours, with both coming out of the retail industry. A triple play is when a company reports better than expected earnings and revenues and also raises guidance. On Tuesday after the close, Nordstrom (JWN) reported EPS 19 cents above estimates and revenues of $3.657 billion compared to estimates of $3.329 billion. In spite of those strong results, the stock is not only down but it has also erased all of the gains of the past week dropping 16.5% as of this writing in today’s session. The leaves the stock right around its lows from the end of last month which are also at a similar level to the consolidation that took place at the end of last year.

Meanwhile, another retailer, Dick’s Sporting Goods (DKS), is seeing the opposite reaction. The stock is up 15% today after reporting EPS of $5.08 ($2.82 expected) and sales that were $440 million above forecasts. While both companies reported triple plays, those inverse reactions are also resemblant of the longer-term trends in the stocks heading into the reports. Since the start of the year, JWN has been making a series of lower lows and lower highs while DKS has been in a steady uptrend.

As for where the reactions stand relative to each stock’s respective history, JWN is on pace for its worst one-day reaction to any quarter since at least 2001 surpassing the 15% drop from its report in November 2015.

The stock price reaction for DKS is not at a record, but it is historic in its own right. The move today is similar to that of last August when it surged 15.68% on earnings, although that quarter didn’t qualify as a triple play since the company didn’t raise guidance. As such, the stock is on pace for its sixth (or fifth if it closes more than 15.68% higher) largest earnings move on record.

Adding to the irony of today’s reactions, historically Q2 has actually been the strongest quarter for stock price reactions to earnings for Nordstrom. On average, the stock has historically risen 2.26% the day after reporting Q2 results with a positive return 68.4% of the time.

Turning to the retail sector more broadly, the SPDR S&P Retail ETF (XRT) is higher by 15 bps today as the ETF hovers at the high end of the past several month’s range. Given it is an equal-weight ETF, the inverse and volatile moves in JWN and DKS are essentially canceling one another out. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 8/25/21 – Big Test for Small Caps

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I have always believed that it’s important to show a new look periodically. Predictability can lead to failure.” – T. Boone Pickens

You can’t get much flatter than where equity futures are at the given moment, but then again, you can’t get a more quiet time of year than a Wednesday in late August. In COVID related news, China has reportedly started to re-open its Ningbo port after a two-week shutdown, Japan is set to spend an additional 1.4 trillion yen on additional COVID vaccines with two-thirds of the directed towards the purchase of boosters, while JNJ announced that an early study shows a boost in the body’s immune response to a booster of its COVID vaccine.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

It’s been quite a wild ride for small caps over the last few days. After failing to retake its 50-day moving average (DMA) in early August, bulls gave up in the middle of the month, and the Russell 2000 experienced a quick sell-off that not only tested the lows from mid-July but also broke below the 200-DMA for the first time in nearly a year. The break of the 200-DMA didn’t last long, though. Last Friday, the Russell 2000 bounced 1.6%, and that was followed by a 1.9% follow-through on Monday and then another 1% rally on Tuesday.

In the span of just three trading days, the Russell 2000 went from testing the 10% threshold for a technical correction to the point now where it is actually in the upper half (barely) of the trading range it has been stuck in nearly all year. Despite that bounce, though, the Russell heads into today still just below its 50-DMA. With it already rallying 1% in each of the last three trading days, does it still have gas left in the tank to get back above that level? That will be the big short-term test.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.