Nasdaq 9+ Day Winning Streaks

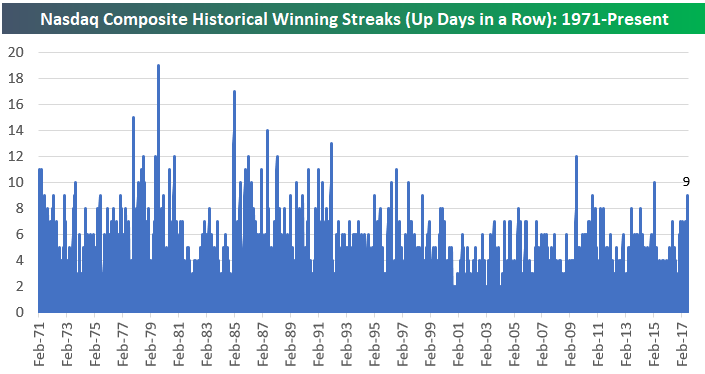

The Nasdaq Composite is set to close up for the 9th trading day in a row today. Below is a look at historical winning streaks for the index since its inception back in 1971.

Start a two-week free trial to Bespoke’s research platform to see our full offering.

Below is a list of Nasdaq winning streaks of 9 days or longer throughout its history. For each streak, we highlight how the index performed in the days and weeks following the end of the streak as well.

As you’ll see at the bottom of the table, the index has done slightly better than average in the week and month after these long winning streaks have ended. So conventional wisdom that we might be due for a pause or pullback after a long winning streak does not really hold water.

The last winning streak of 9+ days for the Nasdaq came in February 2015 when it went up 10 trading days in a row. Following the end to that streak, the index did pullback 2% over the next month, however.

Fixed Income Weekly – 7/19/17

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s note, we take a look at international investors’ purchases of US securities.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here to start your no-obligation free Bespoke research trial now!

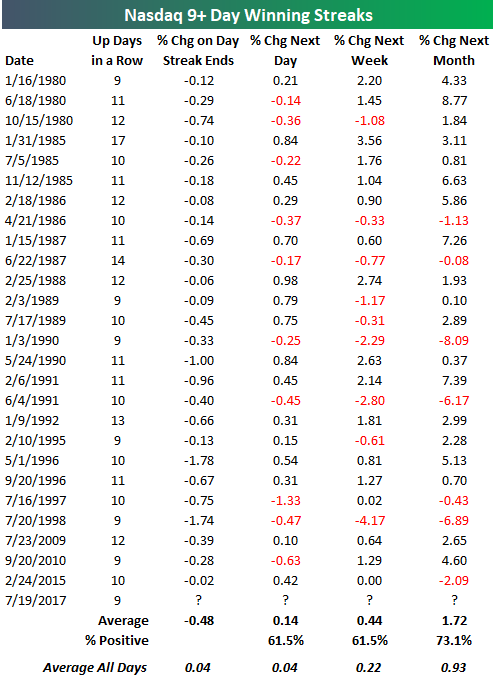

S&P 500 Average Change by Weekday

Below is an updated look at the performance of the S&P 500 by day of the week so far this year. For all trading days, the index has averaged a gain of 0.07% this year. But as shown below, the trading week has seen back and forth action between green and red. Mondays, Wednesdays, and Fridays have all averaged gains, with Wednesday posting stronger gains than Monday, and Friday posting stronger gains than Wednesday. In between, Tuesdays and Thursdays have both averaged slight declines. Go figure.

Start a two-week free trial to Bespoke’s research platform to see our full offering.

ETF Trends: International – 7/19/17

Coffee tops our list of best performing ETFs this week, up 7% after appearing on the other side of this chart last week. Solar has been a consistent outperformer as of late, joined by Oil, South Africa, and a host of European countries. Mortgage Real Estate continues its struggles, down almost 2%, while Transports, Banks, and the US Dollar are also notable underperformers.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

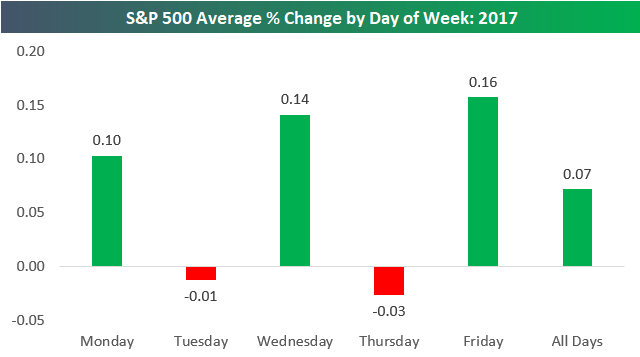

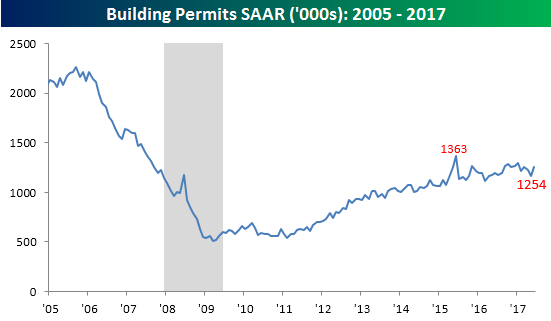

Chart of the Day: Housing Provides a Sigh of Relief

Four-Month Highs For Housing Starts and Building Permits

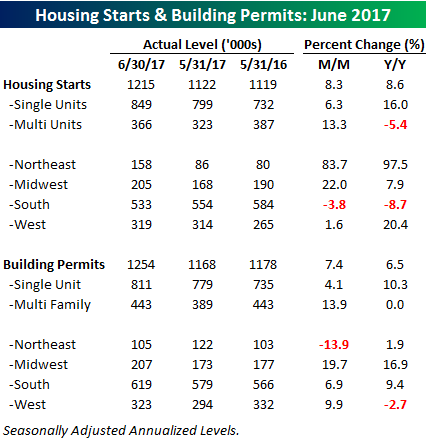

The US residential housing sector received a nice boost this morning as both Housing Starts and Building Permits for the month of June came in better than expected. That’s the first time both reports have exceeded estimates in the same month since the January report earlier this year. For each report, the actual reported number was more than 50K ahead of expectations and both readings were a four-month high. So, after a few months of declines, June’s numbers provided a nice respite from the lackadaisical numbers.

Start a two-week free trial to Bespoke’s research platform to see our full offering.

Taking a look at the internals of the report showed solid results. For Housing Starts, the 8.3% m/m gain was driven by a 13.3% gain in multi-family units and a 6.3% gain in single-family starts. For Building Permits, it was a similar picture as single-family permits increased 4.1%, while multi-family permits were up 13.9%. It would have been preferable to see more of the gains coming from single-family units, but with both showing growth, we’ll take it. On a regional basis, starts were strongest in the Northeast and Midwest, while permits showed the strongest m/m growth in the Midwest and West regions.

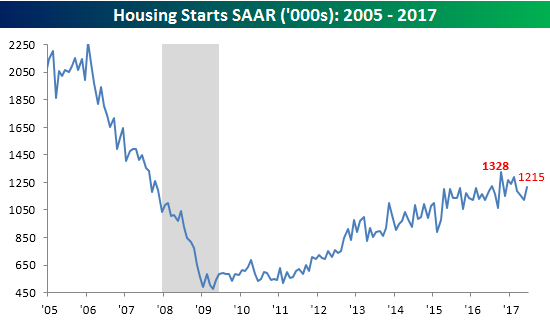

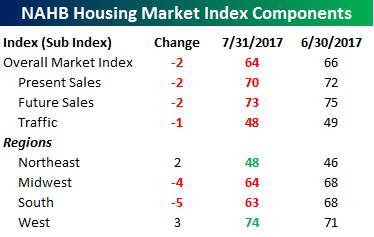

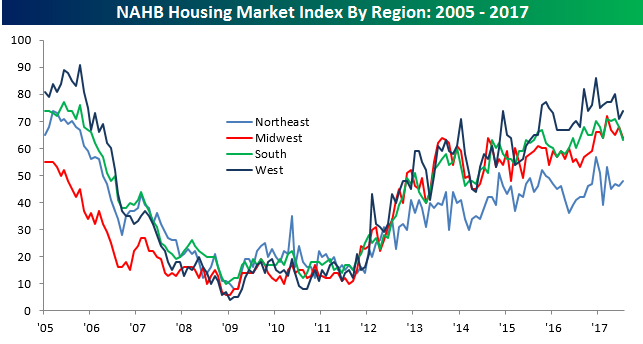

Homebuilder Optimism Up in Smoke

If there’s an economic indicator that gets released these days, taking the under usually ends up being the prudent bet. Today’s release of homebuilder sentiment for the month of July from the NAHB on Tuesday was the latest example. While economists were expecting the headline reading to come in at a level of 67, the actual reading was 64- the weakest reading since November. After a four-month surge post-election, the last four months have seen homebuilder sentiment decline in three of the last four months. Making matters worse, Tuesday’s reading was the weakest relative to expectations since May 2015.

Start a two-week free trial to Bespoke’s research platform to see our full offering.

The table below breaks down July’s report by Present and Future Sales, Traffic, and Regions. There wasn’t much to get excited about in July as every category of the report declined. On a regional basis, sentiment was more mixed with relatively large declines in the Midwest and South but actually increases in both the Northeast and West. Finally, Tuesday’s NAHB sentiment reading comes ahead of Wednesday’s report on Housing Starts, which has been weaker than expected for three straight months and Building Permits, which has missed the mark each of the last two months.

The Closer — Chinese Real Estate, European Banking, Obscure FX — 7/18/17

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke Institutional clients, we review monthly data from China on property prices, quarterly Eurozone Bank Lending Survey data on the supply and demand of bank lending in Europe, and take a look at some interesting FX charts.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

The Closer is one of our most popular reports, and you can see it and everything else Bespoke publishes by starting a no-obligation 14-day free trial to our research!