ETF Trends: Hedge – 2/25/16

the Bespoke 50 — 2/25/16

Bespoke’s Sector Snapshot: 3/3/16

S&P 500 Higher High and Back Above 50-DMA

We’ve shown the chart below of the S&P 500 number of times over the last week. The big hang-up for the market lately has been that in spite of the gains off of the February lows, the index still had not made a higher high and taken out its February lows, and it was still below its 50-day moving average. Early in the day yesterday, it looked like we were in the midst of another failed rally, but a big reversal in the afternoon followed by a strong day today has really improved the picture of the S&P 500 from a technical perspective. Not only is the S&P 500 above its early February highs (higher high), but it also closed above its 50-DMA for the first time in 2016. Now, if these gains can hold for the next day or two, it’s hard to fight the rally.

S&P 1500 Most Heavily Shorted Stocks: 2/25/16

Short interest figures for the middle of February were released after the close yesterday, and we just sent out our regular update on the topic to Premium and Institutional clients. Into the sell-off during the first half of February, short interest levels saw nearly across the board increases. The table below is from our most recent update and it lists the 45 stocks in the S&P 1500 that have more than 25% of their free-floating shares sold short. For each stock, we also include its performance so far during the month of February.

Despite the fact that the rally off the February lows has been driven by a lot of short covering where the most heavily shorted stocks outperformed, for the entire month of February, these stocks are actually trailing the market. This is because they were absolutely decimated during the first half of the month. As of this morning, the average return of the 45 stocks listed was a decline of 3.42% (median: -2.39%) versus a decline of 0.32% for the S&P 1500. What is interesting about the performances of the stocks listed, however, is how disparate the returns have been, ranging from a decline of 59% for SunEdison (SUNE) to a gain of 44% for Century Aluminum (CENX). In total, there are fourteen stocks that are down 10%+ while nine are up 10% or more.

Bespoke Short Interest Report: 2/25/16

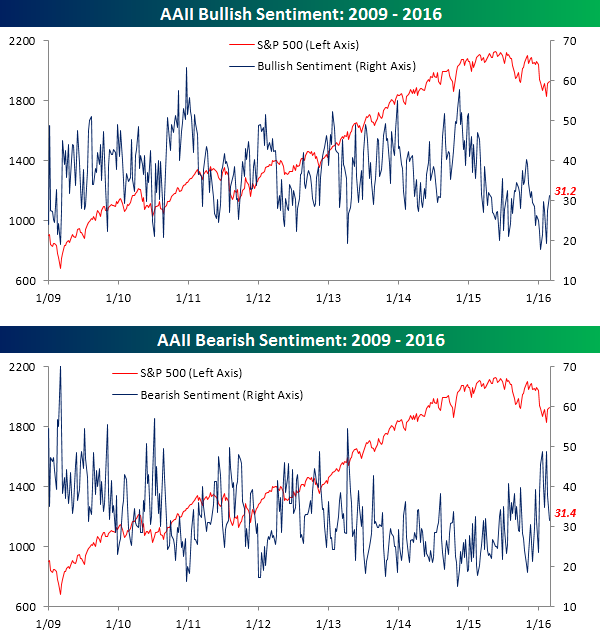

Bullish Sentiment Bounces

After several weeks of back and forth action in bullish and bearish sentiment, this week we saw both measures start to break out of their recent ranges. According to the weekly sentiment poll from AAII, bullish sentiment rose to 31.2% last week. That’s still depressed by historical standards, but it is still the highest weekly reading since November! Similarly, bearish sentiment dropped from 37.8% down to 31.4%, which was the lowest level of the year. It’s a start!

US Equity ETFs Attempting to Move Back Above 50-DMAs

Below is a snapshot of U.S. equity index and style ETFs that we track in our daily ETF Trends report available to Bespoke Premium and Bespoke Institutional members. A few key columns that only subscribers can see have been removed, but this snapshot still gives you a good idea of where the market stands.

In the trading range section below, the black vertical “N” line represents each ETF’s 50-day moving average. As you can see, nearly every ETF is currently in neutral territory, with most just a notch below their 50-day moving averages. If we get a decent up day today, though, the large majority will end up breaking back above their 50-days for the first time in weeks. We wouldn’t get too giddy just yet, but this kind of move is what bulls are looking for if the longer-term downtrends in place are going to be broken.

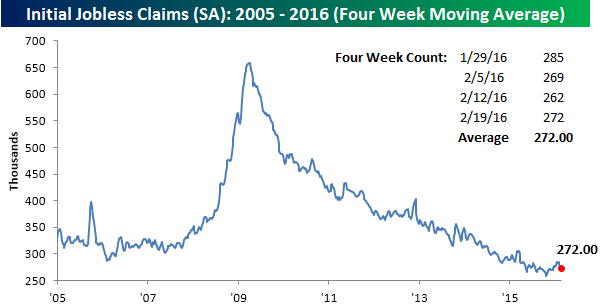

Jobless Claims Slightly Higher Than Expected

After two weeks of significantly stronger (lower) than expected jobless claims reports, this week’s reading came in slightly higher than expected. While economists were forecasting first-time claims to come in at a level of 270K, the actual reading came in at 272K which was up 10K from last week. That’s the highest reading this month, and as shown in the inset chart below, it takes claims right up to that uptrend line it broke to the downside last week. Going forward, it is reasonable to expect claims to tick higher, but the key is that they stay stable and don’t suddenly spike above 300K.

Although the weekly reading increased this week, the four-week moving average actually declined slightly, falling from 273.25K down to 272K (the same level as the weekly reading). Again, this is a healthy reading as it’s just 13K above the cycle and multi-decade low of 259.25K from late October and the lowest since mid-December.

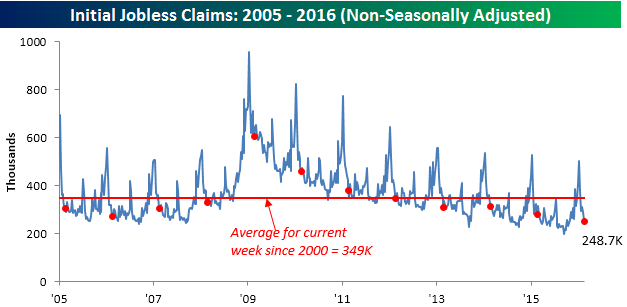

On a non-seasonally adjusted basis, claims continue to come in solid. At a level of 248.7K, claims are more than 100K below the average of 348.9K for the current week going back to 2000, and to find a week where claims were lower in this particular week of the year, you have to go all the way back to 1973.

The Closer 2/24/16 – “Housing Dividends”

Looking for deeper insight on global markets and economics? In The Closer tonight we analyze the drivers of performance for high dividend stocks since December. We also break down two housing data points from today (New Home Sales) and yesterday (Existing Home Sales).

The Closer also includes its standard charts, large volume and price movers in the US equity market, and Bespoke’s Market Timing Model. The Closer is one of our most popular reports, and you can sign up for a trial below to see it free for the next two weeks!

[thrive_leads id=’58717′]