B.I.G. Tips – June Employment Report Preview

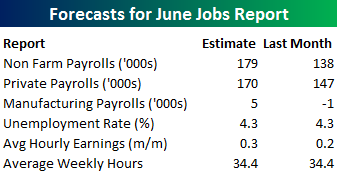

Heading into Friday’s Non Farm Payrolls (NFP) report for June, economists are expecting an increase in payrolls of 179K, which would be a 41K gain from last month’s much weaker than expected reading of 138K. In the private sector, economists are also expecting an increase of 170K, which would represent a modestly smaller gain than the headline number. The unemployment rate is forecasted to remain unchanged at 4.3%. Growth in average hourly earnings is expected to accelerate to 0.3%, while average weekly hours worked is also forecast to remain unchanged at 34.4.

Ahead of the report, we just published our eleven-page monthly preview for the April jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in September. We also include a breakdown of how the initial reading for September typically comes in relative to expectations and how that ranks versus other months.

One topic we cover in each month’s report is the S&P 500 stocks that do best and worst from the open to close on the day of the employment report based on whether or not the report comes in stronger or weaker than expected. In other words, which stocks should you buy, and which should you avoid? The table below highlights the best-performing stocks in the S&P 500 from the open to close on days when the Non-Farm Payrolls report has been better than expected over the last two years. Of the 25 top performing stocks, seven sectors are represented, and Technology leads the way with seven. One of the top performing and consistently positive stocks on these days is Qorvo (QRVO) which as seen an average gain of 2.28% with positive returns 90% of the time.

For anyone with more than a passing interest in how equities are impacted by economic data, this report is a must read. To see the report, sign up for a monthly Bespoke Premium membership now!

Electric Cars On Sale

Over the last few days, Elon Musk’s Tesla (TSLA) has gotten hit, and hit hard. After an all-time high close of $383 on June 23rd, the stock has gone down almost every day and the last three have been particularly brutal with falls of 2.5%, 7.2%, and 4.5% (as of the time of this writing). In the course of that decline, the 14-Day RSI (a measure of momentum) has crept closer to deeply oversold territory around 30, and as of this writing, it stood at 31.5, the lowest since September of last year. Many technicians like to look at extreme RSI readings as a way to gauge mean-reversion: it’s hard for an oversold stock to stay oversold for long periods of time.

In the case of TSLA, though, buying the dip because it’s created an oversold condition might not work. In the table below, we show average 1y forward returns for all periods since TSLA’s IPO. When a period has an RSI of less than the period listed, it is included in the average return calculation. So for all days (0.2% of the total) when TSLA has had an RSI less than 20, it’s generated an average 1y forward return of 91.3%. As shown, the sweet spot for TSLA returns has been when RSI has been neutral, and that’s when most of the trading days have taken place. While the current reading on RSI (31.5) doesn’t necessarily mean there are more big declines to come, there’s also no reason to get fired up about a great entry point based on how the stock has traded in the past.

Another shocking aspect of the table below relates to how strong a stock TSLA has been since its IPO seven years ago. For all eight of the different RSI categories shown, the worst 12-month return is 37.5% (under 30), while every other category has seen an average gain of at least 57%!

Click here to start a no-obligation two-week free trial to our premium research platform.

ETF Trends: Fixed Income, Currencies, and Commodities – 7/6/17

Agriculture headlines our list of best performing ETFs this week, up nearly 5% on a 5 day rolling basis. Banks, Oil, and Steel also outperformed and continue to be fixtures on the left side of this chart. On the losing side, Natural Gas and Silver were the biggest losers along with other notable ETFs Pharma and Real Estate.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Pulse Smartphone Ownership — iPhone vs. Samsung Breakdown

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than three years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

Along with valuable macro analysis, we also cover individual stocks and sectors in our monthly Pulse report as well. Our smartphone data is some of our most coveted. As shown below, 89.4% of our survey respondents reported owning a smartphone in our June 2017 survey. That’s just off a record high in May, but it still shows how high the smartphone penetration rate is.

In terms of brands, 49.4% of smartphone owners reported owning an Apple phone in our June 2017 survey, which is up quite a bit from our April and May readings. Even still, the peak for Apple smartphone ownership in our survey was just over 55% back in late 2015.

Apple is clearly on top of the world when it comes to customer retention. As shown below, 90.9% of Apple phone owners upgraded to an Apple phone during their most recent upgrade. That number is only 64% for Samsung phone owners.

Finally, in case you’re wondering, females own iPhones at a slightly higher rate than males. The bottom chart below shows that 49.3% of female smartphone owners have an iPhone, while 41.5% of male smartphone owners have an iPhone. (Note that this reading is a 3-month rolling average.)

To see even more of our proprietary smartphone research, plus coverage of other sectors like streaming media and e-commerce, click here to start a 30-day free trial to our Pulse service now!

Does This Sound Like a Slowing Economy

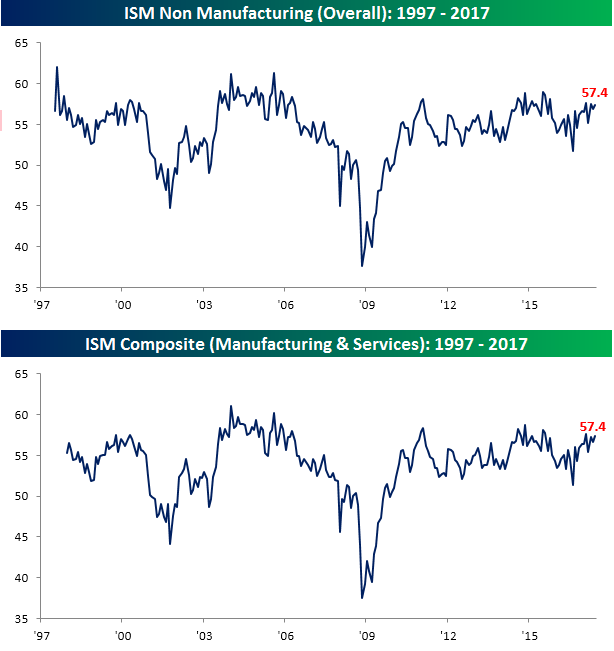

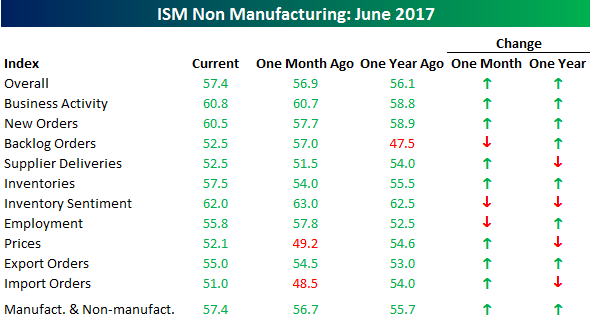

The ISM Services index for June was released earlier today, and like its manufacturing peer, the report was stronger than expected. While economists were expecting a headline reading of 56.5, the actual reading came in at 57.4 and just 0.2 points shy of the post-election high of 57.6. On a combined basis and accounting for each sector’s share of the overall economy, the ISM for June also came in at 57.4 up from 56.7 in May.

Click here to start a no-obligation two-week free trial to our premium research platform.

Looking at the internals of the report, most of the sub-indices in this month’s report also showed m/m increases. The only decliners on the month were Backlog Orders, Inventory Sentiment, and Employment. On the upside, the largest increases were in Inventories and Prices.

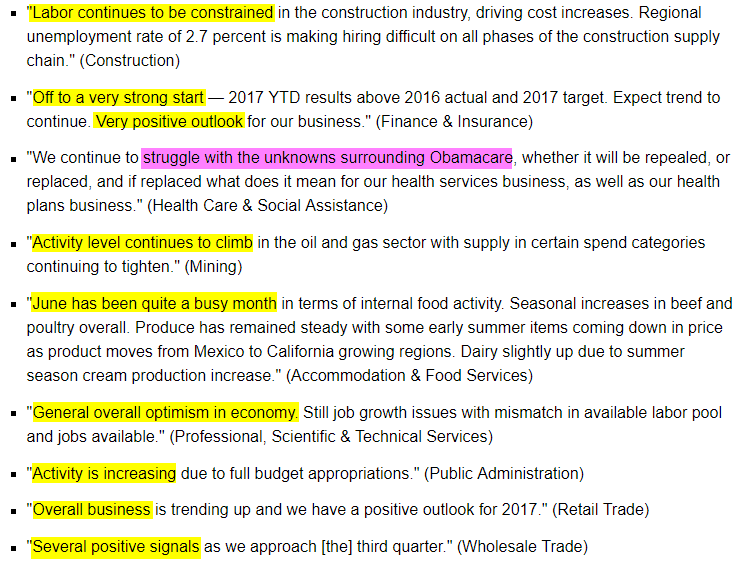

One of the most interesting aspects of this month’s report was the commentary. As shown below, despite some recent softness in economic data, there seems to be little in the way of concern on the part of respondents in the services sector. Besides uncertainty surrounding ObamaCare, activity appears to be strong and improving.

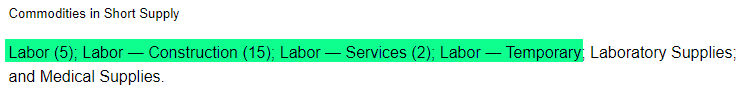

Finally, with regards to the commodities that were reported as being in short supply this month, can you see the trend?

the Bespoke 50 — 7/6/17

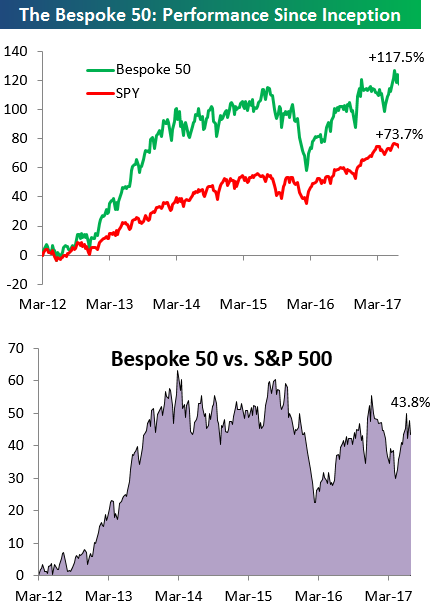

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 43.8 percentage points. Through today, the “Bespoke 50” is up 117.5% since inception versus the S&P 500’s gain of 73.7%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, sign up for Bespoke Premium ($99/month) at this checkout page and get your first month free. This is a great deal!

Chart of the Day: Should Bond Selling Spook Stocks?

Investor Sentiment Little Changed

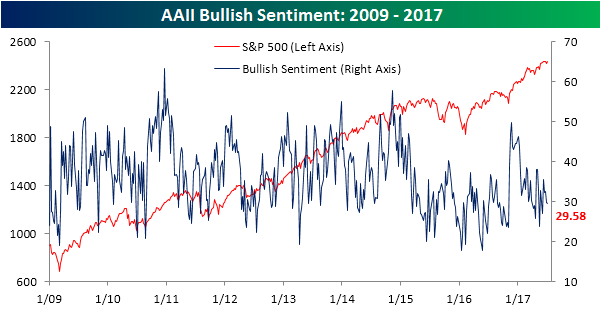

There was unsurprisingly little change in investor sentiment this week given how slow it has been around the July 4th holiday. According to AAII, bullish sentiment fell by just 0.13 percentage points to 29.58%. That’s the fourth straight week that less than a third of individual investors have been bullish and a record 131 straight weeks where less than half of them have been optimistic towards equities.

Click here to start a no-obligation two-week free trial to our premium research platform.

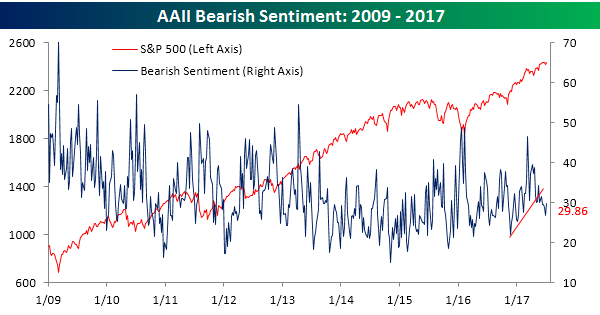

Bearish sentiment saw a larger move than bullish sentiment this week, but with a gain of just three points, the move was still small, and at a level of 29.86%, negative sentiment is nearly the exact same as bullish sentiment. You really can’t get more balanced than that!

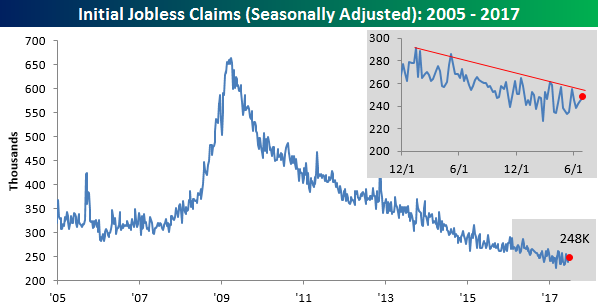

Jobless Claims Slowly Drift Higher

Jobless Claims came in higher than expected this week (248K vs 244K), continuing the recent trend of a slow drift higher. The key word here is slow, as even though claims have risen for three straight weeks, they are only up by 10K during that span and remain below the longer term downtrend. Weekly claims still remain very low by historical standards as they have been below 250K for five straight weeks and nine of the last ten. On a longer-term time frame, claims have now been below 300K for 122 straight weeks.

Click here to start a no-obligation two-week free trial to our premium research platform.

The four-week moving average increased by less than 1K this week to 243K. That’s still within 8K of the multi-decade low of 235.5K that was hit seven weeks ago in mid-May.

On a non-seasonally adjusted basis, first-time claims came in at 250.4K. That’s up over 10K from last week but is typical for this time of year. For the current week of the year, NSA claims are more than 100K below their average of 357K and haven’t been this low at this time of the year since 1973.

The Closer — Mexico, Markit, Minutes, Manufacturing — 7/5/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review recovery in Mexican IMEF PMI series, global PMIs from Markit released over the last couple days, today’s Fed minutes, and the release of May Factory Orders this morning.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!