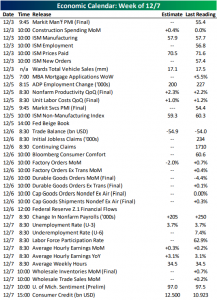

This Week’s Economic Indicators – 12/3/18

Last week was a busy one for economic data. Of the 28 releases, the majority (16 data points) either missed estimates or declined relative to prior readings. The Chicago and Dallas Feds’ manufacturing indices kicked off the week with Chicago seeing a nice beat, but the opposite held true for the Dallas Fed which declined more than expected. The next and final input for our Five Fed Index—Richmond—was released on Wednesday and came in slightly below estimates. Housing data continued to show weakness across the board with both Case-Shiller and FHFA price indices falling short while new and pending home sales also fell—pending sales missed badly. The second release for Q3 GDP was on Wednesday with the aggregate number coming in right in-line with expectations, although consumption, trade, and government all were revised lower. Jobless claims hit a six month high. To cap off the week, the Chicago PMI blew away expectations, hitting the best level of the year.

Manufacturing data kicks off December and another busy week with ISM and Markit manufacturing PMIs releasing later this morning. It will be a hush Tuesday with no releases scheduled for tomorrow. Things are scheduled to pick back up on Wednesday with productivity numbers, the ISM and Markit PMI for Services, ADP Private Payrolls, as well as the Fed’s Beige Book report; although these are subject to change due to the National Day of Mourning in honor of former President Bush. With the government closing for the day, it is likely Nonfarm Productivity and the Beige Book will get postponed. Thursday will have trade balance numbers and the final print for manufacturing orders and shipments. Finally, on Friday we see the monthly Non-Farm Payrolls report which is currently expected to come in at +205k. Consumer Credit then releases late in the day to finish the week.

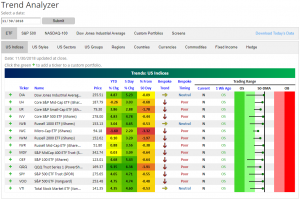

Trend Analyzer – 12/3/18 – Open Above 50-DMAs

It is still early in the holiday season but this morning investors are waking up to quite the gift as assets are rallying on positive trade news out of the G20. Taking a look at our Trend Analyzer, every major US index ETF ended November at neutral levels with most sitting just below their 50-day moving averages (DMA). With futures pointed sharply higher this morning, it is likely we will see a majority of these ETFs open above their 50-DMAs. Additionally, each name in this group is up from the start of last week when they were coming off of a post-Thanksgiving selloff. Things have come a long way in a week’s time. The Core S&P Mid-Cap ETF (IJH) and the Micro-Cap ETF (IWC) are the only ones with YTD losses, but even these could easily be reversed if they see the same upward movement as the broader market today.

Chart of the Day: Strong Starts to the Week, December

Morning Lineup – Strong December Start

US equities are set to surge at the open this morning, kicking off the month of December on an incredibly positive note. The obvious catalyst today is new developments in the ongoing trade dispute between the US and China and a 90-day halt to any new tariffs. How long the positive impact of these headlines lasts is up for debate. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/3/18

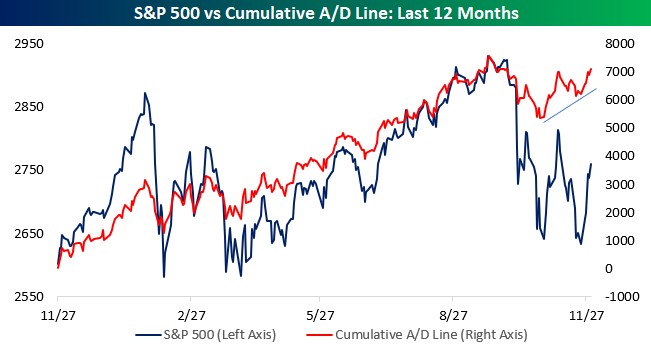

Just as important as the positive trade-related headlines this morning is the fact that market breadth has been holding up pretty well. While the S&P 500 made a lower low on a closing basis in November, its cumulative A/D line held up much better and actually saw a positive divergence from price. In fact, closing out the week, it was only 450 below its all-time high from September. All it would take for the cumulative A/D line to make a new high would be two good days in a row.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 12/2/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, try a two-week free trial to Bespoke’s premium stock market research! You’ll be able to read our important “Equity Market Pros and Cons” report that was just published.

Investing

The Stock Market’s Dangers Are Easier to See Now by Jeff Sommer (NYT)

Markets are weighing a series of positives and negatives, and for the first time in some years the negatives are starting to loom larger than the positives. [Link, soft paywall]

No Refuge for Investors as 2018 Rout Sends Stocks, Bonds, Oil Lower by Akane Otani and Michael Wursthorn (WSJ)

90% of asset markets have posted negative returns this year, the worst breadth across asset classes since at least 1901. [Link; paywall]

Tax Reform

US capital expenditure boom fails to live up to promises by Rana Foroohar (FT)

Despite claims that companies would pass tax cuts on to workers or ramp up capital expenditure, there’s scant evidence that they’re doing anything of the sort. [Link; paywall]

Tax Reform Made Me Do It! by Michelle Hanlon, Jeffrey L. Hoopes, and Joel Slemrod (NBER Working Papers)

Analysis of earnings calls show only 4% of public companies intend to pass on some portion of tax savings towards workers, while 22% said they would raise investment. Share repurchases were more common, but highly concentrated in a few firms, with only nine explicitly tying a new repurchase program to the taxes. Interestingly, the authors also link Political Action Committees more that donate more to Republicans to employee benefit announcements. [Link]

Real Estate

The homes millennials can buy for a million by Melissa Lawford (FT)

A new TD Ameritrade survey shows 51% of people between 21 and 37 years old believe they will become millionaires, though of course that amount of net worth would be about a fifth as much after adjusting for inflation compared to 1980. [Link; paywall]

OK, Computer: How Much Is My House Worth? by Ryan Dezember and Cezary Podkul (WSJ)

A proposed change in federal regulations would allow a large chunk of the real estate market to be bought and sold without a human being appraising the value of the transaction. [Link; paywall]

One of America’s Richest Suburbs Just Lost Its AAA Rating by Martin Z. Braun and Danielle Moran (Bloomberg)

S&P has downgraded New York’s Westchester County from AAA to AA+, and kept the county on ratings watch negative thanks to budget shortfalls. [Link; soft paywall]

Parking

America Probably Has Enough Parking Spaces for Multiple Black Fridays by Laura Bliss (CityLab)

Suburban malls and shopping centers have such a dramatic over-supply of parking spots that there is more land per car in the US than housing per human being. [Link]

Police Shootings

“I Don’t Want To Shoot You, Brother” by Joe Sexton (ProPublica)

The heartbreaking story of a person committing suicide by cop, and the absurd consequences afterwards: the firing of a police officer who arrived on the scene first and did not kill the suspect. [Link]

Sports

NBA Breaks Fresh Ground for Sports With First Gambling Data Deal by Eben Novy-Williams (Bloomberg)

The NBA has signed agreements to provide gambling operators with high speed data links to NBA scores and other forms of information related to in-play betting. [Link; soft paywall]

Antitrust

US antitrust enforcement falls to slowest rate since 1970s by Kadhim Shrubber (FT)

Antitrust enforcement as measured by the number of criminal antitrust cases filed by the DoJ has fallen to the lowest level in almost 50 years. [Link; paywall]

Computing

On The Turing Completeness of PowerPoint (SIGBOVIK) by Tom Wildenhain (YouTube)

A hilarious presentation that demonstrates PowerPoint is at least hypothetically Turing complete, a degree of computational capability we never would have guessed was possible. [Link]

China

Beijing to Judge Every Resident Based on Behavior by End of 2020 (Bloomberg)

China’s currently ad hoc social credit system is set to expand significantly, making life much harder for those that break traffic laws and commit other minor infractions. [Link; soft paywall, auto-playing video]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a good Sunday!

2018 Week 13

Week 12 Results: 4-8, Overall 91-68 (57.2%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening).

On to the week 13 slate of Sunday and Monday Night games:

2018 NFL Week 13 Bespoke Picks:

Indianapolis (-4) at Jacksonville: Indianapolis -4

Carolina (-3) at Tampa Bay: Carolina -3

Baltimore at Atlanta (-2.5): Atlanta -2.5

Cleveland at Houston (-5.5): Cleveland +5.5

Buffalo at Miami (-3.5): Buffalo +3.5

Chicago (-3.5) at NY Giants: Chicago -3.5

Denver (-5) at Cincinnati: Cincinnati +5

LA Rams (-10) at Detroit: LA Rams -10

Arizona at Green Bay (-13.5): Arizona +13.5

Kansas City (-14) at Oakland: Kansas City -14

NY Jets at Tennessee (-8): NY Jets +8

Minnesota at New England (-5): Minnesota +5

San Francisco at Seattle (-10): San Francisco +10

LA Chargers at Pittsburgh (-3): Pittsburgh -3

Washington at Philadelphia (-6.5): Philadelphia -6.5

2018 NFL Week 12 Bespoke Results:

Jacksonville (-3) at Buffalo: Jacksonville -3 (Loss)

Oakland at Baltimore (-10.5): Oakland +10.5 (Loss)

San Francisco at Tampa Bay (-2.5): Tampa Bay -2.5 (Win)

NY Giants at Philadelphia (-5): Philadelphia -5 (Loss)

Cleveland at Cincinnati (-1): Cincinnati -1 (Loss)

New England (-10) at NY Jets: New England -10 (Win)

Seattle at Carolina (-3): Seattle +3 (Win)

Miami at Indianapolis (-8): Indianapolis -8 (Loss)

Arizona at LA Chargers (-13.5): Arizona +13.5 (Loss)

Pittsburgh (-3) at Denver: Denver +3 (Win)

Green Bay at Minnesota (-3): Green Bay +3 (Loss)

Tennessee at Houston (-4): Tennessee +4 (Loss)

The Bespoke Report – All This, And We’re Only Here?

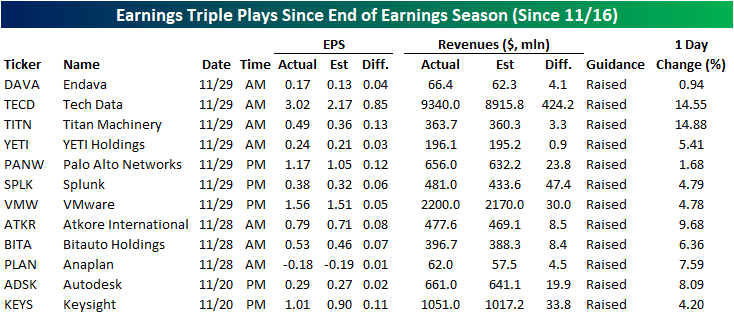

Earnings Triple Plays Since the End of Earnings Season

As we discussed in an earlier blog post, after the most recent earnings season left something to be desired, many of the companies that have reported since the end of the season (11/15) have fared much better. In that time, over 100 companies have had an earnings report, and of these companies, just over ten percent have reported an earnings triple play, which means they beat on earnings, revenues, and raised guidance. You can always check here for our list of recent earnings triple plays.

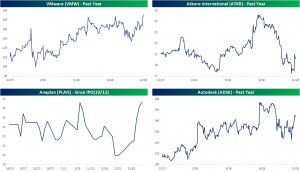

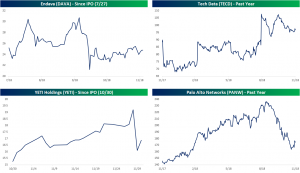

Below is a table and charts of the 12 triple plays since the end of earnings season. Most of these names are smaller technology companies. A few even are recent IPOs like YETI (YETI), Endava (DAVA), and Anaplan (PLAN). Autodesk (ADSK) is the only one that is a member of the S&P 500. As you might expect, the reactions to these earnings have been broadly positive, rising an average of 6.91% on their earnings reaction day. YETI is the only standout with an overly negative reaction during the day following earnings.

Post Earnings Season Stats Relatively Healthy

The third quarter earnings reporting period that spanned from early October through mid-November was a rough one for investors. The broad market struggled quite a bit during this period, and the actual earnings reports coming from corporate America were weaker relative to recent quarters. Since the unofficial earnings season ended with Wal-Mart’s (WMT) report on November 15th, though, earnings have been coming in a little better. Just over 100 companies have reported since the 15th, and below are a few stats worth highlighting.

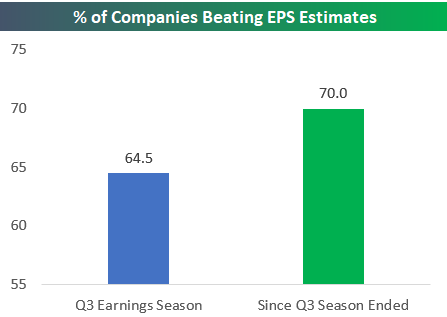

The first chart below shows the percentage of companies that beat consensus EPS estimates during the Q3 earnings season and since the season ended. As shown, the EPS beat rate since earnings season ended stands at 70%, which is 5.5 percentage points higher than the beat rate seen during the Q3 earnings season.

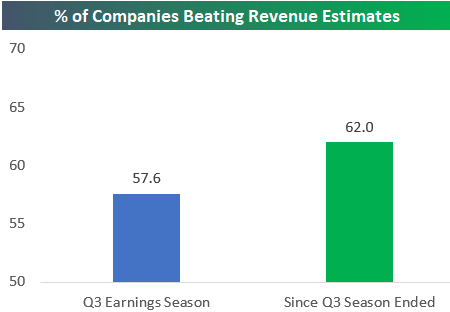

Top-line beat rates have also improved a bit. During earnings season, only 57.6% of companies beat revenue estimates, while the beat rate stands at 62% for companies that have reported since then.

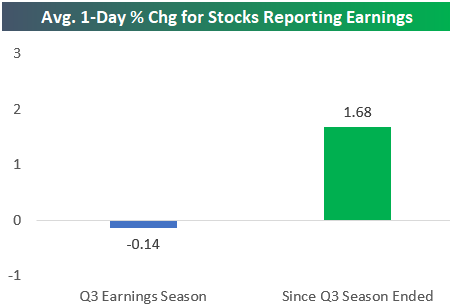

Finally, stock prices are reacting much more positively to earnings reports as well. During earnings season, the average stock that reported fell 0.14% on its earnings reaction day (the first trading day following the earnings release). Since earnings season ended, the 100+ companies that have reported have averaged a one-day gain of 1.68% in response to earnings.