Housing Keeps Getting Worse

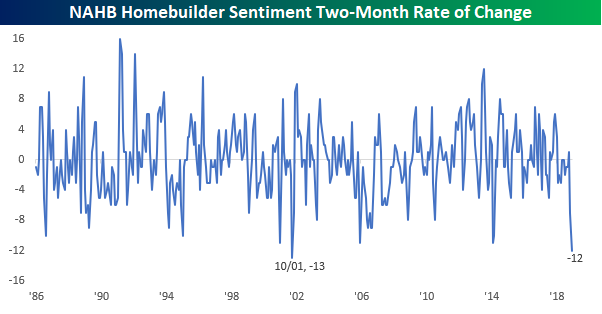

Just when you think that housing-related data can’t get any worse, the December report on homebuilder sentiment came in with a big stinker. After last month’s report where the actual level missed expectations by seven points, today’s report for December missed estimates by four points with a reading of 56 compared to expectations of 60. Combining the declines of the last two months, homebuilder sentiment has now dropped by a total of 12 points, which is the second largest two-month drop in the history of the report. Not even during the housing crisis did sentiment drop at this fast of a rate, and the only time it dropped faster was in the two months that followed the 9/11 attacks.

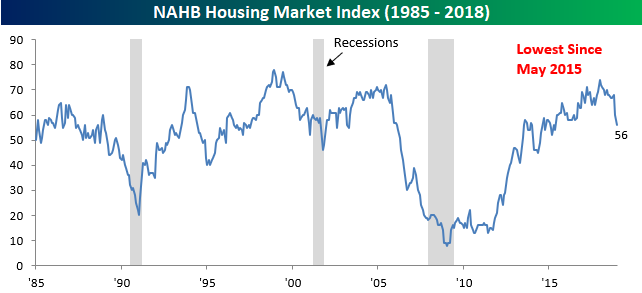

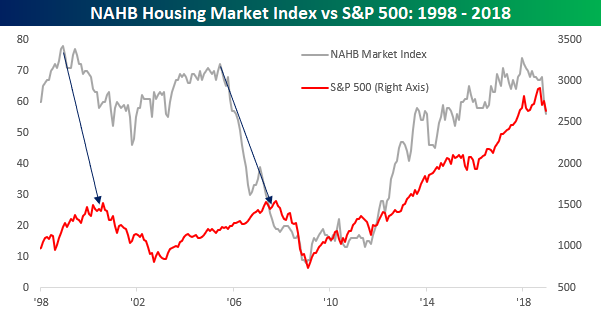

The chart of the actual level of the NAHB Sentiment index doesn’t look pretty either. Following this month’s decline, the index is at its lowest level since May 2015. One thing to take note of with regards to the NAHB Housing Index, though, is that peaks haven’t historically been associated with the onset of recessions. At the start of each of the last three recessions, this index was well past its peak by a matter of years rather than months.

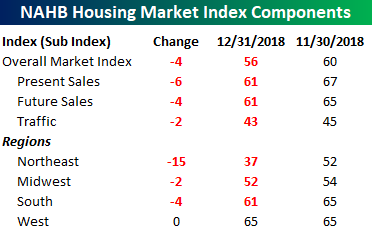

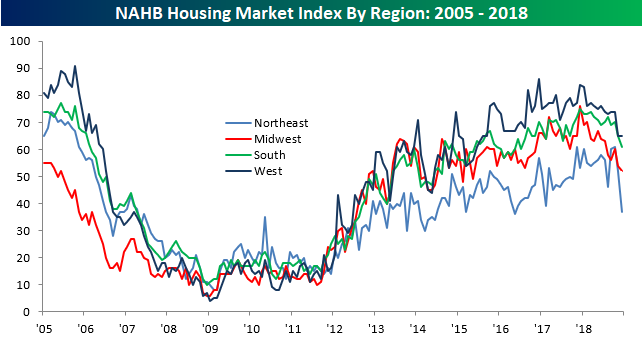

The chart below shows the breakdown of this month’s report by traffic and region. We saw broad-based declines in traffic trends in December, and the bulk of the weakness came in the Northeast. Sentiment in that region dropped by 15 points, which was the largest one month decline since June 2011 and capped off the largest two-month decline on record. It was said a year ago that the Trump tax cuts would have the greatest negative impact on housing in the high tax states of the northeast, and recent data has borne this out.

While homebuilder sentiment in the northeast has seen the sharpest declines, the trend is the same around the country- sentiment has peaked.

As mentioned above, homebuilder sentiment hasn’t been strongly correlated to trends in the business cycle over time, and with respect to stock market performance, that has been the case as well. Leading up to each of the prior bear markets in the last twenty years, homebuilder sentiment peaked well over a year before the market peak. While not pictured below, we have also seen similar trends play out in prior bear markets since 1985 (when the NAHB survey data begins).

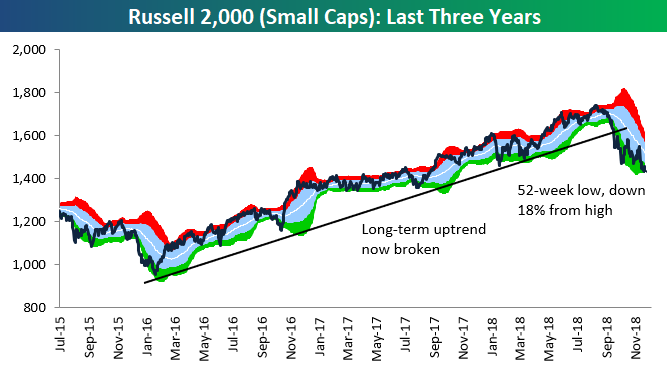

This Week’s Economic Indicators – 12/17/18

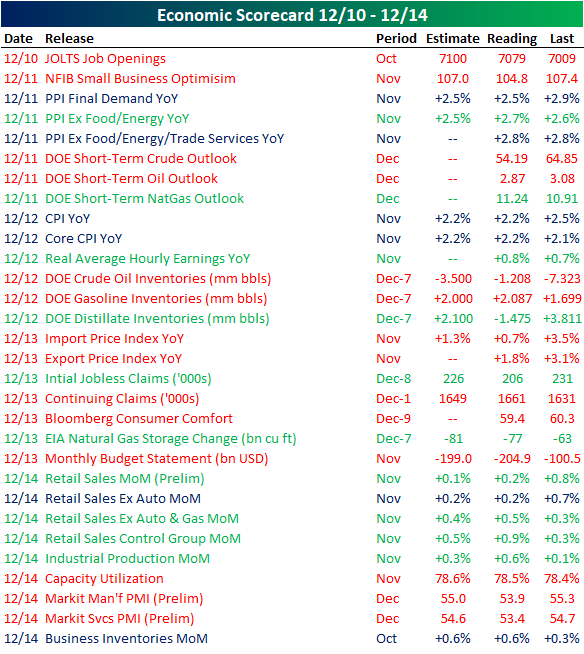

Last week’s economic data came in somewhat disappointing with a little less than half of the 30 releases below estimates or the previous period’s reading. JOLTS kicked off the week still strong and higher than the September reading, but below estimates. Small business optimism saw a decline for November. Inflation data through PPI and CPI both came in mostly in line with forecasts with core PPI being the only measure to release above estimates. However, export and import price indices both came in well below October’s levels. Jobless claims saw a substantial beat. Despite a strong Industrial Production reading, preliminary Markit PMIs for manufacturing as well as services pointed to a weaker release for December.

This week will see a heavy slate of data. Empire manufacturing didn’t start the week off on the best note with the index cutting nearly in half. Homebuilder sentiment and TIC flows report later today. Housing starts and permits are the only releases Tuesday, but Wednesday through the end of the week will be busy. On Wednesday, the FOMC will have their rate decision where interest rates are expected to rise a quarter of a percent. This will by far be the most talked about event of the week. Thursday we will get the Philly Fed’s business outlook and the leading index. There will be many releases to finish the week on Friday with The third GDP release, goods orders, personal income and spending, PCE inflation data, and the Kansas City Fed’s manufacturing activity.

Small-Caps, Transports Getting Close to Bear Market Territory

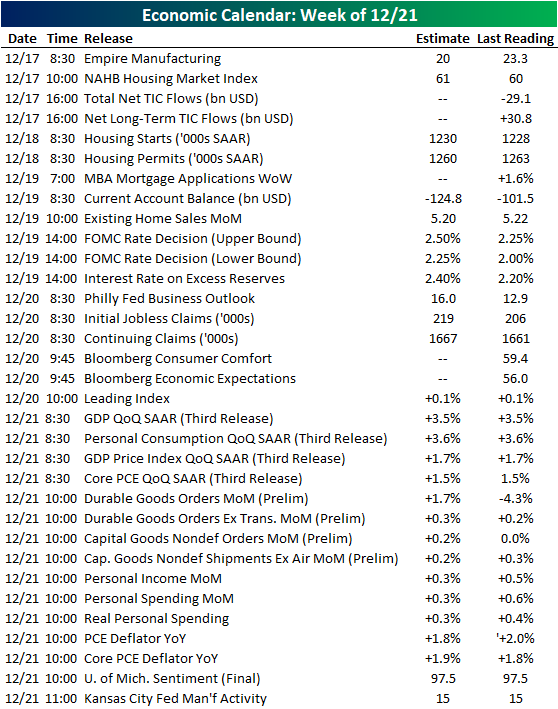

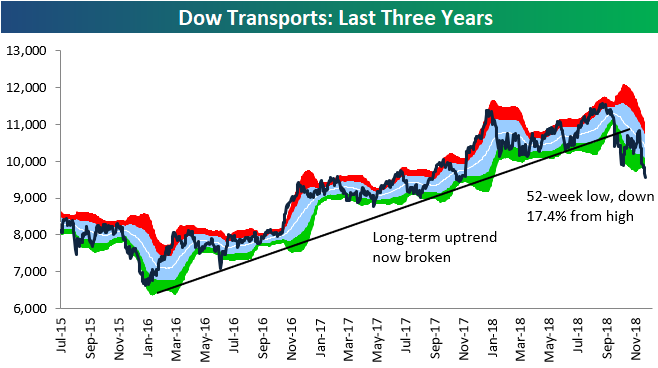

The two charts below were published in our weekly Bespoke Report newsletter that went out to research clients on Friday. They show long-term three-year price charts of two equity indices that are generally thought of as “leading” indicators — that is, they’re thought to lead the broader indices like the S&P 500.

Unfortunately for market bulls, both appear to be in serious trouble from a technical perspective.

As shown, the Russell 2,000 (small-cap) and Dow Transportation indices have recently broken below long-term uptrend channels, and they have yet to find any kind of support during this correction. The Russell 2,000 is down 18% from its 52-week high, which puts it just two percentage points away from a new bear market. The Dow Transports aren’t far behind. The Transports index is down 17.4% from its 52-week high, meaning a bear market isn’t far away for this area of the market either.

Keep an eye on these two indices in the coming days and weeks as 2018 comes to an end. If they slip into bear market territory, it’s not a good sign for the major indices like the S&P 500 and the Dow Jones Industrial Average. For more analysis of leading indicators and market internals, try out one of our three premium research offerings.

Chart of the Day – S&P 500 Performance After Strongly Bearish Sentiment Readings

Trend Analyzer – 12/17/18 – Few Positives

Following Friday’s steep declines, our Trend Analyzer shows that every major index ETF is now oversold just like they were at this time last week. Some of these, such as the Russell 2000 (IWM) and Core S&P Small-Cap (IJR), are deeply oversold. Losses from last week also eliminated most YTD gains for these index ETFs. The Nasdaq (QQQ) has been the best performer only falling 0.28% over the past week. It is also the lone survivor in regards to YTD gains. All other ETFs are now down on the year, with the Micro-Cap (IWC) being the worst of these down almost 10%. With another down week, long-term trends have also gotten further beaten down with all but the Dow (DIA) moving into downtrends.

Morning Lineup – A December to Remember…For All the Wrong Reasons

After the fourth down week in the last five, US equities are looking lower once again this morning and the magnitude of the implied decline is getting worse as the opening bell nears. Even though it’s only Monday, the focus is already on Wednesday’s FOMC meeting, even more so now that Stanley Druckenmiller and former Fed Official Kevin Warsh have urged Powell and Company to pause its tightening ‘blitz’ in a WSJ op-ed.

Today, we’ll get reads on Empire Manufacturing and Homebuilder sentiment for the month of December. Last month’s homebuilder sentiment report showed the largest decline since February 2014, so that will be an important release to watch for signs of a bounceback or further deterioration. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/17/18

Plain and simple, the first half of December has been awful. Normally one of the strongest months of the year, the S&P 500 has dropped over 5% so far this month putting it on pace to be one of the worst Decembers in the post WWII period. Looking back over the last 25 years or so, it hasn’t been uncommon to see weakness in the first half of December but not declines of 5%+! Going back to 1945, there have only been two other months where the S&P 500 was down 5% or more through the close on 12/14 – 1980 (-8.03%) and 2002 (-5.00%).

So is it time to cancel Christmas? The chart below shows the performance of the S&P 500 in the period covering the close on 12/14 through the close on Christmas Eve. Since 1945, the S&P 500 has seen an average gain of 0.82% (median: 0.70%) during this period with positive returns 63% of the time. And how about the two prior years highlighted above where the S&P was down over 5%? In 1980, stocks really rallied leading up to Christmas with a gain of 5.15%, while in 2002, the rebound was a more muted 0.34% (at least it stopped going down).

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 12/16/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Big Calls

One of the Best Sell-Side Calls in History Is Over: Taking Stock by Arie Shapira (Bloomberg)

The first analyst to rate GE below neutral did so with almost perfect timing, with his change in rating almost perfectly timing a +70% drop in the market cap of the company. [Link, soft paywall]

Harvard Quietly Amasses California Vineyards—and the Water Underneath by Russell Gold (WSJ)

The largest college endowment has started rapidly gobbling up California vineyards sitting atop very valuable freshwater resources. [Link; paywall]

Labor Markets

Labor Market Considerations for a National Job Guarantee by Ryan Nunn, Jimmy O’Donnell, and Jay Shambaugh (The Hamilton Project)

A long review of possible labor market effects of a job guarantee. While total effects are uncertain, the paper highlights 27.9mm full-time workers, 15.9mm part-time workers, 5.9mm unemployed workers, and tens of millions of non-participants and estimates 2-4 percentage point contributions to the employment rate (along with hundreds of billions of dollars of costs). [Link; 37 page PDF]

Reducing the language barrier by Dan Mika (The Gazette)

Workers are scarce enough in Iowa that employers are offering free language classes to workers who don’t speak English as a way to attract labor resources. [Link]

Sports

My Dad’s Friendship With Charles Barkley by Shirley Wange (WBUR)

The story of a cat litter scientist’s friendship with one of the greatest – and most colorful – NBA players of all time, sparked by a random encounter in a Minneapolis hotel which led to a dinner and a lasting relationship. [Link]

‘Netflix of sport’ Eleven Sports could close UK site after just four months by Alex Netherton (Yahoo!)

A UK startup sought to distribute live sports via streaming, with low monthly subscription costs, but failure to strike a deal with the UFC led to the collapse of Eleven Sports. [Link]

Stumbling Startups

Robinhood Will Retool Checking Product Following Scrutiny by Julie Verhage (Bloomberg)

After announcing a new “checking and savings” product with an impressive 3% yield this week, people started asking questions about how Robinhood (the free stock trading company) was able to skirt regulation. The answer is they were not, and have since walked back the offering. [Link; soft paywall]

When the “best” busts: the spectacular rise and fall of smart luggage startup Raden by Chavie Lieber (Vox)

The story of how a first-mover in “smart luggage” completely flopped because it focused on sustainable growth over massive fundraising rounds and advertising spend. [Link]

Dr. Elon & Mr. Musk: Life Inside Tesla’s Production Hell by Charles Duhigg (Wired)

A tick-tock of the horrifying personal management, engineering deployment, and industrial design processes that have kept Tesla from achieving anything resembling profitability. [Link; soft paywall]

ISIS

Lund professor freed student from Islamic State war zone (The Local)

An Iraqi man studying at Lund University returned to the country in 2014 as ISIS threatened his family. When he got pinned down and had to go into hiding himself, the university dispatched a private security company to arrange heavily-armed mercenaries to extract the man and his family. [Link]

Media

How YouTube’s Year-in-Review ‘Rewind’ Video Set Off a Civil War by Kevin Roose (NYT)

An annual review of YouTube’s creative output put together by the company has sparked a massive controversy that pits some of the site’s creators against Alphabet’s interest as an advertising vendor. [Link; soft paywall]

Social media outpaces print newspapers in the U.S. as a news source by Elisa Shearer (Pew)

New data from Pew shows that roughly 1 in 5 Americas use social media to get news “often”, versus 16% for newspapers. TV (~half) is still the dominant form, while 1-in-3 use news websites. [Link]

China

China Sets up New Forex Reserve Investment Arm by Pen Qinqin and Shen Lu (Caixin)

A look at some new strategies reserve managers in China are using to invest the country’s $3tn of reserve assets. [Link; paywall]

Madoff

Lessons From the Bernie Madoff Fraud, 10 Years Later by Joel Arbaje (Barron’s)

A retrospective on how and why Bernie Madoff was able to start a $64bn Ponzi scheme, which is still being unwound 10 years later. [Link; paywall]

Regulation

Cuomo to release plan for legalizing recreational use of marijuana by Carl Campanile (NYP)

The New York governor is planning a measure to make recreational marijuana use legal, which could generate nearly half a billion in new revenue for the state. [Link]

Fed, big banks on collision course over payments by Victoria Guida (Politico)

The US’s antiquated payment system (featuring slow, expensive, and cumbersome interbank transfers) is looking at the feasibility of building a real-time payments system. [Link]

Real Estate

There could be an unlikely place to hide out if a recession is coming: Housing by Yun Li (CNBC)

Despite housing market weakness in recent quarters, investors are hoping that home prices will hold up far better than equity or market prices in the next recession. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a good Sunday!

2018 Week 15

Week 14 Results: 6-9, Overall 101-88 (53.4%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season.

On to the week 15 slate of Saturday, Sunday and Monday Night games:

2018 NFL Week 15 Bespoke Picks:

Houston (-7) at NY Jets: Houston -7

Cleveland at Denver (-1.5): Cleveland +1.5

Arizona at Atlanta (-9.5): Atlanta -9.5

Detroit at Buffalo (-2.5): Buffalo -2.5

Green Bay at Chicago (-5): Chicago -5

Oakland at Cincinnati (-3): Oakland +3

Dallas at Indianapolis (-3): Dallas +3

Miami at Minnesota (-7.5): Miami +7.5

Tennessee (-1) at NY Giants: NY Giants +1

Washington at Jacksonville (-7.5): Jacksonville -7.5

Tampa Bay at Baltimore (-7.5): Tampa Bay +7.5

Seattle (-3.5) at San Francisco: Seattle -3.5

New England (-2.5) at Pittsburgh: Pittsburgh +2.5

Philadelphia at LA Rams (-13): LA Rams -13

New Orleans (-6) at Carolina: New Orleans -6

2018 NFL Week 14 Bespoke Results:

NY Jets at Buffalo (-4): NY Jets +4 (Win)

Carolina (-1.5) at Cleveland: Carolina -1.5 (Loss)

Atlanta at Green Bay (-4.5): Atlanta +4.5 (Loss)

Baltimore at Kansas City (-6.5): Kansas City -6.5 (Loss)

New England (-7.5) at Miami: New England -7.5 (Loss)

New Orleans (-10) at Tampa Bay: Tampa Bay +10 (Loss)

NY Giants (-3) at Washington: NY Giants -3 (Win)

Indianapolis at Houston (-4.5): Indianapolis +4.5 (Win)

Cincinnati at LA Chargers (-14.5): LA Chargers -14.5 (Loss)

Denver (-3.5) at San Francisco: Denver -3.5 (Loss)

Philadelphia at Dallas (-3): Dallas -3 (Win)

Pittsburgh (-10) at Oakland: Oakland +10 (Win)

Detroit (-3) at Arizona: Detroit -3 (Win)

LA Rams (-3) at Chicago: LA Rams -3 (Loss)

Minnesota at Seattle (-3): Minnesota +3 (Loss)

The Bespoke Report — Fresh Lows

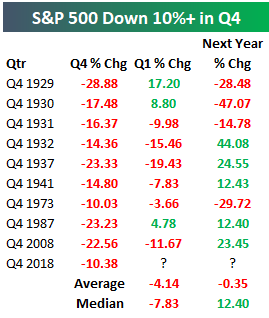

We’ve just published our weekly Bespoke Report newsletter for subscribers (learn more here). Below is one of many tables and charts featured in this week’s report. The table shows all years in which the S&P 500 fell 10%+ in the fourth quarter. As shown, Q4 2018 is tracking to be just the 10th time since 1928 that the S&P has fallen 10%+ in Q4. Not good. And unfortunately, when Q4s have been bad for the S&P, the following Q1s have been bad more often than not as well. For more in-depth analysis, start a free trial to any membership level and access the full Bespoke Report.

2019 Outlook — Market Cycles

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Market Cycles” section of the 2019 Bespoke Report, which focuses on market performance during the late stages of bull markets, in bear markets, as well as corrections.

To view this section immediately and all other sections, sign up for our 2019 Annual Outlook Special!