Morning Lineup – Boxed In

Futures have been all over the place this morning on headlines coming out of China (what else is new) and the latest ECB rate decision. In the US, jobless claims are due out shortly, and investors are hoping the recent string of increases reverses. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/13/18

With all the wild swings we have seen, the US equity market has essentially been trapped in a box over the last several weeks, albeit a relatively large one ranging from 2,600 to 2,800. Until stocks break out of that range in either direction, it’s hard to read these day to day moves as anything more than noise. Right now, the S&P 500 is trading a lot closer to the bottom end of that range than the lower end, so at this point, there’s less room for error.

Perhaps one clue of which way the market will break is to watch the semis. They led the broader market lower, and they too have been pretty much boxed into a range for the last several weeks. Like the S&P 500, the semis are also trading a lot closer to the bottom end of the range than the top.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

the Bespoke 50 — 12/13/18

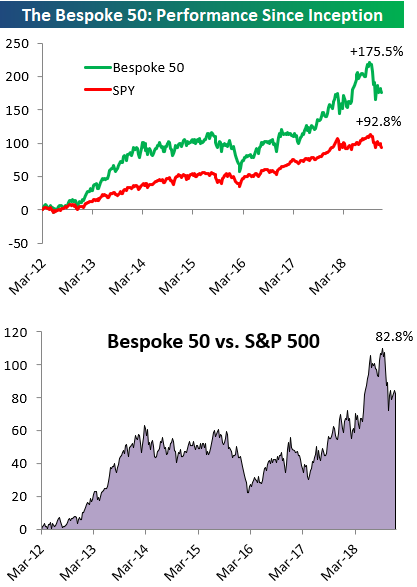

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 82.8 percentage points. Through today, the “Bespoke 50” is up 175.5% since inception versus the S&P 500’s gain of 92.8%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

Chart of the Day: Reversals of Reversals

Twitter (TWTR) Takes Out Resistance

Social media giant Twitter (TWTR) has been on an absolute tear this week. Since Monday’s open, the stock has risen over 12% as of this writing. Half of this comes from today alone as the stock broke out above a key resistance level of $35/$36. This has been an important level for the stock throughout the past year. In March, TWTR failed to break above this resistance, but over the course of the next few months, the stock surged over 20% from there, only to give up all of those gains on a poorly received earnings report in July. From these new lows, the stock would come to once again retest the $35/$36 level twice before today’s breakout. If the past year’s price action is any indication, this breakout could provide a technical base for a solid run back into the $40s.

Long-Term Price Charts of Key Country Equity Indices

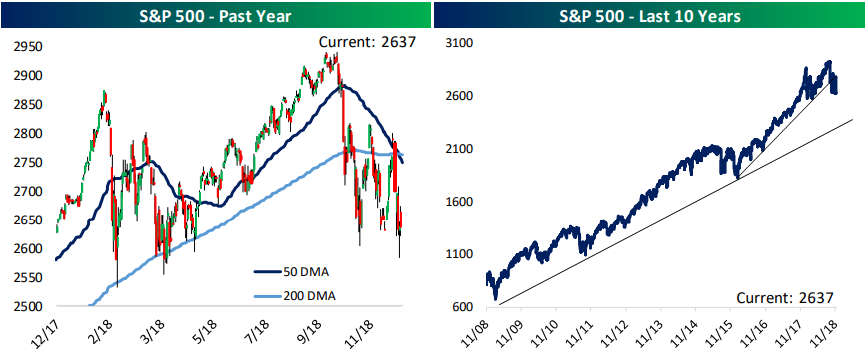

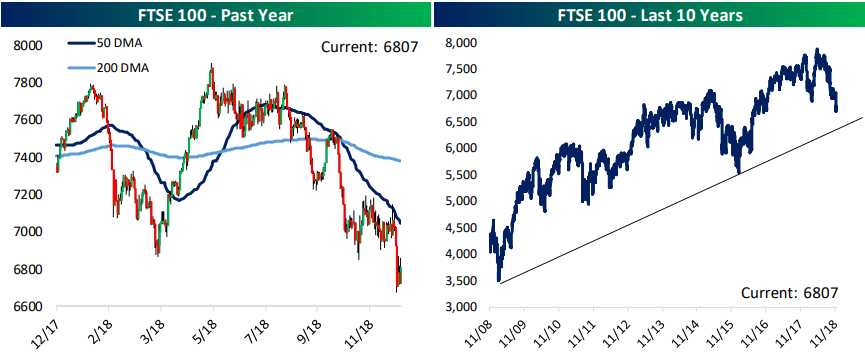

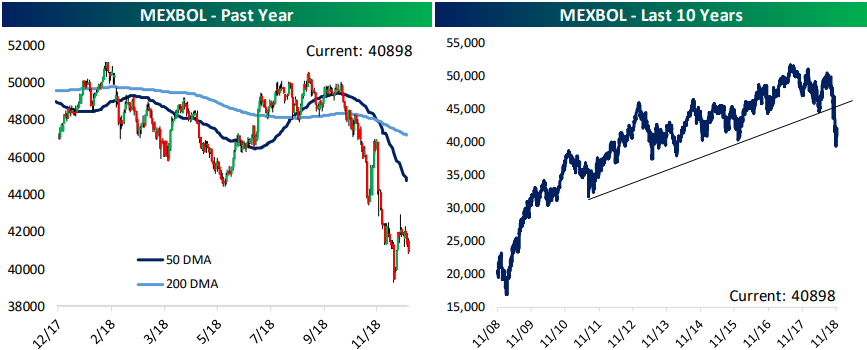

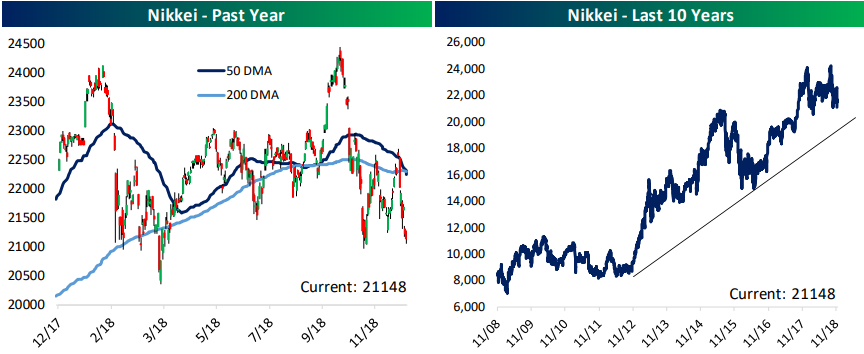

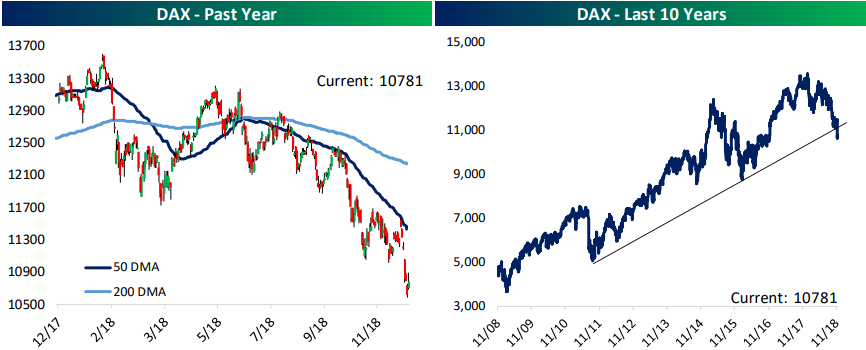

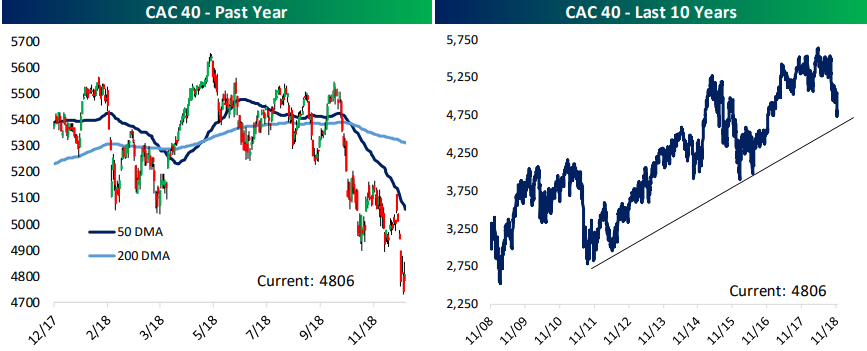

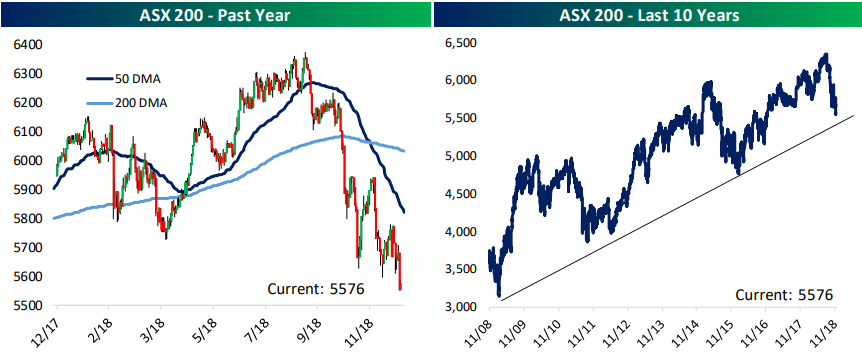

Each week we publish our Bespoke Macro Dashboard, which is a high-level summary of 22 major economies from around the world. Below we provide two charts from the Dashboard covering a short-term and long-term look at selected country stock markets.

While the one-year charts look bearish for all seven countries, some of the countries remain within their long-term uptrend channels, while others have broken down.

The S&P 500 (U.S.) has so far managed to hold above support at 2,600, while its 10-year chart still looks relatively bullish.

The FTSE 100 (UK) is in a nasty multi-month downtrend with a recent break to new 52-week lows, but price has still yet to test the bottom of its 10-year uptrend channel.

Mexico’s Bolsa index has plummeted 20% from its recent highs, and this drop also broke a key support level on its 10-year chart as well.

Japan’s Nikkei 225 looks somewhat similar to the chart for the S&P 500. The index has been choppy over the last year but hasn’t made a new 52-week low, and it remains well within its 10-year uptrend channel.

The German DAX index looks very negative on both a short-term and long-term technical basis. As shown, the index is a falling knife on the one-year chart, and it just broke below its long-term uptrend channel on the 10-year chart.

While Germany’s DAX has broken down on a 10-year chart, France’s CAC 40 remains slightly above the bottom of its long-term uptrend channel.

Like the French CAC 40, Australia’s ASX 200 has recently made a 52-week low, but it remains above the bottom of its 10-year uptrend channel.

For a weekly look at these global equity market charts plus much more, start a two-week free trial to our Bespoke Institutional service.

Fixed Income Weekly – 12/12/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we look at the decline in Treasury yields from a term premium perspective.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Global Macro Dashboard — 12/12/18

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Trend Analyzer – 12/12/18 – Index ETFs Holding Steady

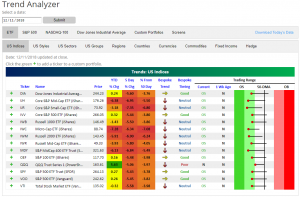

Even with drastic moves intraday, on a closing basis things have actually been fairly flat so far this week. As a result, not much has changed in our Trend Analyzer tool. Only the Nasdaq (QQQ) is neutral while the rest of the index ETFs remain oversold. Still, QQQ is very close to oversold and well below where it was this time last week. YTD performance also remains weak with small and mid-cap focused ETFs are showing the worst performance.

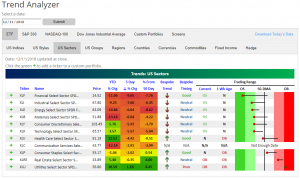

When looking at sectors, since last week the utilities sector is outperforming all others. Along with the real estate sector (XLRE), XLU is one of two overbought sector ETFs. Conversely, the financial sector (XLF) has continued to get crushed as it sits deeply oversold and is closing in on 10% lower from 5 days ago.

Morning Lineup – Same Headlines as Yesterday

For the second day in a row, US equities are poised to open higher on positive trade headlines regarding the US and China. Hopefully today these gains can hold. The dollar is down, once again failing to break out higher from the top of its recent range, while interest rates are starting to firm up a bit with 1-2 bps of yield gains across the curve and a bias towards steepening. Crude oil is up a healthy 1.8% with gasoline rallying as well. Since OPEC announced output curbs last week, things have been mixed but generally positive for Texas Tea, with products basically staying on top of the raw oil price

Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/12/18

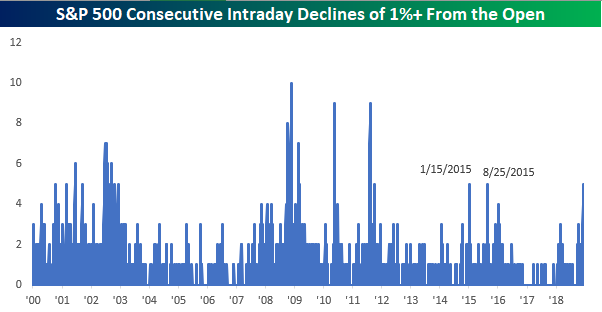

As mentioned above, the S&P 500 has had trouble lately holding onto gains. In fact, yesterday was the fifth straight trading day that the S&P 500 traded down 1% or more from its opening level at some point in the trading day. That doesn’t tend to happen often, and the last time we saw a similar string of consecutive intraday selloffs from the open was back in August 2015 when China devalued. We’re still far from really extreme levels in this streak, though. Back during the financial crisis, we saw ten straight days of similar intraday selloffs. Let’s hope we don’t get to that point.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Breadth Bombs, Reversing Reversals, Credit Considerations, PPI Solid — 12/11/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we cover how the market performs following intraday reversals as we have seen over the past few trading sessions. Then we discuss credit markets in depth in regards to bank loan ETFs, short-term interest rate markets, bank credit spreads, and macro data. We finish by going over today’s PPI release.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!