Stable Homes and Emerging Markets

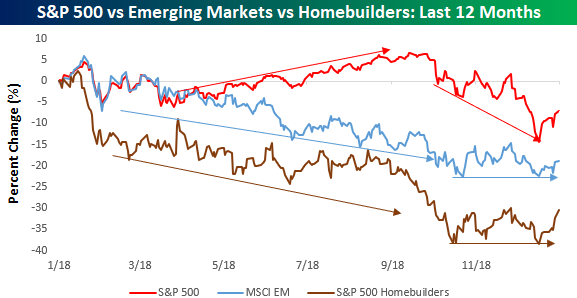

While the S&P 500 continues to try and find a firm footing that would hopefully set the stage for a meaningful rally, two sectors which led the broader market lower have been showing much healthier signs of stability. As shown in the chart below, while the S&P 500 (red line) was trending higher all throughout the second and third quarter of 2018. both homebuilders (brown line) and emerging markets (blue line) were forming steady downtrends.

Ever since late October, though, when the S&P 500 saw its first leg lower, both emerging markets and homebuilders stopped going down and have been trading in sideways patterns while the S&P 500 traded to new lows right before Christmas. While neither emerging markets or homebuilders have managed to rally back enough to make higher highs, homebuilders are getting close. Needless to say, if this group, which was the first to falter in 2018 can manage to turn things around, the prospects for the broader market would become a lot brighter as well.

Rates Carried Away Given Fed’s Tone

It’s no secret that the Fed has shifted more dovish of late, but in our running analysis of the tone in Fed commentary using our Fedspeak Monitor, the last 20 speakers have averaged a score just between “neutral” and “slightly dovish”. Our Fedspeak Monitor qualitatively tracks what FOMC members say publicly and classifies it to varying degrees of hawkishness or dovishness. Using each speech’s rating, we can keep track over time how hawkish or dovish the FOMC is. The result is shown in the chart below, which tends to track the 3-month change in the 10-year yield pretty well over time. Obviously, assigning a category of hawkishness or dovishness is a challenging exercise, but over time our gauge does a pretty good job tracking the movement of yields. As shown in the chart below, after the tone of Fed speakers moved into more dovish territory ahead of downdrafts in yields, their commentary has now been much less dovish than the market.

Chart of the Day: Commodity Price Pressures Continue to Abate

Bespoke Market Calendar — January 2019

Please click the image below to view our January 2019 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases.

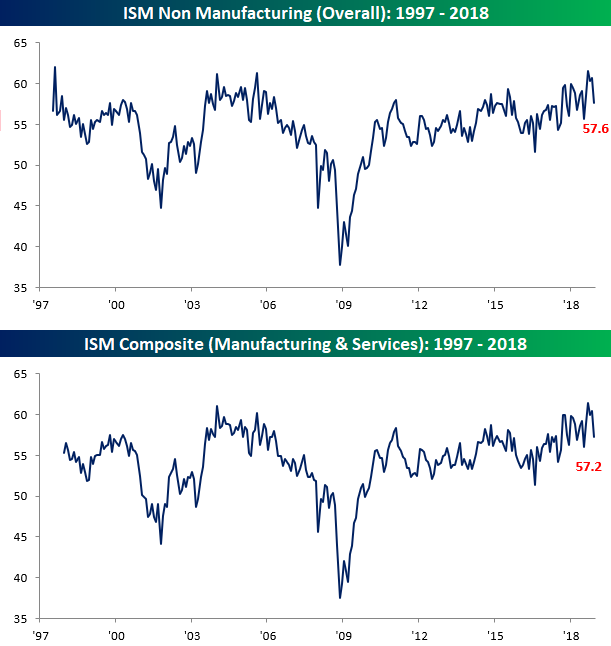

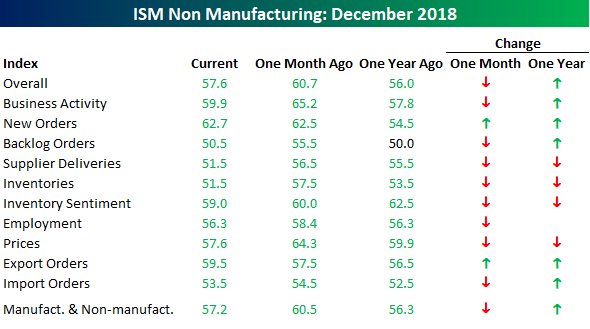

A Not So Bad Weaker Than Expected ISM Services Report

It’s hard to describe a weaker than expected economic indicator as being OK, but that was pretty much the case with the ISM Services report for the month of December. While economists were forecasting the headline reading to come in at 58.5, the actual reading came in at 57.6 versus a reading of 60.7 in November. While that 3.1 point decline sounds large, there was actually a move of a similar magnitude as recently as last July. On a combined basis, though, the ISM for December saw a larger decline, falling from 60.5 down to 57.2. On that basis, the 3.3 point decline was a bit more significant as it was the largest m/m decline since November 2008.

Like its manufacturing counterpart, breadth in this morning’s ISM Services report was also pretty poor as the only two components that saw any improvement on a m/m basis were New Orders and Export Orders. The largest decliners were Prices (-6.7), Inventories (6.0), and Business Activity (-5.3). On a year/year basis, breadth wasn’t nearly as bad, though, as more subcomponents showed y/y increases versus y/y declines.

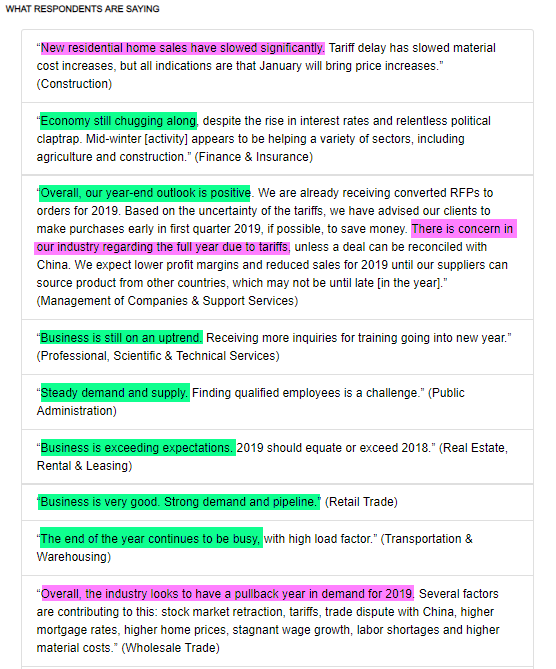

Finally, while both the ISM Manufacturing and Non-Manufacturing reports showed large m/m declines this month, the commentary section of the Non-Manufacturing report was a lot less dour than its Manufacturing counterpart. In the graphic below, we have highlighted both positive and negative comments regarding business activity from this month’s commentary section. While there were a couple of statements suggesting slower business conditions, based on the sample provided in the report, there’s still more optimism than pessimism. Given that the US economy is much more skewed towards the Non-Manufacturing sector than Manufacturing, that’s a positive trend!

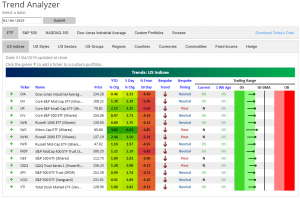

Trend Analyzer – 1/7/19 – Back to Neutral

It has been some time since we last saw even one of the major index ETFs in the neutral part of its trading range. Whereas all of these ETFs have remained oversold to extremely oversold for the past few weeks, the recent rally has helped to lift six of them out of this range. The remaining eight, while still oversold, are all on the verge of moving to neutral. With steep declines to close out 2018, it has also been some time since we have seen YTD performance in the green, but we are starting off this week with exactly that. Despite the recent moves higher, though, all of the index ETFs all remain below their 50-DMA. The closest of any of them is the S&P 100 (OEF) which is still 3.96% away.

An important factor to note of this most recent rally is the outperformance of small caps as they had been mattered the most towards the end of last year. The Micro-Cap (IWC) leads the way higher with a gain of 6.03% in the past week and 3.82% since the start of the year. The Russell 2000 (IWM) and Core S&P Small-Cap (IJR) have also done remarkably well with each up well over 3% over the past five days. Meanwhile, larger caps have lagged with a prime example being the Dow (DIA). Granted, last week’s warning from Apple (AAPL) of weaker sales has been a big contributor to the large-cap underperformance.

Morning Lineup – A Quiet Start to the Week

Unlike what we have grown accustomed to recently, this week is kicking off rather quietly as US equity futures are indicating just a modestly positive open. The only major economic indicator being released today is the ISM Services report at 10 AM. In the Health Care sector, though, things are pretty busy as the annual JP Morgan Healthcare Conference kicks off today. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and commentary.

Bespoke Morning Lineup – 1/7/19

Chinese equities saw another positive session overnight with a gain of just over half of one percent. In the last two days now, the CSI 300 is up just over 3% as optimism over the US-China trade talks increases, especially after Xi’s top trade official unexpectedly attended the latest round of trade talks. While it’s nice to see strength in equities both here and in China, we would note that the latest two-day rally is just the latest in a series of other two-day rallies of 3% plus that all took place at higher levels than the current one.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 1/6/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Crime

Chicago sees decline in murders, other violent crimes for second straight year by Tim Stelloh (NBC)

While the number of shooting deaths in Chicago remains appallingly high, over the last two years murders have fallen by over a quarter in a remarkable turnaround. That turnaround may prove temporary but for shattered communities it’s welcome regardless. [Link]

The Fed

Powell Says Fed Prepared to ‘Shift’ Path as Economic Data Warrant by Jim Tankersley (NYT)

After a worrying set of declines in stock prices and interest rate collapses, the Federal Reserve Chair took to the stage at the annual American Economic Association conference in Atlanta to walk back hawkish rhetoric and signal a risk to the 2-hike forecast from the FOMC for 2019. [Link; soft paywall]

Real Estate

Wall Street’s Big Landlords Are So Hungry for Houses They’re Building Them by Ryan Dezember (WSJ)

Demand for new homes isn’t just coming from households who want to buy; investors are desperate to gobble up new units for rent as part of a broader shift to rentals from ownership in the single family housing market. [Link; paywall]

College Football

He runs one amateur football game per year. He makes more than $1 million. by Will Hobson (WaPo)

The paycheck hauled in by the Outback Bowl chair is a truly gaudy sum given the paltry revenues, negligible charitable giving, and athletes’ amateur status, and is part of a broader pattern of excessive administrator salaries across the college sports world. [Link; soft paywall]

Taxes

In a Shutdown, IRS Will Take Your Money, but Give No Refunds by Richard Rubin (WSJ)

As appropriations have run out and the government shutdown continues, the IRS won’t be paying refunds until funding is restored. That puts a huge chunk of disposable income for a large, likely-to-spend segment of the population at risk. [Link; paywall]

Renewables

India cancels plans for huge coal power stations as solar energy prices hit record low by Ian Johnston (The Independent)

14 gigawatts of coal fired power plants have been cancelled as Indian solar projects come in at radically lower prices than were thought possible a few years ago. [Link]

Mathematics

First Big Steps Toward Proving the Unique Games Conjecture by Kevin Hong (Quanta)

A conjecture which in practical terms asks the question “can you efficiently color networks in a certain way?” has huge implications and is close to being solved. [Link]

Religion

Mormon church issued money substitute scrip by Neil Shafer (Numismatic News)

During the height of the Great Depression, a bishop in Salt Lake City authorized the issuance of scrip, a novel solution to the problem of providing ample supplies of liquidity during a financial crisis. [Link]

Faith on the Hill (Pew Research Center)

The official numbers on the stated religious affiliation of Congress, which has a religious make-up substantially different from that of the population overall. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a happy New Year!

The Bespoke Report – Patience for the Pateint

Next Week’s Economic Indicators – 1/4/19

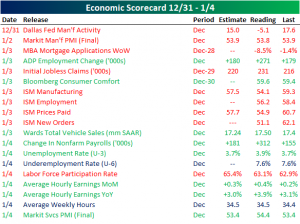

This week saw a mix of manufacturing and labor data with results spanning from huge beats to horrible misses. While most manufacturing data saw sizeable misses, on the bright side, labor data had strong beats in the second half of the week. Dallas Fed Manufacturing Activity started the week on a sour note. As the last US release of 2018, it came in well below expectations and even further below the previous period at a meager –5.1. Markets took Tuesday off to celebrate New Years Day, and on Wednesday we came back to a better, but still weaker, manufacturing reading with the Markit Manufacturing purchase managers index seeing a drop of only 0.1. Thursday saw the ISM release of their manufacturing data which saw broad—but predictable given recent regional Fed indices—declines that far exceeded most forecasts. Despite weak manufacturing sector data in the first half of the week, some positive labor data helped to end the week on a high note. On Thursday ADP released their employment change data for December with a huge surprise to the upside showing 271K additional jobs created. The BLS’s Nonfarm Payrolls report (which typically moves in tandem with the ADP numbers) saw a nice surprise to the upside on Friday as well further reinforcing evidence of a strong labor market.

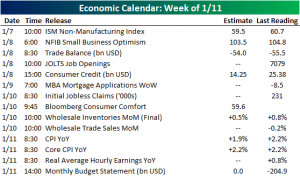

Despite being the first full week coming back from the holidays, next week will be a bit quieter. Whereas this week saw 19 releases, next week will only have 14; none of which will likely be major market movers like the manufacturing or NFP data we just saw. The only release on Monday will be the ISM Non-Manufacturing Index which, like its manufacturing counterpart, is expected to decline although it is also expected to remain at very strong levels. On Tuesday we get a variety of indicators including small business optimism, trade balance data, JOLTS job openings, and consumer credit. Mortgage applications will be the only release scheduled for Wednesday. Thursday will see weekly claims and consumer comfort data alongside wholesale inventories and sales for December. We cap off next week with CPI and the monthly budget statement which will surely be impacted by the government shutdown.

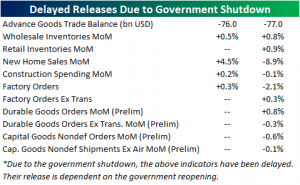

While on the topic of the shutdown, there are a number of indicators that were scheduled to release in the time since the shutdown began but have been postponed due to the closure of the agencies in charge of the data. Below is a list of these indicators. Their release is contingent on the government reopening.