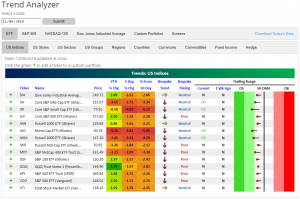

Trend Analyzer – 12/7/18 – Intraday Recovery Staves Off Oversold

Despite intraday recovery yesterday which helped to salvage the major index ETFs in our Trend Analyzer from moving into oversold territory, each member of the group has moved closer to oversold, and all of them are well below their 50-DMAs. Currently, there are only four ETFs that are oversold while the rest are neutral and moving towards oversold territory. Long-term trends are still firmly biased towards the downside. The widespread declines over the past few days have also erased almost half of these ETFs’ YTD gains. Six are now negative on the year.

While the Nasdaq (QQQ) has fared the best recently only falling 1.07% in the past week, Mid-Caps and Small-Caps have taken it on the chin. The Core S&P Small-Cap (IJR), Micro-Cap (IWC), and Russell 2000 (IWM) are all down the most in the past week with double or more the losses of most of the other members of this group.

Morning Lineup – Treasury Bid Continues

Treasuries continue to catch a bid this morning as investors don’t want to stick their necks out on the risk curve ahead of today’s jobs report. Given all the volatility in markets and other events swirling around recently, it seems as though this morning’s report has taken a backseat, and let’s hope that it is uneventful enough to stay that way! In a speech at a housing conference in DC yesterday, FOMC Chair Powell continues to see the economy humming along and described the labor market as “very strong.” The market is only hoping that it’s not too strong. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/7/18

Yesterday’s ‘moral victory’ rebound for US equities was impressive and most so in the Nasdaq which actually finished the day in the green. The index still has a lot to prove from a technical perspective, and the first task at hand is to break the string of lower highs. The most recent of those was at 7,490, which is just below the 200-day moving average. What is encouraging, though, is the fact that the index did make a higher low yesterday and could be in the later stages of an inverse head and shoulders pattern. We don’t put a lot of weight into these formations, but many do, so it’s important to at least be cognizant of it.

Also positive is the fact that the Nasdaq’s leading group for much of this year-Software & Services- has also shown signs of stabilizing. After last week’s higher high just above the 50 and 200-DMAs, the group managed to make a higher low in yesterday’s trading. That’s definitely worth watching.

Finally, while not related to the Nasdaq specifically, homebuilder stocks also look to be carving out a bottom. The group has also managed to make a higher high and two higher lows in the last few weeks. In addition to that, the fact that PulteGroup (PHM) just announced a dividend increase indicates at least some level of confidence on the part of one company in the group. We would note that back in the early stages of the housing crisis, the last homebuilder dividend increase was all the way back in August 2006.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Green Shoots, Banks vs Credit, US Data, Trade War Troubles — 12/6/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we note some recent outperformance from market laggards but much weaker price action in the term structure of the oil market. We also discuss credit spreads and their relevance to banks’ performance versus the S&P 500. We then move on to US economic data: factory orders, sales, and inventories as well as the US trade balance. Speaking of which, we close with a look at the impact of tariffs on bilateral US-China trade activity. Bottom line: it’s not going well.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

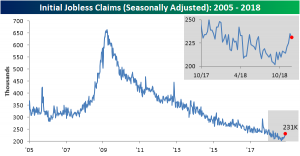

Jobless Claims Fall Off Highs

Falling off of their six-month high from last week, this morning’s report on jobless claims showed a decrease from 234K last week to 231K this week. A much stronger decline to 225K had been expected. While claims are down for the week, they remain at elevated levels.

That is to say, elevated compared to where they have been most of this year. From a broader time horizon, jobless claims have held onto impressive streaks. They have now spent 61 weeks below 250K. That’s the longest since January 1970 when the streak ended at 89 weeks long. It has also now been 196 weeks below 300K. Keep in mind, population and employment have grown dramatically since then, so the current streaks are arguably a lot more impressive. The health of these streaks means that even with the uptick, things are still very good.

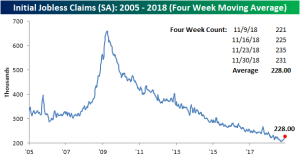

The four-week moving average has also seen a decent sized uptick this week rising to 228K from 223.25K. That is the highest it has been since April of this year. This week brings the indicator to a streak of 12 weeks since the last time it made a cycle low.

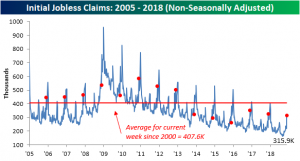

On a non-seasonally adjusted basis, claims saw a huge jump to 315.9K but that is due to seasonality. It is still below its level this time last year and the average for the current week since 2000 at 407.6K. This is down from the past couple of years, while 2015 saw a much lower reading for this week. Tomorrow we will see if the recently higher jobless claims numbers are reflected through the Employment Situation Report including the Nonfarm Payrolls number.

Bespoke’s Sector Snapshot — 12/6/18

A 9-Year Low for Fluor (FLR)

One of the country’s largest engineering and construction companies, Fluor (FLR), has declined 40% from its highs just two months ago. The company primarily offers engineering and construction services in oil, gas, industrial, and government projects including the development of power plants, petrochemical factories, mining facilities, and infrastructure. Seeing as misery loves company, the declines in oil prices track fairly well to the company in which oil and gas related business account for as much as 40% of revenues. With oil’s decline broadly being centered around an oversupply of the commodity, FLR’s business in oil and gas infrastructure understandably would be hurting.

Below is a price chart for FLR over the last ten years. Declines today have caused a breakdown below 2017 lows that takes shares to their lowest level since April 2009 — just one month after the Financial Crisis low was made.

Bespoke’s Consumer Pulse Report — November 2018

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in year two of Trump’s economy. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

November Employment Report Preview

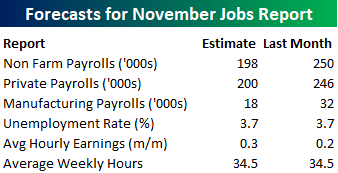

Heading into Friday’s Non Farm Payrolls (NFP) report for November, economists are expecting an increase in payrolls of 198K, which would be a decline from October’s report which came in above expectations at 250K. In the private sector, economists are expecting an increase of 200K, which would imply a similar decline versus October as the headline reading. The unemployment rate is expected to remain at 3.7%. Average hourly earnings are expected to grow at a rate of 0.3% versus the 0.2% reading last month. Higher wage growth is probably not something this market wants to see, but with expectations already anticipating some increase, it would have to be a big jump to really have a negative impact on the market. Finally, average weekly hours are expected to be unchanged at 34.5.

Ahead of the report, we just published our eleven-page preview of the November jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in November. We also include a breakdown of how the initial reading for November typically comes in relative to expectations and how that ranks versus other months.

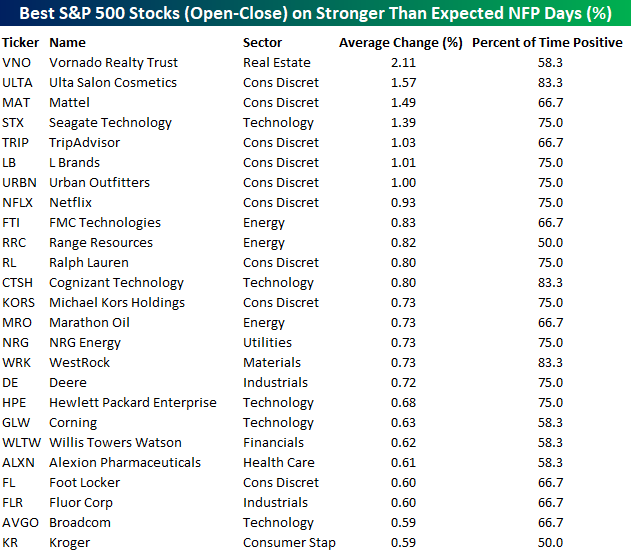

One topic we cover in each month’s report is the S&P 500 stocks that do best and worst from the open to close on the day of the employment report based on whether or not the report comes in stronger or weaker than expected. In other words, which stocks should you buy, and which should you avoid? The table below highlights the best-performing stocks in the S&P 500 from the open to close on days when the Non-Farm Payrolls report has been better than expected over the last two years.

Of the top performing stocks on days when NFP beats expectations, ten sectors are represented, but Consumer Discretionary leads the way with nine. Vornado (VNO) has been the best performing stock with an average open to close gain of 2.11%, but six of the next seven stocks are from the Consumer Discretionary sector. In terms of consistency, just three stocks (Ulta Beauty, Cognizant, and WestRock) have been in the black more than three-quarters of the time.

For anyone with more than a passing interest in how equities are impacted by economic data, this November employment report preview is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Yield Curves Near Inversion

On Tuesday, the front end of the yield curve inverted as 3-year yields rose above 5-year yields. Other front end curves, by that measure, while not there yet, have also begun to dip to cycle lows. The 10-year minus 3-month spread is at its lowest level since 2007. Despite being at a low for the current cycle, the curve remains around 40 bps from inversion.

In the charts below we look at various yield curves over the past 15 years; this time frame allows us to see the curve’s movement leading up to the last recession.

Perhaps the most widely followed curve, the 10 year versus the 2-year spread, is also at levels it has not seen since 2007. Although it is picking up slightly today as yields across the board fall, 2s10s is looking much more ominous at only 13 bps away from becoming inverted. This will be the main curve that investors will keep their eyes on; expect to see it ad nauseam in headlines if it moves those 13 bps lower.

Shifting our focus to the longer end of the curve, spreads are off of lows from earlier in the year, but may not have quite bottomed just yet. The 10-year versus the 5-year spread has recently fallen back down towards these lows.

Even longer maturities like the 30-year versus the 10-year have a higher spread still and has much more clearly made a bottom. It is important to note, leading up to the previous recession this curve was not inverted for long. Most of the bottoming occurred with a normal—albeit very flat—curve.

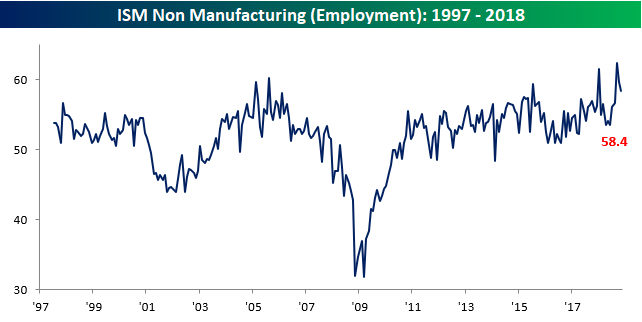

Services Sector Continues to Hum Along

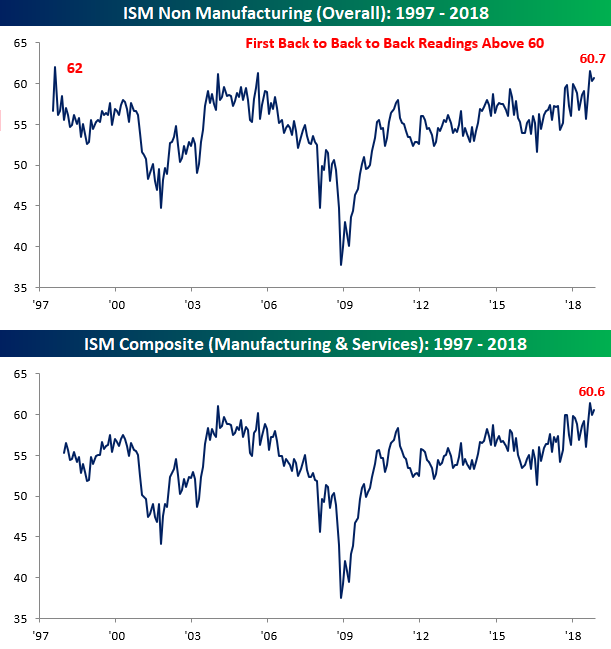

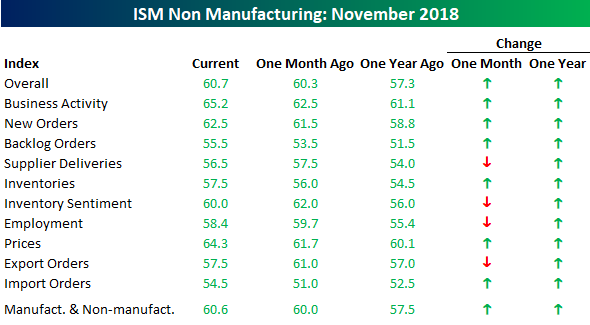

The ISM Non-Manufacturing report for the month of November showed that the services sector of the economy (the lion’s share) continues to hum along. While economists were expecting the headline index to come in at a level of 59.0, the actual reading stayed above 60, hitting a level of 60.7. What’s notable about this is that even though it is still off its highs from two months ago, the current string of back to back to back readings above 60 is the longest streak of 60+ readings since the survey began in 1997! On a combined basis and accounting for each sector’s share in the overall economy, the combined ISM for the month of November was 60.6, which is also among the highest readings on record.

Breadth in this month’s report was somewhat mixed. Of the index’s ten sub-components, six were up in November and four were down, but all of them are still well above 50 – the threshold for growth. The key gainer on the month was Business Activity (top chart below table), which is back at its highest levels of the cycle, while one of the bigger disappointments to the downside was Employment, which has seen a bit of a reversal from its recent surge higher in the prior few months (lower chart).