Jobless Claims Back Up

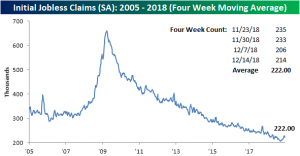

Following last week’s significant downtick to 206K for initial jobless claims, this week’s reading rose to 214K. This is slightly below the 215K rise that was expected, and while this week’s release is about 12K higher than last week, it is still at the lower end of the range we have seen in the past year. It is also well below the surprisingly elevated levels that we saw only a few weeks ago in late November.

As we have been highlighting, despite short-term upticks in claims, the indicator remains at very strong levels and has maintained some impressive streaks. This week marks the 63rd straight week with claims coming in at or below 250K. That’s the longest streak since the 89-week streak that ended in January 1970. Claims have also remained below 300K for a record 198 weeks.

The 4-week moving average saw a slight decline to 222K. This is only a little over 2K lower than last week’s 224.75K but well off of the short-term high of 228K from two weeks ago.

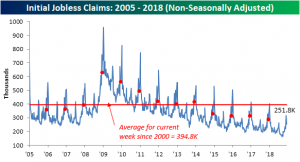

As we mentioned last week, the drop in claims was in line with seasonal patterns and likely bottomed out for the holiday season as this week’s uptick was to be expected. Claims still had their strongest week in the time since 2000 on a non-seasonally adjusted basis. It is also over 140K below the average for the current week since 2000.

Morning Lineup – The Day After

Equity futures are trading modestly lower this morning, and based on the market’s inability to hold on to any early gains anyway, maybe it’s a good thing that we’re starting out a little weaker. In case you missed it yesterday, the S&P 500’s negative reversal from an intraday gain of 1.5% to a decline of over 1.5% on the day was pretty monumental. The last time it happened was in February 2009! In economic news, Jobless Claims and the Philly Fed Manufacturing index both missed expectations with the Philly index hitting its lowest level since August 2016. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/20/18

Here’s a doozy for you and something not many would have expected back in January. Over the last 12 months, long-term Treasuries are now outperforming equities! The chart below is from the second page of today’s Morning Lineup, and it shows the relative strength of the S&P 500 versus long-term treasuries over the last year. When the line is rising, it indicates equities are outperforming and vice versa for a falling line. After outperforming Treasuries by a wide margin as recently as September, all of that outperformance has now been erased and equities are now underperforming!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

the Bespoke 50 — 12/20/18

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 77.8 percentage points. Through today, the “Bespoke 50” is up 160.2% since inception versus the S&P 500’s gain of 82.4%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

2019 Outlook — Sentiment

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Sentiment” section of the 2019 Bespoke Report, which looks at the performance of equities and bonds following various levels of bullish and bearish sentiment.

To view this section immediately and all other sections as they’re published between now and December 21st, sign up for our 2019 Annual Outlook Special!

2019 Outlook — Sector Analysis

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Sector Analysis” section of the 2019 Bespoke Report, which looks at S&P 500 sector weightings, technicals, and correlations.

To view this section immediately and all other sections, sign up for our 2019 Annual Outlook Special!

Facebook (FB) Unfriends Privacy

Facebook (FB) is down over 6% today after headlines last night that the company had exposed users’ information to other companies, and while the stock isn’t at new lows it’s still nearly 40% from record highs posted as recent as July 25th. There are two ways to think about the catastrophe that the company has been for investors over the last five and a half months: declines in market cap in dollar terms and declines in percentage terms. In dollar terms, the losses are staggering. The company’s market cap has fallen from a peak of $629bn in July to $394bn today. That drawdown makes prior retreats in the company’s value look like nothing. In percentage terms, things have actually been worse though. Following its IPO, Facebook retreated more than 50% from its high water mark and in both 2014 and 2016, the stock saw drawdowns of over 20%. Facebook is currently trading $7 (~5%) above its November low of $126.85, so as the stock faces pressure from its latest round of legal woes, that is the line in the sand for the stock going forward.

Fixed Income Weekly – 12/19/18

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

This week we look at relative yields across equities, corporate bonds, and USTs. We also discuss mortgage rates and applications.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day: Semis, FANG+ Make Higher Lows So Far

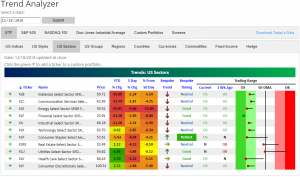

Trend Analyzer – 12/19/18 – Defensive Sectors Tumble

Despite a gap up and some large movements intraday, most indices finished yesterday right around the prior day’s close leaving the picture in our Trend Analyzer largely unchanged. Every major index ETF remains extremely oversold. In addition, all of these names firmly remain in downtrends. The Nasdaq (QQQ) also has still held onto gains for the year. QQQ is also the least oversold relative to the other index ETFs. Despite this, the degree of the movement into/deeper into oversold territory over the past week is about in line with its peers.

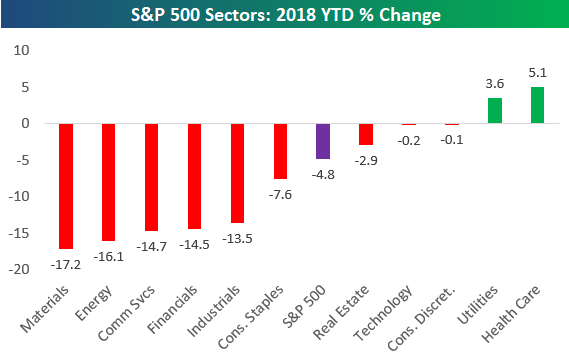

Taking a look at sector ETFs, while YTD returns of cyclicals have gotten hammered, over the past week more defensive sectors haven’t been immune either. These groups have quickly retreated off of neutral and overbought levels as illustrated by the long tails in the Trading Range section of our Trend Analyzer. Headlines of the ACA’s constitutionality coming to question late last week has sent the Health Care Sector (XLV) tumbling. It is currently the second most oversold sector behind Financials (XLF). It is also down the second most in the past week behind the battered Energy Sector (XLE). Energy, much like oil, has fallen off a cliff recently, now down almost 16% on the year and 5.66% in the past five days. While Energy is down a lot in YTD terms, Materials (XLB), Communication Services (XLC), and Financials are not far behind.

Morning Lineup – Fed on Deck

US stocks are looking to start the day higher but given the inability of the market to hold onto gains in recent days, no rally, not even in December, is safe these days. Obviously, the main draw for today will be the FOMC rate decision early this afternoon. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/19/18

In the past, we have referred to Fed Ex as a bellwether for the state of the US and global economy, so it was only fitting that the day before the “most important” Fed decision of the year, the company reported Q3 earnings. Unfortunately, the stock is trading down sharply on the results, and if it finishes today where it is trading in the pre-market, it will be FDX’s worst earnings reaction day in over five years based on the data from our Earnings Screener.

After listening to the company’s conference call last night, FDX’s view on the state of the global economy is not particularly positive and should give pause to anyone who thinks the global economy is just humming along fine. Below we have included a number of key quotes from the call. Reading through the commentary, it’s clear that while the US economy remains solid, global trends are weakening at an increasing state. The key quote is the last one, where FDX management pins the blame for economic weakness on “bad political choices.” Not just in the US, but around the world. The question Fed policymakers must contend with is, how long the US can continue to keep itself insulated from global trends.

“Some of the largest economies in Europe are experiencing weakness.”

“World trade slowed in Q3 to just 3.5% compared to 5.3% in Q3 2017. Leading indicators point to positive, but even slower trade growth near-term.”

“Economic growth in the UK has slowed sharply since July.”

“The peak for global economic growth now appears to be behind us.”

“China’s economy has weakened due, in part, to trade disputes.”

“Our international business, especially in Europe, weakened significantly”

“FedEx is experiencing strong growth in the US, where the economy remains solid.”trade will continue to grow.”

“I’ll just conclude by saying most of the issues that we’re dealing with today are induced by bad political choices, making a bad decision about a new tax, creating a tremendously difficult situation with Brexit, the immigration crisis in Germany, the mercantilism and state-owned enterprise initiatives in China, the tariffs that the United States put in unilaterally. So, you just go down the list, and they’re all things that have created macroeconomic slowdowns. The good news is, with a change in policy, they could turn it around pretty quick, too. So fundamentally, we think trade will continue to grow.”

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.