Chart of the Day: Breadth Hanging In

Sectors Also Picking Up in Second Half Where They Left Off The First

In an earlier post, we highlighted the fact that some of the biggest winners in terms of individual stocks in the second half so far were also up strongly in the first half. Similarly, the worst performers to start the second half were also down big in the first half. In terms of sector performance, the continuation pattern is even more apparent.

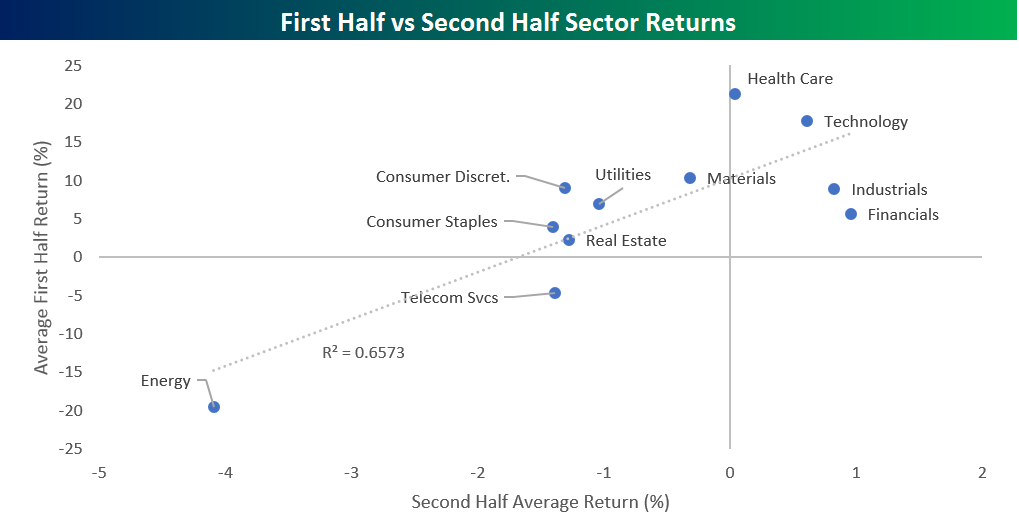

The scatter chart below compares the average return of stocks in the Russell 1000 by sector in the first half (y-axis) to their average return in the second half through last Friday (x-axis). Here, there is a clear pattern where the sectors with the stocks that did best in the first half are continuing to feel the love in the second half, while the sectors with the worst average performance in the first half continue to be out of favor in the second half. For example, stocks in the Energy sector were down the most in the first half, and they are off to the weakest start in the second half as well. Similarly, the sectors with the best-performing stocks in the second half were all positive in the first half as well. As shown, the trendline of returns for all eleven sectors has an r-squared of 0.65, which implies a strong positive correlation. Obviously, a lot can change as time goes on, but so far this half investors are using a very similar playbook in the second half as they did in the first.

Click here to start a no-obligation two-week free trial to our premium research platform.

ETF Trends: Hedge – 7/10/17

A lot of new names appear on our list of best performing ETFs this week. Among these, India, Coffee, and Italy are the most notable ETFs making solid gains. Financials and Banks also sustained their momentum from previous weeks. Those continuing movement in the negative direction are Oil and various commodities, which has been a trend as of late. Retail and Energy are other notables in the red, both down nearly 4%.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Second Half Picking Up Right Where First Half Left Off

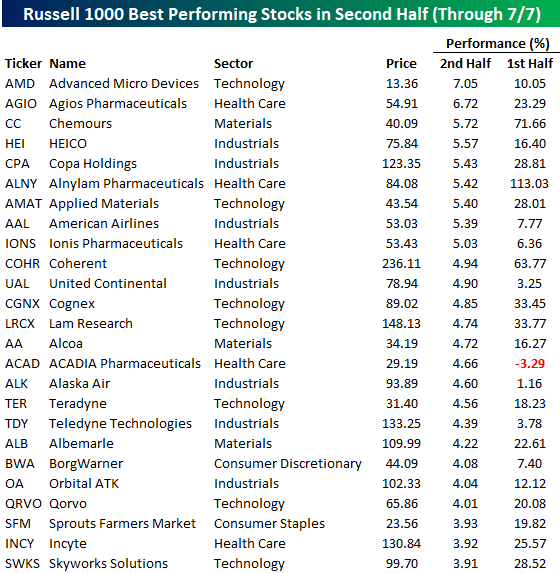

The second half of the year is only three and a half trading days old, but there have already been some decent winners and big losers among large cap stocks in the Russell 1000. The first table below lists the 25 best-performing stocks in the Russell 1000 through the first week of the second half. Leading the way higher, shares of Advanced Micro (AMD) are already up 7%, nearly matching their first-half gain of just over 10%. Behind AMD, Agios Pharma (AGIO) is up 6.7%, followed by Chemours (CC) and HEICO (HEI) rounding out the top four. Airlines have gotten off to a strong start in July so far as four made the list of best performers (Copa, American, United Continental, Alaska Air) with gains of more than 4.5%. Other notables listed include Alcoa (AA), Albermarle (ALB), and Skyworks Solutions (SWKS).

One trend that stands out among the biggest winners so far in the second half is that they also did very well in the first half too. Of the 25 names listed, just one (ACADIA Pharma) was down in the first half, and the average first-half gain was over 24%!

Click here to start a no-obligation two-week free trial to our premium research platform.

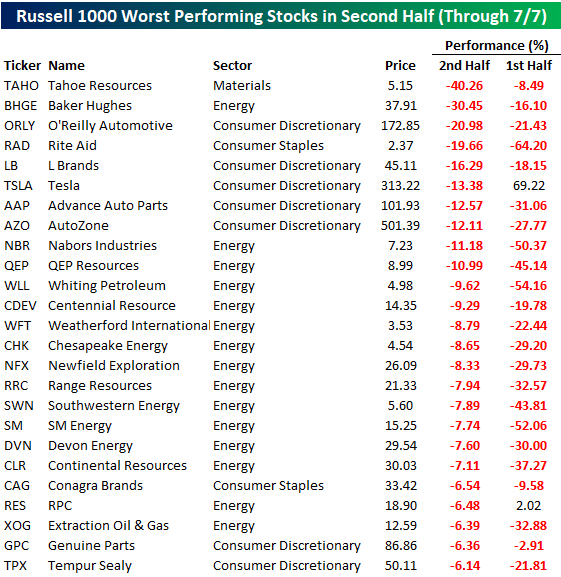

While just nine stocks in the Russell 1000 are up over 5% in July, a number of stocks are already down big, and we mean really big! The table below lists the 25 biggest losers in the Russell 1000 so far in the second half. As shown, three stocks are already down over 20%, while another seven stocks are down over 10%! Leading the way to the downside, Tahoe Resources (TAHO) is down over 40% after falling over 8% in the first half. Things have been even worse for Rite Aid (RAD), whose performance has been anything but “rad.” After losing nearly two-thirds of its value in the first half, the stock is already down nearly 20% in July! The real pain point so far in the Russell 1000 is the Energy sector. The average stock in the sector is already down over 4%, and less than one out of every ten stocks in the sector are up.

Like the list of winners, there is clearly a trend in the losers as well. As shown, just two of the biggest losers in the second half were up in the first half. The big standout here is Tesla (TSLA). After rallying 69% in the first half, the stock has been the sixth biggest loser in the second half falling more than 13%. Even including TSLA’s big first half gain, the average decline of the 25 biggest losers in the first half was a haircut of 25%! So far at least, the second half of 2017 is picking up right where the first half left off.

Click here to start a no-obligation two-week free trial to our premium research platform.

The Closer: End of Week Charts — 7/7/17

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. This week, we’ve added a section that helps break down momentum in developed market foreign exchange crosses.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

Click here to start your no-obligation two-week free Bespoke research trial now!

Bespoke Brunch Reads: 7/9/17

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Economic Measurement

On the measuring and mis-measuring of Chinese growth by Hunter Clark, Maxim Pinkovskiy, Xavier Sala-i-Martin (Voxeu)

An effort to gauge Chinese GDP growth based on the amount of light thrown off by cities and towns at night, suggesting that recent activity has been stronger than reported, rather than weaker. [Link]

Goldman Sachs thinks the opioid crisis is so bad it’s affecting the economy by Evelyn Cheng (CNBC)

Spiraling use and abuse of opiods for pain management has created a crisis, with more than 90 Americans killed by overdoses each day. Goldman thinks that is holding down the labor force participation rate. [Link, auto-playing video]

Big Thoughts From Tech

Bill Gates Made These 15 Predictions In 1999 – And It’s Scary How Accurate He Was by Biz Carson (Business Insider)

Payments, shopping, mobile devices, social media…all predicted years before they were deployed. [Link]

The music industry according to super-producer Jimmy Iovine by Matthew Garrahan (FT)

Inside the head of the billionaire founder of Beats, who now directs Apple’s strategy around music. [Link, soft paywall]

Investing

Tech Stocks Boom, but Some Stock Pickers Are Wary by Landon Thomas Jr (NYT)

It’s almost impossible to outperform when you’re not at least equal-weight the huge tech giants which have surged to new all-time highs this year. [Link, soft paywall]

A Kansas Investment Firm Spurring Change on Wall Street by Landon Thomas Jr (NYT)

A look at the RIA industry and the new approach it brings to helping Americans manage their assets, including a greater focus on services over products. [Link, soft paywall]

User Error

Finance sites erroneously show Amazon, Apple, other stocks crashing by Mike Murphy (Marketwatch)

Test data from Nasdaq was released into the public stock pricing feeds that power numerous data providers, causing a night of chaos this week. [Link]

Shkreli’s Hedge Fund Went From Success to Bust in 31 Minutes by Patricia Hurtado and Misyrlena Egkolfopoulou (Bloomberg)

One investor received two emails a half hour apart showing gains of $135,000 and complete losses after an investment with Martin Shkreli. [Link]

Food

So Long, Hamburger Helper: America’s Venerable Food Brands Are Struggling by Annie Gasparro and Saabira Chaudhuri (WSJ)

Shifting consumer preferences, ineffective marketing strategies, and the falling market share facing big food brands in the grocery aisle. [Link, paywall]

Durability

Roman concrete is still standing tall – and now we know why by James Temperton (Wired)

By infusing their staple building material with seawater, Roman architects were able to make it last two millennia and counting. [Link]

Sports

Dak Prescott accused of using machine to sign autograph by Darren Rovell (ESPN)

The Dallas Cowboys quarterback has been accused of using a performance enhancing machine to sign cards tirelessly without holding a pen. [Link]

Science

Is the staggeringly profitable business of scientific publishing bad for science? by Stephen Buranyi (The Guardian)

A deep dive into the world of for-profit scientific journals and the consequences of perverse incentives for that business model as it interfaces with the world of scientific discovery. [Link]

European Banks

Rough policy notes on Veneto Banca and Banca Popolare di Vicenza (V&V) by Jonathan Alger (Medium)

A comprehensive and in-the-weeds look at recent ECB actions to resolve two failing periphery banks. Filled with jargon and impressive detail that probably goes well over the head of the casual reader but a very helpful resource on the complex subject of the ECB’s governance of banks. [Link]

Code

A programmer figured out how to automate his job and work 2 hours a week — but he’s not sure it’s ethical by Julie Bort (Yahoo! Finance/Business Insider)

Maybe slow productivity is being caused by worker deception? We kid, but the ethical dilemma involved with this worker’s efforts to become more efficient is definitely interesting. [Link]

Have a great Sunday!

The Bespoke Report — 7/7/17

Bespoke Global Macro Dashboard — 7/7/17

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly at the Bespoke Institutional membership level.

Click here to start a no-obligation two-week free trial to Bespoke Institutional!

S&P 500 Quickview Chart Book — 7/7/17

Facebook (FB) Age Problem

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than three years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

Along with valuable macro analysis, our Pulse survey also covers groups and sectors like smartphones, e-commerce, streaming media, and social media. Having long-term data on these sectors allows us to identify shifts in consumer activity and sentiment essentially in real time.

Yesterday we published a post featuring a couple of charts that are part of our broader smartphone coverage in our monthly Pulse report. Today we wanted to highlight a couple of interesting charts related to the social media space.

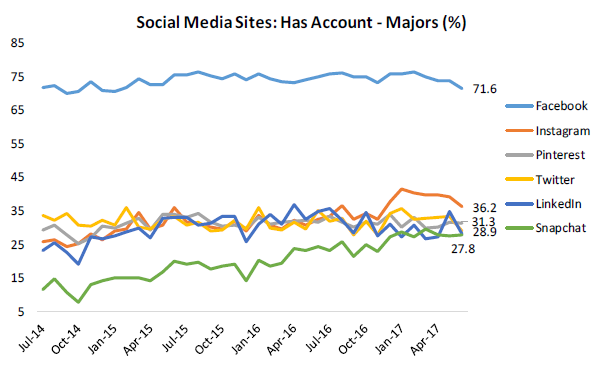

The first chart below shows the historical results from a question we ask consumers (balanced to US census numbers) regarding social media accounts. In our June 2017 survey, 71.6% of consumers reported having a Facebook account. That’s far and away the largest percentage of any social media platform. Instagram (owned by Facebook) ranks second at 36.2%, while Pinterest ranks third at 31.3%. Twitter, LinkedIn, and Snapchat are bunched up together just under the 30% mark.

What’s notable in this chart is the historical trend. Facebook appears to have peaked out at just over 75% and is now trending lower. And up until recently, Instagram had been moving steadily higher, but even Instagram has started to see a decline in those reporting an account on the platform.

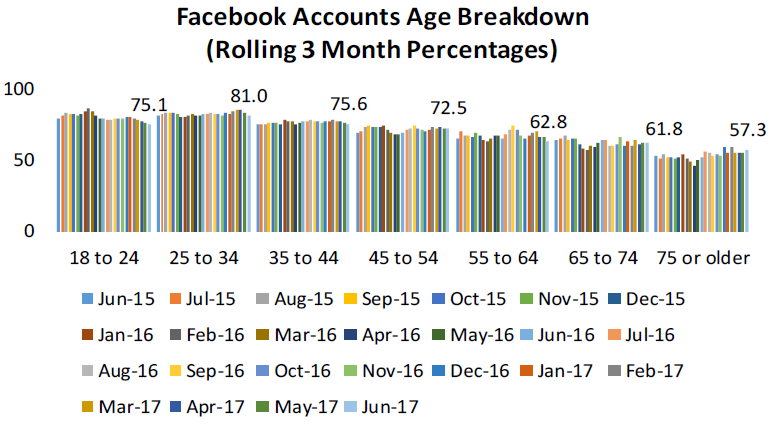

Another issue for Facebook is that younger age groups have started to see a dip in accounts lately. As shown below, the 18 to 24 demographic has been trending lower for the last year, while the 25 to 34 demo has dipped lower over the last few months. The only age groups that have seen a slight increase in accounts in recent months are the 65 to 74 demo and the 75 or older demo. That’s probably not a trend Facebook wants to see.

To see even more of our proprietary social media research, plus coverage of other sectors like streaming media and e-commerce, click here to start a 30-day free trial to our Pulse service now!