High Yield Spreads Come Unhinged

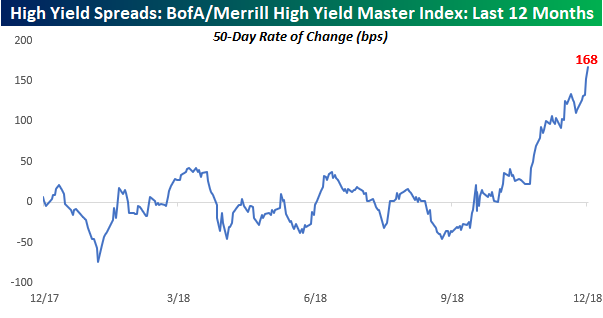

As equity prices have cratered in the last several trading days, one area of the market that has predictably come under selling pressure is high yield credit. The chart below shows the 50-day rate of change in spreads on high yield bonds relative to treasuries. When spreads are rising, it indicates that investors are becoming more risk-averse and demanding higher payment in the form of higher interest rates on riskier credit. As risk aversion fades, the opposite is the case as investors demand less in the form of interest payments causing spreads to decline.

A look at how credit spreads have changed over the course of the last year certainly supports the meltdown we have seen in equity prices. Over the last 50 trading days, spreads on high yield debt have increased by 168 basis points (bps), which is a seismic shift relative to the range of the last 12 months. Prior to this recent move, spreads never widened by more than 50 bps over the prior year.

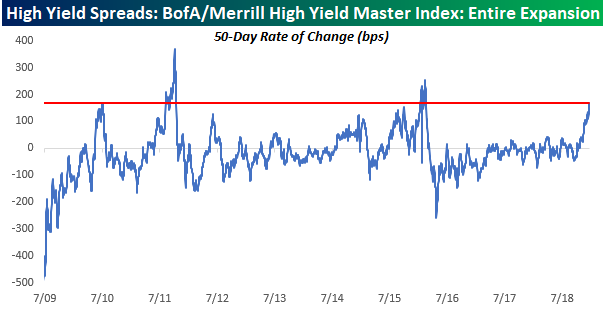

While the move in spreads looks seismic over the short-term, we would note that there have been three other periods during this current economic expansion where we saw spreads widen by as much or even more than they have over the last 50 trading days. To be sure, each one of those periods saw messy markets and/or a slowdown in the US economy, but they didn’t market the end of the expansion either. Things could change from here and easily get worse, but at this point, the move we have seen in high yield spreads over the last few months are not unprecedented.

This Week’s Economic Indicators – 12/24/18

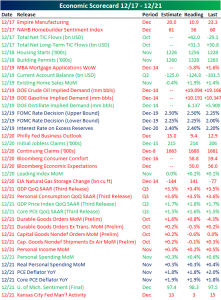

Last week we saw 37 data releases, of which 18 came in below estimates while only 13 beat estimates. Monday kicked off on a sour note as Empire Manufacturing came in way below expectations and homebuilder sentiment from the NAHB broke its streak of releasing above 60. Despite these misses, both indicators are still at positive levels. Tuesday was quiet with only a couple pieces of housing data, both of which came in above expectations. Wednesday was the real market mover day as the FOMC announced their rate decision which sent markets further into a tailspin. This event greatly overshadowed beats from the Current Account and Existing Home Sales. Thursday and Friday were the busiest data days last week, and most of the report missed expectations. The Philly Fed’s Business Outlook came in lower despite an expected uptick. Friday’s GDP release saw a slight decline in GDP and mixed PCE numbers. Goods orders all came in weaker on top of the Kansas City Fed’s manufacturing activity keeping the trend of weaker regional Fed activity data.

Turning to this week, with a shortened day today and tomorrow’s Christmas holiday, it will be a much lighter week of economic data. Earlier this morning, the Chicago Fed released their National Activity Index, which came in above the 0.20 forecasted level at 0.22. Aside from some treasury auctions later on, that is the only economic data point for today. Tomorrow will see no releases domestically due to the Christmas holiday; even abroad the only release to speak of will be Japan’s leading and coincident indices. Wednesday will be another light day with only the Richmond Fed’s Manufacturing Index on the docket. Thursday we get more home price data with the FHFA Home Price Index and New Home Sales alongside the weekly jobless claims and Bloomberg Consumer Comfort reports. The Conference Board’s Consumer Confidence numbers will also come out Thursday morning. We cap off the week with the preliminary Trade Balance for November, Chicago PMI, and more home data with Pending Home Sales. You can keep up with all of these releases daily with our Economic Scorecard.

Morning Lineup – Bah Humbug

Futures are getting in the Christmas spirit this morning, although not in the way you might expect as we have already seen the market trade both firmly in the green and deeply in the red. After trading decently higher overnight, they started to drop sharply shortly after six. There’s been a slight rebound off the lows since the initial leg lower, but they are still indicating a lower open.

A walk around Main Street and the malls this weekend would suggest that the economy remains on a firm footing, but after a rocky 72 hours in DC, confidence on K street is a whole different story. One thing we’re sure of, though, is that if you thought markets were thin lately, any expectations for liquidity today are nothing more than a mirage. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/24/18

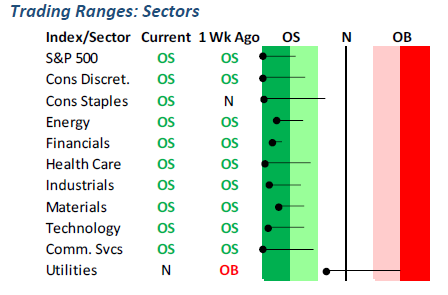

Last week they even got the Utilities to break. While still holding up better than most sectors, which are trading at extreme oversold levels, the Utilities sector, which had been trading at extreme overbought levels just a week earlier is now firmly below its 50-DMA and not far from oversold territory,

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Intraday Bear Market

One of the most remarkable characteristics about the stock market’s sell-off from its highs over the last three months is that all of the declines have come during regular trading hours. Basically, if the stock market has been open for trading (between the 9:30 AM ET open and the 4 PM ET close), investors have been selling.

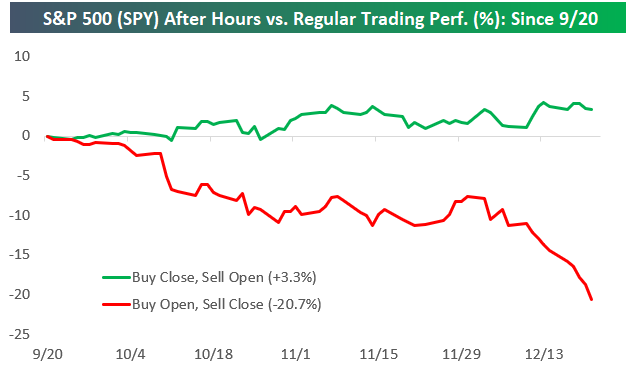

The way to track this is to look at how the S&P 500 performs inside of regular trading hours versus outside of regular trading hours. Since the 9/20 closing high for the S&P 500, had you bought SPY at the close of trading every day and then sold at the next day’s open (the after hours strategy), you’d actually be up 3.3%! Conversely, had you bought SPY at the open on every trading day and sold at the close that day (the regular trading strategy), you’d be down 20.7%. Based on these numbers, more than 100% of the stock market’s declines since the 9/20 peak have come during regular trading hours.

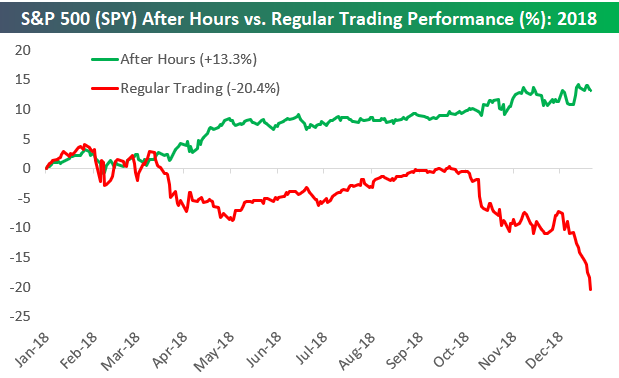

The numbers are even more lopsided when you run the analysis on the two strategies for all of 2018. As shown below, you’d actually be doing very well this year if you only owned SPY outside of regular trading hours. Had you bought SPY at the close every day and sold at the next open, you’d be up 13.3% this year. Had you bought at the open every day and sold at the close, however, you’d be down 20.4%.

Join Bespoke Premium to read our 2019 market outlook report now!

Bespoke Brunch Reads: 12/23/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

China

PBOC Ratchets Up Monetary Support With `Low-Profile’ Rate Cut (Bloomberg)

A new PBOC facility is linking access to funding to lending to small businesses and other parts of the real economy; that cheaper liquidity is in part a stealth rate cute. [Link; soft paywall, auto-playing video]

How the ‘Five Eyes’ cooked up the campaign to kill Huawei by Chris Uhlmann & Angus Grigg (Sydney Morning Herald)

An inside story of the secret coordination by “Five Eyes” (US, Canada, UK, Australia, New Zealand) security services to push back on potential security risks posed by China’s Huawei. [Link]

Other Asia

Philippine Analysts Get Feisty on Twitter in Inflation Spat by Ditas B. Lopez (Bloomberg)

You know things are going well with your economic management when you take to Twitter in order to blame analysts for the recent weakness of inflation data. [Link; soft paywall]

The rise and rise of Bangladesh by Gwen Robinson (Nikkei Asian Review)

A glowing – perhaps too glowing – profile of the current economic backdrop and outlook in Bangladesh, a rapidly growing export-driven economy that is moving out of the lowest category of economic development. [Link; soft paywall]

Tech Troubles

Why Should Anyone Believe Facebook Anymore? by Fred Vogelstein (Wired)

As the author points out, every month this year has seen a new negative headline for Facebook related to privacy and indeed the core of its business, suggesting that the core of the company needs a complete change in order to re-assure investors and regulators alike that it can be trusted. [Link]

Competing with Complementors: An Empirical Look at Amazon.com by Feng Zhu and Qihong Liu (SSRN)

The authors find that Amazon uses 3rd party sellers to assess new markets, entering them when other sellers have proven viability. Amazon also outsources more difficult markets to 3rd party sellers in order to maximize its platform value with minimal investment. [Link]

Blue Apron Falls Under $1 as Sell-Off Shows No Signs of Stopping by Ryan Vlastelica (Bloomberg)

The meal delivery company has lost more than 90% of its value since IPO, and is now trading for less than $1 per share. [Link; soft paywall]

Food & Film

The Diner Reviews Are In: 100 Best Restaurants in America for 2018 (OpenTable)

The restaurant booking country has analyzed more than 12mm reviews for 28,000 restaurants and come up with its best 100 across a range of restaurant types and geographies. [Link]

How Peter Jackson Made WWI Footage Seem Astonishingly New by Mekado Murphy (NYT)

The famed Lord of the Rings director is releasing a new documentary on the experiences of British soldiers during WWI, and he uses a series of novel techniques to bring his subject to life. [Link; soft paywall]

Humor

FTAV Person of Interest 2018: The Longlist (FTAV)

The annual tradition of the FT Alphaville blog highlighting the year’s most scorn-worthy characters continues with a valiant 2018 effort. [Link; registration required]

Crime

Goldman’s Malaysian Scandal Revives the ‘Too Big to Jail’ Debate by Peter Eavis (NYT)

After virtually no criminal proceedings in the wake of the largest systemic fraud in modern American history, Americans are looking to Malaysia as a new debate over how to handle corporate malfeasance kicks off. [Link; soft paywall]

Slavery

Inside The Country Where You Can Buy A Black Man For $400 by Monica Mark (Buzzfeed)

The hear-rending story about a Nigerian man seeking a better life but ending up in bondage, held by modern slave traders in Libya. [Link]

Regulation

An Epidemic Is Killing Thousands Of Coal Miners. Regulators Could Have Stopped It by Howard Berkes (NPR)

Preventable workplace hazards of coal mining are killing miners, thanks in part to a failure to act by safety regulators amidst ample evidence that they were in danger. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a happy holidays!

2019 Outlook — The Bespoke Report (Full Report)

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we cover every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more.

To view the full report now, sign up for a Bespoke Premium research subscription with our 2019 Annual Outlook Special!

2019 Outlook — Our View

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Our View” section of the 2019 Bespoke Report, which details our overall thoughts on equity markets and other asset classes in the year ahead.

To view this section immediately and all other sections as they’re published, sign up for our 2019 Annual Outlook Special!

2019 Outlook – Currencies

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Dollar and Stocks” section of the 2019 Bespoke Report, which reviews the performance of various measures of the US Dollar’s strength this year as well as how it has impacted stock markets around the world.

To view this section immediately and all other sections as they’re published between now and December 21st, sign up for our 2019 Annual Outlook Special!

2019 Outlook — Commodities

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Commodities” section of the 2019 Bespoke Report, which reviews the price action in commodities this year.

To view this section immediately and all other sections as they’re published between now and December 21st, sign up for our 2019 Annual Outlook Special!

2019 Outlook — Prognostications

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Prognostications” section of the 2019 Bespoke Report, which looks at year-end 2019 price targets from Wall Street strategists as well as economist expectations for GDP growth, inflation, interest rates, and currencies.

To view this section immediately and all other sections, sign up for our 2019 Annual Outlook Special!