Yield Curves Near Inversion

On Tuesday, the front end of the yield curve inverted as 3-year yields rose above 5-year yields. Other front end curves, by that measure, while not there yet, have also begun to dip to cycle lows. The 10-year minus 3-month spread is at its lowest level since 2007. Despite being at a low for the current cycle, the curve remains around 40 bps from inversion.

In the charts below we look at various yield curves over the past 15 years; this time frame allows us to see the curve’s movement leading up to the last recession.

Perhaps the most widely followed curve, the 10 year versus the 2-year spread, is also at levels it has not seen since 2007. Although it is picking up slightly today as yields across the board fall, 2s10s is looking much more ominous at only 13 bps away from becoming inverted. This will be the main curve that investors will keep their eyes on; expect to see it ad nauseam in headlines if it moves those 13 bps lower.

Shifting our focus to the longer end of the curve, spreads are off of lows from earlier in the year, but may not have quite bottomed just yet. The 10-year versus the 5-year spread has recently fallen back down towards these lows.

Even longer maturities like the 30-year versus the 10-year have a higher spread still and has much more clearly made a bottom. It is important to note, leading up to the previous recession this curve was not inverted for long. Most of the bottoming occurred with a normal—albeit very flat—curve.

Services Sector Continues to Hum Along

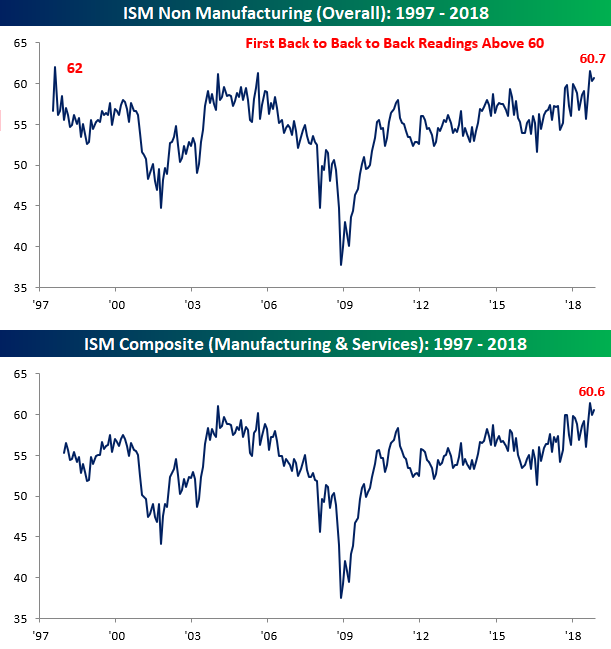

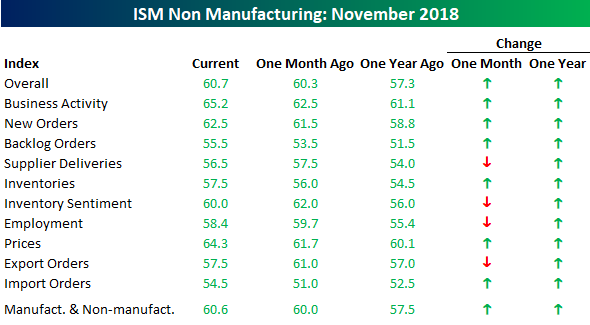

The ISM Non-Manufacturing report for the month of November showed that the services sector of the economy (the lion’s share) continues to hum along. While economists were expecting the headline index to come in at a level of 59.0, the actual reading stayed above 60, hitting a level of 60.7. What’s notable about this is that even though it is still off its highs from two months ago, the current string of back to back to back readings above 60 is the longest streak of 60+ readings since the survey began in 1997! On a combined basis and accounting for each sector’s share in the overall economy, the combined ISM for the month of November was 60.6, which is also among the highest readings on record.

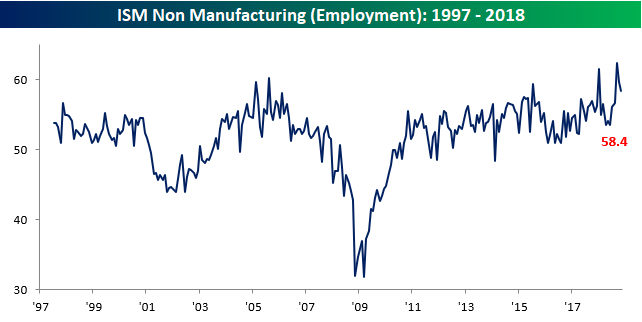

Breadth in this month’s report was somewhat mixed. Of the index’s ten sub-components, six were up in November and four were down, but all of them are still well above 50 – the threshold for growth. The key gainer on the month was Business Activity (top chart below table), which is back at its highest levels of the cycle, while one of the bigger disappointments to the downside was Employment, which has seen a bit of a reversal from its recent surge higher in the prior few months (lower chart).

Individual Investors Ironically Turn Bullish

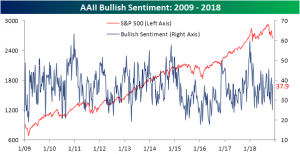

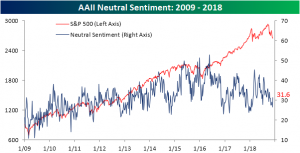

This may be hard to believe after the past few days, but individual investors’ outlook on markets from the AAII survey actually saw a bump in bullish sentiment this week. Bullish sentiment rose for the second week in a row to 37.94% from last week’s 33.88%. This is off of one of the lowest readings of the year from only a few weeks ago.

As always, as bullish sentiment rose, bearish sentiment took a hit returning back towards the historical average. Bearish sentiment fell to 30.5%. This is well off the high of 47.14% hit a couple weeks ago.

Neutral sentiment also saw a decent bump this week rising to 31.55%. Coming off of lows, this could indicate that investors are growing increasingly uncertain with how markets have performed recently.

As we mentioned last week, much of the more optimistic outlook from this week’s survey likely came as the result of Fed Chair Powell’s speech. Seeing as the survey polling closes Wednesday, this week’s results may not have fully taken into account Tuesday’s stock rout; just as last week’s survey likely did not take into account Powell’s speech. In other words, as the expected rise in bullish sentiment came this week, next week we should expect to see a rise in bearish sentiment especially if this price action keeps up.

Chart of the Day – Big Downside Gaps Following a Big Decline

Morning Lineup – More Weakness

At least US stocks couldn’t go down yesterday. Equities are looking to open the day sharply lower on new concerns regarding the US-China relationship. Not helping matters is the fact that the latest round of US economic data that released this morning was disappointing as ADP Private Payrolls came in weaker than expected while Jobless Claims were a little higher than expected. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/6/18

The last thing you want to see the day after a 3%+ decline in the S&P 500 is another 1%+ decline at the open the following day, but that’s what today’s open is shaping up to be. In looking at the chart of the S&P 500 below, the fact that we were unable to hold above 2,800 for a third time on Monday is certainly a disappointment, but this latest swoon to the downside hasn’t violated any important levels as of yet. Even with today’s implied open, we still won’t be making any sort of lower low. That doesn’t mean things will not get worse going forward, but we just wanted to provide some perspective of where things stand now. As always, we’ll be watching some of our key internal indicators for any further clues.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

the Bespoke 50 — 12/6/18

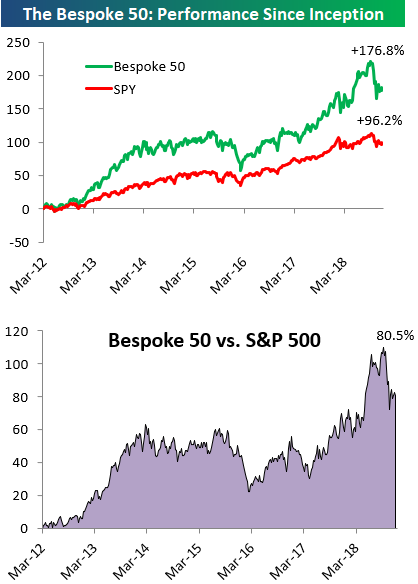

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 80.5 percentage points. Through today, the “Bespoke 50” is up 176.8% since inception versus the S&P 500’s gain of 96.2%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

The Closer — Technical Selloff, Homebuilders The New Energy, Rates Positioning — 12/4/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we review the 5th 3% decline for the S&P 500 this year. Selling has been in large part a function of technicals, but there are deeper fears about the possibility of recession. We compare the current sector suffering (housing) to the oil market weakness of 2014-2016, which is a good example of markets and pundits confusing sector weakness for secular weakness. We also take a look at fixed income relative value and positioning to get more insight on the massive flattening and bond rally of the last two days.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Yield Curve, Yield Curve, Yield Curve

A Negative “Turnaround Tuesday”

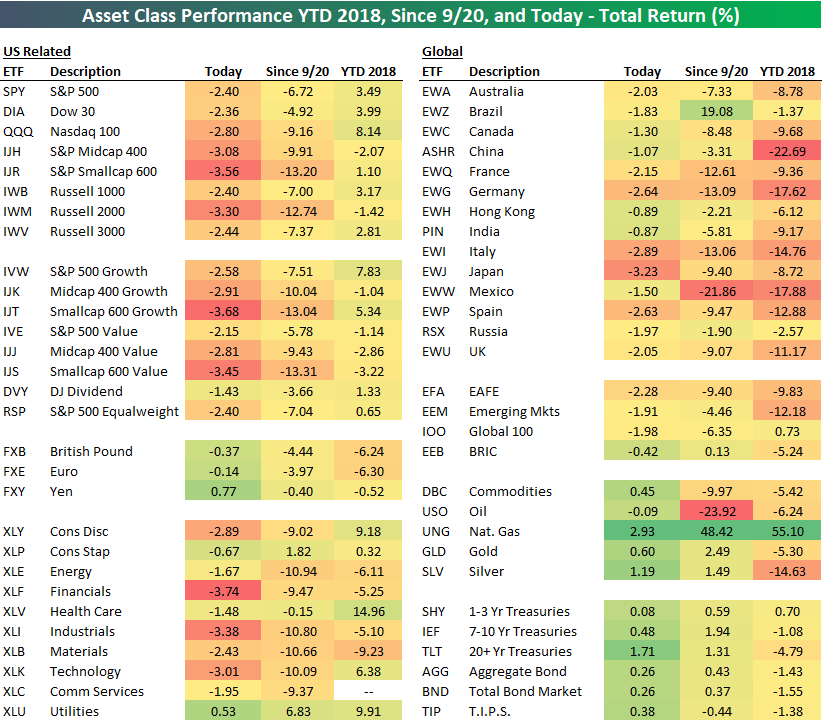

Monday’s 1.09% gain for the S&P 500 was the 19th time that December has started off with a 1%+ up day since 1928 when the index began. Unfortunately, all of yesterday’s gains and then some have been lost as of early afternoon today. Below is a quick look at the performance of various asset classes today using our key ETF matrix. We also include each ETF’s total return since the 9/20 peak for the S&P 500 as well as year-to-date.

As shown, major US index ETFs are down 2%+ across the board, with even more pain coming in the mid-cap and small-cap space. The S&P Smallcap 600 (IJR) is getting crushed by 3.56% as we type.

Looking at US sectors, the most pain is being felt in Financials (XLF), Industrials (XLI), and Technology (XLK), with all three down more than 3% on the day. The one sector that’s higher is Utilities (XLU), which benefits on days like today when risk-free interest rates are falling. The high-dividend yields of Utilities become more attractive as risk-free yields fall.

Outside of the US, Japan (EWJ) is getting hit the hardest with a drop of 3.23%. Germany (EWG), Italy (EWI), and Spain (EWP) are all down 2.6% or more as well. Hong Kong (EWH) and India (PIN) are down the least on the day with drops of roughly 90 bps.

The equity asset space is getting crushed today, but commodities and fixed income are performing well. The 20+ Year Treasury ETF (TLT) is up 1.71%, which is its best day since May 29th when it rose more than 2.19%.