Chart of the Day: Fixed Income Extreme Overbought

Small Business Optimism Pulls Back

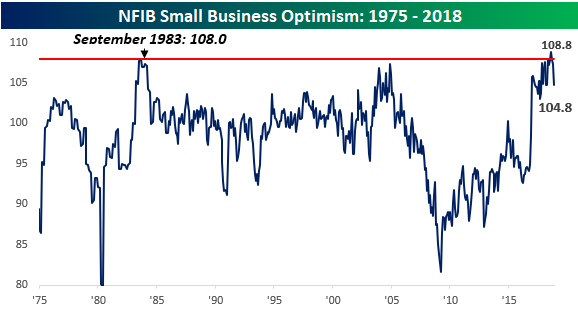

Small business optimism showed a meaningful pullback in November on both an absolute basis and relative to expectations. While economists were forecasting the headline index to come in at a level of 107.0, the actual reading was 2.2 points lower, making it the weakest report relative to expectations since April and the largest m/m decline since March.

After hitting record high levels back in August, the NFIB Small Business Optimism Index has now seen three straight monthly declines, and like a few other indicators, it’s showing signs of rolling over. With that, we’ve heard and read a number of comments suggesting that this decline is another signal that the business cycle may be turning.

In our section on “Economic Cycles” for this year’s 2019 outlook report that was published last Friday, we highlighted a number of economic indicators that have had pretty good records historically at anticipating a turn in the business cycle. One indicator that was not included in that section is the NFIB’s Small Business Optimism Index.

The chart below is the same one as above, but we have also overlaid periods of recession with gray shading. From this perspective, it is pretty obvious that there has been very little correlation to peaks in the Small Business Optimism Index and the onset of recessions. In fact, the two times the index peaked at or around similar levels was actually closer to the beginning of an expansion than the end. This is not to say that this indicator is suggesting strength or weakness in the economy going forward, but instead to simply point out that it hasn’t been the best indicator in terms of predicting the business cycle.

Which indicators should investors be watching for signs of a turn in the business cycle? Sign up today for our 2019 Annual Outlook Special to receive access to our section on “Economic Cycles” and find out!

Bespoke Stock Scores — 12/11/18

Morning Lineup – Positive Trade Headlines Provide a Boost

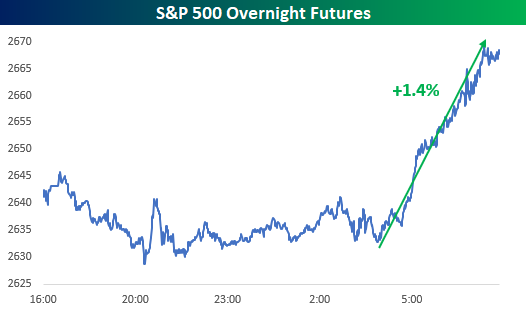

How many times can equity futures around the world rise and fall on the same headlines? We’re learning that lesson in real time these days, as US futures are rallying today on reports that China will cut tariffs on imported US autos from 40% down to 15% and that officials from both countries continue to negotiate despite the arrest of Huawei’s CFO in Canada. Believe it or not, futures were lower for most of the overnight session before getting a real boost right around 4 AM.

Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/11/18

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Chart of the Day: Decile Analysis of the Correction

The Intraday Correction

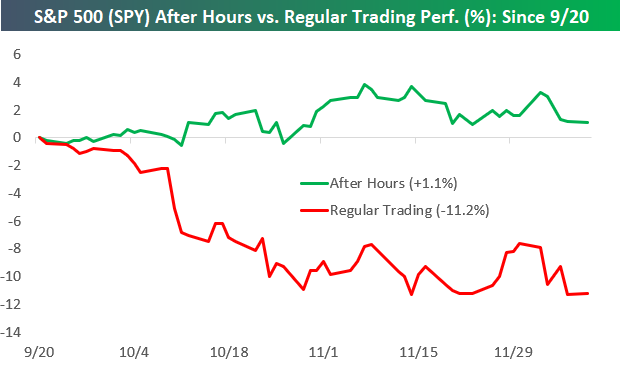

A key characteristic of this correction during its early stages in late September and October was the unrelenting selling pressure that went on during regular trading hours. While futures were either flat or even pointed higher on a lot of trading days, the selling began pretty much immediately after markets opened at 9:30 AM ET and didn’t let up until the 4 PM close.

This type of intraday selling is not a bullish sign, so today we wanted to update the readings to see where things stand as the correction closes in on three months in length.

Below we show the cumulative change since 9/20 (the date of the high for the S&P) of buying SPY at the close every day and selling at the next open (after hours) versus buying at the open every day and selling at the close (intraday). If you only owned SPY after hours during the current correction, you’d actually be in the green with a gain of 1.1%. Had you only owned intraday by buying at the open and selling at the close, however, you’d be deep in the red with an 11.2% decline. This means that more than 100% of the S&P’s losses during the current correction have come during regular trading hours.

Looking at this strategy for all of 2018, had you only owned SPY after hours this year, you’d still be up 10.8%. If you only owned during regular trading hours, you’d be down 10.9%.

As you can see in the chart, there were two periods where these two strategies diverged. One came towards the end of Q1 into early Q2 when the after-hours strategy traded sharply higher as the intraday strategy plummeted. The second came at the start of the current correction when the intraday strategy started to collapse while the after-hours strategy continued to tick higher.

US Stock Market Performance During Years Ending In…

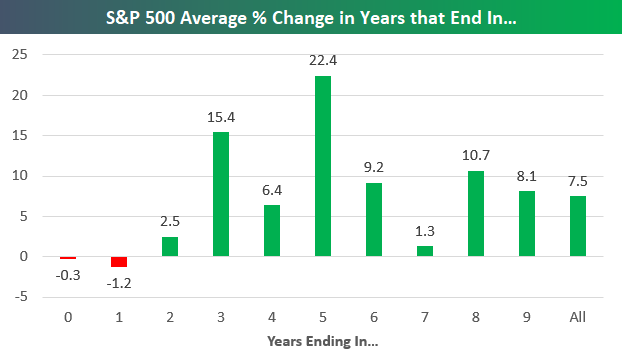

Below is a quick market stat to log as 2018 nears an end and 2019 approaches. In the chart, we show the S&P 500’s average price change in years ending in 0 through 9. This data goes back to 1928 when the S&P 500 begins.

As shown, years ending in “8” have historically seen the S&P 500 gain an average of 10.7%. At one point earlier in 2018, this type of gain seemed likely, but not anymore now that the S&P is down 2% YTD.

Years ending in “9” have historically seen an average gain of 8.1%, which is just a hair above the average of 7.5% seen for all years since 1928.

The best years have come in years ending in “5” with an average gain of 22.4%. Years ending in “3” rank second with a gain of 15.4%.

On the negative side, years ending in “0” and “1” have both averaged losses throughout history.

Below we show the consistency of positive returns for the S&P 500 in years ending in “0” through “9”. As shown, years ending in “5” have been positive 88.9% of the time (8 out of 9), while years ending in “0” and “1” have been positive just 44.4% of the time (4 out of 9).

Trend Analyzer – 12/10/18 – YTD Gains Get Decimated

The major US index ETFs are starting off the week on a far weaker note following last week’s sell-off. Every ETF in this group has fallen over 3% since this time last week. The Russell 2000 (IWM) and Core S&P Small-Cap (IJR) have led the way down falling 5.14% and 5.36%, respectively. Despite attempting to press above their 50-day moving averages at one point last week, currently, these ETFs have collapsed well below their 50-DMAs into oversold territory. As YTD gains either turn to losses or become just barely positive, long-term trends have remained biased to the downside. The Nasdaq (QQQ) is the only ETF in the group that has maintained any sort of significant gains YTD.

Morning Lineup – Small Bounce

Things aren’t as bad as they were when futures first opened Sunday evening, and US equities are now looking to kick off the week on a modestly positive note this morning. After the S&P 500 and Nasdaq just had their worst week in over six months while the Russell 2000 had its biggest decline since January 2016, one could say that we were at least due for some gains. Keep in mind too that all that weakness last week came in the span of just four days too! Global equities are mostly in the red as Asian markets traded down over 1%, and European markets are down just modestly as they, like US futures are off their lows. Treasuries are selling off slightly this morning as the 10y3m curve steepens slightly but remains at an exceptionally flat level of less than 50 bps. Meanwhile, crude oil saw a quick 1.5% sell-off at right around 4:30 New York time which was blamed on continued worries that the US/China trade war will sap demand.

Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/10/18

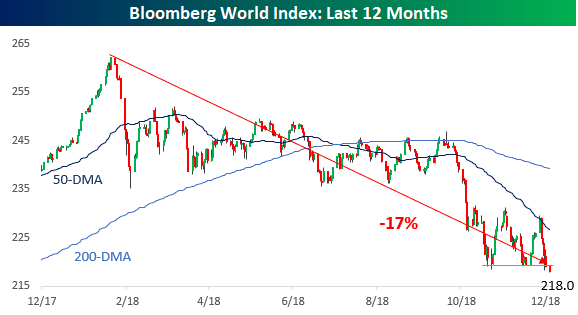

We’ve discussed numerous times how many international equity benchmarks are already in their own bear markets, but because the US has held up considerably better than global peers and its overall weighting in the global equity pie is so large, it has been able to keep global equities as a whole outside of bear market territory…for now. This morning, global equities are moving one step closer to bear status as the Bloomberg World equity index appears to be breaking below support. The index is now down 17% from its highs earlier in the year, so a few more days like we saw last week, and global equities will have lost one-fifth of their total market value.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 12/9/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Entrepreneurship Ups & Downs

Inside the $400 Million Family-Run Supermarket That Helped Launch Martha Stewart and Paul Newman by Leigh Buchanan (Inc.)

A profile of a grocery store beloved in the Bespoke offices, which has managed to gain serious ground in a very competitive market in the Tristate area. [Link]

“Everyone’s For Sale”: A Generation Of Digital-Media Darlings Prepares For A Frigid Winter by Joe Pompeo (Vanity Fair)

An overview of profitability pressures, revenue growth slowdowns, and liquidity pressures that have digital media start-ups seeking sales at 95% discounts and cutting staff. [Link]

American Entrepreneurs Who Flocked to China Are Heading Home, Disillusioned by James T. Areddy (WSJ)

American entrepreneurs and investors who flocked to China are starting to come back, grappling with worsening conditions for foreigners driven by Chinese politics and grand strategy. [Link; paywall]

Miscellaneous Stories

How missing Dubai princess practised her escape by Sanya Burgess (Sky News)

The story of Sheikha Latifa bint Mohammed bin Rashid Al Maktoum, the daughter of Dubai’s ruler. After a failed escape attempt involving scuba-diving with an underwater scooter and an abduction via helicopter from India where she was seeking asylum. [Link]

The Oral History of ‘San Junipero’ by Charlie Brooker, Annabel Jones, and Jason Arnopp (Vulture)

Black Mirror is known for its dystopian, horrifying vision of the future, but the episode entitled San Junipero offered an optimistic view of human connection and the technology that can make it easier. [Link]

Research

Gross capital flows by banks, corporates and sovereigns by Stefan Avdjiev, Bryan Hardy, Sebnem Kalemli-Ozcan and Luis Servén (BIS Working Papers)

This new paper attempts to disaggregate gross capital flows (that is, inflows and outflows, rather than the net numbers which tend to get more attention) by sector, with important empirical findings. [Link]

Japan’s age wave: Challenges and solutions by David Bloom, Paige Kirby, JP Sevilla, and Andrew Stawasz (VOX EU)

A review of the challenges and possible solutions related to aging populations, using Japan as an example for both. [Link]

Politics

Iowa Democrats Say They Want Generational Change by Reid J. Epstein and Janet Hook (WSJ)

An interesting straw poll of Iowa’s Democratic leadership suggesting that many Presidential front-runners face a significant headwind in their bids for early delegates: their age. [Link; paywall]

Busts

Titans of Junk: Behind the Debt Binge That Now Threatens Markets by Shannon D. Harrington, Sally Bakewell, Christopher Cannon and Mathieu Benhamou (Bloomberg)

Data and analysis on the massive junk bond market, which has grown dramatically in size over the last decade as global bond buyers have bid up the asset class. [Link; soft paywall]

The U.S. Housing Boom Is Coming to an End, Starting in Dallas by Laura Kusisto (WSJ)

Part of the ongoing series of worries about the US housing market, featuring unsold houses in the booming Dallas economy and price cuts on new builds. [Link; paywall]

So Far, the Corporate Tax Changes Have Been a Bust by Matthew C. Klein (Barron’s)

Benefits promised by lawmakers related to corporate tax cuts passed at the end of last year seem to be making little difference across a variety of metrics: corporate investment, dividends and buybacks, and repatriation. [Link; paywall]

Tech

Microsoft Pushes Urgency of Regulating Facial-Recognition Technology by Jay Greene and Douglas MacMillan (WSJ)

Competition in facial recognition technology has led to some unlikely outcomes, including some of the companies involved calling for regulation in the space. [Link; paywall]

The Friendship That Made Google Huge by James Somers (WSJ)

Everyone knows Larry and Sergey but another less-heralded duo also made the world’s link to information via search what it is today. [Link]

Tesla drove 7 miles using Autopilot as driver allegedly slept drunk behind the wheel by Rob Thubron (Techspot)

Don’t drink and Autopilot. A California man turned on the Tesla feature and then fell asleep as his car continued to drive, making it 7 miles before police officers intervened. [Link]

Financial Industry

The Amazing Madoff Clawback by Tunku Varadarajan (WSJ)

Bernie Madoff’s Ponzi scheme was the largest ever, and trustees trying to return investors’ money expected to get back only 5-10% of what investors had put in. At this point, claims have seen recovery rates of almost 75%, a remarkable figure all things considered. [Link; paywall]

Nasdaq moves into ‘alternative data’ with Quandl acquisition by Robing Wigglesworth (FT)

Desktop data provider Quandl proved an inviting target for the exchange company, which has started moving into non-traditional data sources. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a good Sunday!