B.I.G. Tips – Earnings Season Cometh

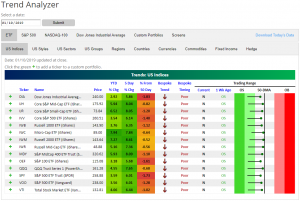

Trend Analyzer – 1/11/19 – So Close

The major index ETFs have now spent a full week in a neutral range; a welcome change from the extremely oversold levels we saw to finish 2018. That is a major change from where they were at the end of last week when they all still sat firmly in oversold territory. As we close out the first full week of the year, the YTD gains are yet another nice change when compared to how we finished last year. The trend of the current rally has further solidified that investors are rotating more heavily into small-caps. These ETFs are leading their larger peers by a wide margin as the Microcap ETF (IWC) and the Russell 2000 (IWM) are still the best performers. Over this past week, the IWM has been the better of the two with a gain of 8.61%. That strong performance is shared by IJH, IJR, and MDY which also each have edged out gains of over 8%. In contrast, while by no means are they doing poorly, the large-cap Dow (DIA) and S&P 100 (OEF) are doing the worst as the aforementioned small caps have seen over twice the gains on a YTD basis.

Morning Lineup – Manic Breadth

Futures are indicated a bit lower this morning after five straight days of gains. The only economic indicator on the calendar today was CPI for December which came in right inline with expectations at both the headline (-0.1%) and core levels (0.2%). Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and commentary.

Bespoke Morning Lineup – 1/11/19

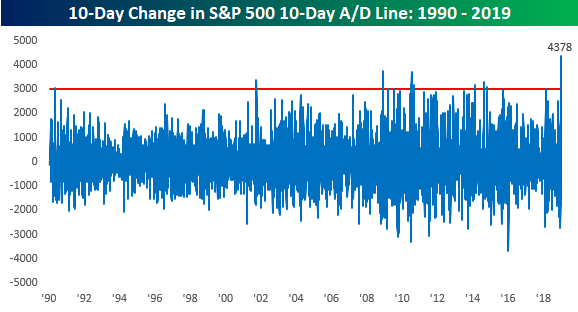

Similar to the swings in the equity market from the sharp leg lower in late December to the massive rally to kick off this year, breadth has also swung from one extreme to another in the last two weeks. Take the S&P 500’s 10-day A/D line, for example. On Christmas Eve, it clocked in at -2,440, which was the most negative reading in this indicator since 8/8/11 and the fourth most negative reading going all the way back to 1990! Ten days later, the 10-day A/D line totally reversed to a positive reading of 1,938, which was the most positive reading since July 2016 and the ninth strongest since 1990. That kind of a reversal from one of the most negative readings in 30 years to one of the most positive is pretty much insane!

With the 10-day A/D line shifting from -2,440 on 12/24 to +1,938 on Wednesday, it was the biggest 10-day change in the indicator on record, and it wasn’t even really close. The next closest reading to the upside was on 12/5/08 when it had a 10-day change of 3,755.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke’s Sector Snapshot — 1/10/19

S&P 500 Sector Performance — 2019 vs. 2018

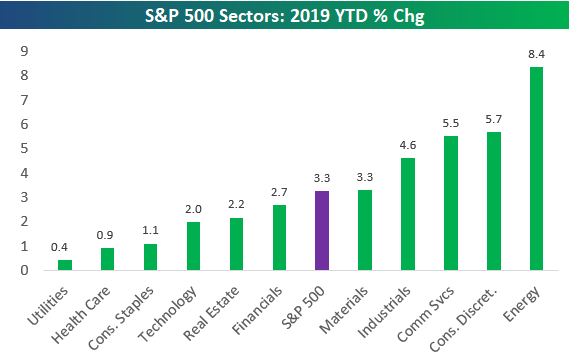

The S&P 500 was up 3.3% YTD as of mid-day today. As shown below, Energy has been by far the best sector so far this year with a gain of 8.4%. Consumer Discretionary ranks 2nd with a gain of 5.7%, followed closely by Communication Services in 3rd with a gain of 5.5%. Industrials and Materials are the other two sectors that have outperformed the S&P 500.

While all eleven sectors are in the black for the year, Utilities and Health Care have lagged the market with gains of less than 1%. Note that the Tech sector — the largest sector of the market — is up 2% YTD, which is 130 basis points less than the S&P 500.

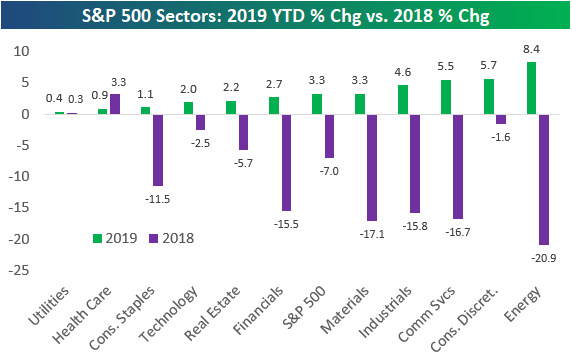

The chart below compares 2019 YTD performance with the change seen in 2018. Utilities and Health Care were the best performing sectors of 2018 and the only two sectors that were up on the year. These two sectors have taken a breather so far in 2019 as the weakest performers.

Generally speaking, the sectors that did the best in 2018 have underperformed so far this year, while the sectors that did the worst in 2018 have bounced the most. Energy was the worst sector of 2018 and is the best so far in 2019. The big exception is Consumer Discretionary, which only fell 1.6% for the full year 2018 and is up 5.7% in 2019 — good for second best so far this year.

B.I.G. Tips – Analysts Increasingly Pessimistic

the Bespoke 50 — 1/10/19

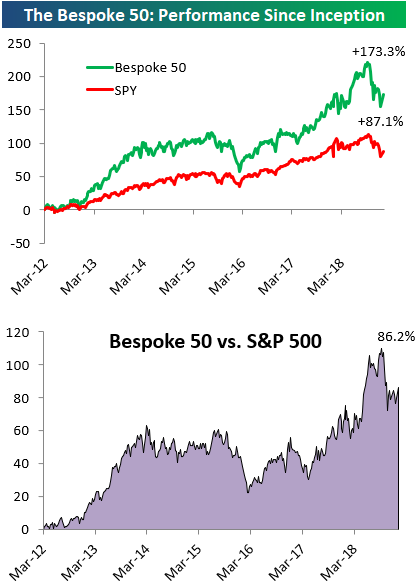

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 86.2 percentage points. Through today, the “Bespoke 50” is up 173.3% since inception versus the S&P 500’s gain of 87.1%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, click the button below and start a trial to either Bespoke Premium or Bespoke Institutional.

Chart of the Day: Homebuilders Looking Positive

Individual Investors Back To Normal

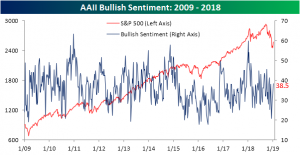

As equity prices have picked back up, so too has bullish sentiment. The survey of individual investors from AAII has seen a decent bounce in bullish sentiment back to more normal levels since hitting a multi-year low back in mid-December. This week’s survey saw 38.5% of investors reporting an optimistic outlook for markets in the next six months. That is right in line with the 38.5% historical average for the history of the survey.

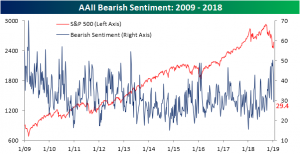

Conversely, bearish sentiment has seen a steep drop. The percentage of investors reporting a negative outlook fell by 13.4% to 29.4%. This measure has also more or less returned to normal levels. It is only around one percentage point lower than the historical average. One interesting point to make, bearish sentiment is currently at its lowest level since early October; right around the time that equities had peaked and took the turn downwards.

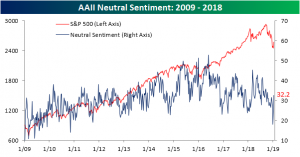

After reaching a remarkably low level only a couple weeks ago, neutral sentiment has picked back up significantly, settling—like the others—right around the historical average. This week, 32.2% of investors reported a neutral outlook, up from 24.2% last week. Though bullish sentiment has lifted, investors who were previously bearish have not necessarily turned bullish. A greater share of the declines in bearish sentiment seemed to have gone to the neutral camp.

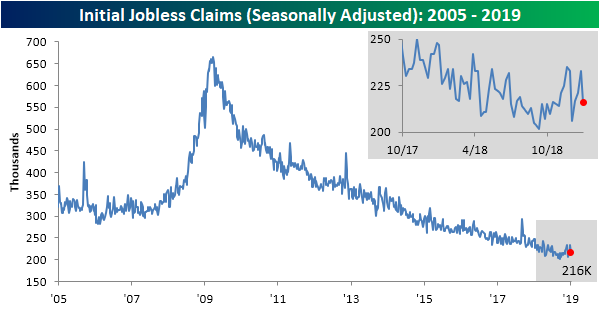

Jobless Claims Beat Expectations

This week’s jobless claims data is piggybacking off the strong readings from Friday’s Nonfarm Payrolls report. Claims for the past week came in at 216K; well below last week’s revised 233K. Forecasts were calling for this drop, though claims were expected to come in 10K higher at 226K. This 216K reading is still off of lows from September but builds the streak of coming in at or under 250K to 66 weeks. This week also marked the 201st week with claims under 300K.

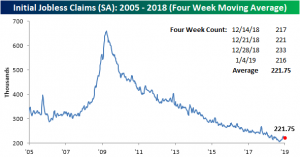

On a four-week moving average basis, claims saw a slight uptick as the low 206K reading from the first week of December has rolled off. The moving average currently sits at 221.75K (up from last week’s 219.25K). While still very low by historical standards, claims seem to have bottomed out some weeks ago, and on a shorter time horizon remain somewhat elevated.

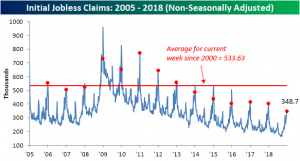

Turning to the non-seasonally adjusted reading is perhaps the most impressive measure of this week’s data. Claims did in fact see a sizeable jump in line with seasonal patterns, but in spite of this rise, claims are still significantly lower than prior years in regards to the current week of the year. At 348.7K, non-seasonally adjusted claims are far below the 533.63K average dating back to 2000. If this week turns out to be the seasonal peak of the year, which is fairly likely based on historical trends, it is the best reading in years. There is still a chance claims can tick higher next week, but even if that uptick happens, this week’s reading only echoes last week’s Nonfarm Payrolls and showcases an enduring and historically hot labor market.