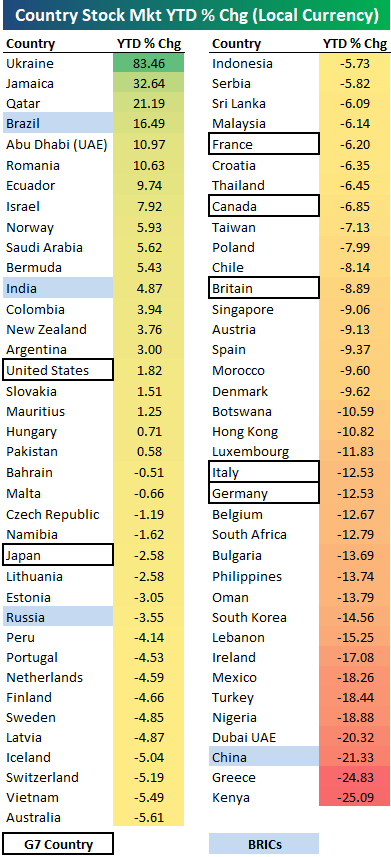

2018 Year-to-Date Country Stock Market Returns

Below is an updated look at year-to-date stock market returns (in local currency) for 75 countries around the world. 2018 has turned into a red year for equities as the average country is now down 3.75% YTD. Just 20 countries (26.7%) are in the green for the year, while 55 are in the red.

As shown, Ukraine ranks first with a gain of 83.46% (remember these returns are in local currency), followed by Jamaica (+32.6%), Qatar (+21.2%), and Brazil (+16.59%). Abu Dhabi (UAE) and Romania are the only other countries up 10%+ on the year.

Of the G7 countries, the US ranks first with a minuscule gain of 1.82%. The US is also the only G7 country in positive territory for the year. Japan ranks 2nd best with a YTD decline of 2.58%, followed by France at -6.2%, Canada at -6.85%, and Britain at -8.89%. Italy and Germany rank at the bottom of the G7 with double-digit percentage declines of 12.5%.

Of the “BRICs”, Brazil ranks first with a gain of 16.49%, followed by India at +4.87%. Russia is down 3.55%, while China is down 21.33%. China is actually the 3rd worst out of the entire list of 75 countries, and one of just four countries down 20%+. Only Kenya and Greece have done worse this year.

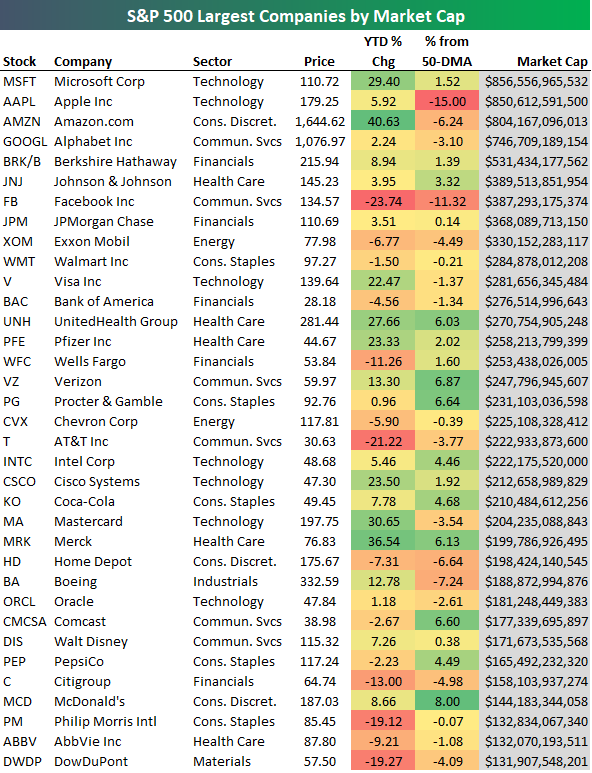

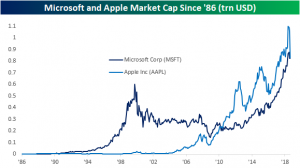

Microsoft (MSFT) Back on Top — Largest Companies in the S&P 500

Yesterday we noted that Microsoft (MSFT) and Apple (AAPL) were once again battling it out for the title of world’s largest company by market cap. As of early afternoon trading today, Microsoft (MSFT) has moved back into the lead. Below is a table showing the 35 largest companies in the S&P 500.

Microsoft (MSFT) sits at #1 with a market cap of $856.5 billion, followed closely by Apple (AAPL) at $850.6 billion. Amazon.com (AMZN) isn’t far behind in third place with a market cap of $804.1 billion, while Alphabet (GOOGL) ranks fourth at $746.7 billion. Berkshire Hathaway (BRK/B) rounds out the top five at $531.4 billion.

Earlier in the year, Facebook (FB) ranked in the top five with a market cap above $500 billion, but the company has lost 23.7% year-to-date at this point, leaving it in 7th place behind Johnson & Johnson (JNJ).

JP Morgan (JPM), Exxon Mobil (XOM) and Walmart (WMT) rank 8th through 10th.

One name conspicuously absent from the list of largest companies is General Electric (GE). At a share price of just $7.60, GE’s market cap has fallen all the way down to $66 billion. As recently as October 8th, the stock had a market cap of $120 billion, but a 44% decline since then has wiped out nearly half of its value. Pretty remarkable.

Chart of the Day: Walgreens (WBA) Offers Medicine for Sell-Offs

Principals of Preferreds

Below is an excerpt from today’s Fixed Income Weekly, which is sent out each Wednesday to recap and analyze developments in fixed income markets both in the US and around the world. Sign up for Bespoke Institutional with our Annual Outlook special to read it today and beyond.

From a price return perspective, preferred share ETFs have been in a world of hurt. Major preferred share ETFs like VRP (Invesco Variable Rate Preferred ETF), PFF (iShares US Preferred Stock ETF), PGX (Invesco Preferred ETF), and PGF (Invesco Financial Preferred ETF) are at or near 52-week lows. Worse, price has gone nowhere since 2014, with prices down almost 6% since the inception of VRP back in May of 2014. That’s pretty brutal.

Fortunately for fixed income investors with preferred exposure, price is not the driver of returns for the product. As shown in the chart below, despite the horrible price returns, total returns on average across all four ETFs listed above are a solid 21% since 2014. Interest returns are significantly higher at more than 26%. Moreover, while day-to-day volatility is almost entirely a function of the price return, interest return is the overwhelming driver of aggregate total returns. As with other fixed income ETFs, failing to account for interest accruals in the form of dividends is a critical mistake that can lead to missed opportunities.

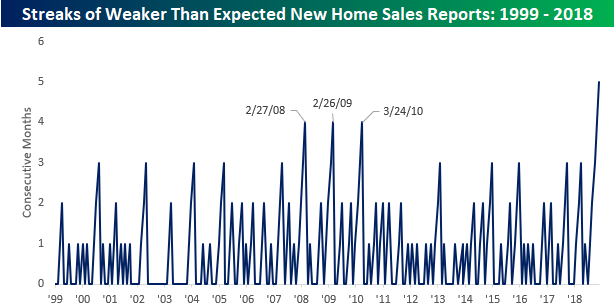

Another Miss in New Home Sales

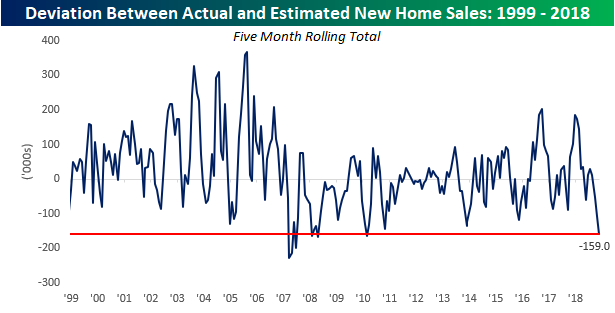

This is becoming a trend. New Home Sales for the month of October were released earlier today and once again missed expectations. While economists were expecting the headline reading to come in at 575K, the actual reading came in 31K below that consensus forecast at 544K. The last time we’ve seen a monthly print in New Home Sales this low was back in March 2016. Not only is this month’s report notable for the fact that sales printed at a 2.5 year low, but it also marked the fifth straight month where sales missed expectations. Usually after a couple of months of weaker than expected reports, economists adjust their forecasts to account for the weakness, but in this case, they haven’t been able to catch up. Using our Economic Indicator Database, we looked to see how the current streak of weaker than expected New Home Sales reports stacks up over time, and what we found was pretty amazing. Going all the way back to 1999, there has never been a streak where New Home Sales missed expectations for five straight months. During the housing crisis and in the early stages of the recovery, there were three streaks where New Home Sales missed expectations four months in a row but never for five straight months.

Not only have economists consistently overestimated New Home Sales, but they have also been way off the mark. The chart below shows the rolling five-month spread between the actual initially reported print for New Home Sales versus consensus expectations. With misses of -31K, -72K, -1K, -18K, and -37K in the last five months, the total deviation between actual and estimated New Home Sales has been -159K. Looking back over time, there haven’t been a whole lot of periods where the spread was this wide indicating just how weak recent housing activity has been relative to expectations.

Fixed Income Weekly – 11/28/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we look at the relationship between credit markets and equity prices.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

B.I.G. Tips: Death Cross Looms

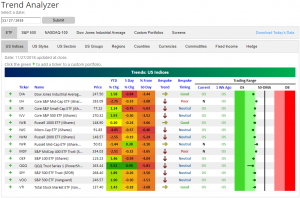

Trend Analyzer – 11/28/18 – Still Not Recovered

The major indices have managed to edge out gains so far this week but the index ETFs in our Trend Analyzer for the most part still have some room to go before they have recovered from last week’s losses. Currently, every major US Index ETF is within 1% of their levels from 5 days ago. Only two of these—the Russell Mid-Cap (IWR) and Nasdaq (QQQ)—are positive. Eleven of these names are oversold while the remaining three are neutral. The oversold ETFs are teetering on neutral, so a little more upward movement would likely shift them to neutral. Unfortunately, longer-term trends remain negative with ten of the names in this group sitting in downtrends.

Bespoke’s Global Macro Dashboard — 11/28/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke Morning Lineup – Three in a Row?

Don’t look now but the S&P 500 is currently on pace for its third straight day of gains, and with the MTD decline now at just over 1%, there’s actually a possibility of a green November! Before getting too far ahead of ourselves, however, Fed Chair Powell is set to speak right at noon today, and the tone of his speech could play a big role in how the afternoon goes. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 11/28/18

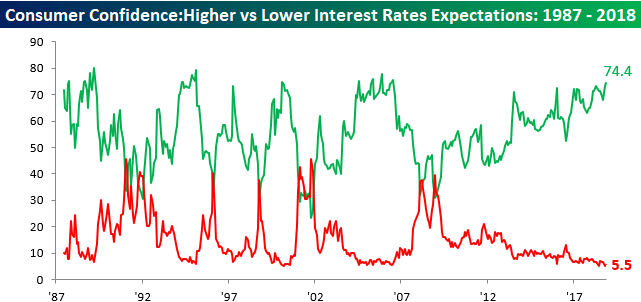

There doesn’t seem to be a more consensus trade these days than that interest rates are going to rise. A prime example is yesterday’s Consumer Confidence report for the month of November. In reference to a question regarding the direction of interest rates, 74.4% of those surveyed expect interest rates to rise (highest since July 2006), while just 5.5% expect rates to decline. At a spread of 68.9 percentage points, you don’t often see sentiment skewed so far to one side. While it’s not always the case, often when you see such lopsided levels of sentiment, things have a way of going the other direction.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.