The Bespoke Report – Range-Bound And Down

2018 Week 14

Week 13 Results: 4-11, Overall 95-79 (54.6%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening).

On to the week 14 slate of Sunday and Monday Night games:

2018 NFL Week 14 Bespoke Picks:

NY Jets at Buffalo (-4): NY Jets +4

Carolina (-1.5) at Cleveland: Carolina -1.5

Atlanta at Green Bay (-4.5): Atlanta +4.5

Baltimore at Kansas City (-6.5): Kansas City -6.5

New England (-7.5) at Miami: New England -7.5

New Orleans (-10) at Tampa Bay: Tampa Bay +10

NY Giants (-3) at Washington: NY Giants -3

Indianapolis at Houston (-4.5): Indianapolis +4.5

Cincinnati at LA Chargers (-14.5): LA Chargers -14.5

Denver (-3.5) at San Francisco: Denver -3.5

Philadelphia at Dallas (-3): Dallas -3

Pittsburgh (-10) at Oakland: Oakland +10

Detroit (-3) at Arizona: Detroit -3

LA Rams (-3) at Chicago: LA Rams -3

Minnesota at Seattle (-3): Minnesota +3

2018 NFL Week 13 Bespoke Results:

Indianapolis (-4) at Jacksonville: Indianapolis -4 (Loss)

Carolina (-3) at Tampa Bay: Carolina -3 (Loss)

Baltimore at Atlanta (-2.5): Atlanta -2.5 (Loss)

Cleveland at Houston (-5.5): Cleveland +5.5 (Loss)

Buffalo at Miami (-3.5): Buffalo +3.5 (Loss)

Chicago (-3.5) at NY Giants: Chicago -3.5 (Loss)

Denver (-5) at Cincinnati: Cincinnati +5 (Loss)

LA Rams (-10) at Detroit: LA Rams -10 (Win)

Arizona at Green Bay (-13.5): Arizona +13.5 (Win)

Kansas City (-14) at Oakland: Kansas City -14 (Loss)

NY Jets at Tennessee (-8): NY Jets +8 (Win)

Minnesota at New England (-5): Minnesota +5 (Loss)

San Francisco at Seattle (-10): San Francisco +10 (Loss)

LA Chargers at Pittsburgh (-3): Pittsburgh -3 (Loss)

Washington at Philadelphia (-6.5): Philadelphia -6.5 (Win)

2019 Outlook Report — Housing

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Housing” section of the 2019 Bespoke Report, which focuses on the recent slowdown in housing-related data and where we think things will shake out in 2019.

To view this section immediately and all other sections, sign up for our 2019 Annual Outlook Special!

2019 Outlook Report — Yield Curve & Fed

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Yield Curve & Fed” section of the 2019 Bespoke Report, which focuses on financial conditions, the level of the yield curve, and the stance of the FOMC heading into 2019.

To view this section immediately and all other sections, sign up for our 2019 Annual Outlook Special!

2019 Outlook Report — Economic Cycles

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year end. Today we have published the “Economic Cycles” section of the 2019 Bespoke Report, which focuses on where we currently are in the business cycle and the likelihood of recession in the year ahead.

To view this section immediately and all other sections, sign up for our 2019 Annual Outlook Special!

2019 Outlook Report — Seasonality

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year end. Today we have published the “Seasonality” section of the 2019 Bespoke Report, which looks at the historical trading pattern for US indices, sectors, and other asset classes throughout the calendar year.

To view this section immediately and all other sections, sign up for our 2019 Annual Outlook Special!

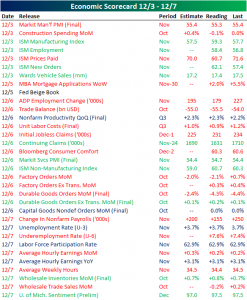

Next Week’s Economic Indicators

It was a busy week in economic data with 33 releases out of the US. Of these 33, only 10 beat estimates or the previous period’s reading while about half came in worse than expected. Manufacturing data kicked this week off with Markit Manufacturing PMI coming in slightly below estimates and the ISM Manufacturing Index saw a healthy beat, although prices paid missed big. Tuesday had no scheduled releases. Wednesday only saw mortgage applications and the Fed’s Beige Book release as all other releases were postponed or canceled due to the observance of President George H.W. Bush’s funeral. Things picked up with a busy end to the week. Thursday we saw the counterparts to Monday’s releases with Markit Services PMI and ISM Non-manufacturing index both coming in strong. The week concluded with a weaker Nonfarm Payrolls report indicating a slowdown of an extremely hot labor market.

Next week will be a bit lighter but still busy economic slate. The JOLTS report will start off the week as the only indicator on Monday. Tuesday we will get small business optimism data as well as producer prices which are both expecting downticks. Consumer prices will follow up on Wednesday with the Treasury’s monthly federal government budget statement coming later in the day. Import and export price indices come out on Thursday alongside jobless claims, which has now seen multiple weeks of increases off historic lows. It will be an end loaded week with retail sales, industrial production, capacity utilization, preliminary Markit PMIs, and inventories all releasing Friday morning.

B.I.G. Tips – November Employment Situation Report Recap

Chart of the Day: ISM Reports Suggest Easing Inflation Pressure

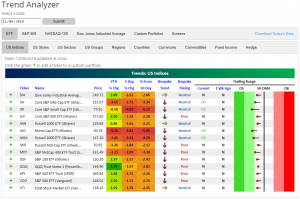

Trend Analyzer – 12/7/18 – Intraday Recovery Staves Off Oversold

Despite intraday recovery yesterday which helped to salvage the major index ETFs in our Trend Analyzer from moving into oversold territory, each member of the group has moved closer to oversold, and all of them are well below their 50-DMAs. Currently, there are only four ETFs that are oversold while the rest are neutral and moving towards oversold territory. Long-term trends are still firmly biased towards the downside. The widespread declines over the past few days have also erased almost half of these ETFs’ YTD gains. Six are now negative on the year.

While the Nasdaq (QQQ) has fared the best recently only falling 1.07% in the past week, Mid-Caps and Small-Caps have taken it on the chin. The Core S&P Small-Cap (IJR), Micro-Cap (IWC), and Russell 2000 (IWM) are all down the most in the past week with double or more the losses of most of the other members of this group.