Chart of the Day – 2/26/16: Short Interest in Energy Approaching Levels of Financials From 2008

Short interest levels for the middle of February were released earlier this week, and in today’s Chart of the Day, we take a look short interest levels in the Energy sector which approaching a critical level.

To continue reading our Chart of the Day, enter your info below and start a free Bespoke research trial. During your trial, you’ll also receive access to our model stock portfolios, daily market alerts, and weekly Bespoke Report newsletter.

[thrive_leads id=’59052′]

B.I.G. Tips – Consumer Staples Caution

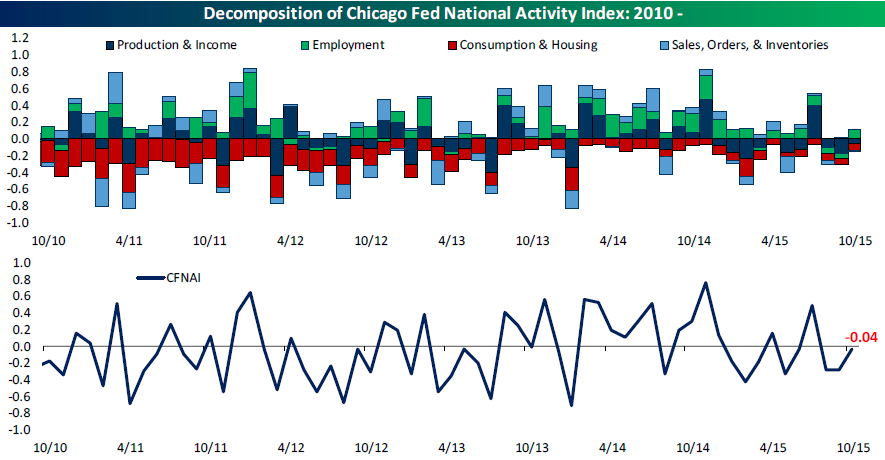

Q4 2015 GDP Revised Up, But A Low-Quality Beat

Economists were expecting a +0.4% QoQ SAAR GDP reading for Q4 2015 on the second reading from the BEA this morning, but growth came in much higher at +1.0% QoQ SAAR. However, the most important categories (in our view), Consumption and Fixed Investment, were both revised downward slightly. Less goods consumption and a slightly slower rate of residential fixed investment weighed, with goods contributing the most. The upward revision to the headline was instead driven by less negative contribution from inventories. Growth in stockpiles of goods reduced GDP by 14 bps QoQ SAAR, versus a -45 bps SAAR impact on the initial release. Also contributing to higher growth was slower imports, which makes sense if goods consumption was lower. Finally, government spending was revised down with Federal outlays contributing +15 bps SAAR versus +18 bps SAAR on the initial release. Local government spending was revised dramatically lower, to -16 bps contribution; that’s the weakest since the recession. This is extremely surprising and in our view unlikely to continue given strong employment, real estate prices, and steady balance sheet repair across that spectrum of government.

Overall, while it’s nice to see growth revised up, it was revised up for the wrong reasons. The brutal contraction in state and local spending is also painful. We’ll have more on this in our weekly Bespoke Report tonight; sign up for any of our research offerings to view the report when it’s sent out this evening.

Bespoke CNBC Appearance (2/25)

US Equity ETFs Move Above 50-DMAs

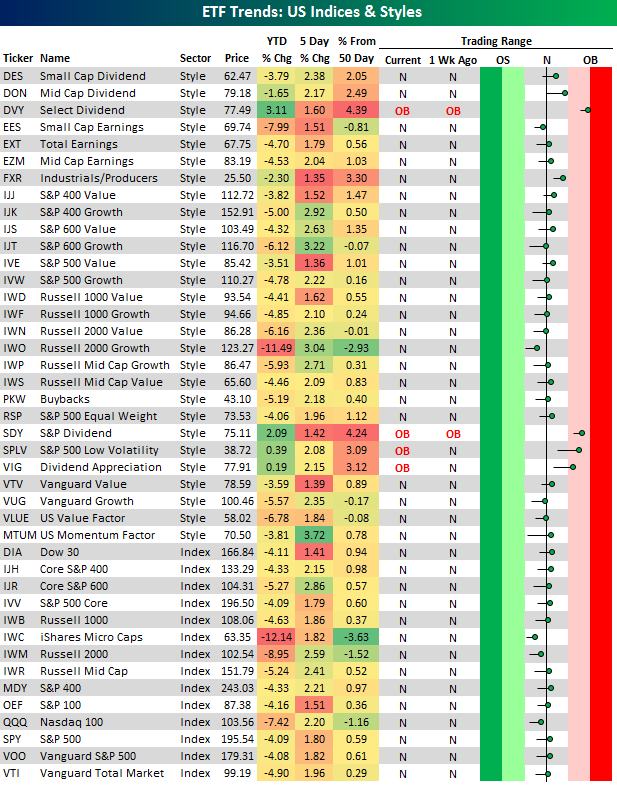

Yesterday morning we published a post titled US Equity ETFs Attempting to Move Back Above 50-DMAs. In the post we highlighted our trading range screen of equity index and style ETFs, which we have updated below. Prior to yesterday’s open, nearly all of the ETFs shown were trading just below their 50-days and needed just a little boost to break back above them. As you can see in the updated screen below, nearly all of them did indeed break above their 50-days by the close yesterday.

Sector Breadth Bouncing Back

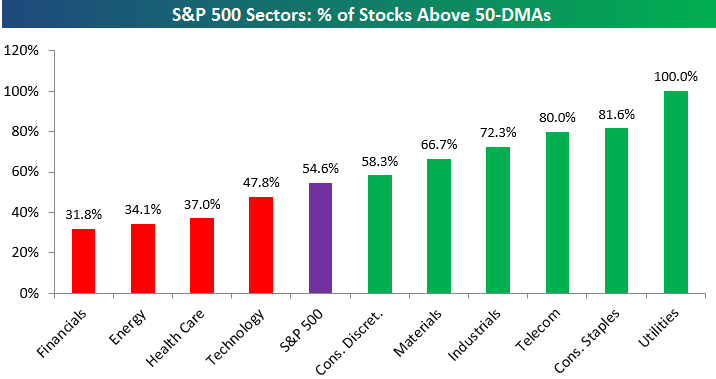

In our weekly Sector Snapshot available to Bespoke Premium and Bespoke Institutional members, we provide a number of charts covering sector technicals, internals, relative strength and valuations. Below is data taken from this week’s Sector Snapshot published today showing the percentage of stocks in each sector trading above their 50-day moving averages. For the entire S&P 500, this reading has moved back above 50% — up to 54.6% today. That’s a healthy reading that we haven’t seen yet in 2016.

Six of ten sectors have readings even stronger than the 54.6% mark for the broad S&P 500. Utilities ranks at the top at 100%, followed by Consumer Staples and Telecom, but then you get to Industrials, Materials and Consumer Discretionary. Those last three are all cyclical in nature, and they’ve been market leaders over the last couple of weeks.

Notably, the four sectors with weaker-than-market readings are all cyclical in nature as well, and Financials rank worst with just 31.8% of stocks above their 50-days. Energy and Health Care are both in the 30s as well.

While the bounce for the market off of its lows has been a positive, for it to have any staying power, it’s going to need these four cyclical sectors to participate even more than they have been.

The Closer 2/24/16 – “Manufacturing Turning Up Definitively”

Looking for deeper insight on global markets and economics? In The Closer tonight we update our view on the manufacturing sector following a series of changes in a number of trends for nominal factory output. We also summarize some indicators on the market that are painting quite unambiguous signals on direction. Finally, we preview a very significant overnight data slate and two major US releases tomorrow.

The Closer also includes its standard charts, large volume and price movers in the US equity market, and Bespoke’s Market Timing Model. The Closer is one of our most popular reports, and you can sign up for a trial below to see it free for the next two weeks!

[thrive_leads id=’58717′]Bespoke’s Sector Snapshot — 2/25/16

Chart of the Day: S&P 500 Finally Back Above 50-DMA

The S&P 500 closed back above its 50-day moving average for the first time all year today. In today’s Chart of the Day, we take a look at how the market has historically performed when it has moved back above its 50-day after long periods of time below it. The results might surprise you.

To continue reading our Chart of the Day, enter your info below and start a free Bespoke research trial. During your trial, you’ll also receive access to our model stock portfolios, daily market alerts, and weekly Bespoke Report newsletter.

[thrive_leads id=’59052′]