Bespoke’s Consumer Pulse Report — June 2017

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service here. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

B.I.G. Tips – It Happened Again…

In what has become an increasingly disheartening trend for investors and traders loaded up to the gills on tech stocks, while the DJIA traded up 0.60% on Monday, the Nasdaq lost ground all day and finished lower by nearly half a percent. Had the session not ended at 1 PM, the damage in Nasdaq could have been even worse. Monday’s underperformance was the third time in under a month that the Nasdaq underperformed what had been the out of favor Dow Jones Industrials by more than 1% in a given day.

Naturally, the Nasdaq’s recent underperformance has investors questioning whether the rotation represents a broader shift in investor sentiment out of the high multiple growth stocks and into more cyclical industrials. To help frame this issue, in a just published B.I.G. Tips report, we looked to see how uncommon (or common) it is to see the Nasdaq have multiple days of large underperformance (1%+) relative to the Dow in a four week period. Further, we also analyzed market performance in the period following each of these occurrences. The current period represents the fifth time during this bull market that we have seen the Nasdaq underperform the DJIA by more than 1% over a four-week span (chart below). For anyone interested in seeing this report, sign up for a monthly Bespoke Premium membership now!

June 2017 Headlines

Fixed Income Weekly – 7/5/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we take a look at the Eurodollar term structure and implications for the so-called “Greenspan conundrum”.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

ETF Trends: International – 7/5/17

Steel, Agriculture, and Banks headline our list of best ETF performers this week. Oil continues its turnaround, although at a slower pace than the end of last week. Other notable outperformers include Financials, Metals, and Biotech. On the other hand, commodity ETFs such as Silver and Gold continue to underperform, which has been a common theme so far this year. Also, Utilities and Pharma round out the list of notable underperformers.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

S&P 500 Sectors in First Half 2017

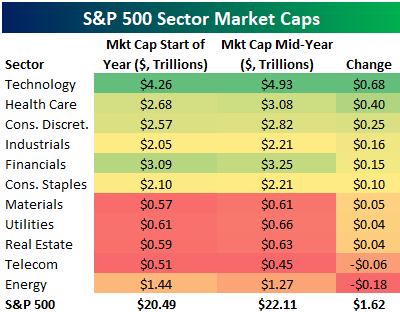

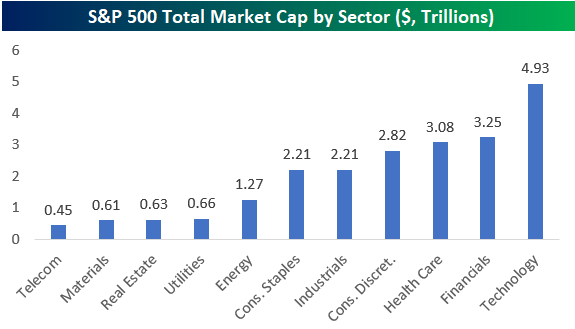

Below is a look at the change in market cap experienced by the S&P 500 and each of its eleven sectors in the first half of 2017. The members of the S&P 500 had a combined market cap of $20.49 trillion at the start of the year, and they added $1.62 trillion in the first half. This leaves the S&P 500’s current market cap at $22.11 trillion.

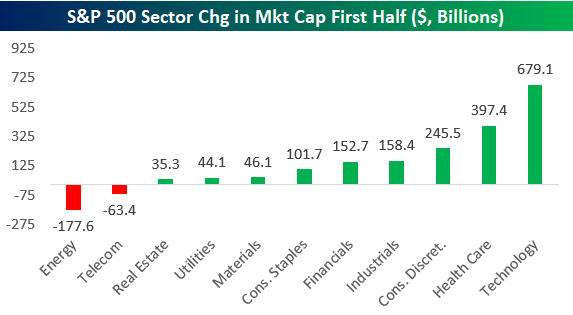

Of the eleven sectors, Technology gained the most in market cap at roughly $680 billion — moving from $4.26 trillion at the start of the year up to $4.93 trillion at the end of June. Health Care, Consumer Discretionary, Industrials, and Financials all added more than $150 billion in market cap.

Only two sectors — Telecom and Energy — saw a decline in their market cap during the first half. The Energy sector lost the most in market cap in the first half at -$177.6 billion.

Click here to start a no-obligation two-week free trial to our premium research platform.

The Closer — Mixed Indicator Monday — 7/3/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review very mixed economic data from the US today, including ISM, vehicle sales, construction spending, and an unlikely piece of data from Mexico that speaks to the US economy’s current outlook. We also take a look at the huge rotation into Transports with the Dow Jones Transports index breaking out to new all-time highs today.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!

B.I.G. Tips – 2017 First Half Decile Analysis

Bespoke Stock Seasonality: 7/3/17

ETF Trends: US Sectors & Groups – 7/3/17

Oil continues its strong performance among the world of ETFs that we track, up 7% over the past 5 days. Steel and Banks are also notable outperformers. On the other hand, Miners and Real Estate are underperforming, which has been a constant trend over the past couple sessions. Additionally, Biotech has slowed down after its recent strong performance, down just over 3% this week.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.